Ever thought your cargo could take a long Thai massage as it travels from Thailand to the USA? Jokes aside, the logistics of shipping goods across the globe can make heads spin with confusion over complex rates, transit times, and customs regulations. In this comprehensive destination guide, we unravel all the secrets, and lay out the various types of freight options available to you - air, ocean, road, and rail. We'll delve deep into the intricacies of customs clearance, duties, taxes, and provide practical advice meticulously tailored for businesses. If the process still feels overwhelming, let DocShipper handle it for you! As an experienced international freight forwarder, we sweat the details to turn your logistics challenges into business success.

Which are the different modes of transportation between Thailand and USA?

From spicy curries to the chic streets of New York, shipping from tranquil Thailand to the bustling USA beckons a question- how?! It's like planning a road trip. You don't ride your bike 9,000 miles(you could, but wouldn't)! Instead, you opt for a fast and comfortable jet. Similarly, for smaller goods, air freight zips things across fast. For mammoth items, ocean voyages in container ships are your sturdy SUVs. Each plays its part, like speedy rabbits or steadfast turtles, it boils down to your cargo's needs and rush hours. So, ready for this trans-Pacific journey?

How can Siam Shipping help?

Experience stress-free shipping from Thailand to the USA with DocShipper! Our experts take care of the complex logistics, customs clearance, and administrative tasks so you can focus on growing your business. Ready for smooth sailing? Reach out for a free cost estimate within 24 hours or dial up our consultants at any time for a free consult!

Siam Shipping Tip: Consider ocean freight if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- You're not racing against the clock. Ocean freight takes its sweet time, especially when stacked up against other transport methods.

- Your supply chain is linked up with big-name ports. Think of it as the VIP lane on the maritime superhighway.

Sea freight between Thailand and USA

Bridging the gap across the vast Pacific, ocean freight serves as a vital trade artery between Thailand and the USA. Anchoring this connection are bustling ports like Laem Chabang in Thailand and Los Angeles in the USA, connecting key industrial centers and fostering bilateral trade. Believe it: voluminous consignments of toys, car parts, or canned tuna journeying at a turtle's pace across the ocean can keep costs low!

Yet, it's not all smooth sailing. Challenges lurk beneath the surface. Ever felt like you're trying to solve a jigsaw puzzle, but the pieces keep changing shape? That's what it feels like for many businesses navigating the complexities of ocean shipping. Success lies in knowing the best practices, reading the ocean currents, so to speak. Over the course of the guide, we'll be your helmsman, demystifying those wave-like regulations, untangling the knot of customs paperwork, helping you plot a course to effortless shipping. Watch this space.

Main shipping ports in Thailand

Laem Chabang Port

Location and Volume:Located in Chonburi Province, this port is essential for trade within the ASEAN region, with a shipping volume of over 7.6 million TEU as of 2019. The port's vast volume is credited to it being the largest deep-sea port in the country, capable of facilitating large vessels and diverse types of cargo.

Key Trading Partners and Strategic Importance: Prominent trading partners include China, Japan, the United States, Singapore and Malaysia. Laem Chabang holds strategic significance as Thailand's major port, playing a crucial role in international trade.

Context for Businesses: If you're looking to penetrate the ASEAN market, Laem Chabang Port is a considerable component of your logistics strategy, on account of its high connectivity and extensive capacity for various cargo types.

Bangkok Port: Situated on the Chao Phraya River in Khlong Toei District, this port represents a significant conduit for shipping, with a trading volume of approximately 1.5 million TEU per year.

Key Trading Partners and Strategic Importance: Major trading partners consist of China, Japan, US, Australia, and Indonesia. With its advantageous location, the port serves as a primary direct gateway to the heart of Thailand, thus being beneficial for business operations particularly in Thailand's capital.

Context for Businesses: If penetrating the metropolitan market is your aim, Bangkok Port could significantly enhance your delivery efficiency due to its unparalleled proximity to Bangkok.

Map Ta Phut Port

Location and Volume:Located in Rayong, this port specializes in handling large volumes of liquid and gas cargos, processing approximately 183,000 TEU in 2019.

