Ever wondered why shipping doesn't sound as entertaining as hopping from Thailand's full moon parties to New Zealand's adrenaline-filled adventures? Because it involves handling complexities like deciphering freight rates and coping with uncertainties about transit times or custom regulations. This guide, however, simplifies these intricate portions of the shipping puzzle. It enlightens you on varieties of freight options – be it air, sea, road or rail –, the mystery of the customs clearance process, obligations related to duties and taxes, and customized advice for businesses eyeing this route. If the process still feels overwhelming, let DocShipper handle it for you! Leveraging their expertise as an international freight forwarder, they transform these logistically layered challenges into success stories, ensuring your international shipping saga becomes as smooth as a Kiwi fruit from New Zealand making its way into Thailand's vibrant markets!

Which are the different modes of transportation between Thailand and New Zealand?

Choosing the right transport mode from Thailand to New Zealand isn't as simple as A-B-C - it's like picking the best route on a treasure map. You see, these two are more than 7,400 miles apart, with the vast Pacific Ocean as their playground. Now, your mightiest giants like air and sea freight rise like superheroes ready for dispatch - each with their unique superpowers. Air freight flies in with speed, while ocean freight sails with cost-effectiveness. So, it's your call, dear shipper - will you go for the Flash's speed or Superman's might? Make your choice your superpower.

How can Siam Shipping help?

Ship goods from Thailand to New Zealand hassle-free with DocShipper. Our dedicated experts will manage everything from customs clearance to pick-up. Why wrestle with logistics when you can focus on business growth? Connect for an obligation-free consultation and get a detailed quote within 24 hours!

Siam Shipping Tip: Consider ocean freight if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- You're not racing against the clock. Ocean freight takes its sweet time, especially when stacked up against other transport methods.

- Your supply chain is linked up with big-name ports. Think of it as the VIP lane on the maritime superhighway.

Sea freight between Thailand and New Zealand

Envision a colossal container ship, brimming with goods, slowly sailing from bustling Bangkok to picturesque Auckland. That's what ocean shipping between Thailand and New Zealand looks like - a vibrant symbol of their robust trade relationship. Two significant seaports, Laem Chabang in Thailand and Ports of Auckland in New Zealand, serve as key connectors for this trade.

Chances are, if you're dealing with high-volume goods, sea freight is your cost-effective lifesaver. Imagine trading a super-fast sports car for a steady minivan; it's slower but can surely carry more load!

But, oh boy, isn't it a maze! Too many businesses and shippers stumble through complications when it comes to shipping between these countries. Missteps can be costly, but don't worry! It's like a board game; know the rules (or best practices and specifications) and you'd sail through. Stick around, and you'll uncover these nuggets of wisdom throughout this guide. Get set to make your sea freight journey a smooth sail!

Main shipping ports in Thailand

Laem Chabang Port

Location and Volume: Situated in Chonburi province, Laem Chabang is Thailand's largest port and the 20th busiest globally. It processed over 8 million TEU (Twenty-foot Equivalent Unit) in 2019.

Key Trading Partners and Strategic Importance: Laem Chabang Port is a crucial gateway for trade with neighboring Asian countries such as China, Japan, and Singapore. The port has vast strategic importance due to its proximity to the Eastern Economic Corridor (EEC), a significant manufacturing and export zone in Thailand.

Context for Businesses: If you're looking to access Asian markets or have goods manufactured in the industrial areas of the EEC, Laem Chabang should be a significant consideration in your shipping plan due to its vast facilities and efficient handling.

Port of Bangkok

Location and Volume: The Port of Bangkok is located on the western side of Chao Phraya River, some 30 km from the Gulf of Thailand. It does not have the capacity of Laem Chabang, but it handled about 1.5 million TEU in 2019.

Key Trading Partners and Strategic Importance: Being the closest sea entry point to Thailand's capital and largest city, Bangkok, this port has direct shipping routes to major ports in Vietnam, Japan, China, and Singapore.

Context for Businesses: If your business involves delivery to or distribution in Bangkok, this port's location may provide logistical benefits, given its proximity to one of the biggest consumer markets in Thailand.

Map Ta Phut Port

Location and Volume: Located in Rayong province, Map Ta Phut is the largest industrial port in Thailand, designed to handle liquid and gas cargo, with a loading capacity of more than 19,000 DWT (Deadweight Tonnage) per hour.

Key Trading Partners and Strategic Importance: The Port is an integral part of the largest petrochemical industrial estate in Thailand, facilitating direct export to China, Japan, and South Korea.

Context for Businesses: If your operation revolves around petrochemicals, Map Ta Phut is an unavoidable part of your supply chain due to its specialized facilities and strategic location.

Sattahip Port

Location and Volume: Sattahip Port, located in the Sattahip district of Chonburi province, is a commercial and naval maritime facility. Its cargo handling capacity is not as high as others, but its strategic significance is unquestionable.

Key Trading Partners and Strategic Importance: Being a military-cum-commercial port, Sattahip provides a reliable channel for cargo transportation to and from major Asian economies.

Context for Businesses: If your business necessitates increased security or you're dealing with sensitive cargos, Sattahip offers ideal solutions due to its unique nature of operations.

Ranong Port

Location and Volume: Located in the southern region of Thailand, Ranong Port isn't among the largest ports but has importance due to its position as the closest Thai port to the Indian Ocean, with a cargo handling capacity of around 1 million tons annually.

Key Trading Partners and Strategic Importance: Ranong Port plays a key role in facilitating trade with Myanmar, recently seeing increased use due to improved political relations between the two countries.

Context for Businesses: Fo tradeoriented towards Myanmar or further towards the Indian subcontinent and Middle East, Ranong Port would provide a strategic advantage due to its location.

Songkhla Port

Location and Volume: Songkhla Port resides on the eastern side of the southernmost part of Thailand, with an annual cargo handling capacity of roughly 7 million metric tons.

Key Trading Partners and Strategic Importance: Songkhla predominates as a key maritime hub for suppliers and manufacturers in Thailand's southern region, with direct shipping routes to Indonesia, Malaysia, and Myanmar's ports.

Context for Businesses: For businesses operating in or targeting the Southern Thai market, as well as more extensive connection to the southeast Asian market, this port offers a direct, all-weather connectivity that could simplify your logistics considerations.

Main shipping ports in New Zealand

Auckland

Location and Volume: Situated on the north island, Auckland handles approximately 31% of New Zealand’s total annual maritime trade, making it a significant port for international trade. The port handled around 938,000 TEU in the last year.

Key Trading Partners and Strategic Importance: Auckland maintains a strong relationship with trading partners across Asia, particularly China, Japan, and South Korea. The port's strategic importance lies in its central location and extensive connectivity to domestic and overseas markets.

Context for Businesses: If you're looking to expand your business within the Asia-Pacific region, consider incorporating the Port of Auckland into your shipping strategy due to its high-volume capacity and strong trade ties with key Asian economies.

