In this article, we will delve into the intricate world of custom clearance in Thailand. Importing goods into a foreign country can be a daunting task, especially when it comes to navigating customs regulations. Thailand has its own set of rules and procedures that must be followed in order to ensure a smooth and efficient customs clearance process. Whether you are a business owner importing goods for your company, or an individual importing personal belongings, this article will provide you with the necessary information to understand the custom clearance process in Thailand. We will cover everything from required documents to fees and taxes, to how to handle any potential issues that may arise during the process. Get ready to learn all about custom clearance in Thailand.

SIAM SHIPPING (by DocShipper) – YOUR CUSTOM BROKER IN BANGKOK, THAILAND.

To minimize problems, additional costs and shipping delays, SIAM Shipping offers a custom clearance service to our clients for import and export. Our regular contacts with administrative departments simplify all procedures: saving time and money and less problems.

Our experts analyze case by case each request and consider what should we do to provide a fast and qualitative service.

SIAM Shipping consider the challenges of the custom clearance for some customers; that’s why we strive to discharge a maximum of charges.

SIAM Shipping Info: We are aware of Thai regulations in order to estimate and anticipate any problems that our customers may encounter. We pay attention about every documents in order to avoid any kind of fees from the local customs. If you need a customs clearance service in Thailand, contact us today. Will will take care of all your needs like we always have since 2016.

Your goods are blocked at Thai customs, contact us to release it!

DocShipper can assist in organizing and setting up any authorization for your imports into Thailand. Systematically, our know-how and our experience will enable you to realize significant savings in terms of time and money.

We are located in the heart of Bangkok, close to Suvarnabhumi International Airport. We have a state-of-the-art warehouse in which we offer a wide range of services for all products that leave or arrive in Thailand.

We are able to handle customs clearance at all airports, railway stations and ports in the country. The following items can help you understand some aspects of customs clearance.

Withdrawal of customs duty: When you bring goods to Thailand, you have to pay taxes, VAT, etc., which are not the same as in other countries.

However, a solution is available, which is to delay the payment of your import costs (including VAT) for an average of 30 days. To implement this system, you must meet certain conditions, such as providing an approved guarantee or agreeing to be debited by automatic payment

On the other hand, we work as “consultant” as we advise our customers on each step of the customs clearance: what they should do, what they shouldn’t do. The process to import or export is not so easy, that’s why we follow our customers on every step of the shipment: from the departure to the arrival.

SIAM Shipping Tip: Imported goods should normally be accompanied by an individual valuation statement and subject to customs duty when valued at more than US $ 6,000. However, if you regularly import merchandise, you can save time and money by completing and recording a single general evaluation statement. Every 3 years, you must complete this form, showing basics agreement of the product remain the same during this period.

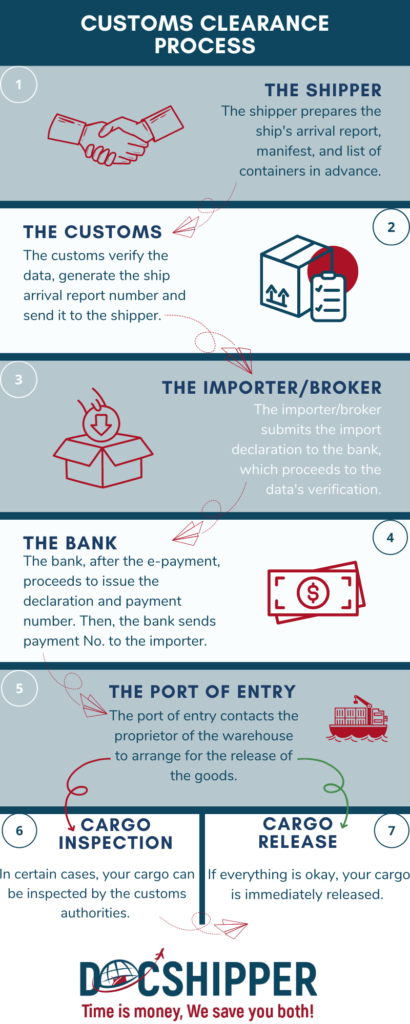

Customs clearance point by point

Customs clearance – The process step by step

- Simplified customs cargo procedures: Simplified maritime transport procedures (CFSP) are electronic declarations that simplify and speed up customs procedures for imported goods. The CFSP offers a range of procedures that can be applied on a case-by-case basis or simultaneously to meet different client needs. You can also choose the simplified declaration procedure (SDP) or the Local Authorization Procedure (LCP).