Key Trading Partners and Strategic Importance: Significant trading partners include member nations of ASEAN, China, Japan, and South Korea. The port is strategically important due to its niche for liquid and gas cargo handling, making it a vital part of Thailand's energy industry.

Context for Businesses: Map Ta Phut Port could be integral to your logistics strategies if your business deals with large volumes of liquid or gas cargo, or if you are aiming to engage in the Thai energy sector.

Sattahip Port

Location and Volume:Nestled in Chonburi alongside Laem Chabang, it deals primarily with domestic and military shipping rather than international commercial trade.

Key Trading Partners and Strategic Importance: Asides from domestic trading, there is limited emphasis on foreign trade. The port holds strategic importance as it plays a crucial role in the naval activity of Thailand.

Context for Businesses: Sattahip Port might become an essential part of your logistics if your business operations are primarily domestic or if you are involved with the defense supply chain in Thailand.

Songkhla Port

Location and Volume:Located on the southernmost part of Thailand, this port focuses primarily on domestic and regional cargo, facilitating direct trading routes to Malaysia and other Southern ASEAN countries.

Key Trading Partners and Strategic Importance: Key trading partners include Malaysia, Singapore, and Indonesia. Its strategic importance lies in its ideal positioning for southern regional trade and its comprehensive facilitating facilities.

Context for Businesses: If your intent is to branch out to Malaysia and the southern region of ASEAN, Songkhla Port can be an effective way to fulfill this strategy, given its direct trading routes and abundance of facilities to smooth out operations.

Ranong Port

Location and volume:Located on the Andaman Sea, Ranong Port offers direct land and sea accessibility to Mawlamyine in Myanmar, a strategic trade entry for Northern ASEAN.

Key Trading Partners and Strategic Importance: Significant trading partners are primarily Myanmar and other neighbouring ASEAN countries. It holds high strategic importance due to its geographical advantage, providing direct access to Myanmar and Northern ASEAN.

Context for Businesses: If you see potential in Northern ASEAN markets, Ranong Port is an excellent choice given its direct route into Myanmar and its twee-tiered accessibility both by land and sea.

Main shipping ports in USA

Port of Los Angeles

Location and Volume: Located in San Pedro Bay, the Port of Los Angeles is central to the Pacific Rim economies. It is the leading seaport in North America by container volume and cargo value, managing over 9.2 million TEU.

Key Trading Partners and Strategic Importance: This port's primary trading partners include China, Japan, and South Korea. Its strategic location positions it favorably for trans-Pacific trade, and it's a vital hub for Pacific Rim economies.

Context for Businesses: If your business strategy involves significant trade with Asian markets, the Port of Los Angeles's comprehensive services and extensive trading network might provide you an edge.

Port of Long Beach

Location and Volume: Adjacent to the Port of Los Angeles, the Port of Long Beach is the second busiest container port in the United States. It handles approximately 8.1 million TEU yearly.

Key Trading Partners and Strategic Importance: Importantly, its key trading partners are China, Hong Kong, and Japan. The port is a crucial gateway for trans-Pacific trading and a key transporter of a substantial variety of commodities.

Context for Businesses: If your commodity mix includes household goods, electronics or petroleum, the Port of Long Beach might be an integral part of your import/export strategy due to its vast assortment of cargo specializations.

Port of New York and New Jersey

Location and Volume: Situated on the East Coast, the Port of New York and New Jersey is the busiest port on the Eastern Seaboard. It processes over 7.5 million TEU per year.

Key Trading Partners and Strategic Importance: Nations like China, Germany, and India are the main trading partners. It is the key access point for trans-Atlantic trade and a crucial player in the Atlantic trucking network.

Context for Businesses: If you're planning to tap into the European market or require efficient road connectivity to the U.S interior, exploring the possibilities with the Port of New York and New Jersey can be advantageous.

Port of Savannah

Location and Volume: Located in Georgia, the Port of Savannah is one of the largest container ports in the United States, handling more than 4.5 million TEU annually.

Key Trading Partners and Strategic Importance: This port's main trading partners are China, Germany, and India. It's a central hub for agricultural goods and features the largest single-terminal container facility of its kind in North America.

