Making sense of Thai customs regulations can be as puzzling as a fortune cookie. Shipping between Thailand and Hong Kong involves navigating rates, transit times, and other complexities, but this guide is here to simplify things.

We’ll guide you through your transportation options—whether it’s by air, sea, road, or rail—explain customs clearance procedures, and cover the essentials on duties and taxes. Plus, you'll get practical advice tailored to your business.

If it still feels overwhelming, let DocShipper take over. As your trusted international freight forwarder, we handle every step, turning shipping challenges into smooth, successful deliveries.

Table of Contents

Which are the different modes of transportation between Thailand and Hong Kong?

Deciding on the perfect transport method between Thailand and Hong Kong can feel like picking the best route for a treasure hunt. The secret? Understanding the terrain. The journey is a bit like sailing a boat across a big lake, no international borders to worry about, but distance matters. Let's dive into the options - sea and air. The larger your cargo and the less hurry it's in, the more you'll lean towards cruising by sea. But if you're moving feather-light goodies in a race against time, air travel might just be your jet-propelled solution. Let's start plotting your map into the world of freight!

How can Siam Shipping help?

Planning to ship goods from Thailand to Hong Kong? DocShipper streamlines your logistics experience. From handling complicated customs procedures to selecting the most efficient shipping modes, we've got you covered. Make a smart shipping move, contact us now for a free estimate within 24 hours. For free advice, dial our consultants anytime.

Siam Shipping Tip: Consider ocean freight if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- You're not racing against the clock. Ocean freight takes its sweet time, especially when stacked up against other transport methods.

- Your supply chain is linked up with big-name ports. Think of it as the VIP lane on the maritime superhighway.

Sea freight between Thailand and Hong Kong

If shipping goods is like a game of chess, then planning your moves between Thailand and Hong Kong is a significant strategy. These two countries share a nuanced trade relationship, their industrial centers linked by bustling cargo ports. Imagine, a massive game board stretching over the South China Sea!

Now, you might think of ocean shipping as the slow kid in the class, lagging behind its swifter counterparts like air cargo. However, let's think of it instead as the 'strong, silent type'. Although slower, it's cost-effective and perfect for your heavy weight consignments, like your bookstores or automobile businesses moving in bulk.

But just like getting that Christmas present stuck in a chimney, shipping between these two nations can lead to eyebrow-raising mistakes and endless paperwork. Do I hear a collective groan? Worry not, we will delve into the meaty ways to avoid playing the guessing game and make your shipping process as smooth as sailing the calm seas. Let's begin!

Main shipping ports in Thailand

Port of Laem Chabang:

Location and Volume: Located in the Chonburi Province, Port of Laem Chabang is Thailand's largest port and key transshipment hub, handling over 8.4 million TEUs per year.

Key Trading Partners and Strategic Importance: This port's main trading partners include China, Japan, and Vietnam. It's strategically important due to its location on the Gulf of Thailand and proximity to Bangkok and the Eastern Economic Corridor.

Context for Businesses: If you're seeking to target the thriving markets of Southeast Asia, Laem Chabang Port is a strong logistical choice due to its well-developed network and capacity.

Port of Bangkok:

Location and Volume: Located on the west bank of the Chao Phraya River, the Port of Bangkok is the second busiest port in the country, with a shipping volume of over 1.8 million TEUs.

Key Trading Partners and Strategic Importance: It frequently trades with countries like China, Malaysia, and Singapore. Its location in Thailand's capital city and its direct connection to Thailand's broad and efficient road network make it strategically significant.

Context for Businesses: If you're keen to tap into the expansive Thai markets, utilizing the Port of Bangkok may help streamline your supply chain due to its direct inland access and comprehensive customs facilities.

Map Ta Phut Port:

Location and Volume: Map Ta Phut, in Rayong province, specializes in the transport of industrial cargo with a capacity of approximately 30 million tons per year.

Key Trading Partners and Strategic Importance: Main trading partners include Japan, South Korea, China, and India. The port plays a crucial role in Thailand’s petrochemical, oil, and gas industries due to its proximity to the Map Ta Phut Industrial Estate.

Context for Businesses: If your operations involve petroleum, petrochemical products, or other industrial goods, Map Ta Phut Port's specialized facilities offer unique advantages.

Sattahip Commercial Port:

Location and Volume: Situated in the Chonburi Province, Sattahip is a versatile port handling diverse cargo types, including automobiles and livestock.

Key Trading Partners and Strategic Importance: Sattahip's main trade partners include China, Japan, and ASEAN countries. The port serves as an essential naval base for the Thai Navy and has a significant role in the region's auto industry.

Context for Businesses: Businesses eyeing the Asian automobile or livestock markets might find Sattahip Commercial Port's specialized docking and handling facilities especially beneficial.

Songkhla Deep Sea Port:

Location and Volume: Located in the Southern Province of Songkhla, this port is a key gateway to Thai markets catering to various cargo, including dry bulk and liquid cargo.

Key Trading Partners and Strategic Importance: It trades extensively with Malaysia, Singapore, and Indonesia. The port has a key role in southern Thailand's burgeoning economy due to its access to the International Shipping Route via the Malacca Straits.

Context for Businesses: Songkhla Deep Sea Port can be an asset to export-oriented businesses as it offers a strategic entry point for goods meant for Southern markets.

Phuket Deep Sea Port:

Location and Volume: Located in the southern region of Phuket Island, this port mainly serves cruise liners, with a substantial import-export volume for various goods.

Key Trading Partners and Strategic Importance: Key trading partners include China, Singapore, and India. Due to a boost in tourism, the port is strategically important as a prime cruise ship destination.

Context for Businesses: If your business caters to the tourism industry, including luxury and leisure goods, opting for Phuket Deep Sea Port could prove to be profitable given its link to the thriving tourism market of the region.

Main shipping ports in Hong Kong

Location and Volume: Located along the South China Sea, the Port of Hong Kong is one of the world's busiest container ports, with a shipping volume of over 23 million TEU in 2020 alone.

Key Trading Partners and Strategic Importance: Major trading partners include Mainland China, Singapore, USA, Vietnam, and Taiwan, facilitating a substantial flow of goods along these key trade routes.