- Storage: If you import goods subject to customs duties or taxes under the Common Agricultural Policy (CAP), you may suspend the payment of import taxes by storing the stock in a specific and appropriate warehouse. However, the costs are not payable if you pick out the current stock from the warehouse.

- Free Zones: You can also choose to move imported goods to a free zone without paying import fees. So, you just have to pay your customs fees and you only charge VAT. The conditions are that you bring the goods out of the area to the European Union market, And you use them in this area.

With the appropriate authorizations, you can process the imported goods without customs duties and VAT. However, customs duties are payable only when the products are destined for the European Union market; And import VAT is payable when the processed products are delivered to the EU market. Any supply of goods and services in the area is subject to the normal VAT rules.

SIAM Shipping Advice: Whether you're a large company, a small business, a start-up or an individual, DocShipper can arrange your shipment from start to finish, without you having to do anything. Tell us about your project, so our experts can find the most appropriate solution for your freight and give you tips on how to save on shipping costs. We'll answer any questions you have!

How to get the right to import goods into Thailand?

SIAM Shipping Alert: Are you planning to ship goods overseas by sea? Whether it's a groupage shipment or a full container, DocShipper takes care of all the procedures with the various players in the logistics chain.

A single point of contact, dedicated service, peace of mind, expertise... DocShipper makes importing and exporting more pleasant.

Need a quote? Contact us to receive a free estimate in less than 24 hours.

You have a question ? Call our consultants for free.

Once the company is established in Thailand, registered for VAT and holds a corporate bank account, you can request an import/export permit (paperless license). This card comes with a number which is mandatory if you are willing to import or export goods in/to Thailand.

You will have to fill an application form and put together documents that have to be presented to the Customs Department. Nowadays, the whole process rarely takes more than one day. After that, you will be assigned a license number that will allow you to carry out import and/or export of goods.

The documents required are as follows:

- KSK 1 application (only 1st and 2nd pages)

- Copy of company affidavit (updated within six months)

- Two copies of value added tax certificate (PP 20)

- Copy of first page of bank account and bank statement

- Copy of seal registration (BAJ 3)

- Copy of passport

- Power of attorney (The 3rd page of KSK 1)

HOW DUTIES AND TAXES ARE CALCULATED?

Duty rates

In Thailand, CIF (cost, insurance and freight) is used to estimate the value of incoming goods. Duty rates are calculated based on:

- Item Value: $100

- Shipping: $20

- Insurance: $30

- Total CIF: $150

This CIF value is used to determine the duty rate. Duty rates hover between 0% – 80% with an average of 21%. Some goods are not subject to duty charges. Laptops, some electronic devices, and items with a value not exceeding $30 are exempt from customs duties.

SIAM Shipping Info: DocShipper assists small and medium-sized businesses and individuals in importing or exporting, by arranging all the steps in international transport, including customs clearance. If you are looking for assistance from A to Z, request a quote. We look forward to learn more about your needs!

A few notes on duty rates

Even though you are declaring the item’s real value, Thai customs often end up valuating the item at a higher rate. You may estimate a value of $50 for a bicycle you are shipping to Thailand, but Thai customs may decide those bicycles are worth $100 or even $150. This is very common out here, and there are limited means of action to prevent it from happening. Some managed to avoid that problem, by providing proofs of the items’ true value (receipts, documents, etc.).

The other tricky aspect of duty rates is the non-uniformity of the percentages. Like often in Thailand, standardization is rare when it comes to rules and regulations. What duty rate you will end up paying often varies from one postal or customs agent to another. It is totally normal to pay different duty rates for the exact same item.