Context for Businesses: If you operate in the agricultural sector, the well-equipped Port of Savannah can enhance your logistics, providing streamlined shipping operations and services.

Port of Houston

Location and Volume: Nestled in Texas, the Port of Houston plays an essential role in the Gulf Coast, handling approximately 5 million TEU per year.

Key Trading Partners and Strategic Importance: The port has strong trading ties with China, Mexico, and Brazil. Primarily, it’s a strategic node in the oil and gas industry owing to the vast refinery networks surrounding the area.

Context for Businesses: If you're in the energy sector, the Port of Houston, with its excellent connectivity to national oil and gas networks, might serve as an ideal logistic route for your enterprise.

Port of Seattle

Location and Volume: Located in Washington State, the Port of Seattle is key to the Pacific Northwest's economy, handling more than 3.5 million TEU annually.

Key Trading Partners and Strategic Importance: Major trading partners include China, Japan, and South Korea. It's an essential gateway to the vast markets of the Pacific Rim, and heavily supports the region's retail industry.

Context for Businesses: If your focus is on the Asian market or you're associated with the retail industry, the diverse facilities and strategic positioning of the Port of Seattle could be beneficial to your shipping strategy.

Should I choose FCL or LCL when shipping between Thailand and USA?

Making the right sea freight selection between Thailand and the USA could be a game-changer for your business. Learn about Full Container Load (FCL) and Less than Container Load (LCL) or consolidation, crucial options that have direct implications on your shipping costs, timelines, and overall success. Choosing between the two is a strategic decision that needs a broad understanding of your specific shipping requirements. Dive in, and let's break down these options to empower you to make a well-informed choice.

LCL: Less than Container Load

Definition: Less Than Container Load (LCL) shipping is a method of transporting smaller cargo volumes by sea. Instead of filling a whole container, your freight shares space with other shippers' goods in one container, which could be a more cost-effective and flexible solution.

When to Use: LCL freight is an excellent choice when you have modest amounts of cargo, particularly less than 13 to 15 cubic meters (CBM). It's best suited for businesses that prefer meeting specific delivery schedules and not waiting to fill a whole container.

Example: Consider a Thai handicraft business intending to explore the US market. They only have 10 CBM of goods ready for initial shipping. Instead of waiting to produce more to fill an entire container, they can use an LCL shipment. This approach gets products into the hands of their US customers swiftly and can kickstart their market penetration.

Cost Implications: In LCL, you're billed only for the space you use, making it less expensive than Full Container Load (FCL) for smaller volumes. However, costs can escalate with higher volumes as charges become proportionately higher. Additionally, note that consolidation and deconsolidation charges at both ends could apply.

FCL: Full Container Load

Definition: FCL, or Full Container Load, is a type of ocean freight where a shipment takes up an entire container. This means the container is exclusively for your goods.

When to Use: Opt for FCL shipping when your total cargo volume exceeds 13, 14, or 15 cubic meters. Apart from providing a secured space for your freight, it's cheaper for high-volume shipments - since you’re paying for the whole container, you’re not charged per each unit of cargo.

Example: Suppose an electronics manufacturer in Thailand wants to send 300 large television sets to the USA. For such a hefty volume, securing a 20'ft FCL container or even a larger 40'ft container will be the most cost-effective and safest method. The televisions will be packed and sealed in this container at the origin and only unsealed at the final destination.

Cost implications: In terms of cost, reaching out for an FCL shipping quote can reveal how it scales with volume. The cost per unit decreases the more you ship, this makes FCL more economical for larger shipments. While upfront costs can be more than LCL, greater cargo volume makes FCL per unit cheaper.

Unlock hassle-free shipping

Looking to ship from Thailand to the USA and unsure whether to choose consolidation or a full container? Let DocShipper, your trusted freight forwarder, handle it! Our team of ocean freight experts will determine the optimal choice built around factors such as shipment size, budget, and delivery timeline. No more shipping hassle, just straightforward solutions. Ready to streamline your shipping? Contact DocShipper now for a free estimation!

How long does sea freight take between Thailand and USA?

