Boost your commercial exchanges between Thailand (TH) and Germany (DE) with efficient freight shipping solutions! Discover the key elements that guarantee the success of your operations: competitive rates, optimized transit times, and effective management of customs duties and taxes.

Be amazed by the logistics challenges overcome, the modern infrastructure in place, and the seamless collaboration among all stakeholders involved. From maritime freight to air transport and rail cargo, each link in the supply chain.

Take advantage of this strategic information to plan your freight operations with precision and ensure the fluidity of your commercial exchanges between Thailand and Germany. Enhance your competitiveness and contribute to the development of fruitful business partnerships right now with Siam Shipping, your international freight forwarder.

Table of Contents

What’s the best method of transport between Thailand and Germany ?

There are 2 modes of transport between Thailand and Germany : air freight, sea freight.

However, the best method of transport largely depends on various factors such as :

- Budget

- Time constraints

- Personal preferences

- The level of comfort desired

In this direction guild, you can determine the mode of transport best suited to your needs.

Sea freight between Thailand and Germany

DocShipper Tip : If your shipment is larger than 2m³ and you're looking for a cost-effective means of transport, sea freight is the ideal solution ! Need help, look no further than DocShipper ! We specialize in sea freight, offering reliable and affordable transport options. Contact us now for a tailored shipping solution that fits your needs.

Remark Siam Shipping: If you need information, advice or a quote, don't hesitate to contact our experts! Fill in our online form and our specialists will answer all your questions. You'll be contacted within 24 hours !

TOP 5 – Shipping line

Ocean freight between Thailand and Germany

Shipping goods by ship between Thailand and Germany is a popular and efficient method of transportation. It's a vital component of international trade between these 2 countries. It provides an efficient and cost-effective means of transporting goods, contributing to the growth of both economies.

This mode of transport offers several advantages. It allows for the transportation of large volumes of goods, making it ideal for industries such as manufacturing, automotive, and electronics. Additionally, shipping by ship is cost-effective for long-distance journeys, as it generally has lower transportation costs compared to air freight.

Sea freight is a reliable and safe option, with cargo ships designed to withstand different weather conditions. However, factors like weather disturbances, port congestion, and geopolitical situations can occasionally cause delays or disruptions.

The advantages and disadvantages of this mode of transport are described in detail below.

Main Thailand ports

Port of Bangkok

Located in Chonburi province, approximately 125 kilometers southeast of Bangkok, the Port of Bangkok is the largest and busiest port in Thailand. It serves as a major gateway for international trade and handles a wide range of cargo, including containers, vehicles, and general goods.

Port of Laem Chabang

Situated in Chonburi province, adjacent to the Port of Bangkok, the Port of Laem Chabang is a deep-sea port and one of the busiest container ports in Southeast Asia. It offers modern facilities and infrastructure, making it a crucial hub for international shipping.

Port of Map Ta Phut

Located in Rayong province, the Port of Map Ta Phut is a major industrial port on the Eastern Seaboard of Thailand. It primarily focuses on the handling of petrochemical products, oil, and gas. The port also accommodates general cargo and container shipments.

Port of Sriracha

Situated in Chonburi province, near Laem Chabang, the Port of Sriracha is a multipurpose port that handles various types of cargo, including containers, bulk cargo, and roll-on/roll-off (RoRo) vessels. It serves as an important link for both domestic and international trade.

Port of Phuket

Located in Phuket province on the Andaman Sea, the Port of Phuket is a significant seaport catering to tourism and local trade. It handles passenger ferries, cruise ships, and also serves as a base for fishing and leisure boats.

Port of Songkhla

Situated in Songkhla province, the Port of Songkhla is a major port in southern Thailand. It handles a range of cargo, including petroleum products, fertilizers, and general goods. The port also serves as a gateway for trade with Malaysia and other countries in the region.

Main Germany ports

Port of Hamburg

Located on the River Elbe, the Port of Hamburg is Germany's largest seaport and one of the busiest ports in Europe. It is a major hub for container shipping, handling a significant volume of international trade. The port also handles various types of cargo, including bulk cargo, liquid cargo, and project cargo.

Port of Bremerhaven

Situated on the River Weser, the Port of Bremerhaven is Germany's second-largest container port and one of the busiest in Europe. It serves as a crucial transshipment hub for global trade, with excellent rail and road connections to the hinterland. The port also specializes in the handling of automobiles, high and heavy cargo, and breakbulk shipments.

Port of Wilhelmshaven

Located on the Jade Bight in the North Sea, the Port of Wilhelmshaven is Germany's only deep-water port. It has the capacity to accommodate large vessels and serves as an important hub for the handling of crude oil, liquid natural gas (LNG), and petroleum products. The port also has facilities for container and general cargo handling.

Port of Rostock

Situated on the Baltic Sea, the Port of Rostock is one of the largest ports in Germany and the main port in the state of Mecklenburg-Vorpommern. It is a multifunctional port that handles containerized cargo, bulk cargo, RoRo traffic, and ferry connections to Scandinavia and the Baltic states.

Port of Lübeck

Located on the Trave River near the Baltic Sea, the Port of Lübeck is a major port in northern Germany. It is known for its container terminal and specializes in handling intermodal cargo, including containers, general cargo, and forest products. The port also provides ferry services to Scandinavia and the Baltic states.