Context for Businesses: If you're looking to expand your business in Asia, particularly in the booming markets of China and Southeast Asia, the Port of Hong Kong can be an essential part of your logistics, given its high handling capacity and strategic location.

Location and Volume: Modern Terminals in Kwai Tsing, Hong Kong, are amongst the busiest ports in the world, handling a significant volume of cargo in the city.

Key Trading Partners and Strategic Importance: As one of the primary container terminal operators in Hong Kong, it's a vital hub connecting major trading nations across the globe.

Context for Businesses: Businesses looking to take advantage of the rapidly growing trade in the Asian market may find Modern Terminals, with its high capacity and efficient services, an effective solution for their logistics and transportation needs.

Location and Volume: Victoria Harbour, located between Hong Kong Island and Kowloon, is not only a major tourist attraction but also a significant port that handles a sizeable amount of freight.

Key Trading Partners and Strategic Importance: This port holds historical strategic importance and continues to attract major trading partners across the globe due to its central location.

Context for Businesses: Victoria Harbour could be an important part of your logistics if you are looking to gain a strong foothold in the Asian markets. Its central location and well-established connections make it a reliable choice for seamless goods transportation.

Location and Volume: Located in Tuen Mun, the River Trade Terminal in Hong Kong operates 24/7 and caters to high-volume cargo movement, enhancing productivity and efficiency.

Key Trading Partners and Strategic Importance: Serving as a consolidation centre for river cargo, it plays a pivotal role in the Pearl River Delta goods flow.

Context for Businesses: If your business deals with large freight volumes, the River Trade Terminal, with its continuous operation and efficient consolidation system, could be an advantageous addition to your logistics strategy.

Kwai Tsing Container Terminals

Location and Volume: Kwai Tsing Container Terminals, located in the New Territories, accommodates nine terminals and handles over 80% of the total throughput in Hong Kong.

Key Trading Partners and Strategic Importance: Connected with more than 500 destinations around the world, the port has a vital role in global trade, serving key markets like China, USA, and Europe.

Context for Businesses: Businesses seeking widespread and efficient distribution of goods should consider Kwai Tsing Container Terminals as they offer extensive global connections and high handling capacity.

Public Cargo Working Areas PCWA

Location and Volume: Public Cargo Working Areas PCWAs located in various districts of Hong Kong, serve as buffer areas for temporary storage of cargo, handling more than one million TEU annually.

Key Trading Partners and Strategic Importance: As these areas are scattered around in different locations, they are connected with a myriad of global trade routes.

Context for Businesses: If your business requires temporary storage and distribution of goods to various locations, incorporating PCWAs into your logistics plan could provide a flexible solution to your shipping strategy.

Should I choose FCL or LCL when shipping between Thailand and Hong Kong?

Embarking on a shipping journey between Thailand and Hong Kong? The choice between Full Container Load (FCL) and Less than Container Load (LCL), or consolidation, could make or break your logistics process. This can directly influence cost, delivery timeline, and overall shipping success. Read on as we unfold the key contrasts between FCL and LCL, and guide you to discern which fits your unique cargo needs best. Prepare to glean insights that will empower you to ship smart and effectively.

LCL: Less than Container Load

Definition: LCL (Less than Container Load) shipping, also known as groupage, is a method of transporting goods that aren't enough to fill a whole container. In LCL shipment, your cargo shares space with other freight.

When to Use: Choose LCL freight when your cargo volume is less than 13-15 cubic meters (CBM), as it provides price flexibility for low-volume shipments.

Example: Consider a Thai furniture manufacturer who wants to send 10 CBM of chairs to a retailer in Hong Kong. Instead of paying for an unused full container, they could share the container space with other businesses and only pay for their portion, which is more cost-effective.

Cost Implications: While the lcl shipping rate per CBM is higher than full container load (FCL), the overall cost is often lower for small volumes. However, be mindful that you may face additional handling charges due to freight being loaded and unloaded multiple times.

FCL: Full Container Load

Definition: FCL shipping, or Full Container Load, refers to when an entire container is booked by one shipper for transporting goods. It can involve a 20'ft container or a larger 40'ft container, depending on the volume of your cargo.

When to Use: FCL is a smart choice if your shipment is larger than 13/14/15 CBM. The reasons are two-fold: it's economical for high volume shipments as you pay a singular FCL shipping quote for the entire container, and more secure since the container remains sealed from origin to destination.

Example: For instance, let's say your Bangkok-based furniture business frequently exports high-volume shipments to Hong Kong. Opting for FCL shipping guarantees secure transportation for sensitive items like shelving units, chairs, and tables.

Cost Implications: Although an FCL container generally costs more than LCL (Less Container Load), it may lead to significant cost savings for large shipments. For instance, when shipping over 15 CBM, the cost per unit in an FCL shipment will typically be less, making the overall expense lower than that of LCL shipping.

Unlock hassle-free shipping

Struggling to decide between consolidation or a full container for your shipment from Thailand to Hong Kong? Let DocShipper smoothen the process for you. Our seasoned ocean freight experts evaluate key factors such as your shipment weight, volume, budget, and timeline to recommend the optimal solution. Say goodbye to shipping drawbacks and take the leap today. Reach out to DocShipper now, and avail a free estimation to make your shipping process as seamless as possible.

How long does sea freight take between Thailand and Hong Kong?

On average, shipping goods from Thailand to Hong Kong by sea freight takes around 7 to 10 days. However, various factors can influence these transit times, including the particular ports involved, the weight of the goods, as well as the nature of the items being transported. For a more tailored and precise quote, you should consider getting in touch with an experienced freight forwarder like DocShipper.

| From Thailande Port | To Hong Kong Port | Average Transit Time (days) |

| Laem Chabang | Hong Kong | 7 |

| Map Ta Phut | Hong Kong | 7 |

| Bangkok | Hong Kong | 7 |

| Sriracha | Hong Kong | 7 |

*Please note that these are estimated times and actual transit times may vary.

How much does it cost to ship a container between Thailand and Hong Kong?

Grasping the cost of shipping a container between Thailand and Hong Kong can be challenging, as ocean freight rates dramatically fluctuate. The tentacle-like variables—your chosen carrier, nature of goods, point of loading and destination, and monthly market fluctuations—devise a dynamic shipping cost landscape.