Finding bad stories about Thai customs is pretty much effortless. People report missing items or even items getting blocked or retained in customs for an extended period. You will also find stories of customs using a shipment as leverage to collect more duty, asking for a ransom.

SIAM Shipping Advice: Bribes and corruption are widespread. You can end up paying 50% of the duty rate under the table without invoices or paperwork. This kind of practices depends a lot on the location. It is recommended to carefully keep all shipping documents and receipts for later verification.

VAT

VAT, or Value Added Tax, is a sales tax added to items coming into Thailand. Currently, the VAT rate is 7%, calculated on the basis of the CIF value, as well as any duty added to the item.

*In that respect, the value once VAT is applied is greater than the original value of the item, as it combines the item’s value, shipping, insurance, and duty. Another 10% tax might apply to alcoholic beverages and food.

WHO SHOULD I PAY, THE BROKER OR CUSTOMS AUTHORITIES?

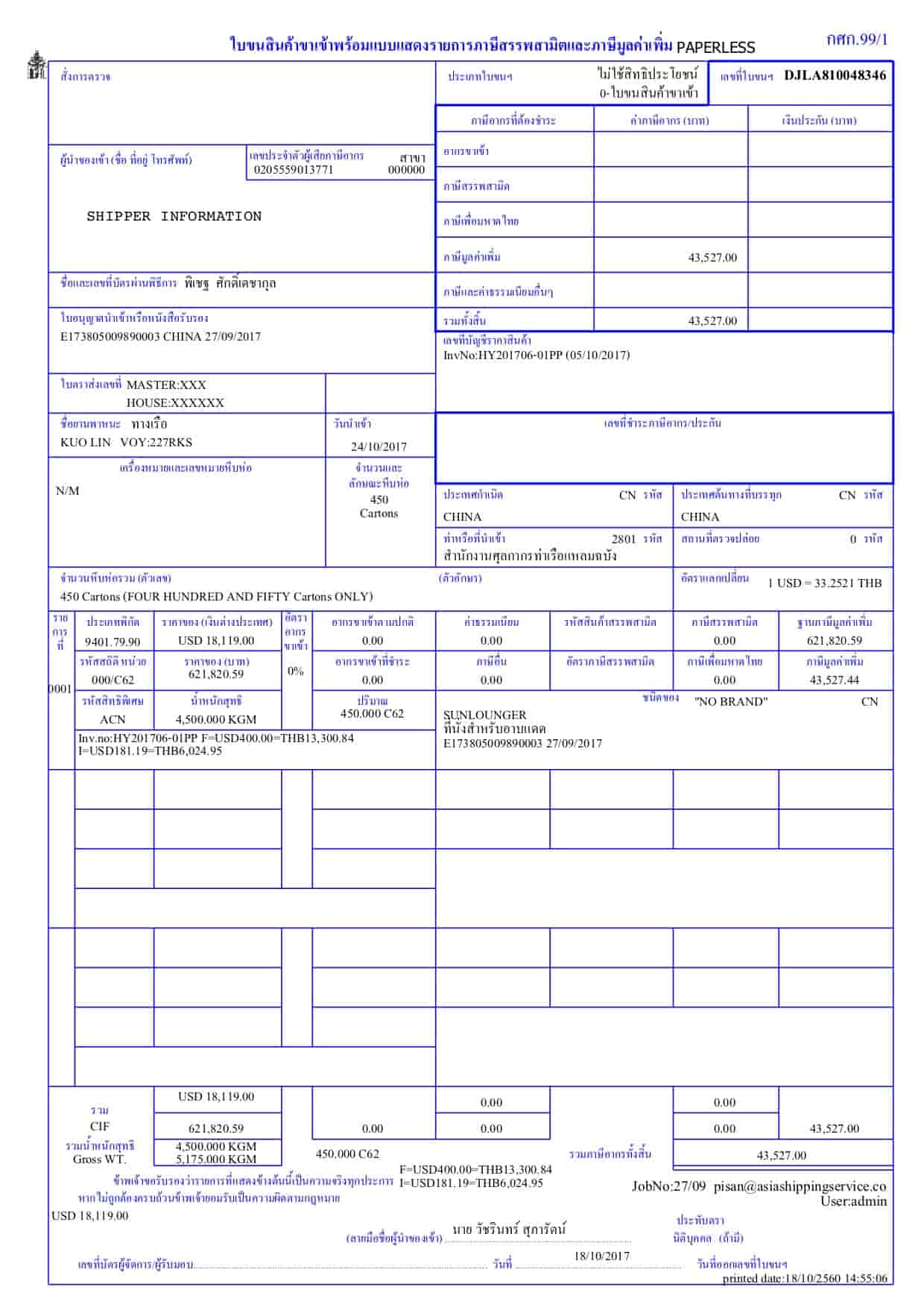

Most of the time, we will provide you a draft, an official document as follow:

This document acts as an invoice, we must receive payment before the release of your shipment. It is easier for you to pay us directly, so that you can save a lot of time. As we all know, time is money in logistics.

Customs clearance – Official receipt from Thai customs

Can I underestimate goods to save money?

If the declared value of goods is considered to be deliberately low, or too far from their real value, the Director-General is allowed to impose the customs price of the goods.

Arbitrators

If no agreement is reached on the price, the Director-General is allowed to accept such goods as payment tax or to buy all or some parts of the goods, or he can nominate arbitrators to resolve the disagreement. The number of arbitrators has to be equal, with a maximum of two arbitrators on each side.

If both parties have still not reached an agreement, an umpire is designated to make the final decision.

WHAT HAPPENS IF MY SHIPMENT IS EXAMINED BY THE CUSTOMS?

How shipments are chosen to be examined by Thai customs is still an enigma, as no official criteria have been revealed yet. All shipments are ascribed a risk factor number when approaching Thailand, but we still don’t know it is calculated.

THE LEGISLATION IS CLEAR: THAI CUSTOMS HAS FULL AUTHORITY IN CHOOSING ONE SHIPMENT TO EXAMINE OVER ANOTHER.