Tauranga

Location and Volume: Located in the Bay of Plenty, the Port of Tauranga is New Zealand’s largest port by volume, handling over 1.2 million TEU annually.

Key Trading Partners and Strategic Importance: The port has a diversified portfolio of key trading partners across Asia, Australasia, and America. Due to its high capacity, Tauranga plays a vital role in New Zealand’s trade activities, especially in the export of agricultural products.

Context for Businesses: Businesses planning to export agricultural goods or commodities might benefit from utilizing the Port of Tauranga due to its high throughput and vast export network.

Napier

Location and Volume: Positioned on the east coast of the north island, the Port of Napier handles around 123,000 TEU annually, making it ideally suited for low volume, high-value cargo.

Key Trading Partners and Strategic Importance: Trading predominantly with Asia and the US, the Port of Napier plays a crucial role in the transportation of processed food and wood products.

Context for Businesses: If your business specializes in high-end goods requiring secure, reliable transport, the Port of Napier could be a strategic choice because of its low-volume, high-value focus.

Lyttelton

Location and Volume: The port of Lyttelton, located on the east coast of the south island, handles about 420,000 TEU per year, indicating its mid-range volume capacity.

Key Trading Partners and Strategic Importance: Lyttelton principally trades with Asia and Australia, being crucial for the efficient shipment of coal, timber, and dairy products.

Context for Businesses: Businesses in the coal, timber, and dairy industries may find the Port of Lyttelton efficient and advantageous for trades due to its specialization and strategic location.

Otago

Location and Volume: Situated on the south island's east coast, the Port of Otago handles approximately 200,000 TEU annually.

Key Trading Partners and Strategic Importance: Asia and Australia are the port's main trading partners. Otago is pivotal for the region's economy, specifically in facilitating the exportation of agricultural and forestry products.

Context for Businesses: Companies dealing in agricultural and forestry products intending to penetrate Asian and Australian markets may consider the Port of Otago as a strategic trade gateway.

Nelson

Location and Volume: Located on the north of the South Island, the Port of Nelson operates at a lower freight volume, handling around 62,500 TEU per year.

Key Trading Partners and Strategic Importance: Nelson maintains consistent trade relations primarily with Australasian, American, and Asian economies. It's particularly known for facilitating the export of seafood and forestry products.

Context for Businesses: If your enterprise is engaged in the seafood or forestry sectors, aiming to trade with American, Australian, or Asian nations, the Port of Nelson might serve as a valuable logistic hub due to its low volume handling and niche expertise.

Should I choose FCL or LCL when shipping between Thailand and New Zealand?

Shipping goods from Thailand to New Zealand? You'll need to pick between Full Container Load (FCL) and Less than Container Load (LCL), also known as consolidation. This is no small decision. Your choice here swings the pendulum on your costs, delivery times, and overall shipping success. So, let's dive deep and unravel the ins and outs of FCL and LCL shipping, helping you stay savvy and make an informed decision that fits neatly into your shipping puzzle.

LCL: Less than Container Load

Definition:

LCL (Less than Container Load) Shipping is a type of freight forwarding where businesses consolidate their cargo with others' in the same container. It's a cost-efficient and flexible option for low-volume shipments.

When to Use:

LCL is the preferred choice when your cargo volume is less than 15 cubic meters (CBM). Since you're sharing container space, you don't need to wait until you have enough goods to fill an entire container yourself.

Example:

Consider a Thai handicraft exporter sending a variety of decorative items to a boutique shop in New Zealand. The shipment only amounts to 10 CBM, too small for a full container. Using LCL, they can still promptly send their goods without incurring excessive shipping costs.

Cost Implications:

While LCL tends to be more expensive per CBM than full container shipping, it's more affordable overall for smaller capacities as you're only paying for the space you use. In addition, LCL freight gives you greater control to manage your inventory and cash flow as you can ship goods based on demand, not on container capacity.

FCL: Full Container Load

Definition: FCL, or Full Container Load, refers to the use of an entire container for your shipment. This is a method under ocean freight known as 'FCL shipping'.

When to Use: Opt for FCL when your cargo is more substantial - typically more than 13/14/15 cubic meters (CBM). It tends to be economical for high volume shipments and offers safety due to the container being sealed from origin to destination.

Example: Let's assume you're shipping furniture. Given their size and the potential for several items, you'll likely fill an entire container - either a 20’ft or a 40’ft FCL container. FCL ensures your furniture is transported securely without mixing with other goods.

Cost Implications: While FCL sounds costly due to the use of a whole container, high volume shipments make this option less pricey per unit. An FCL shipping quote accounts for the exclusive use of the container, meaning you absorb the whole cost, undercutting the per-unit cost for high volume freight. However, if you can't fill the entire container, you're still paying for unused space, making it less efficient.

Unlock hassle-free shipping

Discover the trusted services of DocShipper, your dedicated freight forwarder aimed at simplifying cargo shipping for businesses. Our ocean freight experts stand ready to advise on the most appropriate shipping method between Thailand and New Zealand, considering volume, speed, and costs. Let us help you decide between consolidation and a full container, always working towards your business objectives. Take the first step towards a stress-free shipping experience – contact us for a free estimation today.

How long does sea freight take between Thailand and New Zealand?

Sea freights travelling between Thailand and New Zealand, on average, take between 15 to 35 days. This estimation takes into consideration certain factors such as the ports used, the weight and nature of the goods being transported. For a more accurate quote that's tailored to your specific requirements, we recommend contacting a freight forwarder like DocShipper.

Below, please find a text-only table representing the average transit times in days when shipping via sea freight between the main freight ports of the two nations:

| Main Freight Ports in Thailand | Main Freight Ports in New Zealand | Average Transit times in Days |

| Laem Chabang | Auckland | 30 |

| Bangkok | Tauranga | 30-35 |

| Map Ta Phut | Lyttelton | 36-38 |

| Songkhla | Wellington | 22 |

*Please note, these are just averages and actual times can vary. For the most accurate quote, please reach out to a professional freight forwarder.

How much does it cost to ship a container between Thailand and New Zealand?

Decoding ocean freight rates isn't a simple task, especially when estimating the shipping cost between Thailand and New Zealand. A myriad of factors - everything from the Point of Loading and Destination, carrier selection, right down to the nature of goods and market fluctuations each month- make it impossible to give a one-size-fits-all price. What you can expect is a range, possibly as broad as $15-$60 per CBM. Remember, this is an estimated range, not a static figure. Our dedicated team of shipping specialists is on deck to work with you, ensuring you get a customized and competitive quote that resonates specifically with your shipment needs.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is a unique shipping option that caters to oversized items, larger than the standard container dimensions. These types of containers are ideal for out-of-gauge cargo that doesn't fit into standard containers due to excess weight or extended dimensions.

Suitable for: These containers are specifically designed to carry and ensure safe transportation for heavy machinery, large equipment, and oversized cargo.