On average, sea freight between Thailand and the United States can take roughly 30 to 45 days, though the exact transit time can vary. Factors to consider include the specific ports used, the weight, and the nature of the goods being shipped. For the most precise and customized quote, we recommend reaching out to a freight forwarder like DocShipper.

Here's a snapshot of the average transit times between key freight ports in both countries:

| Thai Ports | U.S. Ports | Average Transit Time (days) |

| Laem Chabang | Los Angeles | 23 |

| Bangkok | New York | 30 |

| Si Racha | Houston | 35 |

| Songkhla | Savannah | 40 |

Remember, this table offers average times, and your shipment's actual time could vary depending on several factors such as seasonal variations, and customs clearance times.

How much does it cost to ship a container between Thailand and USA?

Estimating ocean freight rates between Thailand and the USA is quite dynamic, serving a wide spectrum, typically ranging from $500 to $2500 per CBM. Various aspects influence this shipping cost, such as points of loading and destination, selected carrier, type of merchandise, and even market temperaments month-to-month. Without a detailed analysis, pinpointing an exact price is a bit tricky. Fret not, our shipping specialists stand at the ready. Tailoring solutions to your unique needs, they provide individualized quotes to secure the most cost-effective route for your cargo, making every cent count. Just reach out and let's set the sails for your shipping success!

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is specially designed for cargo that surpasses standard container dimensions, in either length, width, or height. As a result, they are perfect for accommodating Out of Gauge cargo that doesn’t fit in regular shipping containers.

Suitable for: Large or heavy machinery, big infrastructure components, yacht or boats.

Examples: Moving a farming tractor, a wind turbine, or an oversized industrial generator from Thailand to the USA.

Why it might be the best choice for you: If your business deals with goods that don't conform to the usual sizing restrictions of standard containers, OOG containers offer the flexibility and space you need to accomplish shipping safely and securely.

Break Bulk

Definition: Break bulk refers to cargo that is too large to fit into a container and needs to be handled individually. Here, goods are loaded, shipped, and unloaded piece by piece.

Suitable for: Large items like machinery, wood, construction materials, or oversized cargo.

Examples: Transporting yachts, helicopters, timber logs, or heavy machinery parts.

Why it might be the best choice for you: If you're shipping goods that wouldn't fit or wouldn't be efficiently transported even in an OOG container, then Break Bulk offers the maximum flexibility with your loose cargo load.

Dry Bulk

Definition: Dry bulk refers to commodities like coal, grain, or minerals which are transported in large, unpackaged quantities.

Suitable for: Mining, agricultural products, or construction materials.

Examples: Shipping bulk orders of rice, dried spices, sand, or similar goods.

Why it might be the best choice for you: If your enterprise involves large quantities of unpackaged goods, Dry Bulk is your most cost-efficient and convenient option.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro is a shipping method designed for items that are driven or rolled onto a specifically designed ro-ro vessel. This shipping procedure is common for wheeled items.

Suitable for: Vehicles including automobiles, vans, trucks, buses, and even heavy construction machinery.

Examples: Shipping entire fleets of new cars for a dealership or moving construction vehicles like bulldozers.

Why it might be the best choice for you: If your business makes, sells, or needs to transport large rolling equipment or wheeled vehicles, Ro-Ro simplifies the loading and unloading process and ensures safe transit.

Reefer Containers

Definition: Reefer containers are refrigerated containers, designed to transport temperature-sensitive goods. They maintain a constant temperature, regardless of the weather conditions outside.

Suitable for: Perishable goods such as vegetables, fruits, dairy products, and also medical supplies.

Examples: Shipping fresh fish from Thailand or moving temperature-sensitive medicines to the USA.

Why it might be the best choice for you: If your business involves perishable, temperature-controlled goods, reefer containers ensure your goods reach their destination without the risk of spoilage.

At DocShipper, we understand the complexities of international freight forwarding. With us, you're not just getting a service provider; you're gaining a partner that is committed to delivering your goods safely, on time, and within budget. Looking for a free shipping quote from Thailand to the USA in less than 24h? Contact us now!

