The global economy thrives on the exchange of goods and services across borders, and efficient freight transportation plays a pivotal role in facilitating international trade. In recent years, the freight transportation route connecting Thailand and Qatar has emerged as a promising corridor, presenting new opportunities for economic growth and enhanced bilateral trade relations between the two nations. In this article, we will explore the key aspects of this freight route, including pricing, delays, customs clearance, and transportation options. By understanding these factors, businesses and logistics professionals can optimize their operations and ensure efficient trade between Thailand and Qatar.

Table of Contents

What is the best method of transport between Thailand and Qatar?

There are 4 modes of transport, air freight, sea freight, road freight, and rail freight. However, in the situation of Thailand to Qatar, the railway modality does not exist, at least not yet, and road freight is really not recommended because of the great distance between the two countries.

Therefore, there are two ways to transport containers from Thailand to Qatar or vice versa, either sea freight or air freight.

Remark Siam Shipping : This is the most efficient freight solution when taking into account the three key factors of transportation; time, security, and cost.

Remark Siam Shipping: Contact us now! Your personal Siam advisor will find out a customized solution for your import process between Thailand & France.

Ocean freight between Thailand and Qatar

The commercial relations between Qatar and Thailand are important and have developed over the years. Qatar and Thailand have strong bilateral exchanges in trade, energy, and culture. They trade products like petroleum, chemicals, textiles, and machinery. Qatar supplies liquefied natural gas (LNG) to Thailand, meeting its energy needs. Both countries also promote cultural cooperation through events and exchanges. Overall, their exchanges in trade, energy, and culture enhance their bilateral relations.

Main ports in Qatar

Port of Hamad

The Port of Hamad, also known as Hamad Port, is a state-of-the-art port facility located south of Doha, the capital city of Qatar. It was officially opened in 2016 and has since become a crucial infrastructure asset for the country.

Port of Mesaieed

Mesaieed Port is located in a natural bay about half way south on the

east coast

of the State of Qatar, approximately 45 km. south of Doha

Port of Al Ruwais

Al-Ruwais Port, the second commercial port, is located at the northern tip of Qatar. The port plays the role of an additional access facility to promote the regional commercial shipments and to revive and invigorate the economy of the northern part of Qatar.

Main ports in Thailand

The Port of Bangkok

The Port of Bangkok is the largest port in Thailand, located on the Chao Phraya River in Bangkok. It is connected to the national railway system and has several docks for loading and unloading containers.

Map Ta Phut Port

Located in Rayong province, the Map Ta Phut Port is on the east coast of Thailand, this port is an important center for the country's petrochemical industry. It has a rail yard and is connected to the national rail network.

Chiang Saen Port

The Chiang Saen Port is located on the Mekong River in Chiang Rai province, near the border with Laos. It is used for the transport of goods between Thailand and the neighboring countries, in particular Laos and China.

Laem Chabang Port

The Laem Chabang Port is located about 130 kilometers southeast of Bangkok in Chonburi province. It is the second-largest port in Thailand and is connected to the national railway network for the transportation of goods to the interior of the country.

Top Shipping lines

Transit time between Qatar ports and Thailand ports

Here is a summary table of the average transit times, in days, between the largest Qatar and Thai ports.

| Bangkok | Laem Chabang | Map Ta Phut | |

| Hamad | 21 | 21 | 21 |

| Ruwais | 25 | 21 | 21 |

| Mesaieed | 25 | 21 | 26 |

*These transit times between Qatar and Thailand are given as an indication.

Should I ship by groupage or full container between Qatar and Thailand?