Examples: Construction equipment, industrial machinery, large automotive parts, and windmill wings all fall under this category.

Why it might be the best choice for you: Choose OOG containers if you're dealing with items that are too large or heavy for standard containers. They provide the flexibility needed to handle your exceptional load.

Break Bulk

Definition: Break Bulk refers to the shipment of cargo as separate pieces, rather than being loaded into containers. It uses specialized cranes and handling equipment for loading and unloading.

Suitable for: Break Bulk shipping addresses logistics needs of companies dealing with loose cargo loads, chunky goods, or items that are typically not put in containers.

Examples: Timber, construction components, or large machinery are typically shipped by Break Bulk.

Why it might be the best choice for you: If your business needs to ship items that are cumbersome or irregularly shaped, break bulk could be the ideal method for you.

Dry Bulk

Definition: Dry Bulk cargo refers to loose goods that are dry and can typically be poured. These goods are loaded directly into the vessel's cargo holds.

Suitable for: Commodities transported include grains, coal, steel, and other granular products.

Examples: Business involved in grain exportation, coal mining, or transporting construction materials often utilize this mode of shipping.

Why it might be the best choice for you: Choose Dry Bulk if you have large volumes of bulk cargo that can be poured such as grains, coal, or cement.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off, or Ro-Ro, is a method of sea freight where wheeled cargo is driven on and off a ro-ro vessel.

Suitable for: Any vehicles or machinery that can be rolled on and off the vessel.

Examples: Automobiles, trucks, semis, trailers, cranes, motorhomes, and even railway carriages can be transported via Ro-Ro.

Why it might be the best choice for you: If your cargo comes on wheels, Ro-Ro is a safe, efficient, and affordable way to get it overseas.

Reefer Containers

Definition: Reefer Containers are refrigerated containers used to transport temperature-sensitive cargo.

Suitable for: Perishable goods like dairy, seafood, vegetables, fruits, meat, or medical supplies such as vaccines.

Examples: Export of fresh produce from Thailand to New Zealand is a common application.

Why it might be the best choice for you: If your cargo needs to stay cool during the journey, opting for reefer containers can guarantee your goods remain fresh and unspoiled.

Whether you're shipping a fleet of cars or a load of fresh produce, understanding your options can lead to more efficient and cost-effective solutions. Here at DocShipper, we know international shipping can be complex. Don't navigate these waters alone. Contact us and get a free shipping quote in less than 24h for your specific needs.

Siam Shipping Tip: Consider Air freight if:

- Time's ticking and you can't wait. Air freight is like the express train of shipping; it's the quickest way to get your stuff from A to B.

- You're not shipping a warehouse. If your cargo is under 2 CBM, air freight is a snug fit for your smaller haul.

- Your supply chain ends somewhere off the beaten path. Airports are everywhere, so you can get your goods to those hard-to-reach spots.

Air freight between Thailand and New Zealand

When it comes to shipping small, valuable cargo between the sensational shores of Thailand and the stunning landscapes of New Zealand, air freight is your ultimate ally. Offering unmatched speed and reliability, it ensures your high-tech electronics or designer jewelry reach their destination swiftly and safely.

However, many merchants get tangled up in rough air pockets when it comes to air freight. Missteps in estimating shipping costs, like using the wrong weight formula, can make your pockets lighter than the air your goods are traveling on. Not knowing the best practices, like optimizing packaging, is like flying blind through a thunderstorm — it's risky and can rack up costs. In this part, we will equip you with the right compass to dodge these common errors, ensuring that your air freight experience feels as smooth as a calm sky after a storm.

Air Cargo vs Express Air Freight: How should I ship?

Shipping your goods between Thailand and New Zealand poses the question: Air Cargo or Express Air Freight? If your shipment isn't urgent, shipping on a commercial airline with Air Cargo could be perfect. But if speed is essential, Express might be your champion, with a dedicated plane that lives up to its name, 'Express'. Let's dive in and see which option best supports your business needs.

Should I choose Air Cargo between Thailand and New Zealand?

Opting for air cargo between Thailand and New Zealand can be a cost-effective and reliable solution. Airlines like Thai Airways and Air New Zealand offer such services, ensuring your goods reach their destination safely. However, bear in mind that transit times may be longer due to fixed flight schedules. Crucially, air freight becomes notably cost-effective from around 100/150 kg (220/330 lbs) of cargo. Therefore, if your shipment falls under this weight, this can be an optimal solution for you. Find out more about their services Thai Airways and Air New Zealand.

Should I choose Express Air Freight between Thailand and New Zealand?

Express air freight is a unique service harnessing only cargo planes, sans any passengers. Renowned courier firms, like FedEx, UPS, or DHL, cater to this niche. The strongest advantage it offers is speedy transport, ideal for shipments less than 1 CBM or in the range of 100/150 kg (220/330 lbs). If time is your prime concern and your cargo fits these specifications, this transport method can be your ideal choice.

Main international airports in Thailand

Suvarnabhumi Airport

Cargo Volume: Over 1.3 million tonnes of cargo per year

Key Trading Partners: China, Japan, USA, Hong Kong, and Singapore

Strategic Importance: Being the main international gateway to Thailand, Suvarnabhumi handles the majority of the country’s international cargo.

Notable Features: The airport is equipped with a modern Cargo Terminal and Free Zone area, capable of handling a vast range of goods.

For Your Business: As your shipment will have access to excellent international connectivity, Suvarnabhumi could be an ideal entry point

Don Mueang International Airport

Cargo Volume: Nearly 130,000 tonnes of cargo per year.

Key Trading Partners: China, Japan, and several ASEAN countries.

Strategic Importance: As the major domestic flight hub, Don Mueang provides excellent connections to every region of Thailand.

Notable Features: The airport has dedicated cargo facilities and a 'Cargo Village' to ease customs clearance and logistics.

For Your Business: Ideal for shipments destined for local businesses as it provides the convenience of swift domestic dispersal of goods.

Chiang Mai International Airport

Cargo Volume: More than 36,000 tonnes of cargo per year.

Key Trading Partners: China, Singapore, Malaysia, and Laos.

Strategic Importance: It is the primary international airport in Northern Thailand and connects with over 30 international destinations.

Notable Features: The airport offers comprehensive handling services, including agricultural and perishable goods.

For Your Business: If your destination is northern Thailand, using Chiang Mai can speed delivery while minimizing the risk for perishable goods.

Phuket International Airport

Cargo Volume: Over 28,000 tonnes of cargo per year.

Key Trading Partners: China, Australia, Malaysia, and Singapore.

Strategic Importance: It is the second busiest airport in Thailand and the main gateway to Southern Thailand.

Notable Features: It includes a dedicated cargo terminal for efficient logistics handling.

For Your Business: Ideal for shipping goods to destinations in southern Thailand, benefiting from customs facilities located within the airport.

Hat Yai International Airport

Cargo Volume: Nearly 7,000 tonnes of cargo per year.

