Export and import licenses are key requirements for conducting international trade in Thailand. The government regulates the import and export of goods to ensure the protection of local industries, public health and safety, and compliance with international trade agreements. Companies and individuals looking to participate in international trade must obtain the necessary licenses and permits to ensure that their operations are compliant with Thai law. The process of obtaining export and import licenses can be complex, requiring knowledge of regulations and procedures, as well as a thorough understanding of the goods being traded. However, with the support of experienced professionals and the right resources, it is possible to navigate the process smoothly and successfully. Export and import licenses play a critical role in supporting the growth of the Thai economy, enabling businesses to access new markets, and promoting economic development through international trade.

Table of Contents

WHY YOU MUST GET IMPORT/EXPORT LICENSE BEFORE SHIPPING FROM/TO THAILAND ?

If you want to export from Thailand, you must have an export license, if not you cannot ship!

If you want import to Thailand, the minimum requirement is an import license, but many goods require import permit as well.

**In order to optimize our services, Siam Shipping and Siam Relocation are now part of the Docshipper group. Our customers can now benefit from total supply chain coverage**

Remark SIAM: Please note that its one of he first thing we will verify, our import/export department will carefully check all docs before departure/arrival. If you don’t have it or if you need information, just contact us.

Thai import / export license

Whatever the operation you make, you must obtain an Import / Export License (or customs card, valid for 3 years.) It is a smart card for importers and Exporters Thus, online brokers get a golden card, while a yellow is intended for the owner or manager, the lawyer will get a green card and the clearance card is pink.

Info Docshipper : We invite you to check our dedicated page on Frequently Questions Asked on import and export

Import and Export Laws and Rules

All shipments departing or arriving in Thailand are governed by rules.

On the other hand, the export of certain products is formally prohibited by law in the absence of certain licenses.

Example Docshipper : It is illegal to sell rice abroad. The trade in timber, rubber, animal skins, scrap and silk may be allowed to foreign buyers in exchange for substantial taxes at their expense. For gold, livestock or sugar, it is essential to obtain a license from the government.

Info Docshipper : To read more about customs clearance in thailand click here : Customs clearance (process, duties and taxes, calculation and tips, everything you need to know about customs clearance !)

Import license and controls

*Import license is not sufficient, in many cases you also need an import permit

The Thai Ministry of Commerce divides the goods into different families that are controlled on import and often require a license. Over the years, even if these controls are gradually liberalized, there are about 50 categories of goods requiring an import license. They are frequently modified by ministry notifications. The license application must be attached to a supplier’s order, confirmation, invoice.

Many products are subject to other controls from other laws. These include:

- The importation of pharmaceutical products (medicines) requires a Food and Drug Administration authorization from the Ministry of Health.

- The trade in minerals is subject to a strict rule: without the appropriate authorization, it is prohibited to import more than two kilograms of tungsten oxide and tin ores and metallic tin.

- Antiques, works of art, museum and historical exhibits may not be shipped without authorization from the Director General of Fine Arts

- Weapons, ammunition, explosives, fireworks and prohibited firearms are prohibited from the production, purchase, use or import unless they have the appropriate license Of the Ministry of the Interior.

- To protect public health, the importation of cosmetic products must be accompanied by the name and location of the office and place of manufacture of the products and their name and composition.

Info Docshipper : You still have some doubt regarding your future importation of cosmetics ? Contact our SINO expert or check our dedicated page : Import of cosmetics

Remark Docshipper : If your products are not mentioned above, please send us all details by email and we will get back to you within 48 hours. If you want to obtain an import permit you must submit form on specific department as mentioned above, make sure to gather all documents before to avoid any troubles with Thai customs.

Export license and controls

Remark Docshipper : The Ministry of Commerce has legislation in place to control imports and exports of goods that apply to products. Currently, about 50 products require control.

Export licenses have been established for certain products, such as seeds, tobacco leaves and trees. In addition, products such as rice and sugar require export licenses under the Export Standards Act. This law makes it possible to control the quality of these products intended for export.

Agricultural exporters find that membership in business associations is mandatory and that these associations can create and implement their own membership regulations.

* Please note that the Thai rules and laws are constantly changing and that it is very important for you to check every information with the Thai authorities who can update some rules. We do not warrant the accuracy of any information provided on Siam-shipping.com.

Info Docshipper : If you want further information, we invite you to check the website of the Thai ministry of commerce.

WHAT HAPPEN IF I DO NOT HAVE ANY OF REQUIRED LICENSES ?

It depend, and the case will be manage by our customs department. Most of the time, your goods are stuck until reaching an agreement with customs. As its hard to explain, and different according to the shipment, do not hesitate to contact us for more details. Kindly check with us before ship out your goods, because once the shipment is on the way, it might be to late. Please note that for get licences, you have to apply under a company name, an individual is not eligible, except for some cases.

