Freight shipping between Thailand and Spain | Rates -Transit time – Duties & taxes

The world of freight shipping between Spain and Thailand is yours to explore. This guide is designed to give you valuable insights and crucial knowledge for carrying out efficient cargo transportation between these two dynamic nations.

Thailand stands as one of the Asian nations enjoying solid commercial connections with Spain. Renowned for its openness to global trade, Thailand offers a welcoming environment for international business. Spain, in turn, maintains a close economic relationship with Thailand. Key exports from Thailand to Spain include electronic products, vehicles, textiles, and agricultural goods. These trade links demonstrate the mutual benefits of the thriving trade partnership between Spain and Thailand.

This guide will help you navigate the complexities of freight shipping, including rates, transit times, customs procedures, and more, whether you are a business looking to expand your international trade or an individual with shipping needs. You can make decisions that will successfully transport your goods between Spain and Thailand by being aware of the logistics involved. Together, let’s take this journey and explore the opportunities for effective and dependable freight shipping from our experts at Siam Shipping.

What is the most suitable method of transport between Thailand and Europe?

The most practical modes of transportation, specifically between Spain and Thailand, are air freight and sea freight. Road freight and rail freight are not frequently used for shipments between these two countries due to the geographic distance and lack of direct land connections.

Therefore, there are two ways to transport containers from Thailand to Spain or vice versa, either sea freight or air freight.

Docshipper Note:

Besoin d'aide pour votre expédition ? N'hésitez pas à nous contacter, même pour une simple question. Choisissez l'option qui vous convient.

Chat en direct avec un expert Discutez-nous sur WhatsApp Remplissez le formulaire

Sea freight between Thailand and Spain

Overview – Ocean cargo between Thailand and Spain

The majority of the time, shipping containers are used in the ocean cargo services between Thailand and Spain. In order to transport goods, containers are carefully packed with cargo before being loaded onto container ships. The movement of large quantities of goods is possible with this mode of transportation, which is suitable for both commercial and industrial shipments.

Depending on the exact ports of origin and destination, transport by sea from Thailand to Spain typically takes 4 to 6 weeks. Major Thai ports like Laem Chabang and Bangkok serve as the main points of departure, while ports in Spain like Barcelona and Valencia are frequently visited.

During transit, the cargo is safeguarded by the shipping company, and tracking services are often available to monitor the progress of the shipment. Additionally, sea freight offers flexibility in terms of the size and weight of the cargo, accommodating both full-container loads (FCL) and less-than-container loads (LCL) shipments.

It is essential to confirm that shipping complies with Thai and Spanish customs laws before proceeding. For efficient customs clearance procedures, documentation such as bills of lading, commercial invoices, and packing lists must be accurately prepared.

Bilateral relations between Spain and Thailand

Over the years, Spain and Thailand’s bilateral relations have steadily improved, fostering collaboration in numerous areas and fortifying ties between the two nations. The mutually beneficial trade and investment have characterized the strong economic ties that have grown between Spain and Thailand.

Trade between the two countries encompasses a diverse range of sectors, with several areas of focus on machinery and equipment, electronics and electrical equipment, textiles and apparel, food products and beverages, and tourism.

In 2021, Thailand ranked 29 in the Economic Complexity Index (ECI 0.97), and 25 in total exports ($285B). That same year, Spain ranked 35 in the Economic Complexity Index (ECI 0.78), and 16 in total exports ($372B).

Main ports in Spain

Port of Barcelona

Located on the northeastern coast of Spain, the Port of Barcelona is one of the busiest ports in the Mediterranean and serves as a vital hub for international trade. It offers excellent connectivity and handles a diverse range of goods, including containers, automobiles, chemicals, and consumer products.

Port of Valencia

Situated on Spain’s eastern coast, the Port of Valencia is one of Europe’s top ports and one of the largest container ports in the Mediterranean. As a result of its extensive infrastructure and effective logistics services, it serves as a significant entry point for containerized cargo. The port deals with a variety of products, including textiles, equipment, automobile parts, and food items.

Port of Algeciras

The Port of Algeciras is a vital strategic link between Europe and Africa. It is situated in southern Spain, close to the Strait of Gibraltar. It functions as a significant transshipment hub and moves a lot of containerized cargo, including products going to or coming from Thailand.

Port of Bilbao

The Port of Bilbao is a significant seaport in northern Spain that deals with a variety of cargo, including containers, vehicles, bulk goods, and project cargo. It is a key port for trade with Thailand because it provides effective logistics solutions and has good access to the hinterland.

Main ports in Thailand

The Port of Bangkok

The Port of Bangkok is Thailand’s largest port, located on the Chao Phraya River in Bangkok. It is linked to the national railway network and has a number of docks for loading and unloading containers.