Port of Kiel

Situated on the Baltic Sea, the Port of Kiel is a significant port in northern Germany, primarily serving as a hub for passenger shipping and cruise tourism. It offers ferry connections to Scandinavia and the Baltic states, and it also has facilities for the handling of general cargo and bulk cargo.

Advantages of ocean freight

- Economical : Competitive rates for low-cost exports.

- High carrying capacity : Ocean freight vessels efficiently transport large quantities of goods.

- Flexibility : Sea freight is flexible for a variety of goods, meeting a wide range of needs.

- Global network : Sea freight dominates international trade with its extensive network of ports and routes.

- Sustainability : Environmentally friendly, with modern, energy-efficient ships.

- Risk management : Minimizes risks through appropriate safety and insurance measures.

Disadvantages of sea freight

- Long transit times : Due to the distance and stages involved.

- Dependence on weather conditions : Weather at sea impacts delivery times.

- Complexity of customs formalities : Complex customs procedures, leading to delays and administrative costs.

- Risk of loss or damage : Risk of loss or damage, despite security measures.

- Additional costs : Incurring additional costs such as port and handling charges.

- Dependence on overland infrastructure : Overland transport sometimes necessary, with impact on efficiency and lead times.

Transit time between ports in Thailand and ports in Germany

The transit time between the ports of Thailand and Germany can vary depending on several factors:

- Distance between the two countries

- Weather conditions

- Vessel availability

- Customs formalities

- etc.

It is therefore essential to note that the average figures given are approximate and may vary.

Here is a summary table of the average transit times, in days, between the largest Thailand and German ports.

| Bangkok | Laem Chabang | Map Ta Phut | Sriracha | Phuket | Songkhla | |

| Hamburg | 33 | 36 | 36 | 36 | 38 | 42 |

| Bremerhaven | 35 | 35 | 36 | 36 | 43 | 42 |

| Wilhelmshaven | 35 | 35 | 36 | 36 | 37 | 42 |

| Rostock | 33 | 37 | 36 | 36 | 42 | 42 |

| Lübeck | 33 | 37 | 36 | 37 | 42 | 42 |

| Kiel | 33 | 37 | 36 | 37 | 42 | 42 |

*These transit times between Thailand and Germany are given as an indication.

It is advisable to contact shipping companies or freight forwarders for more precise information on current transit times. They will be able to consider the specific details of your shipment and provide you with more accurate estimates based on your particular situation.

Container types used for sea freight between Thailand and Germany

There are 3 main categories of standard container sizes :

- The 40-foot HQ (High Cube) : with a capcity of 76 cubic meters.

- The 40-foot container : with a capacity of 67 cubic meters.

- The 20-foot container : with a capacity of 33 cubic meters.

Each of these containers can be shipped by two different transportation methods.

Less than Container Load (LCL)

LCL stands for "Less than Container Load," referring to a shipping method where multiple small shipments from different exporters are combined in a single container to optimize cost and space efficiency.

Advantages of Less than Container Load

- Cost reduction : Groupage allows transportation costs to be shared between several shippers, which can be more economical for everyone.

- Flexibility : Shippers can ship smaller quantities of goods, without having to wait to fill a full container.

- Reduced wastage of space : Groupage makes efficient use of available container space, avoiding empty spaces.

Disadvantages of Less than Container Load

- Longer transit times : Since the container has to be filled with shipments from different companies, this can lead to delays in transport and customs clearance.

- Risk of damage : When goods from different shippers are grouped together, there is an increased risk of damage during loading, unloading or transit.

Complete container or FCL (Full Container Load)

The full container, or FCL, is used when the quantity of goods to be shipped fills an entire container. In this case, a single shipper uses all the space available in the container. This offers greater flexibility in terms of loading, unloading and transport planning.

Advantages of Full Container Load

- Shorter transit time : With a single shipper using the entire space, there are fewer intermediate steps, which can reduce transit time.

- Less risk of damage : With a single shipper, there is less handling of goods, which reduces the risk of damage.

- More precise planning : The shipper has more control over transport planning and can adapt to his own needs.

Disadvantages of Full Container Load

- Higher costs : Since the shipper pays for exclusive use of the container, costs can be higher, especially if the quantity of goods to be shipped is relatively small.

- Unused capacity : If the shipper doesn't have enough goods to fill a full container, this can lead to wasted capacity and unnecessary extra costs.

Siam Shipping Alert: Please be careful when loading LCL ! Your products may be damaged in transit. What's more, if your container partner encounters difficulties with customs during clearance, this could lead to a delay in your customs clearance process. To find out more about sea groupage and how it differs from FCL, as well as how to avoid these kinds of problems, you can read our dedicated page on sea freight. You can also contact our experts directly with your questions.

Special transport by sea between Thailand and Germany

Reefer container

Used for transporting perishable goods or goods requiring a controlled temperature (between -30°C and +30°C). This type of container is equipped with a refrigeration system that maintains the temperature inside the container within a specific range, thus guaranteeing the freshness and quality of the goods transported, such as heat-sensitive food or pharmaceutical products.