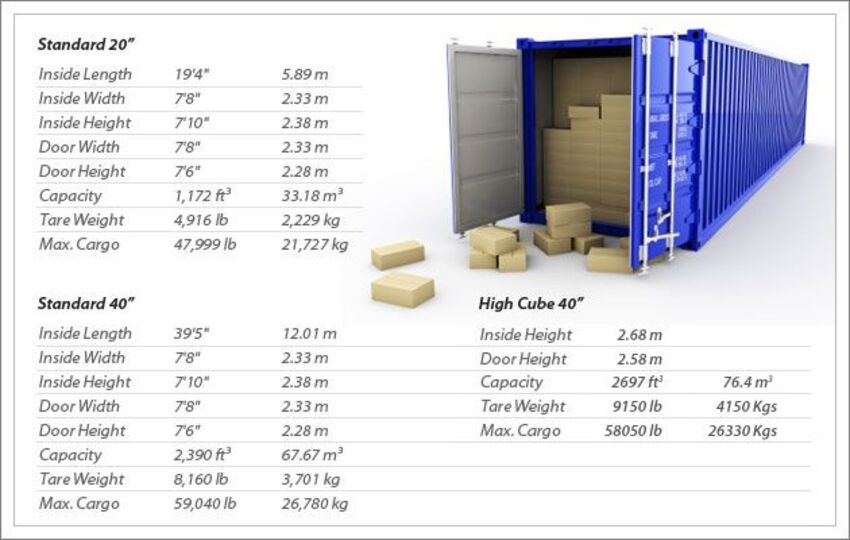

There are three main categories of standard container sizes:

- The 40-foot HQ (High Cube), with a capacity of 76 cubic meters.

- The 40-foot container, with a capacity of 67 cubic meters.

- The 20-foot container, with a capacity of 33 cubic meters.

Each of these containers can be shipped by two different transportation methods.

LCL

Less than Container Load: This type of shipment, allows several people, who do not have enough goods to fill an entire container, to use the same container. The goods of various people are thus combined to fill an entire container.

This is the most cost-effective choice for small shipments of less than 15 m³.

Advantages of LCL

- The advantageous rate for small volumes.

- Allows for fewer but more frequent shipments, reducing storage expenses.

Disadvantages of LCL

- Often longer delivery times due to loading and unloading of goods from all customers.

- Increased risk of loss and damage from multiple loading and unloading.

FCL

Full Container Load: For this type of shipment, one person will use the entire capacity of the container. This minimizes the risk of damage to the goods.

This method would still be advantageous even if you did not fill the container completely. However, it is the most cost-effective for shipments over 15 m³.

Advantages of FCL

- The advantageous rate for large shipments of goods.

- Reduced risk of damage or loss of goods because containers are not opened during transit.

Disadvantages of FCL

- A minimum volume of at least 15 m³ to be profitable.

Siam Shipping Alert: There are certain risks associated with LCL loading. During sea freight, your purchases may be damaged. Also, if your container partner encounters difficulties with customs during clearance, your customs clearance procedure may be delayed as well. Don't hesitate to contact us if you have any questions.

Special transports by sea between Thailand and Qatar

Reefer container

The reefer container is used to transport chemicals or perishable products at controlled temperatures. It is equipped with a cooling system.

Roro

RORO (Roll On/Roll Off) vessels are used to transport vehicles such as cars, trucks, vans, semi-trailers, and rail cars. They are considered the safest and most efficient vessels for heavy or special cargo.

Bulk

Bulk carriers are used to transport solid bulk materials such as minerals, grains, coal, or liquids such as crude oil, gas, and chemicals. These vessels are larger and easier to load and unload.

OOG

OOG cargo is cargo that exceeds the dimensions of a standard container. Two types of containers exist for these goods:

- Open Top Container: they have no roof, which allows loading cargo that exceeds the height of the containers.

- Flat Rack Container: these are flat containers without side walls or roofs, used for goods that cannot be loaded in standard containers.

How much does the sea freight cost between Thailand and Qatar?

The cost of sea freight between Qatar and Thailand will depend on several factors such as the type of cargo being shipped, the volume and weight of the cargo, the distance between the ports of origin and destination, the shipping method, and the current market conditions.

In general, the average cost of shipping a 20-foot container (TEU) from Qatar to Thailand is approximately US$1,500 to US$3,000, depending on the shipping company, the port of origin and destination, and the time of year.