Siam Shipping Tip: Consider Air freight if:

- Time's ticking and you can't wait. Air freight is like the express train of shipping; it's the quickest way to get your stuff from A to B.

- You're not shipping a warehouse. If your cargo is under 2 CBM, air freight is a snug fit for your smaller haul.

- Your supply chain ends somewhere off the beaten path. Airports are everywhere, so you can get your goods to those hard-to-reach spots.

Air freight between Thailand and USA

Speedy yet reliable - that's air freight for you when shipping goods from Thailand to the USA. Picture jet planes speeding high-value goods like electronics or pharmaceuticals across the sky, reaching their destination much faster than any ship could. Think of the saved time as money in your pocket. For small shipments, this method is a true champion.

But beware, shippers! Some forget to factor in the finer details, like using the correct weight formula when gauging freight costs. It's akin to guessing the weight of a package without using a scale - costly inaccuracies are bound to happen. Ensure you're not footing a higher bill due to simple oversights. We'll dive deeper into such considerations in the subsequent sections....stay tuned!

Air Cargo vs Express Air Freight: How should I ship?

Making the right choice between air cargo and express air freight for shipping from Thailand to the USA can be tough for businesses like yours - it's really a toss-up between booking space on a regular airline and sending your cargo on a dedicated plane that screams speed and priority. Let's delve into these two options to help you make an informed decision and streamline your logistics process.

Should I choose Air Cargo between Thailand and USA?

Air cargo between Thailand and the USA could be an ideal option, particularly from 100/150 kg of cargo. Airlines such as Thai Airways and Delta Airlines, prominently serving this route, offer cost-effective rates and guaranteed reliability. While transit times might be longer than anticipated due to fixed airline schedules, air cargo's budget-friendly nature and high dependability factors often outweigh the wait. However, always compare with other shipping methods to ensure you're making the most informed decision.

Should I choose Express Air Freight between Thailand and USA?

Choosing Express Air Freight services, like FedEx, UPS, or DHL, might be ideal if you're shipping under 100-150 kg (220-330 lbs) or up to 1 CBM of goods from Thailand to the USA. This transport mode uses cargo-only planes and offers speedy delivery, ensuring your shipment skips long transits and gets fast customs clearance. So, if you need a faster and more direct solution for your smaller-scale shipments, Express Air Freight can be a game changer.

Main international airports in Thailand

Suvarnabhumi Airport

Cargo Volume: Suvarnabhumi Airport (BKK) is the 3rd largest cargo airport in Asia, with a capacity to handle over 3 million tons of cargo annually.

Key Trading Partners: The major trading partners are China, Japan, and the USA, involving primarily in textiles, electronics, and automotive parts.

Strategic Importance: Located in Bangkok, Thailand's capital, the airport is strategically located for businesses looking to ship goods across Southeast Asia.

Notable Features: The airport has a dedicated cargo terminal equipped with modern facilities to handle a wide range of goods, and operates around the clock.

For Your Business: If your company is in the electronics, textile, or automotive sectors and ships primarily to the aforementioned countries, Suvarnabhumi Airport's significant cargo capacity and strategic location could suit your needs.

Don Mueang International Airport

Cargo Volume: This airport handles around 18,000 tons of cargo annually and is steadily growing.

Key Trading Partners: Major trade routes include Asian cities like Singapore, Hong Kong, and Kuala Lumpur.

Strategic Importance: Given its proximity to Bangkok's metropolitan area, this airport is useful for businesses keen on direct, fast shipments to Asian urban centres.

Notable Features: The airport has undergone recent renovations that improved its cargo handling infrastructure, making the cargo process more efficient.

For Your Business: If timely deliveries to major Asian cities is your priority, consider Don Mueang International Airport for efficient and direct routes to your destination.

Chiang Mai International Airport

Cargo Volume: Chiang Mai International Airport has the capacity to handle approximately 30,000 tons of cargo annually.

Key Trading Partners: It primarily serves countries in the region such as China, South Korea, and Singapore with a focus on agricultural produce exports.

Strategic Importance: The airport serves as a crucial northern gateway connecting Thailand to the Greater Mekong Subregion and other ASEAN countries.