While we can suggest a wide ballpark range per Cubic Meter (CBM), we cannot put an exact price tag on it. Fear not! Our shipping specialists are champions at chiseling out the most competitive rates tailored to your specific needs. Rest assured, you're not alone in this; we quote on a case-by-case basis, ensuring your shipping endeavor is light on your pockets.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container, or Out of Gauge container, is specifically designed to carry cargo that doesn't conform to standard container dimensions due to its size or weight.

Suitable for: Shipments that exceed the dimensions of standard containers.

Examples: Large machinery, industrial equipment, construction materials.

Why it might be the best choice for you: If you have oversized items or unusually shaped cargo, Out of gauge cargo shipping provides flexibility over size and weight constraints of standard containers.

Break Bulk

Definition: Break bulk refers to cargo that is too large or heavy to be loaded into standard containers and must be loaded individually onto the ship.

Suitable for: Large, heavy items that cannot be broken down into smaller, lighter items.

Examples: Cranes, yachts, pre-fabricated homes.

Why it might be the best choice for you: If your cargo is too large to be containerized, or it's cost-effective to send a loose cargo load, break bulk shipping is the way to go.

Dry Bulk

Definition: Dry bulk refers to commodities that are shipped in large, unpackaged quantities, typically poured into the cargo space of a vessel.

Suitable for: Bulk goods like grains, coal, or minerals.

Examples: Agricultural products such as rice or wheat, construction materials like sand or gravel.

Why it might be the best choice for you: If your business deals with large amounts of unpackaged, free-flowing goods, dry bulk shipping can provide cost-effective transport at scale.

Roll-on/Roll-off (Ro-Ro)

Definition: A Ro-Ro, or Roll-on/Roll-off service, uses vessels designed to carry wheeled cargo that is driven on and off the ship on their own wheels or a platform vehicle.

Suitable for: Vehicles and machinery that can be driven or towed.

Examples: Cars, trucks, tractors, trailers, and buses.

Why it might be the best choice for you: If you are looking to ship wheeled or self-propelling machinery, using a ro-ro vessel ensures seamless transportation from origin to destination.

Reefer Containers

Definition: Reefer Containers are refrigerated containers used for the safe transportation of temperature-sensitive goods.

Suitable for: Goods that need controlled temperature conditions.

Examples: Fresh produce, dairy products, pharmaceuticals.

Why it might be the best choice for you: If your business deals with perishable or temperature-sensitive cargo, reefer containers will maintain your product's quality throughout the transit.

Understanding your shipping options is crucial for efficient and cost-effective international trade. DocShipper offers tailored solutions that match your business's specific needs. Contact us now, and get a free shipping quote in less than 24 hours!

Siam Shipping Tip: Consider Air freight if:

- Time's ticking and you can't wait. Air freight is like the express train of shipping; it's the quickest way to get your stuff from A to B.

- You're not shipping a warehouse. If your cargo is under 2 CBM, air freight is a snug fit for your smaller haul.

- Your supply chain ends somewhere off the beaten path. Airports are everywhere, so you can get your goods to those hard-to-reach spots.

Air freight between Thailand and Hong Kong

Speed and reliability are the trademarks of air freight between Thailand and Hong Kong. Imagine needing to rush a small batch of cutting-edge smartphones or exclusive jewelry. You'd choose air freight because it's the fastest and most reliable way to move lightweight, high-value goods. Air freight can be your knight in shining armor, providing the perfect balance between cost and efficiency. However, some shippers stumble in the dark, unware of essential factors.

For instance, failing to use the correct weight formula in estimating freight price could send the costs skyrocketing. It's like neglecting to check fuel efficiency while buying a car. Thus, understanding such nuances is key to availing benefits of air freight without burning a hole in your wallet.

Air Cargo vs Express Air Freight: How should I ship?

Ever wondered which air freight option suits your business ambitions best - Express or Cargo Air? Let's simplify it - imagine express air freight as booking a cab for your goods on a dedicated plane, while air cargo is more like a bus journey, sharing space on a commercial airline. This section will give you a grand tour of both options, so you can boss your Thailand to Hong Kong shipping like a pro. Let's get into it!

Should I choose Air Cargo between Thailand and Hong Kong?

Considering air cargo for your shipment from Thailand to Hong Kong is a savvy move. Despite longer transit times due to fixed schedules, renowned international airlines like Thai Airways and Cathay Pacific ensure not only cost-effectiveness, but also reliability with this mode of freight. It gets particularly attractive if you're looking to transport about 100/150 kg (220/330 lbs) of cargo. A well-balanced decision between your budget and delivery time can make air cargo a viable option for your freight needs.

Should I choose Express Air Freight between Thailand and Hong Kong?

Express air freight involves specialized cargo planes solely for transporting goods, ensuring rapid delivery. Ideal for consignments under 1 CBM or between 100-150 kg (220-330 lbs), this service offers advanced tracking and strict time-bound deliveries. Your options include prominent courier firms like FedEx, UPS, and DHL. These express couriers are experts at hustle-free, fast shipments, potentially making it an optimal choice if your business requires time-sensitive deliveries between Thailand and Hong Kong.

Main international airports in Thailand

Suvarnabhumi Airport

Cargo Volume: Handling around 10 million tonnes of cargo annually

Key Trading Partners: Primarily trades with China, Japan, USA, Hong Kong, and Singapore

Strategic Importance: As one of the busiest cargo hubs in Southeast Asia, Suvarnabhumi plays a critical role in regional trade, particularly with East Asia and the Americas.

Notable Features: Suvarnabhumi Airport boasts modern facilities and offers a wide range of services, including freight forwarding, warehousing, and trans-shipment services.

For Your Business: Considering the vast network of direct cargo flights and state-of-the-art facilities, using Suvarnabhumi for transporting your goods can ensure efficient and reliable movement of goods especially if you trade largely with East Asia and North America.

Don Mueang International Airport

Cargo Volume: Processing up to 20,000 tonnes of cargo annually

Key Trading Partners: Mainly trades with ASEAN countries, China, and India

Strategic Importance: Historically significant, Don Mueang is a vital airport for low-cost carriers in the APAC region, making it a cost-effective hub.