The Port of Bangkok is Thailand’s largest port, located on the Chao Phraya River in Bangkok. It is linked to the national railway network and has a number of docks for loading and unloading containers.

Laem Chabang Port

The Laem Chabang Port is located in Chonburi province, about 130 kilometers southeast of Bangkok. It is Thailand’s second-largest port and is linked to the national highway railway network for the transportation of goods to the interior of the country.

Map Ta Phut Port

Located in Rayong province, the Map Ta Phut Port is on the east coast of Thailand, this port is an important center for the country’s petrochemical industry. It has a rail yard and is connected to the national rail network.

Chiang Saen Port

The Chiang Saen Port is located on the Mekong River in Chiang Rai province, near the border with Laos. It is used for the transport of goods between Thailand and the neighboring countries, in particular Laos and China.

Transit time between Spain ports and Thailand ports

The following table summarizes the average transit times in days between the largest

Spanish ports and Thai ports.

| Bangkok | Laem Chabang | Map Ta Phut | Chiang Saen | |

|---|---|---|---|---|

| Barcelona | 28 | 28 | 28 | 27 |

| Valencia | 32 | 28 | 28 | 41 |

| Algeciras | 29 | 29 | 29 | 17 |

*These transit times between Spain and Thailand are given as an indication.

Container complet ou FCL (Full Container Load)

For this type of shipment, one person will use the entire capacity of the container. This reduces the possibility of product damage.

This method would be useful even if you did not completely fill the container. However, for shipments larger than 15 m3, it is the most affordable option.

Groupage maritime ou LCL (Less than Container Load)

Multiple people who do not have enough goods to fill an entire container can use the same container with this type of shipment. As a result, various people’s goods are combined to fill an entire container.

This is the most economical option for small shipments of less than 15 m³.

Advantages of LCL

- Cost Efficiency: LCL allows you to share the cost of container shipping with other shippers who have smaller cargo volumes. It is a cost-effective option for transporting smaller shipments without the need to pay for a full container.

- Flexibility: LCL offers flexibility in terms of shipment size. You can ship smaller quantities without having to wait for a full container load. This is especially beneficial for businesses with lower volume or irregular shipping needs.

- Reduced Inventory Holding: With LCL, you can ship goods in smaller quantities more frequently, reducing the need to hold a large inventory. This can help in managing inventory levels, minimizing storage costs, and improving cash flow.

- Lower Risk: By shipping smaller volumes through LCL, you can minimize the risk of damage or loss associated with handling and transportation. Your cargo will be consolidated and handled with care at the container freight station.

Disadvantages of LCL

- Longer Transit Times: LCL shipments typically have longer transit times compared to FCL. This is because the container needs to be consolidated with other cargo and undergoes multiple handling and deconsolidation processes at different ports.

- Increased Risk of Damage: As LCL shipments involve multiple shippers’ cargo being packed together in the same container, there is a higher risk of damage or loss during handling and transportation. Improper packing or handling of other cargo can potentially impact your goods.

- Dependency on Consolidation: LCL shipments rely on the availability of other shippers’ cargo to consolidate into a full container. This dependency can sometimes result in delays if there is a lack of sufficient cargo to fill the container in a timely manner.

- Limited Space for Oversized Cargo: LCL shipments may not be suitable for oversized or bulky cargo that cannot be easily accommodated within a shared container space. Special arrangements or alternative shipping methods may be required for such items.

Advantages of FCL

- Exclusive Use of Container: With FCL, you have the entire container exclusively for your shipment. This provides better control and security for your goods as they are not mixed with other cargo.

- Faster Transit Time: FCL shipments usually have shorter transit times compared to LCL. Since the container is loaded directly onto the vessel without the need for consolidation or deconsolidation, it can result in quicker transportation.

- Cost Savings for Larger Shipments: FCL is generally more cost-effective for larger shipments as you pay a fixed price for the entire container regardless of the cargo volume. This can result in savings compared to multiple LCL shipments.

- Simplified Customs Clearance: FCL shipments often have simpler customs clearance procedures, as the container is treated as a single unit. This can result in faster customs processing and reduced paperwork.

Disadvantages of FCL

- Higher Costs for Smaller Shipments: FCL shipping is generally more cost-effective for larger shipments that can utilize the entire container space. If you have smaller cargo volumes, the cost per unit may be higher compared to sharing a container through LCL.

- Container Requirement: FCL shipments require you to have enough cargo to fill a full container. If your shipment volume is not sufficient, you may need to consider alternative shipping options or pay for the unused space in the container.