It is possible to estimate the cost if you know the exact weight and volume of your goods. To do this, you must follow these 3 steps:

- Determine the PU (Paying Unit): for this, you need to compare the mass and volume of your cargo based on the theory of sea freight, which states that one ton = 1 m³. The higher value between volume and mass will be the UP. For example, for a volume of 20 m³ and a mass of 25 tons, the UP will be 25 tons.

- Calculate the basic freight: to do this, multiply the cost of the UP by its number.

- Calculate the net freight: with the following formula, Base freight + BAF + CSP - Rebate. The result will be the cost of your sea freight.

Tariff surcharges

Tariff surcharges may apply on your transport between Qatar and Thailand, here are the main ones:

- Bunker Adjustment Factor (BAF): This surcharge is applied according to fluctuations in the price of fuel and may vary regularly depending on market conditions.

- Security Surcharge (SCS): This surcharge is applied to cover costs related to port and vessel security.

- Overcapacity surcharge (OWS): This surcharge is applied when demand for shipping is lower than supply, resulting in excess vessel capacity.

- Congestion surcharge (CGS): This surcharge is applied in ports where congestion is high, resulting in extended waiting times for ships.

Air freight between Thailand and Qatar

Air freight will be the most efficient solution if :

- Your goods are smaller than 2 CBM and 200 kg

- You’re in a hurry to receive/send the goods

Remark Siam Shipping: Naturally, if you need to get your goods delivered as fast as possible, air freight is the best option for you. You are in the rush? Contact our Siam Expert now!

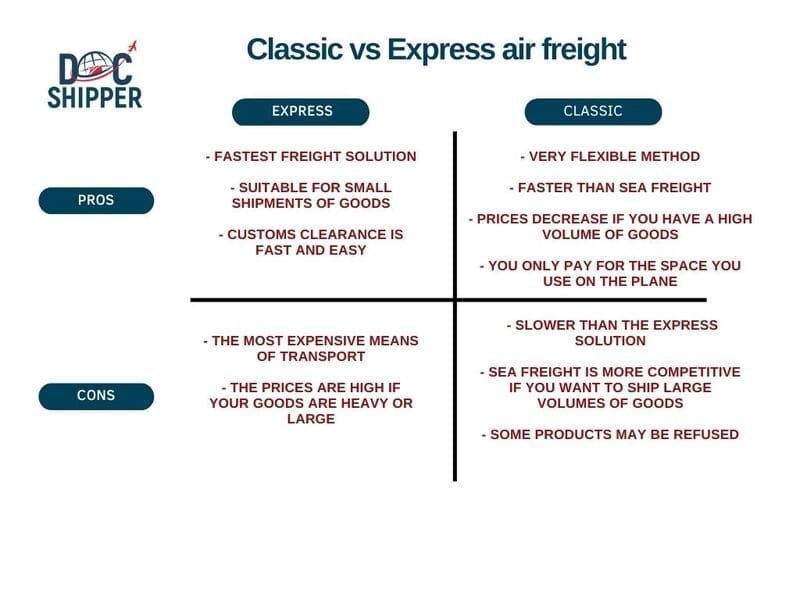

Classic or Express air freight

There are two types of air freight:

- Classic air freight: This option uses the space available on board commercial flights of airlines such as Thai Airways, China Southern Airlines, or even Qatar Airways, and exploits the empty spaces.

- Express airfreight: This option uses aircraft dedicated solely to airfreight. This solution is offered by courier companies, such as FedEx, DHL, UPS, or even TNT, which offers door-to-door solutions.

Main airport in Qatar

Doha hamad international airport

Hamad International Airport is an international airport in the State of Qatar, and the home of Qatar’s flag carrier airline, Qatar Airways. Located east of its capital, Doha, it replaced the nearby Doha International Airport as Qatar's principal and main national airport.

Additional information :

- Passenger capacity: Hamad airport is designed to handle millions of passengers every year.

Main airports in Thailand

Suvarnabhumi Airport

Suvarnabhumi Airport

Additional information:

- It has the highest control tower in the world.

- Its terminal is the third largest in the world with 56.3 hectares.

- Forecasted increase in cargo and aviation capacity.