Notable Features: Don Mueang provides logistical amenities such as warehousing facilities and is the hub for many large freight airlines.

For Your Business: If your shipping strategy revolves around cost effectiveness and shipping to ASEAN region and the Subcontinent, Don Mueang can be an appropriate choice.

Chiang Mai International Airport

Cargo Volume: Handles up to 140,000 tons of cargo annually

Key Trading Partners: Focused trades with China, South Korea, Vietnam, and Japan

Strategic Importance: It serves as the northern region's main air gateway enabling connectivities to countries in the East Asia corridor.

Notable Features: Proximity to the Northern Industrial Zones, making it a convenient cargo airport for the Northern Thailand's industries.

For Your Business: If your business is operating out of Northern Thailand or if you're targeting East Asian markets, Chiang Mai International Airport offers a well-connected, conveniently located cargo shipping option.

Cargo Volume: Around 106,000 tons of cargo shipped annually

Key Trading Partners: Primarily trades with China, Australia, UAE, and European Union

Strategic Importance: It's an important shipping gateway to Southern Thailand and facilitates trade between Thailand and continents such as Australia, Middle East, and Europe.

Notable Features: It has well-equipped terminals dedicated to cargo, and is being expanded to increase its cargo handling capacity.

For Your Business: If your business is engaged in regular trade activities with partners in Australia, Middle East, or EU, Phuket Airport could serve as an efficient channel for your shipping needs.

U-Tapao Rayong Pattaya International Airport

Cargo Volume: Aimed at becoming a key player, the cargo handled is rapidly growing.

Key Trading Partners: Trades predominantly with China and ASEAN countries

Strategic Importance: Slated to become an important part of the Eastern Economic Corridor's (EEC) development plan, this airport's strategic value is on the rise.

Notable Features: The airport is being developed to accommodate large aircraft and streamline freight services.

For Your Business: If your business caters to the Eastern Thailand region or you're looking to diversify your shipping points in Thailand, U-Tapao Rayong Pattaya offers attractive opportunities.

Main international airports in Hong Kong

Hong Kong International Airport

Cargo Volume: With an annual volume exceeding 4 million tonnes, Hong Kong International Airport is one of the busiest cargo airports in the world.

Key Trading Partners: The airport's key trading partners are Mainland China, the United States, Taiwan, Japan, and Singapore.

Strategic Importance: Its strategic location at the heart of Asia and aviation-friendly policies have established it as a crucial international air freight hub.

Notable Features: The airport houses several logistics centers, and its impressive handling capacity is fortified by a continuous 24/7 operation and efficient customs procedures.

For Your Business: If your company conducts intense trade with Asian countries or wants to leverage the vast network of the airport for global reach, this airport is a suitable choice. With advanced logistics support and round-the-clock operations, you can expect fluidity and flexibility in your shipping schedule.

How long does air freight take between Thailand and Hong Kong?

Typically, air freight shipping from Thailand to Hong Kong takes approximately 2-4 days. However, this transit time can vary. Specificities such as the chosen airports, the weight of your goods, and their nature can all impact the extent of this timeframe. For the most accurate and precise timelines for your unique shipment, consulting with experienced freight forwarders like DocShipper is recommended.

How much does it cost to ship a parcel between Thailand and Hong Kong with air freight?

Shipping an air freight parcel between Thailand and Hong Kong typically falls within a broad price range, averaging around $2.50 - $6.00 per kg. However, it's important to note that this can significantly vary depending on several factors: proximity to departure and arrival airports, dimensions, weight, and nature of the goods. An accurate quote is always provided on an individual basis to reflect these specifications. Rest assured, our expert team is committed to working with you closely, ensuring you get the very best shipping rates tailored to your shipment. Contact us today, and we'll provide a free quote within 24 hours.

What is the difference between volumetric and gross weight?

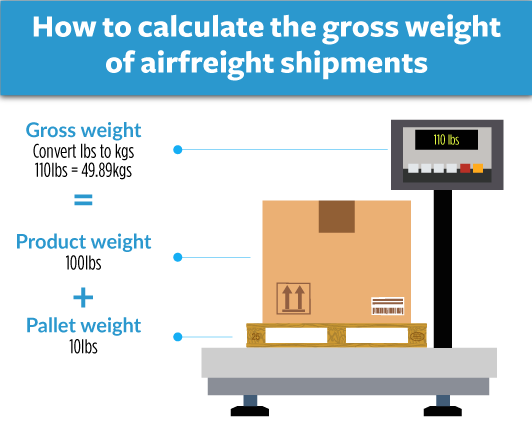

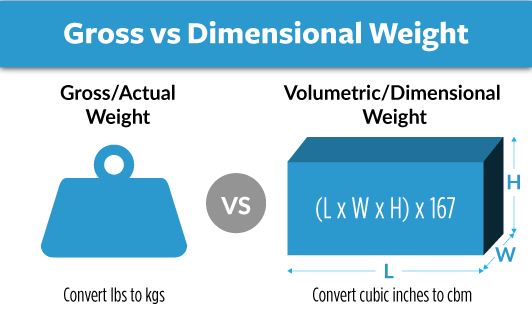

Let's get into what gross and volumetric weight mean in air freight shipping, shall we?

Gross weight is essentially the actual weight of your shipment, including the goods and any packaging material. On the other hand, volumetric weight reflects the amount of space your shipment takes up in the aircraft, irrespective of its actual weight.

Let's say you're shipping a box from Thailand to Hong Kong via Air Cargo. Its actual (gross) weight is 10 kg and its dimensions are 50cm x 40cm x 30cm. The formula for calculating the volumetric weight in air cargo is (lengthwidthheight in cm) / 6000. In this instance, your volumetric weight turns out to be (504030) / 6000 = 10 kg (or approximately 22 lbs).

Now, what if you're using Express Air Freight? The calculation changes slightly. The volumetric weight here is calculated as (lengthwidthheight in cm) / 5000. So, for the same box, the volumetric weight will be (504030) / 5000 = 12 kg (or approximately 26.5 lbs).

These calculations matter because your freight charges depend on them. Shipping companies will look at both your gross weight and volumetric weight, and base your freight charge on whichever is higher. This concept, commonly known as the chargeable weight, ensures optimal utilization of cargo space. So, the understanding of these calculations can help you in cost-efficient packaging and shipping decisions.