- Limited Flexibility in Cargo Size: With FCL, you need to ensure that your cargo can fully utilize the space within the container. If your shipment volume is significantly smaller than the container capacity, there may be wasted space and potential inefficiencies in terms of cost and utilization.

- Higher Responsibility for Packaging: As the entire container is dedicated to your shipment, you bear the responsibility for properly packaging and securing your goods within the container. This includes ensuring proper bracing, protection against shifting and complying with loading requirements.

Special sea transport between Thailand and Spain

Reefer container

Reefer containers are used to transport chemicals or perishable goods at specific temperatures. It comes with a cooling system.

Roro

RORO vessels (Roll On/Roll Off) transport vehicles such as cars, trucks, vans, semi-trailers, and rail cars. They are the safest and most efficient vessels for carrying heavy or special cargo.

Bulk

Bulk carriers transport solid bulk materials like minerals, grains, and coal, as well as liquids like crude oil, gas, and chemicals. These vessels are larger and more easily loaded and unloaded.

OOG

OOG cargo is cargo that is larger than a standard container. There are two types of containers for these goods:

- Open Top Containers: They don’t have a roof, allowing cargo to be loaded that exceeds the container’s height.

- Flat Rack Container: These are flat containers with no side walls or roofs that are used to transport goods that cannot be loaded into standard containers.

What is the cost of shipping goods by sea from Thailand to Spain?

The price of sea freight between Spain and Thailand depends on a number of variables, including the nature of the cargo being shipped, its volume and weight, the distance between the ports of origin and destination, the mode of shipping, and the state of the market.

In general, the average cost of shipping a 20-foot container (TEU) from Spain to Thailand is approximately US$1,800 to US$4,200, depending on the shipping company, the port of origin and destination, and the time of year.

If you are knowledgeable of the exact weight and volume of your goods, you can calculate the cost. You can achieve this by following these 3 steps:

- Determine the PU (Paying Unit): The PU (Paying Unit) is determined by comparing the mass and volume of your cargo using the sea freight theory, which states that one ton equals one m3. The higher value between volume and mass will be the UP. For example, for a volume of 20 m³ and a mass of 25 tons, the UP will be 25 tons.

- Calculate the basic freight: to do this, multiply the cost of the UP by its number.

- Calculate the net freight: with the following formula, Base freight + BAF + CSP – Rebate. The result will be the cost of your sea freight.

Tariff surcharges

Tariff surcharges may apply on your transport between Spain and Thailand, here are the main ones:

- Currency Adjustment Factor (CAF): It is applied to compensate for exchange rate fluctuations between the currencies of Spain and Thailand. It aims to offset the potential impact of currency fluctuations on shipping costs.

- Security Surcharge (SCS): This surcharge is applied to cover costs related to port and vessel security.

- Bunker Adjustment Factor (BAF): This surcharge is applied according to fluctuations in the price of fuel and may vary regularly depending on market conditions.

- Overcapacity surcharge (OWS): This surcharge is applied when demand for shipping is lower than supply, resulting in excess vessel capacity.

- Congestion surcharge (CGS): This surcharge is applied in ports where congestion is high, resulting in extended waiting times for ships.

Air freight between Thailand and Spain

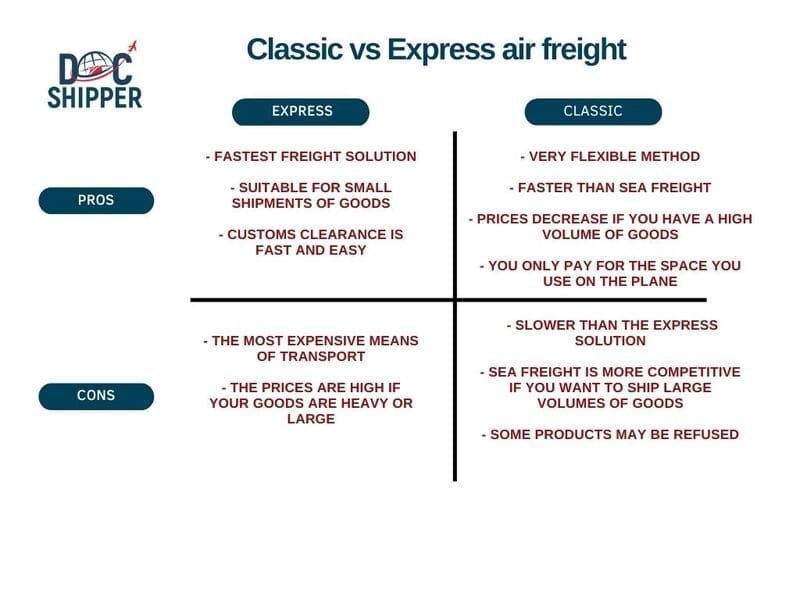

Classic or Express air freight

There are two types of air freight:

- Classic air freight: This option uses the space available on board commercial flights of airlines such as Emirates, Iberia, Thai Airways, or even Qatar Airways, and exploits the empty spaces.