Notable Features: The airport features standard and refrigerated storage facilities – particularly beneficial for perishable goods.

For Your Business: If your enterprise deals with agricultural produce and targets markets in East and Southeast Asia, the storage facilities and regional connections of Chiang Mai International Airport may fit your shipping needs.

U-Tapao International Airport

Cargo Volume: Despite being a smaller airport, U-Tapao accommodates a substantial amount of cargo traffic in the eastern Thailand region.

Key Trading Partners: The airport engages in trade primarily with China, Vietnam, and Malaysia.

Strategic Importance: U-Tapao is part of the Eastern Economic Corridor (EEC), making it strategically important for businesses shipping to eastern Asia.

Notable Features: The airport is part of the Thailand 4.0 initiative, implying potential growth and infrastructural development.

For Your Business: If you're looking to tap into the growing eastern markets and foresee scaling operations, U-Tapao might prove to be an excellent long-term strategy.

Phuket International Airport

Cargo Volume: Phuket International Airport, despite being renowned for passenger traffic, handles a significant amount of cargo, roughly around 28,000 tonnes annually.

Key Trading Partners: The airport mainly caters to international markets within Asia, with China, Malaysia, and Singapore being prominent partners.

Strategic Importance: Phuket's thriving tourism industry means regular international connectivity, aiding businesses shipping to Asian markets.

Notable Features: Its well-maintained infrastructure can reliably handle an array of goods including perishables, often tied to Thailand's vibrant hospitality industry.

For Your Business: If your business involves goods related to the hospitality sector or requires regular connectivity to Asian markets, Phuket International Airport could be an optimal choice.

Main international airports in USA

Los Angeles International Airport (LAX)

Cargo Volume: LAX handles over 2 million metric tons of cargo annually.

Key Trading Partners: Primary trading partners include Asia, specifically China, Japan and South Korea, as well as Australia and New Zealand.

Strategic Importance: The airport's location on the west coast makes it ideal for high-volume transpacific trade, and its extensive network of non-stop flights facilitates quick global connections.

Notable Features: LAX has comprehensive freight terminals and specialized cargo-handling facilities, accommodating everything from general cargo to temperature sensitive goods.

For Your Business: If your trade involves the Pacific markets or necessitates temperature control, consider routing through LAX to enjoy fast connections and appropriate facilities.

John F Kennedy International Airport (JFK)

Cargo Volume: With a cargo volume exceeding 1.3 million metric tons, JFK is one of America's busiest cargo ports.

Key Trading Partners: Major trading partners encompass all of Europe and South America.

Strategic Importance: JFK is the primary international air gateway into North America which makes it a vital component of transatlantic trade.

Notable Features: JFK boasts of specialized cargo facilities for animals and pharmaceuticals, and a state-of-the-art air cargo center for efficient processing.

For Your Business: If your operation requires expansive transatlantic routes or special facilities for unique goods, JFK is a robust choice.

Chicago O'Hare International Airport (ORD)

Cargo Volume: ORD handles annual cargo volumes around 1.8 million metric tons.

Key Trading Partners: The airport sees significant trade with East Asia, particularly China, and European countries.

Strategic Importance: Located in the heart of America, ORD's central positioning facilitates easy reach to various domestic markets.

Notable Features: The airport showcases vast warehousing space and the industry's latest cargo-handling equipment.

For Your Business: If you have a diverse range of prospected market or require spacious storage, consider ORD as your hub.

Miami International Airport (MIA)

Cargo Volume: MIA processes more than 2.3 million metric tons of cargo annually.

Key Trading Partners: A major gateway for cargo from Latin America and the Caribbean.

Strategic Importance: Its geographical advantage, being close to Latin American trade routes, makes it crucial for businesses dealing in these markets.

Notable Features: MIA's cargo facilities house a U.S. Customs & Border Patrol port of entry and one of the world's largest on-airport Foreign Trade Zone.

For Your Business: If your ventures are set in Latin American or Caribbean markets, or entail customs clearances, MIA could streamline your logistics effectively.