Siam Shipping Tip: Consider Door to Door if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You appreciate having a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want less transitions for your cargo, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Thailand and Hong Kong

Unlocking convenience and efficiency, Door to Door shipping is your international logistics solution, bridging the gap between Thailand and Hong Kong. It's the complete package - pick up, transit, customs, and delivery, all handled by one provider. Anticipate less stress, improved tracking, and faster delivery times. Curious? Let's dive into how this could be your ultimate shipping solution.

Overview – Door to Door

Beyond the daunting complexities of international shipping lies door-to-door service, connecting Thailand with Hong Kong in a single seamless transaction. This stress-free option is a beacon for businesses seeking to navigate knotty protocols and challenging customs clearance procedures. The major perk? It’s all handled by adept logistics experts, significantly reducing your administrative burden and associated risks.

That said, costs may lean on the higher side compared to other freight options. Nonetheless, its reputation as DocShipper’s most popular choice reaffirms its value in providing a tranquil shipping experience, offering companies tangible insights into how the process runs from start to finish.

Why should I use a Door to Door service between Thailand and Hong Kong?

Ever wished you could teleport your cargo from Thailand to Hong Kong like a scene out of a Sci-Fi movie? Door to Door service might just be the next best thing! Here’s how:

1. Less Stress, More Success: We handle the entire shipment process. From picking up goods at your premises in Thailand to delivering them at the destination in Hong Kong, we take care of it all. No need to juggle multiple transport companies.

2. Tick-Tock, Beat the Clock: Got an urgent shipment that can't wait? We ensure quick and efficient delivery within agreed timelines. Move your cargo swiftly without any hassle.

3. Special Care for Special Cargo: If your freight requires unique handling, consider it done. Our Door to Door service caters to specific shipping needs such as temperature control, unique sizing, and more.

4. Truckin’ Convenience: Forget about organizing additional transport once your cargo arrives in Hong Kong. We’ll truck it all the way to its final destination.

5. One Partner, Zero Worries: With Door to Door service, you’re not only out-sourcing logistics, but potential headaches, too. We oversee everything, cutting through the red tape of customs clearance or documentation.

In a volatile world of logistics, Door to Door service could be the calm amidst your shipping storm. Hop on for a smoother ride on your global freight journey!

DocShipper – Door to Door specialist between Thailand and Hong Kong

Experience stress-free door-to-door shipping from Thailand to Hong Kong with DocShipper. We manage everything- packing, transportation, customs clearance without you lifting a finger. Whether it's air, sea, road, or rail, our seasoned professionals have you covered. A dedicated Account Executive will be at your service, ensuring a smooth seamless journey for your goods. Get in touch for a free quote in less than 24 hours or dial-up a consultation with our experts at no cost. Let's get shipping!

Customs clearance in Hong Kong for goods imported from Thailand

Customs clearance - the gateway to international trade, yet a complex maze lined with unexpected fees and daunting paperwork. Managing customs in Hong Kong when importing goods from Thailand can be challenging, as it's filled with regulatory responsibilities from duties to taxes, quotas to licenses. Failing to grasp these aspects can risk your shipment getting caught up in red tape.

Fear not, as we are about to dive into the crux of Hong Kong's customs sphere, helping you steer clear of potential pitfalls. What's more? As a global player, DocShipper ensures seamless clearance regardless of what or where you’re shipping. Our team is just a call away, ready to help budget your project. All we need to kick-off are the origin, value, and HS code of your goods. Shipping needn’t be intimidating; let’s navigate it together.

How to calculate duties & taxes when importing from Thailand to Hong Kong?

When you're importing goods from Thailand to Hong Kong, the question of how to estimate customs duties and taxes invariably arises. This process involves several key factors that you need to bear in mind - the country of origin, the Harmonized System (HS) Code of the goods, the Customs Value, the Applicable Tariff Rate, and any other taxes and fees that may apply to your products.

Exploring these facets can seem daunting, but don't fret - we're here to guide you through each step. To kick things off, the first thing you'll need to do is to identify where the goods you're importing were manufactured or produced. By doing so, you're laying the groundwork for accurate duty estimation.

Step 1 - Identify the Country of Origin

Navigating the world of imports can be intricate. Unearthing your product's Country of Origin is no different, yet it's where our journey begins. So, why stress this first step?

Firstly, it establishes your product's identity, a vital step for customs clearance. Secondly, it aids in pinpointing the Harmonized System code for your product. Thirdly and most excitingly, it reveals any perks from the trade agreements between Thailand and Hong Kong. Fourthly, it helps you circumvent any hidden surprises or challenges. Lastly, it keeps you compliant by avoiding misdeclaration, dodging hefty fines in the process.

With 15 trade agreements in place, Thailand keeps a strong trading bond with Hong Kong. Each agreement holds its implications for duties, varying with the product type and its origin. For example, under the ASEAN-Hong Kong, China Free Trade Agreement, most goods might enjoy duty-free or preferential duty status.

Speaking of surprises, keep an eye on restricted items! Thailand has strict regulations on antiques and Buddha images, while Hong Kong limits the import of certain food items and agricultural products.

A tip from the pros? Be proactive. Research these factors nice and early, and you'll create a hassle-free route from Startup Land to import Successville!

Step 2 - Find the HS Code of your product

The Harmonized System Code, or HS Code, is a standardized system of names and numbers to classify traded products. These codes are used by customs authorities around the world to identify products for taxation and regulation purposes.

Usually, the most straightforward way to find the HS Code of your product is to ask your supplier. They're often familiar with the products they're exporting and understand the relevant regulations.

If for some reason this isn't an option, you can follow these simple steps to find your HS code:

- Utilize a tool such as the Harmonized Tariff Schedule.

- In the HS lookup tool, put the name of your product into the search bar.

- Check the 'Heading/Subheading' column where your product's HS code will be listed.

One critical point to remember: accuracy is essential when selecting your HS code. An incorrect code can result in shipping delays and even potential fines. So always ensure the code you're using accurately represents your product to avoid such issues.

Here's an infographic showing you how to read an HS code. Understanding this code will help you accurately classify your product for international trade.