Nevertheless, TCA will inform your customs agent that they will be advising a “manifest hold.” The good news is that SIAM-Shipping has years of experience with this and can advise beforehand of such a possibility. Also, as SIAM Shipping by DocShipper group is certified by TIFFA, your shipment will be given priority and will be inspected before shipments that don’t have the certification.

Below are some of the reasons that your shipment may raise a red flag with Thai customs:

-

- Random Examination – Your cargo can be examined without specific reasons, as Thai customs can arbitrarily decide to examine a small proportion of the incoming cargoes. It can take different forms: a VACIS (x-ray), tailgate, partial, or intensive, exam.

- Type of Commodity – Further inspection may be conducted depending on the type of commodity being imported. For instance, pharmaceuticals and chemicals are often sent for laboratory analysis, to make sure the goods are correctly classified. The Food and Drug Administration (FDA), Thai industrial standard institute or other government agencies also have a final say in approving perishable and animal products.

- Country of Origin – The country of origin plays an important role in the probability to get your cargo examined. If your shipment is coming from Colombia, or any other blacklisted countries, chances are good that customs officers will have a closer look at it. In the same way, keep in mind that there is a list of sanctioned or embargoed countries- Crimea (a region of Ukraine), Cuba, Iran, North Korea, Sudan, and Syria) – for which any transactions are prohibited without a proper license authorization.

- Flagged Shippers – All shippers importing to Thailand are recorded in the TCA’s database. If some shippers reportedly used to under-declare some goods in the past, with an HS code that comes with less duties payable to the government, they will be flagged for inspection. For that reason, there is an imposition of antidumping duties, which is added to regular duties, for countries like China, and for specific shippers or factories.

- Flagged Importers – The same goes for importers. If you have a history of penalties imposed on you for under-declaring a cargo, expect your future shipments to be inspected. Also, first-time importers are flagged for examination until it is determined that they comply with customs rules and regulations.