Roro

Vessel specialized in transporting vehicles, such as cars, trucks or construction equipment. These vessels are equipped with ramps that allow vehicles to roll on and off the ship, facilitating loading and unloading.

Bulk

Transport of bulk goods, such as grain, ores, bulk chemicals, etc. In this type of transport, goods are not packed individually but are loaded in bulk directly into the ship's hold, into specially designed tanks or hoppers. Bulk transport is commonly used for large-volume cargoes, and requires special facilities for loading and unloading.

OOG

Goods that exceed the standard dimensions of containers or ships. These may be very long, very wide, very high or unconventionally shaped objects. Transporting OOG goods requires special measures, such as the use of special containers, cranes or lifting devices, to ensure safe and efficient transport.

Two types of containers exist for these goods :

- Open Top Container : they have no roof, which allows loading cargo that exceeds the height of the containers.

- Flat Rack Container : these are flat containers without side walls or roofs, used for goods that cannot be loaded in standard containers.

How much does sea freight cost between Thailand and Germany

The cost of sea freight between Thailand and Germany can vary according to several factors :

- Type of goods

- Volume

- Weight

- Distance

- Transport conditions

- Port charges

- Other additional charges.

Exact rates can be obtained from shipping companies or forwarding agents specializing in sea freight. We recommend that you contact these companies directly to obtain accurate, up-to-date quotes.

Here are some average cost estimates for sea freight between Thailand and Germany.

*Please note that these figures are approximate and can vary depending on the factors mentioned earlier

- Full Container Load (FCL) :

For a 20-foot container (20' GP) : the average cost ranges from $1,500 to $3,000.

For a 40-foot container (40' GP) : The average cost ranges from $2,500 to $5,000.

- Less than Container Load (LCL) :

The average cost per cubic meter ranges from $100 to $200.

Tariff surcharges

Tariff surcharges in sea freight refer to additional charges that can be applied on top of the base freight rates. These surcharges can vary depending on factors such as :

- Fuel prices

- Currency exchange rates

- Market conditions.

Some common tariff surcharges in sea freight include :

- Bunker Adjustment Factor (BAF) : This surcharge is applied to compensate for fluctuations in fuel prices.

- Currency Adjustment Factor (CAF) : This surcharge accounts for changes in currency exchange rates between the origin and destination countries.

- Peak Season Surcharge (PSS) : It is levied during periods of high demand, such as peak holiday seasons.

- Emergency Risk Surcharge (ERS) : This surcharge may be imposed in situations of political instability, natural disasters, or other emergency events.

- Equipment Imbalance Surcharge (EIS) : It is applicable when there is a shortage or imbalance of shipping containers in a specific region.

Air freight from Thailand to Germany

DocShipper Tip : If your shipment represents a volume of less than 2 m3, and you're looking for a fast means of transport, then air freight is the best solution ! Need help, look no further than DocShipper ! We specialize in air freight, offering reliable and affordable transport options. Contact us now for a tailored shipping solution that fits your needs.

Remark Siam Shipping: Remark Siam Shipping: If you need information, advice or a quote, don't hesitate to contact our experts! Fill in our online form and our specialists will answer all your questions. You'll be contacted within 24 hours !

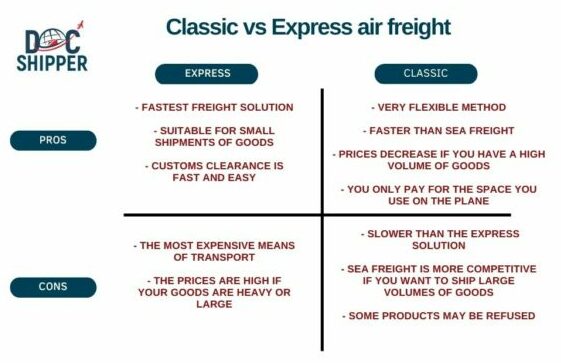

Traditional or express air freight

Air freight from Thailand to Germany can be handled both traditionally and expressly. Both options offer different advantages and features, depending on the shipper's specific needs.

- Traditional air freight: Traditional air freight involves shipping goods by air on scheduled flights. This mode of transport may be less expensive, but it can also take longer as it depends on regular flight schedules. It is generally suitable for less urgent or larger shipments.

- Express air freight : Express air freight is a faster, more efficient service. It uses carriers specialized in express deliveries to get goods quickly to their destination. This type of air freight is frequently more expensive than traditional freight but is ideal for urgent shipments or high-value-added goods.

Shippers are advised to assess their needs in terms of delivery time, nature of goods, and budget before choosing between traditional or express air freight to ship goods. It is also advisable to contact airlines or logistics service providers to obtain precise information on the options available and the corresponding rates.

Thailand’s main airports

Suvarnabhumi Airport

Located in Bangkok, Suvarnabhumi Airport is the busiest and largest international airport in Thailand. It serves as the primary gateway to the country, handling a significant volume of domestic and international flights. It offers a wide range of amenities and facilities for passengers.

Don Mueang International Airport

Also situated in Bangkok, Don Mueang International Airport is the second-largest airport in Thailand. While it used to be the main international airport for Bangkok, it now primarily handles low-cost carriers, domestic flights, and some regional international flights.