Step 3 - Calculate the Customs Value

Understanding the customs value can be overwhelming, but it's vital. It's the basis for customs duties and isn't synonymous with the value of your products. This value is instead the CIF value, comprising the Cost of goods, Insurance, and Freight.

Let's break it down. Say you purchased goods worth $10,000 from Thailand. The freight forwarding cost is $3,000, and the insurance is $200. Your customs value would be $10,000 (goods) + $3,000 (freight) + $200 (insurance) = $13,200. Therefore, the customs duty in Hong Kong would be calculated on $13,200, not merely the $10,000 value of the goods.

This clear understanding of the custom value calculation saves you from unexpected costs and ensures a smooth customs clearance process, a step closer to your business success in Hong Kong.

Step 4 - Figure out the applicable Import Tariff

Import tariffs, often referred to as customs duties, are taxes placed on imported goods. In Hong Kong, a region with a free port status, most of its imports are duty-free with a few exceptions, namely, tobacco, hydrocarbon oils, and a few select commodities which are taxed at specific duty rates.

To calculate the import tariff for your goods shipped from Thailand, you would first need the Harmonized System (HS) code for your product. Once identified, here's what needs to be done:

1. Match the HS code with the corresponding product in the 'List of Dutiable Commodities and Their Tariffs' (available at the Hong Kong Customs and Excise Department).

2. Apply the specific duty rate to the value of the imported goods (CIF - Cost, Insurance, and Freight).

Let's assume you're importing tobacco (HS Code 2402.20) from Thailand. This would attract a duty of 100%. If your CIF for this shipment is USD 1000, the applied import tariff on your goods would be USD 1000 100% = USD 1000.

Knowing your import tariff beforehand reduces unexpected costs and planning your financial commitments accurately. Remember to always verify the HS code and the corresponding duty rate for your specific product.

Step 5 - Consider other Import Duties and Taxes

While the standard tariff is one component of the import cost, you should also account for other potential duties and taxes. These can vary based on the product's nature and its country of origin.

For instance, certain goods might draw an excise duty. This is an additional tax on specific commodities like fuel or alcohol. The exact rate is usually a percentage of the commodity’s assessed value.

Another possible additional tax is anti-dumping duties. These are placed on goods sold substantially lower than their normal value, generally done to stifle competition in the foreign market.

Lastly, and most importantly, is the Value Added Tax (VAT). It's applied to the total cost of the goods, including the valuation of the goods plus all duties and taxes.

For example, let's consider a product valued at $1000 with a tariff rate of 5%, an excise duty of 3%, and a VAT rate of 9% (hypothetical figures). Here’s how to calculate:

- Tariff: $1000 5% = $50

- Excise Duty: $1000 3% = $30

- VAT: ($1000 + $50 + $30) 9% = $96.30

Your total cost turned out to be $1176.30. These are just examples and may not reflect the exact rates, but it underlines the fact that the initial product cost isn't the final figure. Ensure to factor in these aspects while planning your shipping budget to avoid any nasty surprises.

Step 6 - Calculate the Customs Duties

When shipping goods from Thailand to Hong Kong, understanding how to calculate customs duties is pivotal. Customs duties vary significantly, depending on the customs value of your goods, VAT, and possible anti-dumping taxes and, for certain products, Excise Duty.

Here's how you can do it:

Example 1: Say you're importing electronics worth $10,000 with a duty rate of 5%, but no VAT. Your Customs Duty is a simple 5% of $10,000, which equals $500.

Example 2: If importing a luxury handbag worth $2000 with a duty rate of 10% and a VAT of 20%. The Customs Duty is 10% of $2000 = $200. Add this to the value of goods gives $2200, and apply the VAT to this sum to find the total cost, giving you a VAT of $440.

Example 3: Importing wine worth $1,000 with a 20% duty, 15% VAT, 10% anti-dumping tax, and 25% Excise Duty. Here, calculate the Customs Duty as 20% of $1,000 = $200. Count the VAT as 15% of $1,200 = $180. The anti-dumping tax as 10% of $1,000 = $100. And finally the Excise Duty as 25% of $1000 = $250.

However, it's crucial to know that formulas can get complex with additional taxes. This is where DocShipper steps in - we provide a seamless customs clearance service globally, ensuring you pay the right amount, not a penny more. Need a hand? Contact us for a free quote within 24 hours.

Does DocShipper charge customs fees?

Navigating through international shipping fees might seem daunting, but here's a simple breakdown. As a customs broker in Thailand and Hong Kong, DocShipper charges a fee for customs clearance - not for any customs duties. The latter, which includes taxes, goes directly to the government. Rest assured, we provide all official customs documents as proof of where your money has gone. Simply put, we’re here to ensure smooth shipping, not surprise costs. Imagine it as paying a guide to help you through a maze, rather than paying for the maze itself!

Contact Details for Customs Authorities

Thailand Customs

Official name: Customs Department, Thailand.

Official website: http://www.customs.go.th/.

Hong Kong Customs

Official name: Hong Kong Customs and Excise Department

Official website: http://www.customs.gov.hk(http://www.customs.gov.hk)

Required documents for customs clearance

Stumbling over the complex world of shipping paperwork? We're here to clarify! This section aims to define key documents like the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard) - essentials for seamless customs clearance. Let's demystify the process together.

Bill of Lading

In international trade, your Bill of Lading (B/L) is your golden ticket. When shipping goods from Thailand to Hong Kong, the B/L serves as your official receipt from the carrier, provides important transport details, and signifies a change in ownership for your cargo. But what if your business could transfer this document more swiftly? With electronic or 'telex' release, the shipping world is at your fingertips, enabling faster B/L transfers minus the hassle of paper. Similar to the B/L for sea freight, the Air Waybill (AWB) plays a pivotal role in air cargo shipments, tracking your goods as they take to the skies. Remember, keeping accurate B/L or AWB documents is crucial for a smooth customs clearance process. Think of them as your cargo's passport, crucial in your shipping voyage from Thailand to Hong Kong.

Packing List

When shipping goods between Thailand and Hong Kong, crafting an accurate Packing List is crucial. Think of it as your shipment's identification card. It lists details like quantities, descriptions, and types of goods you're shipping. Say you're a Thai business sending furniture to a retail store in Hong Kong. Your Packing List will detail the number of tables, chairs, bookcases, etc., their material make-up, and other specifics. Not a ticket you want to punch incorrectly!