- Express airfreight: This option uses aircraft dedicated solely to airfreight. This solution is offered by courier companies, such as FedEx, DHL, UPS, or even TNT, which offers door-to-door solutions.

Main airports in Spain

Adolfo Suárez Madrid-Barajas Airport (MAD)

Located in Madrid, the capital city of Spain, Adolfo Suárez Madrid-Barajas Airport is the country’s busiest and largest airport. It has extensive cargo facilities and handles a significant volume of air cargo. The airport offers a wide range of services, including temperature-controlled storage areas for perishable goods, express cargo handling, and customs facilities.

In 2020, Madrid-Barajas Airport handled approximately 486,000 metric tonnes of cargo.

Barcelona-El Prat Airport (BCN)

Barcelona-El Prat Airport is the second-busiest airport in Spain and is located near the city of Barcelona. It has a significant cargo operation, with dedicated cargo terminals and facilities.

In 2020, Barcelona-El Prat Airport processed around 158,000 metric tonnes of cargo.

Palma de Mallorca Airport (PMI):

Palma de Mallorca Airport, located in the Balearic Islands, has cargo operations and facilitates freight transportation to and from the popular tourist destination of Mallorca.

In 2020, Palma de Mallorca Airport handled approximately 4,000 metric tonnes of cargo.

Valencia Airport (VLC)

Valencia Airport, situated in the eastern part of Spain, offers cargo services and has facilities for handling freight shipments. It serves as an important gateway for cargo transport in the region.

In 2020, Valencia Airport processed around 5,000 metric tonnes of cargo.

Main airports in Thailand

Suvarnabhumi Airport

Suvarnabhumi Airport is a major cargo hub for the Asia-Pacific region, with direct flights to a variety of international destinations.

Suvarnabhumi Airport is a major cargo hub for the Asia-Pacific region, with direct flights to a variety of international destinations.

More information:

- It has the world’s tallest control tower.

- With 56.3 hectares, it is the world’s third-largest terminal.

- Increased cargo and aviation capacity is expected.

Don Mueang Airport

Don Mueang Airport is one of the world’s oldest international airports. Commercial flights began in 1924, making it one of the world’s oldest commercial airports.

More information:

- This airport handled 700,000 tons of cargo.

- It collaborated with 80 airlines.

Chiang Mai Airport

Although Chiang Mai Airport is not as large as Bangkok Airport, it is vital to the logistics of Thailand’s northern region by providing direct flights to major domestic and international destinations.

Although Chiang Mai Airport is not as large as Bangkok Airport, it is vital to the logistics of Thailand’s northern region by providing direct flights to major domestic and international destinations.

Further information:

- 16,000 tons of cargo per year

- More than 15,000 flights and 2,000,000 passengers are carried out each year.

What benefits does air freight offer?

- Transport is quick

- Rarely late

- Appropriate geographic coverage

What drawbacks does air freight have?

- High price

- Not possible to transport really heavy goods

- The security at the airport is much higher which can make you lose time during the control

How much does it cost to transport cargo by air from Thailand to Spain?

To determine the cost of your goods transported by air freight from Thailand to Spain, consult the airline companies’ tariffs. Their tariffs are presented in decreasing price weight bands.

The weight taken into account by airlines will always be the one that benefits them, that is, the greatest difference between the real weight and the volumetric weight.

Siam Shipping Advice

Getting an accurate price estimate for your airfreight shipment can be challenging on your own. We recommend contacting us for professional assistance. By reaching out to our team, you can receive a free quote tailored to your specific requirements within 24 hours.

How do you figure out your shipment’s volumetric weight?

The volumetric weight is the volume occupied by a package, based on its dimensions and its gross weight. To know it, you must measure the dimensions of the package (length, width, and height), then convert them into cubic meters. Then use the formula below:

Volumetric weight = (length x width x height) / 5000

Siam Shipping Advice

We recommend using air freight for fragile, valuable, or perishable goods to increase security and protect your merchandise. You can get in touch with our specialists for further details if you want to learn more about transporting fragile merchandise.