Phuket International Airport

Located on the island of Phuket, Phuket International Airport is one of the busiest airports in Thailand. It serves as a major gateway to the popular tourist destination of Phuket and handles a large number of domestic and international flights, connecting visitors to various destinations in Thailand and abroad.

Chiang Mai International Airport

Situated in Chiang Mai, in the northern part of Thailand, Chiang Mai International Airport is an important airport in the region. It offers domestic and international flights, connecting travelers to Chiang Mai and its surrounding areas known for their cultural and natural attractions.

Hat Yai International Airport

Located in Hat Yai, in the southern part of Thailand, Hat Yai International Airport is a major airport serving the region. It operates domestic and international flights, connecting travelers to Hat Yai and the nearby provinces of Songkhla and Satun.

Krabi International Airport

Situated in Krabi, on the Andaman Sea coast, Krabi International Airport serves as a gateway to the popular beach destinations in the region, including Krabi, Ao Nang, and Railay. It operates domestic and international flights, welcoming tourists from various parts of the world.

Germany’s main airports

Frankfurt Airport

Located in Frankfurt, Hesse, Frankfurt Airport is Germany's largest and busiest airport. It is also one of the busiest airports in Europe and a major global aviation hub. Frankfurt Airport offers a wide range of domestic and international flights, connecting passengers to destinations worldwide.

Munich Airport

Situated in Munich, Bavaria, Munich Airport is the second-largest airport in Germany and a prominent European hub. It handles a significant volume of domestic and international air traffic, providing connections to various destinations across the globe.

Berlin Brandenburg Airport

Serving the capital city, Berlin Brandenburg Airport is Germany's newest international airport. It replaced the former Tegel and Schönefeld airports and became fully operational in 2020. Berlin Brandenburg Airport connects Berlin with numerous domestic and international destinations.

Düsseldorf Airport

Located in Düsseldorf, North Rhine-Westphalia, Düsseldorf Airport is an important international airport in western Germany. It offers a wide range of flights, including both domestic and international routes, serving as a gateway to the vibrant Rhine-Ruhr metropolitan region.

Hamburg Airport

Situated in Hamburg, Hamburg Airport is one of the busiest airports in Germany, serving the country's second-largest city. It provides domestic and international flights, connecting passengers to various destinations across Europe and beyond.

Cologne Bonn Airport

Located in Cologne/Bonn, North Rhine-Westphalia, Cologne Bonn Airport is a major airport in western Germany. It serves as a hub for both passenger and cargo flights and offers a mix of domestic, European, and intercontinental routes.

Advantages of air freight

- Speed : Air freight is the fastest way to deliver urgent or perishable goods worldwide.

- Global accessibility : Outperforms other modes of transport by reaching even the most remote destinations worldwide.

- Flexibility: High flexibility with frequent flights and flexible schedules.

- Safety : Thanks to sophisticated airport security systems.

- Tracking and tracing : airlines offer precise tracking of goods, optimizing logistics management.

Disadvantages of air freight

- High cost : More expensive due to the volumetric weight of goods.

- Limited capacity : Limited capacity for bulky cargo.

- Environmental impact : Highly polluting in terms of greenhouse gas emissions.

- Restrictions on dangerous goods : Dangerous goods subject to strict regulations.

- Dependence on airport infrastructure : Air freight is dependent on airports, and encounters delays and logistical problems.

Transit time between ports in Thailand and ports in Germany

Transit times between airports in Thailand and airports in Germany can vary depending on several factors :

- The airline

- Flight duration

- Arrival and departure times

- Customs formalities

- etc.

Here is a summary table of the average transit times, in days, between the largest Thailand and German ports.

Suvarnabhumi |

Don Mueang International |

Phuket International |

Chiang Mai International |

Hat Yai International |

Krabi International |

|

| Frankfurt | 6 | 6 | 7 | 6 | 6 | 7 |

| Munich | 6 | 7 | 7 | 6 | 7 | 6 |

| Berlin Brandenburg | 7 | 7 | 6 | 7 | 6 | 6 |

| Düsseldorf | 6 | 6 | 6 | 7 | 6 | 6 |

| Hamburg | 6 | 6 | 6 | 6 | 7 | 6 |

| Cologne Bonn | 6 | 6 | 6 | 6 | 7 | 6 |

*These transit times between Thailand and Germany are given as an indication.

However, it's important to bear in mind that most flights between these two countries involve a stopover in another country, which can considerably increase the total transit time.

For more precise information on transit times, contact us. Our team will be happy to send you a free quote in less than a day.

How much does air freight cost between Thailand and Germany ?

The cost of air freight between Thailand and Germany can vary depending on several factors such as :

- The weight and Dimensions of the cargo

- The chosen airline

- The specific airports involved

- Any additional services required.

Air freight rates are typically calculated based on chargeable weight, which is either the actual weight or the volumetric weight, whichever is higher.

To provide you with some rough estimates, here are the average cost ranges for air freight between Thailand and Germany :

- General cargo :

For small shipments weighing up to 100 kg : the average cost range from $3 to $8 per kilogram.

For larger shipments over 100 kg : the average cost ranges from $2 to $6 per kilogram.