SIAM Shipping Advice: These are some of the most common reasons for which a customs inspection is carried out. If your shipment is a bit borderline with Thai regulation, we advise you to contact one of our SIAM Experts to clear the case and see what will be the most convenient solution. Don’t panic, contact us now !

Is the clearing process similar at port and airport?

The process is always similar. SIAM Shipping has customs services in Suvarnabhumi airport and can clear any goods within 24 hours from arrival (if all documents are eligible).

Customs clearance – Thai customs in airport

PROHIBITED GOODS IN THAILAND?

Restricted Items

Every international shipping services impose their own restrictions on the importation of certain items. But in the end, the final says rests with what Thai customs decide can or cannot be brought into Thailand.

The following items require approval from specific government departments in order to be cleared by the Thai customs:

- Office of National Police – Firearms, parts thereof and ammunition

- Fine Arts Department – Buddha images; Artifacts and antiques

- MDES (Ministry of Digital Economy and Society) – Radio transceivers and telecommunications equipment

- Department of Agriculture – Plants and planting materials

- Department of Live Stock Development – Live animals and animal products

- Office of Food and Drugs Administration – Medicines and chemical products

General Restrictions

- Tobacco

- Beef, products

- Seeds, any type of seed

- Dry Tea Leaf

- Drugs, Non-Prescription

- Electronic Cigarette

- Baraku, Shisha, Hookah (Water pipe)

- Obscene objects (literature, pictures)

- Pornographic materials

- Goods with Thai national flag

- Narcotics (marijuana, hemp, opium, cocaine, morphine, heroin & etc.)

- Fake currency, bonds, or coins

- Fake Royal Seals & Official Seals

- Intellectual Property Rights (IPR) infringing goods (a)

- Counterfeit trademark goods

- Sex Toy (any kind)

- Graven Image (religious idols)

SIAM Shipping Advice: Most household pets can enter Thailand without particular restrictions, but it is not the case for some animals. For a detailed look at how to bring your pet with you in Thailand, check out our dedicated article: import animal to Thailand

Duties and taxes for personal effects

For further and more detailed information about regulations when importing personal effects into Thailand, we encourage you to have a look at our relocation website. Please keep in mind that all personal belongings are taxed. Everything is strictly-regulating these days, so read carefully our page regarding taxes on used household items.

SIAM Shipping Info: We have a specific logistics department specialized on personal effects, if you want further information, feel free to check our dedicated website: SIAM Relocation

SIAM Shipping Info:**In order to optimize our services, Siam Shipping and Siam Relocation are now part of the DocShipper group. Our customers can now benefit from total supply chain coverage. Therefore, Siam Shipping team became DocShipper team**

WHAT ABOUT EXPORT CUSTOMS, HOW DOES IT WORKS?

Exporting from Thailand

Goods to be exported out of Thailand are subject to regular export procedures. All goods that are shipped out of the country must be cleared by the customs. Customs’ job consists in collecting all the information about the nature and the volume of the goods, to make the decision-making process as smooth as possible. Unless specifically exempt, all shipments have to wait for the green light of the Customs before the goods are loaded.

Required Documents

Here is a list of the basic documents that must be presented to the Customs for the clearance procedure in case of red line (risky shipment):

- Export Declaration

- Invoice

- Export License (if applicable)

- Other relevant documents such as catalog, product ingredients, etc.