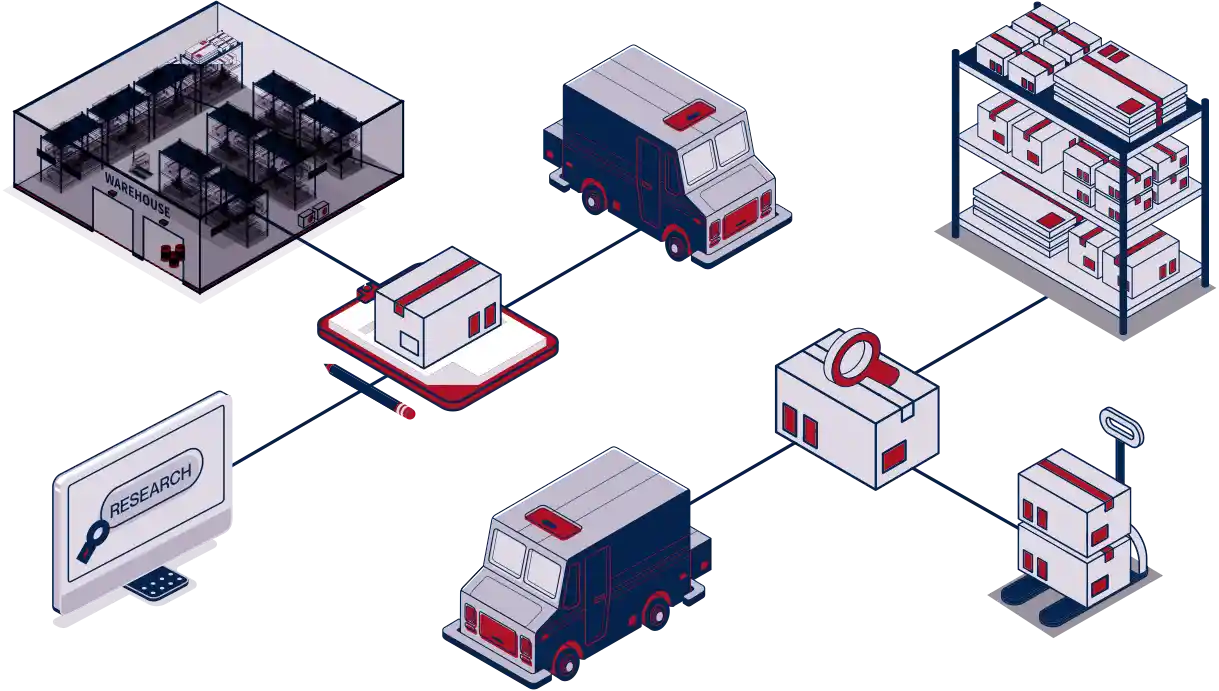

Door-to-door delivery between Thailand and Spain

If you’re looking for a hassle-free transportation solution and don’t have the time to manage the logistics yourself, door-to-door delivery is the perfect option for you. This method is designed to simplify the shipping process, ensuring convenience and peace of mind.

What are the advantages of door-to-door services?

- Convenience: With this service, you can have your goods picked up directly from your location and delivered to the desired destination without the need for multiple intermediaries or additional coordination.

- Time-Saving: Door-to-door services save you valuable time by eliminating the need to personally handle transportation logistics. Instead of arranging for separate pickups, drop-offs, and transfers, a single provider takes care of the entire process, streamlining the shipping experience.

- Enhanced Security: With door-to-door services, your goods are in the hands of experienced professionals who prioritize safety and security. From pickup to delivery, the service provider ensures that your items are properly handled, reducing the risk of damage or loss during transit.

What are the disadvantages of door-to-door services?

- Cost: Door-to-door services may be relatively more expensive compared to other shipping options due to the added convenience and comprehensive service provided.

- Limited Flexibility: Door-to-door services often operate on predefined schedules and routes, which may limit flexibility in terms of pickup and delivery times.

- Longer Transit Time: In some cases, door-to-door services may have longer transit times compared to other shipping methods, especially for remote or less accessible locations.

- Dependence on Service Provider: When opting for door-to-door services, you rely heavily on the service provider to manage the entire transportation process. Any delays or issues on their end can potentially impact the overall delivery timeline.