- Express or time-sensitive shipments :

The average cost can range from $10 to $15 per kilogram or higher.

It's a good idea to contact specialized air freight companies for customized quotes based on your specific needs. These companies will be able to take into account the details of your shipment and provide you with an accurate price for air freight between Thailand and Germany.

Siam Shipping Advice: Don't hesitate to consult our experts for more detailed information on air freight costs. You can always arrange a free quote with us to determine the cost of your shipment.

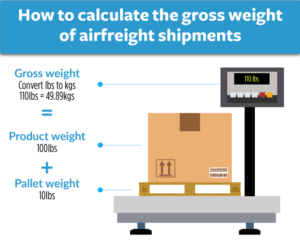

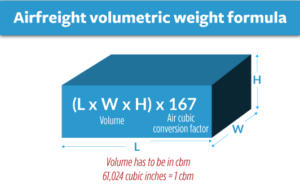

How do I calculate the volumetric weight of my shipment?

To calculate the volumetric weight of your shipment, you'll need to consider the dimensions of the package. The volumetric weight is used to determine the chargeable weight for air freight when it exceeds the actual weight of the shipment. Follow these steps to calculate the volumetric weight :

- Measure the dimensions : Measure the length, width, and height of your package in centimeters (cm). Make sure to use the longest and widest points of the package.

- Calculate the volume : Multiply the length, width, and height measurements together to obtain the volume of the package in cubic centimeters (cm³).

- Convert to volumetric weight : Divide the volume by a volumetric conversion factor. The specific conversion factor may vary depending on the airline or freight forwarder, but it is typically around 6,000 for international air shipments. Divide the volume by 6,000 to convert it to volumetric weight in kilograms (kg).

- Compare with the actual weight : Compare the volumetric weight with the actual weight of your shipment. The higher of the two will be considered the chargeable weight for air freight purposes.

Here's the formula for calculating volumetric weight :

Volumetric Weight (kg) = (Length x Width x Height) / Volumetric Conversion Factor

Keep in mind that some airlines or freight forwarders may use different volumetric conversion factors, so it's always a good idea to check with them directly to ensure you're using the correct calculation method for your specific shipment.

Siam Shipping Advice: We recommend using air freight for fragile, valuable, or perishable goods to increase security and protect your merchandise. You can get in touch with our specialists for further details if you want to learn more about transporting fragile merchandise.

Door-to-door delivery between Thailand and Germany

We can meet your transportation needs, no matter which country in Europe you're traveling to or from. DocShipper's experts are at your side.

When organizing a door-to-door delivery, it's important to take a few things into account. First of all, you should ensure that your goods are properly packaged and labeled in accordance with the requirements of the chosen transport company. It is also advisable to take out insurance to cover any damage or loss during transport.

Delivery times may vary according to the distance between Thailand and Germany, as well as weather conditions, customs formalities and other factors. It is best to contact the transport company directly for precise information on delivery times.

Advantages of door-to-door services

- Convenience : The carrier collects the parcels from the sender's address in France and delivers them directly to the recipient's address, without the need for specific collection points.

- Time-saving : Door-to-door service facilitates shipping by avoiding logistical hassles and travel.

- Tracking and tracing : Door-to-door services offer real-time parcel tracking.

- Security : Ensure parcel protection with special packaging and insurance.

- Simplified customs service : Experienced carriers help complete the necessary paperwork, making it easier for packages to cross the border.

- Direct delivery : delivers parcels directly to the destination address, avoiding travel for both sender and recipient.

Disadvantages of door-to-door services

- High cost : More expensive due to transportation, handling and insurance costs.

- Variable delivery times : delays may occur due to weather conditions, logistical problems or border delays.

- Customs formalities : Involves customs formalities that may cause delays or complications.

- Shipping restrictions : International shipping restrictions, excluding certain products from door-to-door shipment.

- Limited liability : Additional insurance is recommended for better shipment coverage.

- Size and weight restrictions : Size and weight restrictions for packages. Additional charges may apply for bulky or heavy packages.

Customs clearance in Thailand for goods imported from Germany

Customs clearance plays a crucial role in the import and export process in any country, ensuring compliance with regulations and facilitating the smooth flow of goods. In the case of importing goods from Germany to Thailand, understanding the customs clearance procedures is essential to avoid delays and complications.

When importing goods from Germany to Thailand, it is crucial to accurately declare the details of the goods and consult with Thai customs authorities for duty calculation. Additionally, the imported goods are subject to VAT, with a standard rate of 7%. To ensure compliance with Thai import regulations, it is important to consider restrictions on items such as drugs, counterfeits, weapons, hazardous materials, and wildlife. Regulated goods may require additional permits. To facilitate a smooth clearance process, it is advisable to collaborate with a licensed customs broker or freight forwarder who possesses expertise in Thai customs regulations.

Customs value

The customs value is an important concept in international trade and customs clearance procedures. It refers to the value of imported or exported goods on which customs duties and taxes are calculated. Here are some key points regarding customs value :

- Transaction Value : The most common method for determining customs value is the transaction value. This is the price actually paid or payable for the goods when sold for export to the country of importation. The transaction value should include any costs and expenses incurred up to the point of importation, such as transportation, loading, and insurance.