Don Mueang Airport

Don Mueang is considered one of the oldest international airports in the world. Commercial flights began in 1924, making it one of the oldest commercial airports in the world.

Additional information:

- 700,000 tons of cargo were handled by this airport.

- It worked with 80 airlines

Chiang Mai Airport

Additional information:

- 16,000 tons of annual cargo

- More than 15,000 flights and 2,000,000 passengers annually

What are the advantages of air freight?

- Speed of transport

- Rarely late

- Good geographical coverage

What are the disadvantages of air freight?

- High price

- Not possible to transport really heavy goods

- The security at the airport is much higher which can make you lose time during the control

How much does it cost to transport cargo by air from Thailand to Qatar?

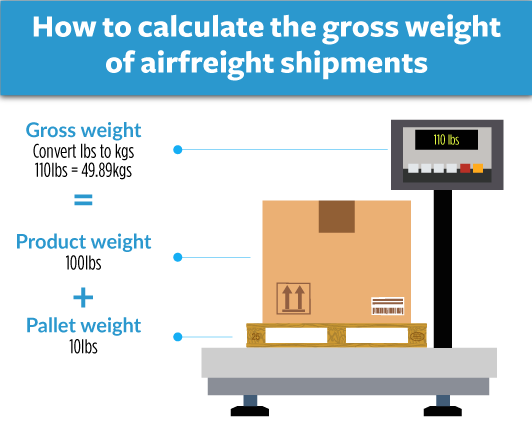

To know the price of your goods transported from Thailand to Qatar by air freight, you must consult the tariffs of the airline companies. Their tariffs are presented by weight bands in decreasing prices.

The weight taken into account by the airlines will always be the one that is to their advantage, that is to say, the highest between the real weight and the volumetric weight.

Siam Shipping Advice: It can be difficult to estimate the exact price of your airfreight shipment yourself. Contact us to receive a free quote within 24 hours.

How to calculate the volumetric weight of your shipment?

The volumetric weight is the volume occupied by a package, based on its dimensions and its gross weight. To know it, you must measure the dimensions of the package (length, width, and height), then convert them into cubic meters. Then use the formula below:

Volumetric weight = (length x width x height) / 5000

Siam Shipping Advice: We recommend using air freight for fragile, valuable, or perishable goods to increase security and protect your merchandise. You can get in touch with our specialists for further details if you want to learn more about transporting fragile merchandise.

Door-to-door delivery between Thailand and Qatar

If you don't have time to devote to transportation, door-to-door delivery is for you. This method is simple, your goods will be picked up directly at your home, and then delivered to the desired destination. You will not need to take care of anything and your goods will be safe with professionals.

What are the advantages of door-to-door services?

- Quick delivery: As everything is completed in a 24-hour period, you can send it if your delivery time is during the day.

- Door-to-door delivery is always available, so your package will come even late at night or on a holiday.

- Convenience: Receiving the package at your location rather than having it delivered to you is better for you.

- Your cargo can be qualified for courier delivery if it is a manageable size.

What are the disadvantages of door-to-door services?

- High cost: The cost increases with the urgency of the cargo, as well as with the package's size and weight, which also affect the cost.