San Francisco International Airport (SFO)

Cargo Volume: SFO handles over 500,000 metric tons of freight annually.

Key Trading Partners: Major trading partners are Asia, Canada, and Europe.

Strategic Importance: Situated on the west coast, SFO is a key player in transpacific trade, and supports extensive connections to global hubs.

Notable Features: SFO has a dedicated freight facility around the clock for swift cargo operations.

For Your Business: If your shipments require quick operations without compromising wider international accessibility, SFO might be the pragmatic avenue.

How long does air freight take between Thailand and USA?

The average transit time for air freight shipments between Thailand and USA typically runs around 3-5 days. However, it's crucial to note that this can fluctuate depending on several factors such as the specific airports involved, the weight of the goods, and their nature. For accurate and tailored timings related to your specific shipping needs, it's advisable to consult with a trusted freight forwarder like DocShipper.

How much does it cost to ship a parcel between Thailand and USA with air freight?

In air freight, costs can vary widely. As a ballpark estimate, you might expect rates from Thailand to the USA to range between $3.5 to $6 per kg. The exact price depends greatly on factors such as distance from departure and arrival airports, parcel dimensions and weight, and the nature of the goods. However, rest assured that each quote is meticulously tailored for you, factoring in all these elements for maximum cost-effectiveness. No two shipping orders are the same, and we firmly believe in a bespoke approach. Contact us today to receive a free, personalized quote within 24 hours or less.

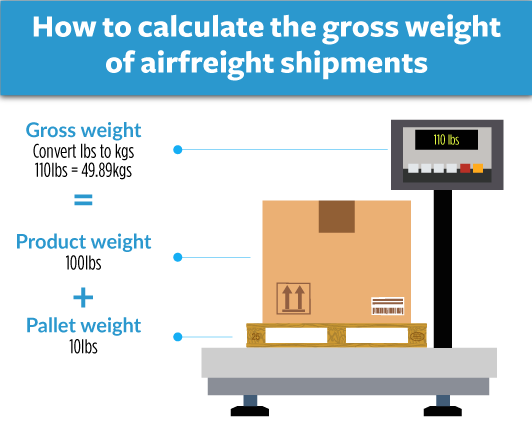

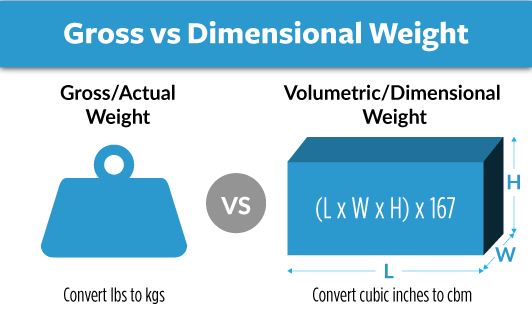

What is the difference between volumetric and gross weight?

Gross weight is the actual physical weight of an item, including all packing materials. Volumetric weight, on the other hand, is a standard calculation of the weight based on the space that your item occupies in an aircraft.

Calculating these weights is different in Air Cargo and Express Air Freight. For Air Cargo, you measure the volumetric weight by multiplying the shipment's length, width, and height in centimeters and dividing that by 6000. In Express Air Freight, the same dimensions are multiplied but divided by 5000. Gross weight is simply the physical weight measured on a scale.

For example, if you're shipping a box with dimensions 50cm x 60cm x 40cm that weighs 20kg, the volumetric weight for Air Cargo would be 20kg (50x60x40/6000). The same box in Express Air Freight would have a volumetric weight of 24kg (50x60x40/5000). Converted to pounds, that's approximately 44 lbs and 53 lbs respectively.

These calculations are crucial because freight charges are determined based on whichever weight is higher between the gross and volumetric. Therefore, a keen understanding of these measurements can lead to significant cost savings on your shipments.

Siam Shipping Tip: Consider Door to Door if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You appreciate having a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want less transitions for your cargo, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Thailand and USA

Navigating the logistics maze from Thailand to the USA? Relax, with door-to-door shipping, you send, we handle the rest - customs, paperwork, all of it. This streamlined service offers seamless transport, fewer hassles, and quicker delivery. Ideal for your Thailand-USA business corridor needs. So without further ado, let's dive into the nitty-gritty of door-to-door shipping between these two vibrant economies.