This document isn't just for your reference - customs authorities in both Thailand and Hong Kong will check it to verify the contents match. Whether your goods travel by sea or sky, accuracy in your Packing List helps dodge customs delays. Better to spend time perfecting this document than untangling transport hold-ups later. For a hassle-free shipping journey, consider your Packing List as important as the goods you're shipping.

Commercial Invoice

Stumbling over paperwork can delay shipping from Thailand to Hong Kong, and the Commercial Invoice often trips businesses up. This vital document details your shipment, providing needed context for customs. Think of it as your shipment's ID card, displaying item names, origin, HS codes, prices, terms of delivery, and more. Without an accurate and complete Commercial Invoice, goods can get stuck in customs limbo. Matching its details with other shipping documents is fundamental, maintaining consistency bridges the gap between your shipment and its destination.

Picture this: the same product description in your Packing List and Commercial Invoice avoids confusion and speeds up clearance. Remember, a well-prepared Commercial Invoice keeps your shipment moving.

Certificate of Origin

Navigating customs between Thailand and Hong Kong can be tricky. Don't slip up - having a Certificate of Origin (CoO) is key. This document is your golden ticket, demonstrating that your goods were indeed manufactured in Thailand. But why is it so important? It can open doors to preferential duty rates reducing your shipping costs. For example, let's imagine you're sending locally made vibrant Thai silk to Hong Kong.

A CoO, correctly stating 'Made in Thailand', will not only smooth your path through customs but can also possibly offer financial benefits. Remember, accurate documentation trumps all when conducting international business.

Get Started with Siam Shipping

Navigating customs between Thailand and Hong Kong can be daunting. Breathe easy - DocShipper is here. We'll manage every step of the customs clearance for you, saving you unnecessary stress. With our in-depth knowledge and expert service, we ensure your goods reach their destination swiftly. Interested? Request a free quote today and receive our response in less than 24 hours. Your seamless shipping experience starts here.

Prohibited and Restricted items when importing into Hong Kong

Shipping goods into Hong Kong? Keep in mind, not everything's allowed. Familiarize yourself with Hong Kong's import laws to avoid delays and potential fines. Missteps in this area can cost you. We've got the scoop on what's restricted or prohibited when importing into this bustling metropolis - let's dive right in.

Restricted Products

1. Live Animals: You have to apply for an AF302 permit from the Agriculture, Fisheries and Conservation Department.

2. Medicines and Drugs: Grab a Certificate of Registration for a Pharmaceutical Product from the Department of Health – Pharmaceutical Service.

3. Radioactive Substances: Secure a license from the Radiation Board.

4. Meat and Poultry: You need an Imported Game, Meat, Poultry, and Eggs permit from the Centre for Food Safety.

5. Plants and their products: Get a Permit to Import/Export/Transship Plants, Plant Products or Other Regulated Articles from the AFCD.

6. Rice: Apply for a Rice Control Scheme permit from the Customs and Excise Department.

7. Firearms and Ammunition: You need a Firearms Dealer's License from the Hong Kong Police Force – Firearms Licensing Office.

8. Milk and Milk beverages: Secure a Milk and Milk beverages permit issued by the Centre for Food Safety.

9. Optical Disc Mastering and Replication Equipment: You have to hold a license from the Customs and Excise Department.

10. Textile products: Grab a SPEO (Special Import/export License) from the Director General of Trade and Industry – Trade and Industry Department.

It's always recommended that you verify these details on the official websites linked above or talk to a transportation expert, as the specifics can vary and regulations often change without prior notice.

Prohibited products

- Articles of food and drugs originating from Chernobyl-affected countries

- Asbestos

- Counterfeit and pirated goods

- Illegal drugs and psychotropic substances

- Obscene and indecent articles

- Rough diamonds

- Unauthorized copies of copyright works

- Weapons classified in certain categories

- Unstamped playing cards

- Illicit tobacco, cigarettes, and cigars

- Endangered species of animals or plants, or their parts and derivatives, unless accompanied by a CITES permit

- Powdered baby formula (for export if exceeds 1.8kg per person)

- Activated carbon face masks

- Foods containing Chinese processed meat

Are there any trade agreements between Thailand and Hong Kong

Yes, Thailand and Hong Kong have strengthened their trade relationship in 2024 through several agreements and initiatives. As of May 2024, the two sides committed to enhancing cooperation in key areas including trade, investment, and tourism. Notably, the governments of both Thailand and Hong Kong have focused on increasing the trade value between them, promoting investments, and boosting tourism exchanges. Additionally, they have discussed the potential for a free trade agreement, aiming to create a more favorable environment for business operations between the two regions

Thailand - Hong Kong trade and economic relationship

Trade Value: Thailand and Hong Kong are committed to increasing their trade value. While exact figures for 2024 are still emerging, the goal has been to push the trade value beyond the previous years' benchmarks. In 2023, the trade value between the two regions was substantial, and efforts have been made to build on this momentum through closer economic cooperation

Key Sectors: The relationship focuses on several key sectors:

-

- Trade and Investment: Both regions are working to boost investment flows and trade, with a particular emphasis on innovative and technological exchanges.

- Tourism: Tourism is another critical area, with Thailand promoting its cultural events like Songkran in Hong Kong to boost mutual tourist arrivals.

- Digital Economy: Cooperation in the digital economy has been highlighted, especially in sectors like fintech, startups, and digital ecosystems

- Agreements: Several memorandums of understanding (MoUs) were signed, covering areas such as:

- Finance: Connecting the stock and capital markets of both regions.

- Innovation: Promoting collaboration in creative industries, including film, advertising, and design.

- Technology: Fostering digital startups through initiatives like Hong Kong Cyberport and Innospace Thailand

Your Next Step with Siam Shipping

Is the headache of handling logistics between Thailand and Hong Kong diminishing your productivity? Let DocShipper alleviate your stress. Our experts simplify the complex freight procedures and customs formalities, guiding you every mile of the way. Get back to growing your business while we deliver success. Ready to ship stress-free? Reach out to us today.