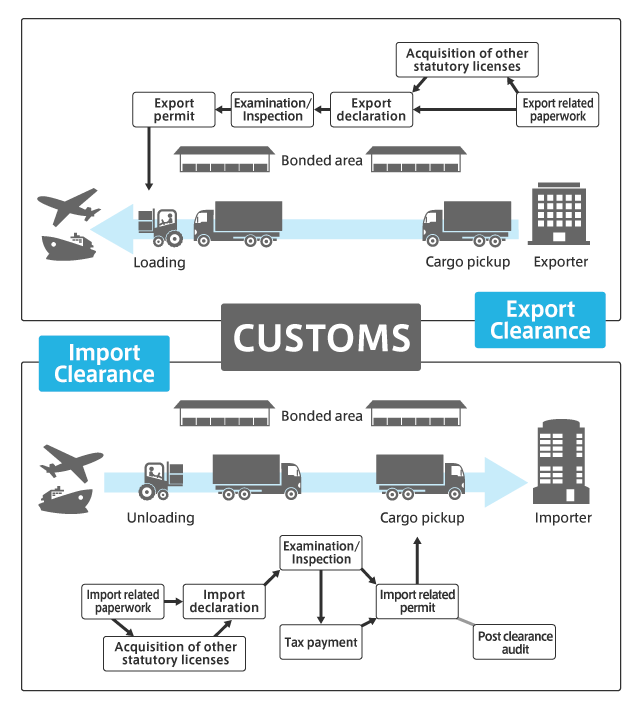

Customs clearance in Qatar for goods imported from Thailand

Customs clearance in any country is an important and mandatory step that must be done when importing and exporting.

When you import goods in Qatar, the customs clearance will consist in paying the customs duties and the VAT. It is also necessary to be attentive to the regulations and standards of the country where you are shipping to avoid having your goods blocked at customs.

Customs valuation

In Qatar, customs valuation is the process of determining the customs value of imported goods. The customs value serves as the basis for calculating customs duties and taxes. The customs valuation is done in accordance with the World Trade Organization's (WTO) Valuation Agreement and Qatar's customs regulations. Here are some key points regarding customs valuation in Qatar:

- Transaction Value Method: The primary method used for customs valuation in Qatar is the transaction value method. This method considers the price actually paid or payable for the imported goods, including any additional costs such as freight, insurance, and other expenses incurred before the goods reach the customs border.

- Related Parties: If the buyer and seller are related, additional considerations may be taken into account to ensure the transaction value is representative of the actual value. The customs authorities may examine the relationship between the buyer and seller to ensure the declared value reflects the open market value.

- Deductive Value Method: If the transaction value method is not applicable or cannot be determined, alternative methods such as the deductive value method, computed value method, or other reasonable methods may be used to determine the customs value.

- Customs Valuation Declaration: Importers are required to declare the customs value accurately and provide supporting documents to justify the declared value, such as invoices, purchase orders, shipping documents, and other relevant commercial documentation.

- Post-Clearance Audit: Qatar Customs Authority has the right to conduct post-clearance audits to verify the accuracy of the declared customs value. If discrepancies or inconsistencies are found, adjustments may be made, and penalties or fines may be imposed for non-compliance.

It's important to ensure that the customs value declared for imported goods is accurate and supported by appropriate documentation. Consulting with customs brokers, freight forwarders, or customs authorities in Qatar can provide further guidance and assistance in complying with customs valuation requirements.

What are the customs duties and taxes in Qatar?

In Qatar, customs duties and taxes are levied on imported goods based on their classification and declared value. The specific rates and calculations may vary depending on the nature of the goods and their country of origin. Here are some key points regarding customs duties and taxes in Qatar:

- Customs Duty: Qatar imposes customs duties on imported goods, which are typically calculated as a percentage of the customs value (CIF value) of the goods. The rates can vary depending on the product category and are outlined in the Qatar Customs Tariff.

- Value Added Tax (VAT): Qatar introduced a 5% Value Added Tax (VAT) on goods and services as of January 1, 2019. VAT is applicable to most goods and services, including imported items, with certain exemptions or reduced rates for specific categories.

- Excise Tax: Qatar also levies excise taxes on certain goods that are considered harmful to public health or the environment, such as tobacco products, energy drinks, and specific luxury items. The excise tax rates can vary depending on the type of product.

- Customs Processing Fees: Apart from customs duties and taxes, there may be additional fees associated with customs clearance and processing of imported goods. These fees can include documentation fees, handling charges, and other administrative costs.

- Exemptions and Free Trade Zones: Qatar has certain exemptions and reduced rates for specific goods and industries, particularly in designated free trade zones or for goods intended for re-export. These exemptions are subject to specific conditions and requirements.