Key Trading Partners: Malaysia, Singapore and Indonesia.

Strategic Importance: Being the fourth largest airport in Thailand, Hat Yai International is a central trade point within the ASEAN region.

Notable Features: The airport includes facilities to handle special types of cargo, such as live animals.

For Your Business: If your cargo needs specialized handling or is being sent to southeastern destinations, consider using Hat Yai for its strategic location and available services.

Main international airports in New Zealand

Auckland Airport

Cargo Volume: Auckland Airport handles over 70% of New Zealand's air cargo, moving approximately 2.5 million tonnes per annum.

Key Trading Partners: The key trading partners include Australia, China, USA, Japan, and various countries in Southeast Asia.

Strategic Importance: It is New Zealand’s largest and busiest airport, providing businesses with robust freight services including handling, storage, and customs services.

Notable Features: Its extensive cargo issues direct services to many global destinations and connects with a domestic network spanning the country.

For Your Business: The airport’s substantial cargo volume along with its diverse range of services can offer businesses reliable and efficient cargo handling for their international trading needs.

Christchurch Airport

Cargo Volume: Christchurch Airport, the second biggest in New Zealand, moves about 30% of the country's airfreight.

Key Trading Partners: Mainly engages with Australia, Southeast Asia, Europe, and North America.

Strategic Importance: The airport houses a freight center that accommodates cargo airlines, general freight operators, and customs.

Notable Features: It is known for its efficient operations, direct services to main cargo markets, and handling of high-value perishable exports.

For Your Business: Its effective operations and streamlined customs clearance processes can greatly expedite your cargo transit times.

Wellington International Airport

Cargo Volume: The airport deals with a moderate air cargo volume, especially from the lower North Island and upper South Island.

Key Trading Partners: Focuses on traditional markets like Australia and increasingly gaining access to Asian markets.

Strategic Importance: Critical for locally based businesses due to its central location in the country.

Notable Features: Handles primarily domestic cargo but also caters to some international shipments.

For Your Business: This airport could be an optimal choice if your business is situated in this locale, providing convenience and cost-saving advantages.

Hamilton International Airport

Cargo Volume: Hamilton Airport has lower airfreight volumes compared to Auckland and Christchurch, but it is growing steadily.

Key Trading Partners: Serves mainly Asian and Australian markets.

Strategic Importance: It is an alternate international gateway to the North Island for freight carriers.

Notable Features: Sees regular cargo jet operations and is co-located with a major freight hub.

For Your Business: If you’re dealing with cargo destined or originating from the Central North Island, Hamilton could offer a cost-effective solution.

Dunedin International Airport

Cargo Volume: As a smaller airport, the cargo volume is moderate.

Key Trading Partners: Connections are predominantly with Australia.

Strategic Importance: It is an important link for businesses located in the southern areas of the South Island.

Notable Features: Handles export of regional perishable commodities due to proximity to supporting industry.

For Your Business: The airport’s specialized handling of perishable goods might be beneficial for businesses requiring optimal conditions for transported goods, especially seafood and agricultural products.

How long does air freight take between Thailand and New Zealand?

With an average duration of 1-3 days, air freight between Thailand and New Zealand is a fast and efficient option. However, the transit time may fluctuate depending on factors such as the specific airports used, the weight of the goods, and their nature. For instance, hazardous materials may require a longer process. To get a precise estimate tailored to your specific shipping requirements, it's advisable to consult with a freight forwarder like DocShipper.

How much does it cost to ship a parcel between Thailand and New Zealand with air freight?

The cost of air freight shipping from Thailand to New Zealand varies greatly, typically ranging from around $5 to $20 per kg. Please note that this is a broad estimate and numerous factors can affect the final cost. These variables include the pickup and delivery locations in relation to the airports, the parcel's dimensions and weight, and the nature of the goods. Rest assured, at our freight forwarding company, we understand the intricacies of this process and are dedicated to securing you the best shipping rates, tailoring each quote to your unique circumstances. Get in touch with us to receive a free, personalized quote within 24 hours.

What is the difference between volumetric and gross weight?

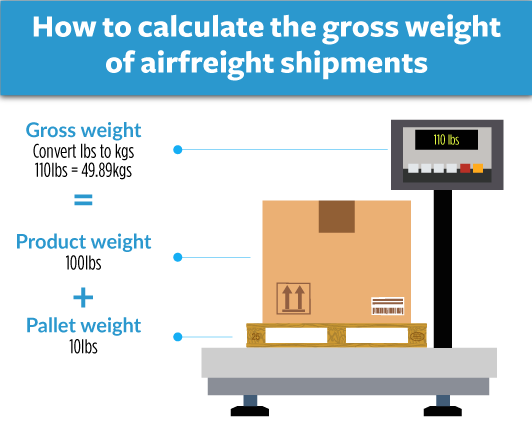

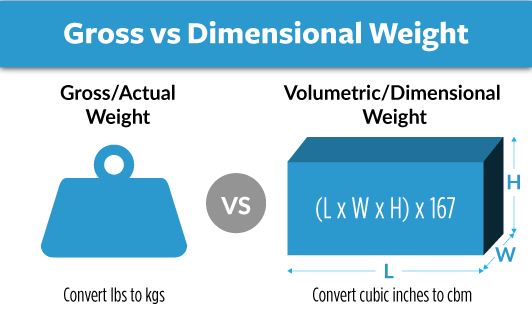

Gross weight refers to the total weight of your shipment including packaging and pallets, while volumetric weight is a calculated value that reflects the density of your shipment. Think of it as the weight of the space your package occupies on the aircraft.

To calculate the gross weight in air freight, simply measure the total weight of your cargo including any packaging materials in kilograms (kgs). If you have a shipment that weighs 200 kgs, that's 440 lbs, this is your gross weight.

Volumetric weight, on the other hand, is calculated by multiplying the length, width, and height of your package (in centimeters) and then dividing by the airlines' chosen divisor. In air freight, the divisor is usually 6000, while express air freight commonly uses 5000. Let's say your shipment measures 120cm x 100cm x 110cm. In that case, your volumetric weight for air freight would be: 120 x 100 x 110 / 6000 = 220 kgs (or 485 lbs). For express air freight, it would be 120 x 100 x 110 / 5000 = 264 kgs (or 582 lbs).

These calculations are vital when determining freight charges. Carriers charge based on whichever weight is higher - gross or volumetric. So, in this example, if using standard air freight, the charges would be based on 220 kgs; if using express, on 264 kgs. This ensures that carriers are compensated fairly for the valuable cargo space your shipment occupies, whether it's heavy or bulky.

Siam Shipping Tip: Consider Door to Door if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You appreciate having a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want less transitions for your cargo, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Thailand and New Zealand

Offering peak convenience, door to door shipping is an international logistics solution that handles goods from origin straight to the final destination. Ideal for Thailand-New Zealand routes, it minimizes hassle, reduces transit times, and lends a hand in efficient handling. Ready to unwrap the advantages of this seamless shipping mode? Let's dive in!