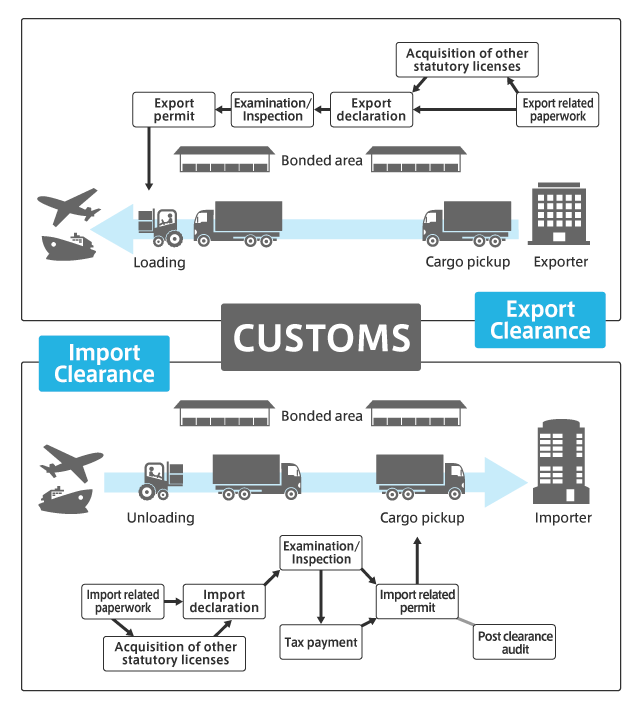

Customs clearance in Spain for goods imported from Thailand

In every nation, Customs clearance is a crucial and required step that must be achieved when importing and exporting.

The customs clearance process when importing goods into Spain entails paying VAT and customs duties. To prevent having your goods seized at customs, it’s also important to pay attention to the laws and regulations of the nation to which you are shipping.

On imported goods, Spain imposes customs duties and taxes that change based on the type of product and its declared value. To accurately estimate the costs of the import, it is essential to be familiar with the applicable duties and taxes.

Here are the prohibited and regulated products in Spain:

- Prohibited products: Drugs and narcotics, firearms and ammunition, counterfeit Goods, cultural and historical artifacts, and hazardous materials

- Regulated products: food and agricultural products (fruits, vegetables, meat, poison, milk), animals, weapons and ammunition, works of art, pharmaceutical products, products…

Customs value

The customs value corresponds to the real economic value of the goods. Its estimation is based on precise rules harmonized at the European level. Thus, the General Rules for the Determination of Customs Value provide for several valuation methods, which are set out in Articles 70 to 74 of the European Customs Code (ECC).

When importing goods, the customs value enables the state to determine the duties and taxes that will be levied against the goods: customs duties, additional duties, anti-dumping duties, dock dues, VAT, etc., and when exporting, it enables the state to determine the basis for some duties and to gather the information required for statistical monitoring of foreign trade.

What are the customs duties and taxes in Spain?

- Import duties: These are taxes levied on certain goods imported into Spain based on the classification, value, and country of origin of the product. Import duties can range from a few percent to more than 50% of the product’s value, depending on the product.

- Value Added Tax (VAT): This is a tax on the value added at each stage of the production and distribution of goods and services. The VAT rate for most goods imported into Spain is currently 21%. When goods enter the country, the importer usually pays the VAT.

- Excise duties: Excise duties are taxes levied on specific products such as alcohol, tobacco, and gasoline. Excise duties are frequently levied in addition to import duties and VAT, and are based on the quantity or volume of the product.

- Anti-dumping duties: These are additional import duties imposed by the EU to counteract unfair trade practices, such as when a foreign company exports a product at a lower price than it charges in its own country. Anti-dumping duties can be significant and may be imposed for several years.

- Environmental taxes: Some products may be subject to environmental taxes, such as taxes on packaging or products that contain hazardous substances.

How to calculate customs duties and taxes

Calculating customs duties and taxes on imports into Spain can be a complex process that depends on several factors, such as the type of product, its value, and its country of origin. Here are the general steps to follow:

- Determine the product’s tariff classification: The first step in calculating customs duties is to determine the product’s tariff classification. This is done by consulting the EU’s Common Customs Tariff (CCT), which lists the various product categories and their corresponding duty rates. You’ll need to know the Harmonized System (HS) code for your product to determine its tariff classification.

- Determine the product’s value: The next step is to determine the product’s value, which is usually the invoice value of the goods plus any additional costs, such as shipping and insurance.

- Calculate the customs duty: Once you have determined the product’s tariff classification and value, you can calculate the customs duty. The duty rate will depend on the product’s tariff classification, its value, and the country of origin. You can use the EU’s TARIC database to look up the duty rate for your product.

- Calculate the VAT: In addition to customs duties, you will also need to calculate the VAT. The VAT rate in France is currently 20%, but there may be reduced rates for certain products, such as food and books.

- Calculate any other taxes or fees: Depending on the product, there may be other taxes or fees to consider, such as excise duties or environmental taxes.

It’s important to note that the customs clearance process and the calculation of duties and taxes can be complex. If you’re unsure about how to calculate the duties and taxes for your specific import, it’s always best to consult with a customs broker or freight forwarder like Siam Shipping. We can help you navigate the process and ensure that you’re meeting all the necessary requirements.