Additional logistics services

Explore our all-encompassing logistics solutions! Beyond shipping and customs, DocShipper streamlines your entire supply chain. Simplify your operations and enhance efficiency with our one-stop-shop approach. Let's put your logistics hassles to rest.

Warehousing and storage

Finding trustworthy warehousing in Hong Kong or Thailand can be challenging - especially when your goods require specific conditions like temperature control. You need a solution that keeps your cargo safe and sound, no matter the weather. Lucky for you, we've got it all covered, making sure your goods are always in the right hands, right temperature. Curious? More info on our dedicated page: Warehousing.

Packaging and repackaging

Transporting goods from Thailand to Hong Kong requires strategic packaging and repackaging, as secure product protection is key to prevent damages during transit. It's essential to have a dependable partner for this task. Just envision how a ceramic manufacturer can have all its delicate goods securely packed and arrive intact! Gain peace of mind with our service, perfectly adaptable to a myriad of products. More info on our dedicated page: Freight Packaging.

Cargo insurance

When shipping goods, the right insurance matters. Just like you wouldn't rely solely on fire insurance for coverage of your entire house, so too should your shipment be more broadly protected. Cargo insurance does just that, safeguarding against potential transport risks. Picture maritime hazards or transport incidents - cargo insurance is your safeguard. For peace of mind, it's an essential step in your shipping journey. Learn more on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Struggling with manufacturing in Asia or East Europe? The complexities can be daunting, especially with language hurdles. DocShipper steps in to simplify the process, actively scouting for suppliers and effectively managing your entire procurement journey. Say goodbye to confusion and hello to seamless sourcing.

Personal effects shipping

Moving personal effects between Thailand and Hong Kong? Our expert team knows how to handle your fragile and bulky items with utmost care. Imagine your grandma's precious vase or your large TV, securely packed, transported, and delivered with professional flexibility. Worried about paperwork? We've got it covered. Dig deeper into our services for Shipping Personal Belongings.

Quality Control

Sending products from Thailand to Hong Kong? A critical step is quality inspection. Picture long-held customs delaying your bamboo furniture due to quality concerns. Prevent this scenario by pre-shipment inspection. Ensures products are up to standard mitigating custom-related issues. Quality check holds the ticket to clearing customs smoothly. Dive deeper into this important service in our Quality Inspection.

Product compliance services

Ensure your goods hit no snags! Regulatory compliance can be a tough labyrinth to navigate. With our Product Compliance Services, we bring clarity and efficiency to this process. No more groaning under paperwork, we take up the mantle - getting your products tested in laboratories and certified to meet destination regulations. From electronics to cosmetics, secure your shipping to any corner of the globe. More info on our dedicated page: Product Compliance Services.

FAQ | Freight Shipping between Thailand and Hong Kong

What is the necessary paperwork during shipping between Thailand and Hong Kong?

To make your shipping process from Thailand to Hong Kong smooth and uncomplicated, the core documentation you’ll need at your end is the packing list and commercial invoice. These will cover the fundamental details about your consignment such as content, value, and quantity. However, depending on the specific nature of your goods, you may need additional documents like a Material Safety Data Sheet (MSDS) or certain certifications, which could be industry-specific or product-specific. Rest assured, we'll handle the transportation document side of things, such as the bill of lading for sea freight or the air waybill for air freight, to ensure all requirements are met.

Do I need a customs broker while importing in Hong Kong?

While it's not legally required to use a customs broker for importing goods into Hong Kong, we strongly advise it. The customs clearance process can be complex, requiring meticulous attention to detail and familiarity with specific documentation. At DocShipper, we handle this work for you, seamlessly acting as your representative during customs clearance for the majority of shipments. Utilizing our expertise minimizes potential complications, streamlining the process and ensuring your imports move through customs smoothly. By allowing us to manage these intricate procedures, you can focus on your core business, leaving the intricate details of shipping and customs to us.

Can air freight be cheaper than sea freight between Thailand and Hong Kong?

Comparing air freight and sea freight costs between Thailand and Hong Kong isn't straightforward due to varying factors like route, weight, and volume. However, if your cargo is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), air freight might be a viable option. Here at DocShipper, we go the extra mile to provide the most economical shipping solution. Together with you, your dedicated account executive carefully analyzes every aspect of your freight requirements to ensure you get the best value for your money. Trust us to offer you the most competitive freight options.

Do I need to pay insurance while importing my goods to Hong Kong?

While importing goods to Hong Kong, or any destination for that matter, we don't require you to purchase insurance. However, we highly recommend considering it, given the incidents that can occur during transit such as damage, loss, or theft. By purchasing insurance, you safeguard your goods and protect your investment from unforeseen events, giving you peace of mind in your shipping process. In the world of freight and logistics, it's always better to be safe than sorry.

What is the cheapest way to ship to Hong Kong from Thailand?

Since Thailand and Hong Kong are relatively close, sea freight is typically the most cost-effective shipping option. Factors such as the size and weight of your cargo, urgency, and specific requirements will influence the final cost. We recommend you contact us at DocShipper for a tailored quote considering all these elements.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF really relies on your relationship with your supplier. As suppliers may not be logistics experts, let specialists like us at DocShipper handle the process, especially International freight and destination procedures. Usually suppliers operate under EXW (from their factory door) or FOB (incorporating all local charges up to the origin terminal). Regardless of these terms, we're equipped to offer you a comprehensive door-to-door service, making the logistics process smooth and worry-free. All you need to do is make the best choice considering your convenience and our expertise.

Goods have arrived at my port in Hong Kong, how do I get them delivered to the final destination?

If your goods are arriving under CIF/CFR incoterms, you'll need to engage a customs broker or freight forwarder who can help clear your goods at the terminal, pay import charges, and ensure delivery to the final destination. Keep in mind, we at DocShipper also offer DAP incoterms; with this, we'll manage the entire process for you. Just consult with your dedicated account executive for more clarity.

Does your quotation include all cost?

Yes, we provide comprehensive quotations that cover all incurred costs, barring duties and taxes at your goods' destination. In the spirit of transparency, we do not include hidden fees, thereby eliminating unwelcome surprises. For an estimate on potential duties and taxes, please consult with your dedicated account executive at DocShipper.