Overview – Door to Door

Shipping from Thailand to New Zealand? Opt for Door-to-Door, the stress-free answer to complex logistics challenges. Enjoy a simple, unified solution that handles everything from pick-up to delivery - without battling customs protocols or tracking multiple service providers. This approach saves time and reduces stress, however, it can be pricier. Despite the cost, it's a popular choice among DocShipper customers. Its greatest advantage? Assurance your goods will reach their destination intact, regardless of the distance between Bangkok and Wellington, or Chiang Mai and Auckland. Discover how Door-to-Door shipping could revolutionize your logistics process.

Why should I use a Door to Door service between Thailand and New Zealand?

Ever tried catching a slippery fish with your hands? It's a real juggle, much like managing international logistics. That's where Door to Door service comes in, turning that juggle into a calming walk in the park. Let's dive into the five reasons why you should be considering this service for your Thailand-New Zealand shipping needs.

1. Stress Reduction: Door to Door service simplifies the complex. We handle everything from goods pickup to final delivery, giving you peace of mind. No more late-night worries about transport organization and customs clearance!

2. Timely Delivery: Need it there faster than a snail on caffeine? Door to Door has got you covered. With strategic coordination of transport, we ensure your urgent shipments don't fall behind schedule.

3. Specialized Care: Got some tricky, complicated cargo? Door to Door service is like a protective bubble wrap, caring for your complex, delicate goods with conditions and precautions tailored to their needs.

4. Convenience: Imagine Netflix, but for shipping – it takes care of everything, and you only need to sit back and relax. We handle all the legwork, including trucking it right to the final destination.

5. On-The-Ground Support: Ever felt lost in a sea of paperwork? Our local logistics teams navigate the maze of administrative procedures, so you don't have to.

So, if you want smooth sailing from Thailand to New Zealand, consider Door to Door service. It's the hassle-free harbor in the stormy sea of logistics.

DocShipper – Door to Door specialist between Thailand and New Zealand

Ease your shipping worries with DocShipper! From Thailand to New Zealand, we offer hassle-free door-to-door services. With expert in-house skills, we manage every step of your goods' journey: packing, transportation, customs clearance across all shipping methods. Benefit from a dedicated Account Executive, providing a personalized touch to your shipping experience. Reach out for a free estimate within 24 hours, or chat with our expert consultants at no charge. Let us make your international shipping streamlined and stress-free.

Customs clearance in New Zealand for goods imported from Thailand

Customs clearance poses a considerable challenge due to its intricacy. This critical process, involving the passage of goods through customs borders, can be riddled with unexpected fees and charges, especially when shipping from Thailand to New Zealand. It's essential to understand the customs duties, taxes, quotas, and licenses involved to avoid potential hassles like goods getting held back. Moreover, it accentuates the importance of effective planning and conducting due diligence. Indeed, the following sections will unravel these aspects more exhaustively. Fear not, DocShipper has got your back. We're ready to assist you in the entire process—no matter the nature or location of your goods. To help us help you, contact our team with the origin and value of your goods and the HS Code. These three data points are essential for us to tailor an accurate project budget.

How to calculate duties & taxes when importing from Thailand to New Zealand?

When you're importing goods from Thailand to New Zealand, estimating duties and taxes is an essential part of the planning process. Getting a precise cost prediction involves several key factors - the country of origin, the Harmonized System (HS) Code of the product, its customs value, the applicable tariff rate, and any additional taxes and fees that the product may attract. Each of these elements plays a crucial role in determining the customs duties you will need to pay.

The country of origin, for instance, refers to where your goods were manufactured or produced. It's the very first information you have to nail down as it sets the stage for everything else in the duty estimation process. Knowing the origin country can provide insights into any import tariffs, trade agreements, or restrictions that might apply to your shipment.

Step 1 - Identify the Country of Origin

You'd think defining your goods' origin is a no-brainer, right? Here's the twist: it's more than scribbling 'Thailand' on a form. Pinning down the country of origin offers a clear picture of what duties your business will face.

All thanks to trade agreements like the ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA), which hugely impact your customs duties. Does your product qualify under AANZFTA? Boom - you could enjoy tariff reductions or even exemptions! Yet, knowing this requires clarity on the country of origin.

Then come specific import restrictions. By identifying your origin country, you can track any possible import restrictions New Zealand may have. And say goodbye to nasty surprises that could delay your shipment or ramp-up costs!

Practical tip? Keep handy your goods' full manufacturing process info. It helps prove the country of origin if customs officials raise questions. Remember, it's your best friend in avoiding sticky customs situations or even penalties.

So, save yourself time, money, and stress. Know your goods' roots before jumping into the HS code maze - a crucial step to hitting the smooth sailing road with your imports.