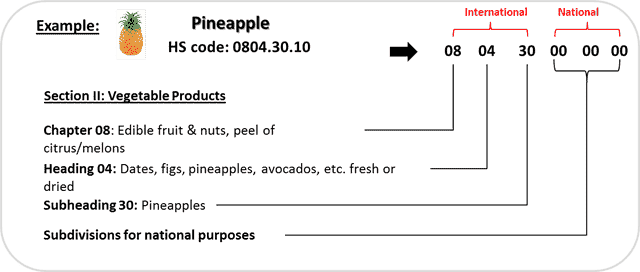

How to find the HS code?

The Hs Code (Harmonized System) is a classification scheme for goods used in international trade. It streamlines the gathering of statistical data and the customs clearance procedure by classifying goods according to their nature and intended use. There are more than 5,000 different products in the HS system, and each one is categorized using a unique eight-digit number.

You can consult these websites to know the HS code of Thailand’s products and Spain’s products

Calculating customs duties with the HS Code

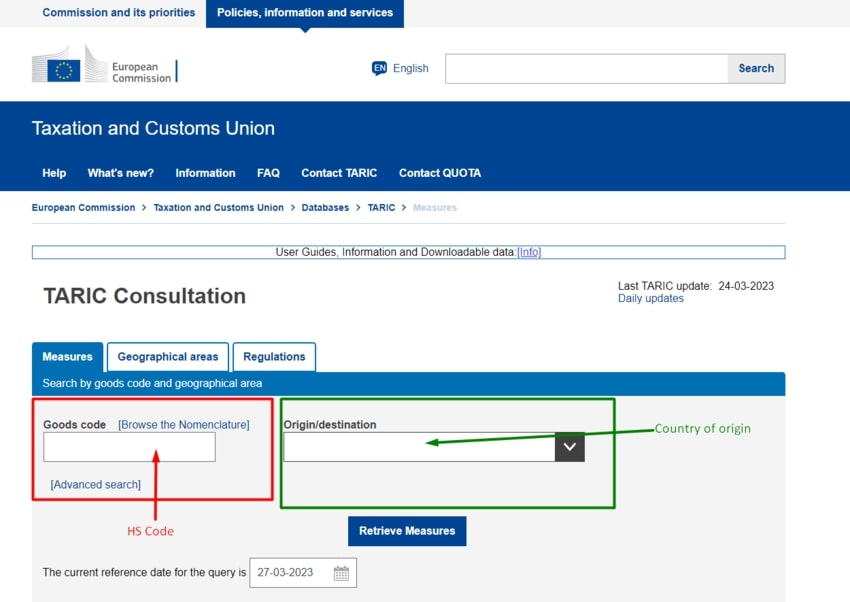

Now that you have the HS code of your products, you can find the associated tariffs on the European customs website.

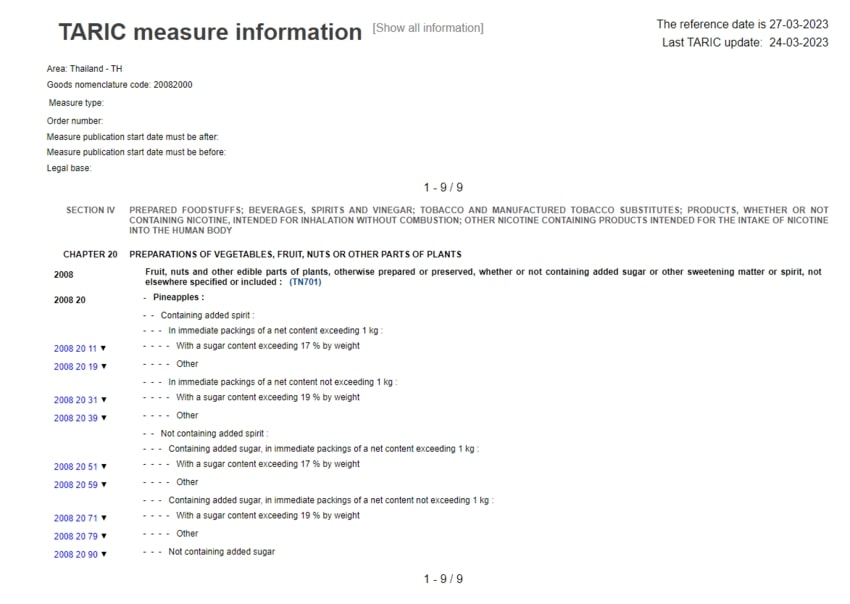

Here is a small illustrated guide to help you understand how to do it:

Enter your HS code and country of origin.

Then, consult taxes applicable to your product.

Does Siam Shipping incur customs fees?