- Adjustments to the Transaction Value : Certain adjustments may be necessary to arrive at the customs value. For example, the value of certain elements, such as royalties, license fees, or commissions related to the imported goods, may need to be added to the transaction value. Conversely, certain elements, such as the cost of transport and insurance after importation, may need to be deducted.

- Related Parties : When the buyer and seller of the imported goods have a relationship that may influence the price, the transaction value may not be acceptable for customs valuation purposes. In such cases, alternative methods, such as the transaction value of identical or similar goods, may be used to determine the customs value.

- Customs Valuation Methods : The World Trade Organization (WTO) has established a set of methods to determine customs value, known as the WTO Valuation Agreement. Apart from the transaction value method, other methods include the transaction value of identical or similar goods, deductive value method, computed value method, and fallback method.

- Documentation : Proper documentation is crucial to support the declared customs value. Commercial invoices, packing lists, contracts, and other relevant documents should accurately reflect the value and terms of the transaction. Customs authorities may request additional documentation or evidence to verify the declared customs value.

- Customs Audits and Disputes : Customs authorities have the right to audit and verify the accuracy of declared customs values. In case of disagreements or disputes, there are procedures to challenge the customs value determination. This may involve providing additional documentation, engaging in negotiations, or appealing the decision through administrative or legal channels.

What are customs duties and taxes ?

Customs duties and taxes are charges imposed by governments on goods that are imported or exported. These charges serve various purposes, such as regulating trade, protecting domestic industries, and generating revenue for the government. Here is a detailed explanation of customs duties and taxes :

- Customs Duties : Customs duties, also known as import duties or tariffs, are taxes imposed on goods when they are imported into a country. The purpose of customs duties is to protect domestic industries by making imported goods more expensive and less competitive in the domestic market. Customs duties can be specific (based on quantity or weight) or ad valorem (based on the value of the goods).

- Value Added Tax (VAT) : Value Added Tax, commonly referred to as VAT, is a consumption tax levied on the value added at each stage of the production and distribution process. VAT is typically applied to the final price of goods or services and is collected by the government. Unlike customs duties, VAT is generally imposed on both imported and domestically produced goods. The rate of VAT can vary from country to country.

- Excise Taxes : Excise taxes are specific taxes imposed on certain goods, such as alcohol, tobacco, gasoline, or luxury items. These taxes are usually intended to discourage the consumption of potentially harmful products or to generate additional revenue for the government. Excise taxes are often applied in addition to customs duties and VAT.

- Other Taxes and Fees : In addition to customs duties, VAT, and excise taxes, there may be other taxes or fees associated with international trade. These can include administrative fees, surcharges, or specific charges related to certain types of products, such as environmental levies. These additional taxes and fees can vary depending on the country and the specific goods being imported or exported.

It is important to note that the rates of customs duties and taxes in Thailand may change at any time depending on current trade policies.

How to calculate customs duties and taxes ?

Calculating customs duties and taxes on imports into Thailand can be a complex process that depends on several factors, such as the type of product, its value, and its country of origin. Here are the general steps to follow:

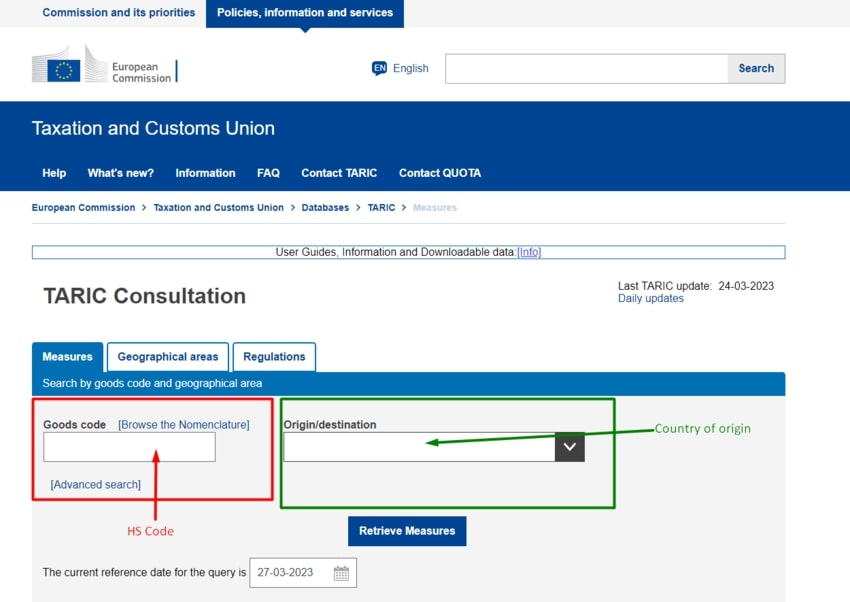

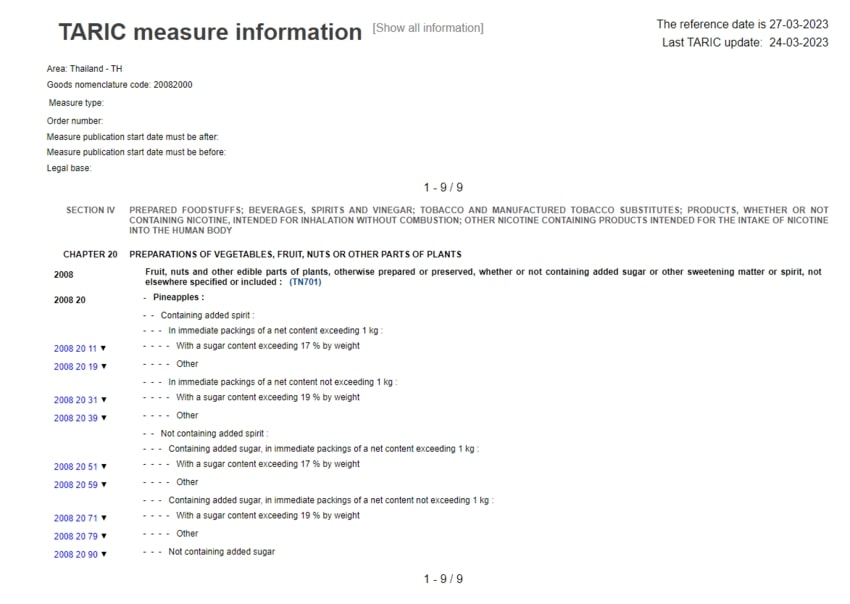

- Determine the product's tariff classification: The first step in calculating customs duties is to determine the product's tariff classification. This is done by consulting the EU's Common Customs Tariff (CCT), which lists the various product categories and their corresponding duty rates. You'll need to know the Harmonized System (HS) code for your product to determine its tariff classification.

- Determine the product's value: The next step is to determine the product's value, which is usually the invoice value of the goods plus any additional costs, such as shipping and insurance.

- Calculate the customs duty: Once you have determined the product's tariff classification and value, you can calculate the customs duty. The duty rate will depend on the product's tariff classification, its value, and the country of origin. You can use the EU's TARIC database to look up the duty rate for your product.

- Calculate the VAT: In addition to customs duties, you will also need to calculate the VAT. The VAT rate in France is currently 20%, but there may be reduced rates for certain products, such as food and books.

- Calculate any other taxes or fees: Depending on the product, there may be other taxes or fees to consider, such as excise duties or environmental taxes.

It's important to note that the customs clearance process and the calculation of duties and taxes can be complex. If you're unsure about how to calculate the duties and taxes for your specific import, it's always best to consult with a customs broker or freight forwarder like Siam Shipping. We can help you navigate the process and ensure that you're meeting all the necessary requirements.

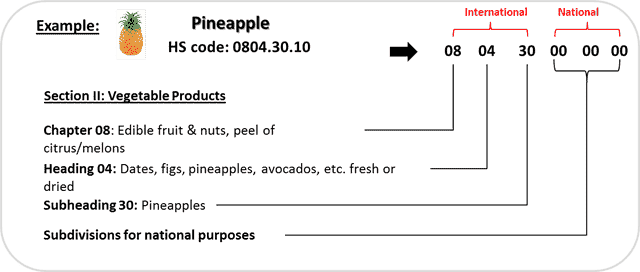

How do I find the HS code ?

A system of classification for products used in international trade is the HS code (Harmonized System). It organizes goods into categories based on their nature and intended use, making the collection of statistical data and the customs clearance process easier. The HS system contains more than 5,000 different products, each of which is categorized using a distinct eight-digit number.

You can consult these websites to know the HS code of the Thailand products.

Calculating customs duties with the HS Code

Now that you have the HS code of your products, you can find the associated tariffs on the European customs website.

Here is a small illustrated guide to help you understand how to do it :

Enter your HS code and country of origin.

Then, consult taxes applicable to your product.

Does DocShipper charge customs duties ?

No, no commission is taken from Siam Shipping. As proof, we will send you all the official documents provided by Thai customs. We will only collect the customs clearance fees, as we declare your goods to the customs for you.

Docshipper offers you a complete service from sourcing to delivery of your goods to your door, including customs clearance services for all types of freight. We have agents all over the world to facilitate customs clearance procedures.

Procedures and customs contacts

Customs procedures are the administrative steps for declaring and submitting goods for inspection by customs authorities, including requirements for documentation, declaration, payment of taxes and duties, verification of compliance with standards and regulations, and dispute settlement. Customs contacts are the people or organizations responsible for communicating and cooperating with customs authorities on customs procedures, including importers and exporters, transport and logistics agents, customs brokers, company representatives and customs lawyers. It is important to have customs contacts to ensure that goods are cleared through customs efficiently.

Siam Shipping Info: Customs clearance is not the easiest part of the transportation process. However, it is a step not to be neglected if you don't want to pay additional fees or suffer delays! We advise you to contact us so that we take care of your customs clearance!

Required documents

When importing goods from Germany to Thailand, several documents are typically required for customs clearance. These documents ensure compliance with regulations and facilitate the smooth entry of goods into Thailand. Here are the details of the required documents :

- Customs Form 99/1 (Import Declaration Form) : This form is prepared by the customs agent and includes essential details such as the importer's information, description of the goods, quantity, value, and other relevant information. It serves as a declaration of the imported goods to the Thai Customs Department.