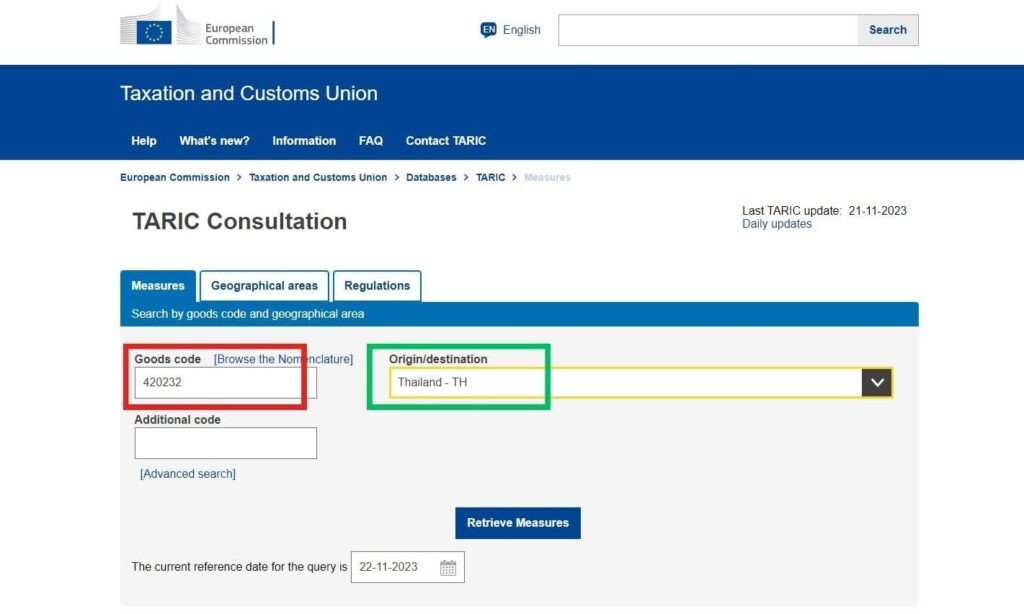

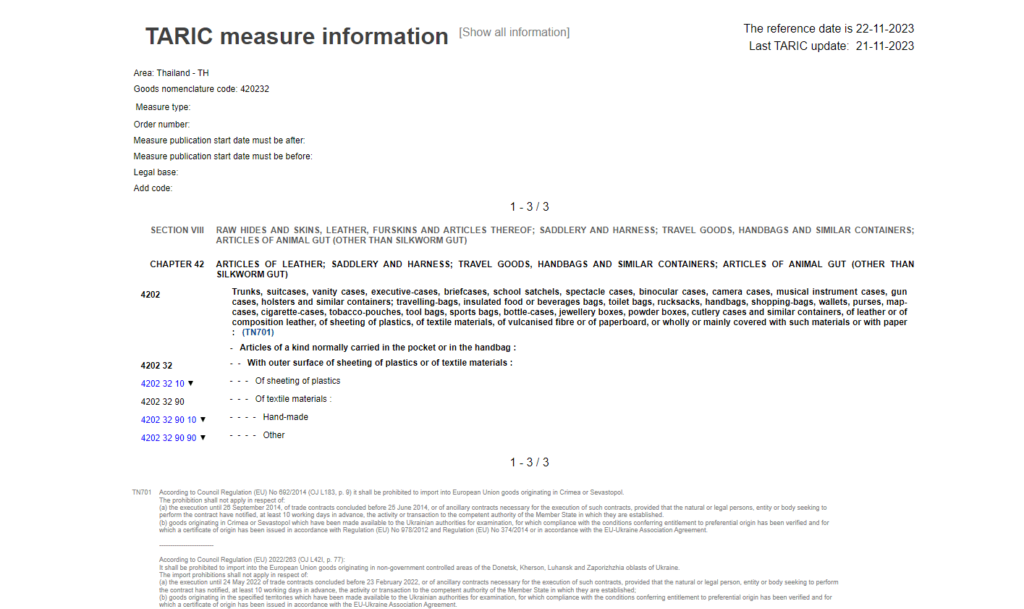

Step 2 - Find the HS Code of your product

The Harmonized System Code, better known as HS code, serves as an international product classification system. It allows customs authorities across the globe to identify and track a wide range of commodities. This 6 to 10-digit code is crucial in determining the duties and taxes imposed on your goods and the required documentation for their international transportation.

In most cases, you can get the HS code directly from your supplier, who is typically well-versed in the products they're exporting and the corresponding regulations.

However, if this option isn't available, don't worry. We have an easy, step-by-step process you can follow. Start by visiting the Harmonized Tariff Schedule . Once there, simply type the name of your product into the search bar. Your HS code can be found in the Heading/Subheading column.

Please note that choosing the correct HS code is critical to your shipping process. An incorrectly stated HS code can lead to shipment delays and potential fines. Accuracy is not a preference, but a must.

Here's an infographic showing you how to read an HS code. Remember, understanding this system is essential for smooth and effective international shipping.

Step 3 - Calculate the Customs Value

Establishing the customs value for your goods might seem daunting, but fret not! It's not merely the product price, as one might assume. The customs value is actually the CIF value, which constitutes the cost of your goods, the international shipping cost, and any insurance fees, all combined.

So, for example, if your product costs $100, the international shipping is $20, and insurance is $10, your CIF and therefore customs value would be $130 (100+20+10).

This amount is critical when calculating any applicable duties and taxes upon landing in New Zealand. By knowing your CIF, you're well-prepared to swiftly move through customs, minimizing potential hiccups and getting your Thai goods to market faster!

Step 4 - Figure out the applicable Import Tariff

An import tariff, simply put, is a tax imposed on goods brought into a country. This tariff works to control the flow of imported goods and is an essential part of any country's trade policy.

In the case of shipping from Thailand to New Zealand, the good news is that New Zealand utilizes a highly transparent and efficient system for identifying the correct import tariff, leveraging the World Customs Organization's Harmonized Commodity Description and Coding System. This universally recognized system aids in aligning tariff rates and goods categorization across international borders.

To identify the applicable import tariff for your goods, follow these steps:

1. Seek the 6-digit HS code (Harmonized System Code) that was identified earlier.

2. Visit the New Zealand's Customs Service website or use their 'Trade Tariff Lookup Tool'.

3. Enter the HS code and the country of origin (Thailand in this case).

4. Review the duties, taxes, and potential free trade agreements applied to your product.

For example, let's say you're importing men's cotton shirts (HS code 620520) from Thailand to New Zealand. Using the above steps, you find that the tariff rate is exactly 10%. This percentage is calculated on the Cost, Insurance, and Freight (CIF) value of the goods. If your CIF value totals to $10,000 USD, your import duty would thus be $1,000 USD. This gives you a clear estimate of the cost of your shipment, helping you make informed financial decisions.

Remember that for every shipment, it's crucial to understand and apply the correct tariff codes, ensuring a smooth customs clearance process. Stay informed and plan ahead!

Please carry out the tasks as what we implied above, fill out the blanks with:

- Your HS Code

- Origin of goods

Step 5 - Consider other Import Duties and Taxes

Beyond the basic tariffs, more layers of import duties and taxes may apply to your goods. These variations are based on the product's nature and its country of origin.

One such extra layer could be excise duty, usually imposed on items like alcohol or tobacco. Suppose, for instance, that you're importing wine from Thailand, you might face an additional cost due to excise duty. Please remember, it's just an example and the actual charges may vary.

Another tax to bear in mind is the anti-dumping tax. This is applicable if goods are sold at a lower price in the overseas market, which may harm the local industry. For example, if Thai companies are exporting rubber products to New Zealand at undervalued prices, anti-dumping taxes may kick in. But again, this is an example meant to illustrate the point.

Last but not least is the Value-Added Tax (VAT). In New Zealand, it's referred to as Goods and Services Tax (GST). As of this writing, the GST is charged at 15%. Let's say the shipment value is $1,000 USD, you would typically need to pay $150 USD as GST. It's crucial to consider these additional costs in your overall budgeting.

These examples and formulas can offer a reference point, but it's always advised to consult a local import professional or customs broker for specific, updated rates.

Step 6 - Calculate the Customs Duties

When shipping goods from Thailand to New Zealand, calculating the customs duties is vital to avoid surprising costs. Duty is generally calculated on the customs value of the goods using the harmonized system and are subject to a goods and services tax (GST).

Consider three situations:

1. A $2000 shipment of car parts is imported. Thailand's preferential rate of 5% is applied so your customs duty is $100 (5% of $2000). No VAT applied here.

2. You're importing furniture valued at $5000. With a 10% customs duty, that's $500. But New Zealand's 15% GST is added to the mix, yielding an extra $825. So your total cost to customs is $1325.

3. Imagine you're importing certain metals worth $10000. The customs duty (15%) is $1500. The GST (15%) on the customs value plus duty equals $1725. Additionally, anti-dumping duties of 10% and excise duty of 5%, showing a total of $2950 in customs charges.