No, customs duties are not imposed by Siam Shipping. No commission from the customs fees levied on your shipments is taken by us. We will give you all the official documents produced by the relevant customs authorities as evidence of our transparency. By declaring your goods on your behalf, it is our responsibility to support you during the customs clearance procedure.

It’s important to remember that the Spanish government will be responsible for collecting the customs fees and taxes related to your shipments. These costs are the importer’s responsibility and are set by customs regulations. Siam Shipping‘s staff will assist you with the customs clearance procedure and make sure that all fees and paperwork are processed properly.

Customs procedures and contact

The customs services

Required documents

- Commercial Invoice: A detailed invoice that includes information about the goods, their value, quantity, and description

- Packing List: A comprehensive list of the shipment’s contents, including the number of packages, their dimensions, weight, and a description of the goods.

- Bill of Lading (B/L): A contract between the shipper and the carrier that serves as a receipt of goods and evidence of the contract of carriage. It includes details about the shipment, such as the names and addresses of the shipper and consignee, the description of the goods, and the terms of the shipment.

- Certificate of Origin: It is a document that proves the country of origin of the goods. It may be necessary to do so in order to be eligible for preferential trade agreements or to comply with customs regulations.

- Insurance Certificate: If the shipment is insured, an insurance certificate or policy may be required to provide proof of coverage for the goods during transit.

- Export License: Depending on the nature of the goods being shipped, an export license may be required by the exporting country or the relevant authorities.

- Import License: In some cases, an import license may be required by the importing country or the relevant authorities to regulate the entry of certain goods.

- Customs Documentation: This may include various forms and declarations required by customs authorities in both Spain and Thailand, such as customs declaration forms, customs power of attorney, and any specific customs-related documents.

Additional logistics services

Venture beyond shipping and customs with SIAM Shipping! Explore our wide array of additional logistics services, ensuring your supply chain operation runs smoothly from start to finish. Let's take care of everything, together.

Warehousing and storage

Finding the right warehouse for your goods can feel like a treasure hunt—a steady temperature for your delicate items is a must. Storing chocolates? You wouldn’t want a meltdown! For a stress-free solution that considers all conditions, explore our warehousing services, designed to keep your goods in prime condition.

Packaging and repackaging

Inherent challenges in shipping from China to France make quality packaging vital. Having a reliable agent can help ensure your wine barrels or electronics are suitably packed and repacked, reducing the risk of damages. Whether it's ceramics securely cushioned or machinery components assembly-segregated, great packaging caters to every product. Find out more about securing your cargo on our dedicated page: Freight packaging.

Cargo insurance

Contrary to fire insurance limited to premises, transport insurance is your flotation device over rough trade seas. Imagine sending a pricey, custom-built machinery and it gets damaged in transit. Ouch! But, with cargo insurance, you're covered and can breeze through such setbacks. It's the booster dose of prevention to keep your trade immunity sky-high.

Personal effects shipping

Moving precious belongings from China to France? No worries, we manage fragile or bulky items with extra care, ensuring they reach your new French home intact. Like Aunt Mei's porcelain vase, we pack, transport, and deliver with professionalism. Save time and energy for croissants and vin rouge!

FAQ | Freight between Thailand and Spain

Exporting to Thailand offers numerous benefits, including access to a growing market with a population of over 69 million people, a strategic location in Southeast Asia, favourable trade agreements, and a diverse economy with opportunities in various sectors.

Spain exports a range of products to Thailand, including machinery, vehicles, pharmaceuticals, chemicals, food products, and agricultural goods. The diversity of the Spanish export industry allows for opportunities in different sectors when trading with Thailand.

To obtain an accurate freight shipping quote, you should provide detailed information about your shipment, including the type of goods, weight, dimensions, mode of transport preference, and any additional services required. Contact Siam shipping specialized in the Thailand-Spain trade route ,we allow you to receive customized quotes based on your specific requirements.

Yes, it is highly recommended to consider cargo insurance to protect your shipment against potential loss or damage during transportation. Insurance options can be discussed with freight forwarders or insurance providers to select the most suitable coverage for your specific needs.

Yes, Siam Shipping has experienced customs brokers who can assist with customs clearance procedures for shipments between Thailand and Spain. We ensure compliance with customs regulations and handle the necessary documentation to facilitate smooth clearance of your goods

Yes, we offer cargo insurance options to provide added protection for your freight shipments. Our team can guide you through the insurance coverage options available and help you choose the most suitable insurance plan for your specific cargo.

We provide tracking services that allow you to monitor the progress of your shipments online. You can access real-time tracking information through our website, or contact our customer service team for updates on the status and location of your cargo.