How to calculate customs duties and taxes

Calculating customs duties and taxes in Qatar involves several factors, including the customs value of the imported goods, the applicable tariff rates, and any additional taxes or fees. Here are the general steps to calculate customs duties and taxes in Qatar:

- Determine the Customs Value: The customs value is the basis for calculating duties and taxes. It includes the cost of the goods, insurance, freight charges, and any other applicable costs incurred before the goods reach the customs border.

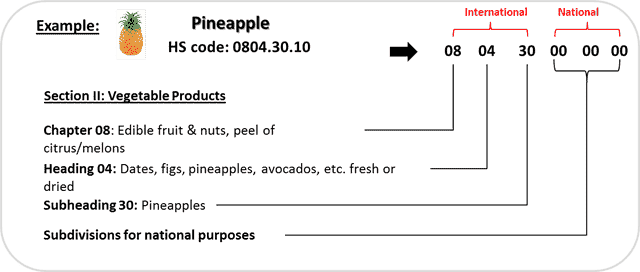

- Identify the Harmonized System (HS) Code: Each product is classified under a specific HS code, which is an international standard for categorizing goods. Determine the correct HS code for your imported goods. This code will help determine the applicable tariff rates.

- Check the Tariff Schedule: Qatar follows a specific tariff schedule that outlines the applicable rates for each HS code. The tariff schedule can be obtained from the Qatar Customs Authority or accessed through their official website. Identify the relevant tariff rate for your product.

- Calculate Customs Duties: Multiply the customs value of your goods by the applicable tariff rate (expressed as a percentage) to calculate the customs duties. For example, if the customs value is $10,000 and the tariff rate is 5%, the customs duties would be $500.

- Consider Additional Taxes and Fees: In addition to customs duties, there may be additional taxes or fees applicable to specific products. For example, Qatar imposes a 5% value-added tax (VAT) on most goods and services. Consult the relevant authorities or resources to determine if any additional taxes or fees apply to your imported goods.

- Determine Other Charges: Apart from customs duties and taxes, there may be other charges such as administrative fees, handling fees, or customs processing fees. These charges vary depending on the nature of the goods and the customs clearance process.

How to find the HS code?

A system of classification for products used in international trade is the HS code (Harmonized System). It organizes goods into categories based on their nature and intended use, making the collection of statistical data and the customs clearance process easier. The HS system contains more than 5,000 different products, each of which is categorized using a distinct eight-digit number.

You can consult these websites to know the HS code of the Thailand products and the Qatar products.

Calculating customs duties with the HS Code

To calculate customs duties using the HS Code in Qatar, follow these steps:

- Determine the HS Code: The HS Code is an internationally recognized code that classifies goods for customs purposes. Identify the correct HS Code for your imported goods. You can find the HS Code by referring to the Qatar Customs Tariff Schedule or using online resources such as the World Customs Organization's HS Code database.

- Access the Qatar Customs Tariff Schedule: Obtain the latest version of the Qatar Customs Tariff Schedule, which provides detailed information on tariff rates for different goods based on their HS Codes. You can access this schedule through the official website of the Qatar Customs Authority or by contacting their customs information center.

- Identify the Applicable Tariff Rate: Locate the HS Code corresponding to your goods in the Qatar Customs Tariff Schedule. Note the corresponding tariff rate mentioned for that HS Code. Tariff rates can be specific (e.g., a fixed amount per unit) or ad valorem (a percentage of the customs value).

It's crucial to note that the Qatar Customs Tariff Schedule may have additional provisions, such as preferential rates for specific countries or trade agreements. Additionally, Qatar may impose other taxes and fees, such as value-added tax (VAT), on imported goods.

Does Siam Shipping charge customs duties?

No, no commission is taken from Siam Shipping. As proof, we will send you all the official documents provided by Qatari customs. We will only collect the customs clearance fees, as we declare your goods to the customs for you.

The fees associated with customs duties and taxes will be collected by the Qatari government.

Customs procedures and contact

Siam Shipping Info: Customs clearance is not the easiest part of the transportation process. However, it is a step not to be neglected if you don't want to pay additional fees or suffer delays! We advise you to contact us so that we take care of your customs clearance!