Balancing these different factors can be complex and time-consuming. That's where DocShipper comes in. Our expert team takes care of every detail of customs clearance globally. We ensure you pay no more than absolutely necessary. Get a free, personalized quote in less than 24 hours. Your goods deserve a smooth journey, and with DocShipper, that's exactly what they'll get.

Does DocShipper charge customs fees?

While DocShipper acts as your custom broker in Thailand and New Zealand, we don't charge customs duties. Our scope covers customs clearance fees, not the duties and taxes that go straight to the government. Think of it like paying a pal to stand in line at the post office - you're covering their time, not your postage. To keep things transparent, we give you the paperwork from customs, proving you're only footing the bill for what the office charged.

Contact Details for Customs Authorities

Thailand Customs

Official name: The Customs Department of Kingdom of Thailand.

Official website: www.customs.go.th.

New Zealand Customs

Official name: New Zealand Customs Service

Official website: https://www.customs.govt.nz/

Required documents for customs clearance

Overwhelmed with the maze of paperwork for customs clearance? Don't fret! We'll cut through the confusion, offering clarity on essentials like the Bill of Lading, Packing List, Certificate of Origin, and CE standard Documents of Conformity. No jargon, just straightforward information, tailored for you.

Bill of Lading

When you're shipping goods between Thailand and New Zealand, the Bill of Lading is your best friend. This document is the official receipt for your international cargo, detailing the type, quantity, and destination of the goods. Crucially, it marks the transfer of ownership from the seller to the buyer. Now let's get savvy – consider opting for a 'telex' or electronic release. It's quicker, cheaper, and cuts out the wait time for physical delivery. For air cargo, replace this with an Air Waybill (AWB). Keep these in your toolkit to sail smoothly through customs and bolster your shipping strategy between these nations. Remember, in shipping, knowing your documents means knowing your business.

Packing List

When shipping goods from Thailand to New Zealand, the Packing List is your best friend. This unassuming document packs a serious punch, detailing the contents, quantity, weight, and measurement of each item transported. Let's say you're exporting Thai silk. Each bolt, its weight, color, and dimensions must be accurately listed. In busy Thai ports, as well as the picturesque harbors of New Zealand, it assists customs officers to swiftly assess and clear your shipment. For air freights, it informs about the payload - necessary for safe and legal flight. Small inaccuracies could lead to unnecessary hold-ups or even fines. So, spare some attention to your Packing List, because detailed accuracy could be the difference between cruising through customs and strict scrutiny. Remember, the success of your shipping journey, be it by sea or air, lies in the details!

Commercial Invoice

Securing a smooth customs clearance between Thailand and New Zealand hinges on a correctly filled Commercial Invoice. This pivotal document provides essential info like the buyer/seller names, address, description of goods, HS codes, and freight charges. It's a bit like your shipment's passport—missteps could cause hiccups in your freight's journey. For instance, discrepancies between your Commercial Invoice and Packing List can lead to delays. So, to avoid this, align details across all shipping documents. You're battling against time, cost, and compliance restraints, but a meticulously filled Commercial Invoice can make your freight-forwarding experience smoother than a kiwi fruit’s skin.

Certificate of Origin

When shipping goods from Thailand to New Zealand, your transit won't be complete without the Certificate of Origin. This vital document ascertains where your goods were manufactured. For instance, if you're exporting Thai silk, details about its production in Thailand would feature here. This isn't just paperwork; it could translate into major savings for your venture! Several goods qualify for lower customs duty if the country of origin has certain trade agreements with New Zealand. If Thailand is that country, you may benefit from such preferential rates. So remember, correctly filling out and providing your Certificate of Origin can reduce expenses and ensure a smoother customs experience for your goods in New Zealand transit. With it, you can capitalize on trade dynamics between the two countries and optimize your shipping costs.

Get Started with Siam Shipping

Stressed by intricate customs regulations between Thailand and New Zealand? With DocShipper, there's no need to be. We handle every step of the customs clearance process, ensuring your cargo moves smoothly, hassle-free. Alleviate the burden and maintain focus on your business. For peace of mind, reach out today to get a free, no-obligation quote within just 24 hours! Let DocShipper un-complicate your international shipping.

Prohibited and Restricted items when importing into New Zealand

Grasping what you can and can't ship into New Zealand can feel like a minefield. High penalties, seized shipments, or even legal trouble could be at the doorstep if the rules aren't adhered to properly. Let's simplify and clarify what's allowed, what isn't, and the grey areas in between.

Restricted Products

- Firearms and Weapons: For shipping firearms, parts, or components, you have to get a permit from the New Zealand Police. An import permit can be sought from New Zealand Police.

- Medicines: Sending prescription medicines to New Zealand? You need to secure an import permit from the Ministry of Health.

- Food: If you're looking to ship any kind of food product, it's crucial you arrange an import permit from the Ministry for Primary Industries.

- Animals and Animal Products: In transport of all live animals or animal products, you must get this in line with a permit from the Ministry for Primary Industries.

- Plants and Plant Products: Should you need to bring any type of plant or plant products, you have to be sure to contact and secure a permit from the Ministry for Primary Industries.

- Hazardous Substances: You're required to hold a valid permit from the Environmental Protection Authority if you're shipping any hazardous substances.

- Radio and Telecommunication Equipment: To import any of this type of equipment, it's required for you to obtain an approval from Radio Spectrum Management.

Remember, always connect with these respective agencies before planning to ship these goods, to ensure that you obtain the necessary permits and fulfill all obligations in good time. Also, regulations may change so it’s crucial you stay updated!

Prohibited products

- Fresh fruit and vegetables

- Live plants and bulbs

- Animal products including meat, dairy, honey, and other bee products

- Pork and pork products from Canada

- Endangered species without a permit

- Equipment used for animals including used beehives, used beekeeping equipment, used saddle blankets, used veterinary equipment, etc.

- Firearms and weapons without a permit

- Objects with indecent or obscene material

- Imitation firearms, airguns, BB guns, and soft air weapons

- Used vehicles or machinery that has not been cleaned and inspected

- Outdoor or sports equipment that has not been cleaned before shipment

- Products known to contain asbestos

- Drug paraphernalia

- Medicines without a prescription

- Most kinds of seeds and nuts

- Cigarette and tobacco products, exceeding allowance.

Are there any trade agreements between Thailand and New Zealand

Indeed, the Thailand-New Zealand Closer Economic Partnership (TNZCEP) is a significant agreement to be aware of. This agreement covers a wide variety of goods and services, aiming to promote and enhance free trade between both nations. Any future discussions or projects regarding trade relations will only amplify the shipping potential between these two countries. Consequently, your business could save on duties or customs clearance complexities whilst capitalizing on increasing trade trends, ensuring smooth navigation of your shipping requirements.