- Commercial Invoice : A commercial invoice issued by the German supplier or exporter is necessary. It provides details such as the description of the goods, unit price, total value, payment terms, and other relevant information. The commercial invoice helps determine the customs value of the goods.

- Packing List : A packing list outlines the contents of each package being imported. It includes information such as the quantity, weight, and dimensions of the goods. The packing list assists customs officials in verifying the goods against the declared information.

- Bill of Lading or Airway Bill : For sea shipments, a bill of lading is required, while an airway bill is necessary for air shipments. These documents serve as evidence of the contract of carriage and receipt of the goods. They contain information about the shipping line or airline, departure and arrival ports, and other transportation details.

- Certificate of Origin : Depending on the goods being imported, a certificate of origin may be required. This document verifies the country of origin of the goods, certifying that they are produced in Germany. The certificate of origin is necessary to determine eligibility for preferential tariff rates under trade agreements.

- Import Permits and Licenses : Certain goods may require import permits or licenses from relevant government agencies in Thailand. These permits and licenses are specific to the type of goods being imported and are obtained prior to importation. They ensure compliance with regulations related to health, safety, and specific industry requirements.

- Product Certifications : In some cases, specific products require certifications to meet quality, safety, or industry standards. These certifications may include ISO certifications, CE markings, or other relevant product-specific certifications. They demonstrate that the goods meet the necessary standards for importation into Thailand.

- Lab Test Reports : Lab test reports may be required for certain goods, particularly those that need to meet specific standards or regulations. These reports provide scientific evidence of the quality, composition, or safety of the imported goods.

- Special Permits : Depending on the nature of the goods, special permits may be required. For example, goods such as firearms, pharmaceuticals, chemicals, or controlled substances may require additional permits or authorizations from relevant authorities.

What goods are prohibited from import into Germany ?

The import of certain goods into Germany is restricted or prohibited. Some of the goods that are generally prohibited from import include :

- Weapons and ammunition : Firearms, explosives, and certain types of weapons are strictly regulated and require special permits to import.

- Drugs and narcotics : Illegal drugs and narcotics, including recreational drugs and substances classified as controlled substances, are prohibited.

- Counterfeit goods : Importing counterfeit products, such as fake designer goods or pirated software, is illegal.

- Endangered species : Products made from endangered plants or animals, including ivory, certain types of wood, and exotic animal skins, are prohibited without the necessary permits.

- Protected cultural artifacts : Importing cultural artifacts, such as archaeological artifacts or artwork, without the proper authorization is prohibited.

- Hazardous materials : Certain hazardous substances, chemicals, or materials that pose a risk to human health or the environment are restricted or prohibited from import.

- Pornographic material : Importing pornographic material, especially involving minors or violent content, is generally prohibited.

- Certain agricultural products : Importing certain agricultural products, such as fresh fruits and vegetables, may be restricted due to phytosanitary regulations.

In conclusion, companies in all sectors have many opportunities thanks to the expansion of freight trade between Thailand and Germany. The strong economic and commercial ties between the two countries are maintained under current trade agreements. Although the various freight solutions that can be used to transport goods between Thailand and Germany, and the procedures required to implement them, may seem difficult and demanding, our knowledge can help you by guaranteeing optimum lead times and value for money. Contact our experts for a free quote within 24 hours.

Other logistics services

Storing and warehousing

We offer storage services in different countries, especially in France and Thailand. You can store your goods in our warehouse until you have enough goods to fill an entire container. This will save you transportation costs.

You can go to our specific page at: Storage services

Packing and repacking

The packaging of your products is an important step that should not be neglected. To ensure that your products are packaged properly and securely, use our professional packaging service!

Additional details can be found on our dedicated page: Packing Services

Insurance for transport

Taking out insurance for your shipment is not mandatory, but is highly recommended. In case of damage or loss of your goods, you will be fully reimbursed. We have negotiated the best prices with the insurance companies so that you can take advantage of this service at a low price!

Visit our specific page here: Insurance services

FAQ | Freight between Thailand and Germany| Rates - Transit time - Duties and taxes - Advice

What is the best mean of transportation to transport freight between Thailand and Germany ?

The best way to ship freight between Thailand and Germany can be through various transport modes including air, sea. We suggest you compare freight rates and transit times to determine the most suitable means of transport.However, the most appropriate method of transportation may vary depending on the type of goods being transported, the urgency of delivery, and the budget available for shipping.

What is the fastest way to ship to Germany ?

Sea freight from Thailand to Germany takes an average of 35 days to reach its destination, but we offer an air express shipment.Siam Shipping offers two services, express and door-to-door, ensuring the shipment, transport, and unloading of your goods in less than 4 days, making it more efficient for urgent shipments.

What are the shipping restrictions in Germany ?

In Germany, there are restrictions for the shipment of dangerous, illicit, perishable, prohibited products, and for certain countries subject to economic or commercial sanctions.Regulations can change, so it is recommended to regularly check the restrictions before sending products or goods.For example, you cannot ship counterfeit goods, drugs, etc.

What are the most imported products by Germany from Thailand ?

The products most imported by Germany from Thailand are Electrical machinery and equipment, vehicles and automotive parts, textiles and apparel, etc.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

SIAM Shipping | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!