Required documents

When importing goods from Thailand to Qatar, the following documents are typically required for customs clearance:

- Commercial Invoice: This document provides details about the goods being imported, including their description, quantity, unit price, total value, and terms of sale.

- Packing List: The packing list itemizes the contents of each package or container, including the type of packaging, weight, and dimensions. It helps customs officials verify the accuracy of the shipment.

- Bill of Lading: For shipments transported by sea, the bill of lading serves as a contract between the shipper and the carrier. It includes information about the vessel, the port of loading, the port of discharge, and the details of the goods being shipped.

- Airway Bill: If the goods are transported by air, the airway bill serves as a transportation document. It contains similar information to the bill of lading but is specific to air cargo.

- Certificate of Origin: This document certifies the origin of the goods and is used to determine eligibility for preferential tariffs or trade agreements. It may be required for certain products or based on specific trade agreements between Thailand and Qatar.

- Import License or Permit: Depending on the nature of the goods being imported, an import license or permit may be required. This is particularly relevant for restricted or regulated products such as pharmaceuticals, chemicals, or certain food items.

- Packing Certificate: Some shipments may require a packing certificate, which confirms that the goods have been appropriately packed for transportation and comply with safety regulations.

- Insurance Certificate: An insurance certificate provides evidence of insurance coverage for the goods during transit.

- Customs Declaration Form: This form provides details about the imported goods, their value, and other relevant information required by customs authorities.

It's important to note that specific documentation requirements may vary based on the type of goods being imported, the mode of transportation, and any applicable regulations or trade agreements.

Other logistics services

Storing and warehousing

We offer storage services in different countries, especially in France and Thailand. You can store your goods in our warehouse until you have enough goods to fill an entire container. This will save you transportation costs.

You can go to our specific page at: Storage services

Packing and repacking

The packaging of your products is an important step that should not be neglected. To ensure that your products are packaged properly and securely, use our professional packaging service!

Additional details can be found on our dedicated page: Packing Services

Insurance for transport

Taking out insurance for your shipment is not mandatory, but is highly recommended. In case of damage or loss of your goods, you will be fully reimbursed. We have negotiated the best prices with the insurance companies so that you can take advantage of this service at a low price!

Visit our specific page here: Insurance services

FAQ | Freight between Thailand and Qatar | Rates - Transit time - Duties and taxes - Advice

What are the major freight routes between Thailand and Qatar?

Sea Freight: The most common route for freight transportation between Thailand and Qatar is via sea. Ships usually travel from Thai ports such as Laem Chabang or Bangkok to Qatari ports like Doha or Hamad.

How has the volume of freight between Thailand and Qatar changed in recent years?

To obtain accurate and up-to-date information on the recent changes in freight volume between Thailand and Qatar, it would be best to contact us to more informations

What are the main commodities exported from Thailand to Qatar via freight?

The main commodities exported from Thailand to Qatar via freight include: -Food products -Consumer goods -Automotive parts -Chemicals and petrochemicals -Construction materials

Are there any challenges or barriers in freight transportation between Thailand and Qatar?

there are challenges and barriers in freight transportation between Thailand and Qatar, including distance, logistics infrastructure, customs procedures, language barriers, and trade restrictions.

How do freight logistics and infrastructure developments impact trade relations between Thailand and Qatar?

Freight logistics and infrastructure developments positively impact trade relations between Thailand and Qatar by improving efficiency, reducing costs, and facilitating the transportation of goods. They support the growth of industries and enhance the competitiveness of both countries in the global market.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

- FREIGHT THAILAND 🇹🇭 - CHINA 🇨🇳| Rates – Transit Times – Taxes

- FREIGHT THAILAND 🇹🇭 - UK 🇬🇧 | Rates – Transit Times – Duties & Taxes

- FREIGHT THAILAND 🇹🇭- AUSTRALIA 🇦🇺| Rates – Transit Times – Taxes

- Freight Shipping Thailand - Russia | Rates - Transit Times - Taxes

- FREIGHT THAILAND 🇹🇭- USA 🇺🇸| Rates – Transit Times – Duties & Taxes

SIAM Shipping | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!