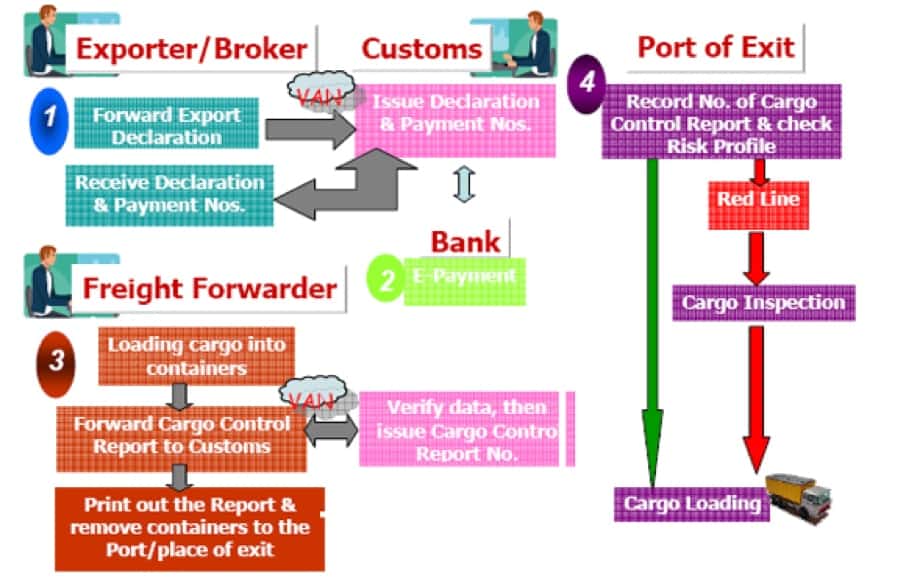

Export declaration & clearance process

The process of Customs Clearance for export is made up of 4 steps:

Step 1: Submission of a Declaration

The whole procedure is launched when an exporter/broker submits an Export Declaration in ebXML message to the e-Customs system.

Step 2: Verification of a Declaration

In a second step, the Declaration is verified (automated verification). The data is verified and validated immediately by the e-Customs system. If no errors are detected by the automated system, the Goods Declaration number is created together with the e-Payment system (in case of export taxes and duties).

The broker/exporter received a confirmation message. Moreover, the selectivity profile system will check the information and classify the Declaration into one of these two categories: Green Line or Red Line.

Step 3: Payment of Duties and Taxes

The third step is the payment of applicable duties and taxes and/or guarantee. For now, there are 3 ways to pay for duties and taxes: payment at the Customs Department, e-Payment, or payment at banks.

Step 4: Inspection and Release of Cargo

Last step: the cargo is examined and released from Customs custody. At that point, the cargo is loaded by a freight forwarder and electronically controlled by the e-Customs system. This system checks all the information and immediately correct any mistakes.

The cargo control report number is automatically created by the system and the response is then sent to the freight forwarder and the exporter/broker, if no errors are detected.

Following this, the cargo control report is printed by the freight forwarder and carry away the cargo to the exit port. At this last stage, the Customs officer at a sub-gate examines whether the declaration is a Red Line or a Green Line.

SIAM Shipping Info: You still have some doubt about your import or export license. Don’t panic ! Contact our SIAM Docshipper Experts or check our dedicated page : Import / Export license

SIAM Shipping Info: We have also been maintaining strong relationships with Thai Govt officials. If you require a full custom clearance service in Thailand and want to be supported in this key process, please contact us. Our legal professional experts will guide you throughout the whole process. Don’t wait any longer, contact us now.

FAQ | The custom clearance in Thailand

What documents are required for custom clearance in Thailand?

To clear customs in Thailand, you will need to have the following documents: a commercial invoice, a bill of lading or air waybill, a packing list, and a certificate of origin. Additionally, if your goods are subject to special regulations or restrictions, you may need to have additional documentation.

How long does the custom clearance process take in Thailand?

The time it takes to clear customs in Thailand can vary depending on the type of goods being imported and the volume of cargo being processed. On average, it can take anywhere from a few hours to several days to complete the customs clearance process.

Are there any restrictions on the type of goods that can be imported into Thailand?

Yes, there are restrictions on the type of goods that can be imported into Thailand. Some goods are restricted for health, safety, or environmental reasons, while others may be subject to special import duties or taxes. It is important to familiarize yourself with these restrictions before importing goods into Thailand.

What happens if my shipment is held up at customs in Thailand?

If your shipment is held up at customs in Thailand, it is likely due to an issue with the documentation or a violation of import regulations. In this case, you will need to work with your shipping company and a local customs agent to resolve the issue and have your shipment released. This may require additional documentation or the payment of additional fees or fines.

SIAM Shipping | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!