Thailand - New Zealand trade and economic relationship

Historically, trade relations between Thailand and New Zealand have been robust, tracing back to 1956. In 2005, these ties strengthened with the signing of the Thailand-New Zealand Closer Economic Partnership (TNZCEP), catalyzing bilateral trade relations. Key sectors encompass dairy, electronics, and agro-industrial goods. New Zealand's dairy exports served a vital role, with Thailand being the largest ASEAN importer of milk products in 2019. By 2020, the exchange of goods reached an impressive NZ$2.6 billion (approx THB 56.35 billion), with New Zealand's investments in Thailand crossed a threshold of TBH25.6 billion. This economic camaraderie not only fortifies global supply chains but also offers strategic benefits for businesses eyeing opportunities in both markets.

Your Next Step with Siam Shipping

End the hassle of cross-border shipping between Thailand and New Zealand. From sorting customs complexities to optimizing shipping routes, DocShipper has you covered. We simplify the process, saving you time and reducing costs. Ready for a seamless shipping experience? Contact us, let's get your goods moving.

Additional logistics services

Discover more ways DocShipper can streamline your supply chain, beyond just shipping and customs. From storage solutions to distribution and beyond, explore our all-encompassing logistics services. Let's simplify your journey from start to finish.

Warehousing and storage

Finding the right warehouse in Thailand or New Zealand can feel like a maze, especially if your cargo needs a special climate. Imagine, you're shipping Thai silk or Kiwi wines - you'd need specific temperature controls, right? Fear those icy problems no more! Check out our comprehensive warehousing solutions, customized for your goods. Ready to learn more? Dive in here.

Packaging and repackaging

Secure packaging is your ticket to safe shipping from Thailand to New Zealand. It's crucial to have a reliable partner for tailoring services to your product's needs - be it delicate ceramics or robust machinery. Picture no breakages on arrival, thanks to expert repackaging. Imagine that, a seamless transport experience! For the inside scoop, check out our dedicated page: Freight packaging.

Cargo insurance

Cargo insurance is a lifesaver for your shipments, unlike just fire insurance. It protects your goods from various potential dangers, not only fire, during the shipping process. Imagine a storm hits sea transport - your Thailand-New Zealand trade shouldn't bear the brunt! Ensure it doesn't by opting for cargo insurance. Want to delve deeper? More info on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Introducing goods from Thailand to New Zealand? With DocShipper's Supplier Management, we'll source and handle your procurement in Asia and Eastern Europe, overcoming language obstacles along the way. Imagine us as your compass throughout this process, guiding you towards reliable suppliers. You focus on the market, we'll focus on bringing your products on board! For a deeper dive, check out our dedicated page: Sourcing services.

Personal effects shipping

When moving between Thailand and New Zealand, trusting your delicate or oversized goods with us means peace of mind. With years of experience, our team can pack, transport, and unpack your items, ensuring their safe arrival at your new home. Faced with a grand piano or a precious vintage wine collection? We've got it covered! More info on our dedicated page: Shipping Personal Belongings.

Quality Control

When shipping from Thailand to New Zealand, you don't want surprises. That's why quality inspections before dispatch are game-changers. Imagine 2000 faulty lamps reaching Auckland – a crisis, right? Our inspections ensure every shipment meets NZ standards, saving you stress and cost! Dig deeper into how our Quality Control process helps you sidestep such hassles on our dedicated page: Quality Inspection.

Product compliance services

Shipping between countries becomes a breeze when your products meet local regulations, saving you from legal hassles. Our Product Compliance Services can do just that--conduct tests in authorized labs, bag you certifications, and ensure your shipment's smooth journey. See how useful it can be? Jump in for more details on our dedicated page: Product Compliance Services.

FAQ | For 1st-time importers between Thailand and New Zealand

What is the necessary paperwork during shipping between Thailand and New Zealand?

When shipping from Thailand to New Zealand, we at DocShipper require several essential documents. The vital document will be the bill of lading for sea freight or air waybill for air freight, which we handle on your behalf. You must supply us with a packing list and the commercial invoice. Depending on the nature of your goods, additional documents might be necessary, such as the Material Safety Data Sheet (MSDS) or certain certifications. Rest assured, we are here to guide you through the entire process, ensuring your goods are shipped smoothly and within the regulations.

Do I need a customs broker while importing in New Zealand?

Absolutely, we at DocShipper highly recommend using a customs broker when importing goods into New Zealand. The reason is, the customs process can be quite intricate and requires specific documents and attention to detail. Furthermore, there are mandatory procedures to follow, which can often be overwhelming if you're not already well-versed in them. But don't worry, this is where we step in. We handle most of your shipping needs and act on your behalf at customs, leaving you to focus on what you do best – running your business.

Can air freight be cheaper than sea freight between Thailand and New Zealand?

While it's challenging to provide a one-size-fits-all answer due to varying factors including route, weight, and volume, air freight might indeed be more cost-effective for shipments less than 1.5 Cubic Meters or 300 kg (660 lbs). However, each situation is unique, and complexities might arise. Here at DocShipper, we specialize in these complexities. Count on your dedicated account executive to navigate these factors and propose the most competitive option specifically tailored to your shipping needs. Our goal is to ensure you're getting the best solution, whether it's air freight or sea freight, between Thailand and New Zealand.

Do I need to pay insurance while importing my goods to New Zealand?

While insurance isn't mandatory for shipping goods, we at DocShipper highly recommend it, especially for international shipments such as to New Zealand. This is because various incidents, like damage, loss, or theft, can occur during the shipping journey. Therefore, insuring your goods offers you an added layer of protection and security, mitigating potential financial risks. Remember, it's better to be safe than sorry when it comes to safeguarding your goods.

What is the cheapest way to ship to New Zealand from Thailand?

Considering the key factors like distance, size, and weight of the cargo, ocean freight is usually the most cost-effective option for shipping from Thailand to New Zealand. Our experience at DocShipper indicates that while air freight may be faster, the longer transit time of sea freight can offer significant cost savings for non-urgent shipments. We recommend consulting with our team for personalized advice based on your specific shipping needs.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF depends highly on your relationship with your supplier. Keep in mind, they may not be logistics experts, so it is often beneficial to let a professional agent, such as us here at DocShipper, navigate the international freight and destination processes. Typically, suppliers sell under EXW (at their factory door) or FOB (including all local charges until the origin terminal). Regardless of which term is selected, you can be assured that we can manage the shipping complexities as we offer a door-to-door service.

Goods have arrived at my port in New Zealand, how do I get them delivered to the final destination?

If your cargo arrives in New Zealand under CIF/CFR incoterms, seek a custom broker or freight forwarder for clearance at the terminal and arrange for final delivery. Be prepared for import charges. Alternatively, our DocShipper team offers DAP incoterms, where we manage everything on your behalf. Please consult your dedicated account executive for clarification or to arrange this service.

Does your quotation include all cost?

Indeed, we ensure full transparency with our quotes which covers all charges, barring the duties and taxes at the destination. If required, our dedicated account executives can provide an estimate for these additional costs. At DocShipper, we're committed to avoiding any hidden fees, ensuring a hassle-free shipping experience for you.