Khun Wanna, import manager @ SIAM Shipping

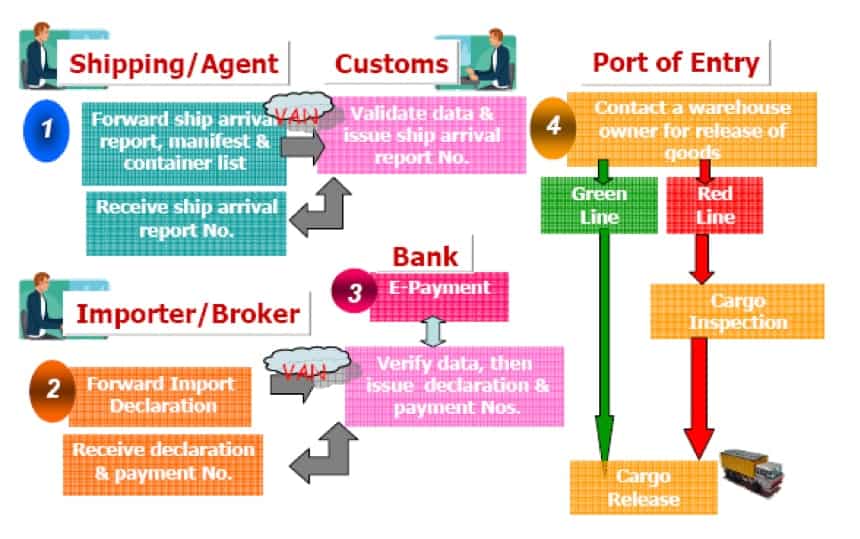

To process the importation / exportation in Thailand , you must follow 5 steps:

*Please note that to get licenses, you must apply under a company name, an individual is not eligible, except for some cases.

Step 1 – fill an official declaration

You can fill the Customs Form 99 or 99/1 manually or via the EDI system, then you go to the step 2.

Step 2 – Provide some official documents:

- Cargo report or air waybill (air freight)or bill of lading (sea freight)

- 3 copies of the invoice

- Packing list

- Insurance mentioned on the invoice

- Release form (customs form 100/1 or 469)

- Foreign transaction form if the import value exceeds 500 000 Baht

- Import license (if applicable)

- Certificates of Origin (if applicable)

- Other relevant documents such as catalogs, product specifications, etc.

Info Docshipper : You want further information about our freight insurance ? Contact our SIAM Expert or check our dedicated page: Freight insurance

Step 3 – Submit the Customs Statement and Support Documents:

Once at the port of entry, you must provide the Declaration of Importation and the supporting documents so that they are checked by the customs.

The customs authorities will ensure that the documents are completed and that there is no missing supporting document attached. The authorities will also control the customs tariff, the calculation of duties and taxes and the valuation of goods.

Docshipper Plus: We will manage all process with customs, it’s a part of our import service.

Step 4 – Pay the applicable import duties and taxes using one of these methods:

- Payment to the Customs Department

- Electronic Funds Transfer via BOT’s BAHTNET

- Electronic payment to Krung Thai Bank

- Electronic Funds Transfer (EFT) via EDI

Docshipper Plus: To facilitate, we can charge you duties and taxes as the draft (paperless) require. Then we will transfer the amount to Thai customs and we will wait to get the release of your shipment.

*In some case, the process isn’t finish, we have to wait for the approval from customs officer.

Step 5 – Inspect and release customs cargo:

Remark Docshipper : The importer must provide the verified statement including the invoice to the appropriate warehouse.

The imported goods will then be inspected by customs inspectors. The inspected parcel must correspond to the declaration submitted by the importer so that the customs inspectors validate and register the computer control and then release the goods to the importer.

Remark Docshipper : Whether you are an exporter or an importer, you know that the secret to increasing your cash flow is to increase the speed of transport of your goods, and for this it is imperative not to make any errors in the documentation.

To conclude, we strongly advice to consult our import/export department before starting your business, Thailand is not an easy country, and if some forwarder does not check, it mean they are not professional.

FAQ | EXPORT AND IMPORT LICENSES IN THAILAND

What is required to obtain an export license in Thailand?

To obtain an export license in Thailand, companies must provide documentation including the commercial invoice, packing list, and bill of lading. In addition, certain goods may require additional permits or certifications, such as health or safety certifications, depending on the type of goods being exported.

How long does it take to obtain an import license in Thailand?

The processing time for an import license in Thailand varies depending on the complexity of the application and the type of goods being imported. On average, it can take anywhere from a few days to several weeks to complete the process.

Are there any restrictions on the import and export of certain goods in Thailand?

Yes, there are restrictions on the import and export of certain goods in Thailand, including items related to national security, public health, and environmental protection. Additionally, certain goods may be subject to tariffs, quotas, or trade embargos, which can impact the ability to import or export these items. It is important to familiarize oneself with the regulations and restrictions related to the goods being traded to ensure compliance with Thai law.

SIAM Shipping info: Do you like our article today? For your business interest, you may like the following useful articles :

SIAM Shipping Advise : We help you with the entire sourcing process so don't hesitate to contact us if you have any questions!

- Having trouble finding the appropriate product? Enjoy our sourcing services, we directly find the right suppliers for you!

- You don't trust your supplier? Ask our experts to do quality control to guarantee the condition of your goods!

- Do you need help with the logistics? Our international freight department supports you with door to door services!

- You don't want to handle distribution? Our 3PL department will handle the storage, order fulfillment, and last-mile delivery!

SIAM Shipping | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!

**In order to optimize our services, Siam Shipping and Siam Relocation are now part of the Docshipper group. Our customers can now benefit from total supply chain coverage. Therefore, Siam Shipping team became Docshipper team**

SIAM Shipping | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!