Overview – Door to Door

Solving the puzzle of shipping between Thailand and the USA just became more effortless with door to door service! This popular choice among DocShipper's clients prides itself on eliminating multiple-stress points. From handling complicated customs processes to coordinating different types of transport, we've got you covered. Yet, it’s important to weigh in the cost, as it’s typically higher than traditional shipping. But remember, the convenience and sheer absence of logistical headaches might just be worth that extra penny! No more juggling communications with various shipping agencies - it's your one-stop shipping solution!

Why should I use a Door to Door service between Thailand and USA?

Why juggle with logistics juggernauts when you can sit back, relax, and let the pros handle it all? Here are five solid reasons to choose a Door to Door service for shipping goods between Thailand and USA:

1. Stress Alleviation: Twisted by puzzling paperwork or clueless about customs clearance? Worry not! With Door to Door service, all your logistics nightmares fade away. The transporters take charge, right from picking up your goods to delivering them at the destination.

2. Timeliness: If time is money, why waste it on complex dealings? Door to Door services assure timely deliveries, making it an excellent choice, particularly for urgent or essential shipments that can't risk delays.

3. Specialized Handling: If your cargo is a tricky or delicate beast, Door to Door services morph into your logistical superheroes. They offer specialized care ensuring your complex cargo is managed deftly and delivered safely.

4. All-Inclusive Guidance: Never dabbled in international shipping? No problem. Door to Door services are like a friendly tour guide for your goods. They navigate through every obstacle, be it varied transport modes or perplexing customs, ensuring a seamless journey for your goods from Thailand to the USA.

5. Convenient and Effortless: With comprehensive trucking services until the final location tossed into the package, Door to Door service is just like ordering pizza - satisfying, effortless, and conveniently delivered right to where you need it.

Embrace a hassle-free shipping experience that brings desired peace, punctuality, and expertise to your doorstep. Time to bid adieu to logistics stress and say hello to convenience with Door to Door service.

DocShipper – Door to Door specialist between Thailand and USA

End-to-end shipping from Thailand to the USA has never been easier with DocShipper! We oversee your freight details from packing, transport, and customs, using our extensive expertise in air, sea, road, and rail shipping. No hassle for you—we have it all covered. Enjoy the convenience of a dedicated Account Executive managing your shipment and providing a free estimate within 24 hours. Have questions? Our consultants are just a phone call away! Experience seamless international shipping with us today.

Customs clearance in USA for goods imported from Thailand

Customs clearance is a complex dance of paperwork and protocol, a pivotal juncture determining whether your shipment makes it from Thailand to the United States seamlessly. It's a place where unexpected charges lurk and items may get tangled up due to overlooked duties, underestimated taxes, overlooked quotas, and licenses. These potential pitfalls highlight the necessity of thorough understanding and meticulous preparation. So, buckle up as we guide you through the ins-and-outs of customs clearance for goods imported from Thailand to the USA in the following sections. Remember, DocShipper is always ready to lead you through the thicket. To get an estimate of your project budget, simply reach out with the origin, value, and HS Code of your goods. These elements are a must to get the ball rolling. With our expertise, we can make any global shipment a breeze.

How to calculate duties & taxes when importing from Thailand to USA?

Figuring out duties and taxes is like piecing together a puzzle – you need to have all the right pieces at hand. The country of origin, the Harmonized System (HS) Code of your goods, the Customs value, the tariff rate applicable in the USA, and any other specific taxes or fees that may apply – all of these elements play crucial roles. Your first move is akin to flipping the puzzle box lid to reveal the picture; determine the country where your products were manufactured or produced. This will help you align the remaining elements, creating a clear picture of your expected customs duties when importing from Thailand to the USA.

Step 1 - Identify the Country of Origin

Nailing down the country of origin is your crucial first stepping stone; here's why. First off, it precisely sets the duties landscape - your HS code rests on it. Second, it reflects the trade agreements impacting the customs fees for your shipment. Are your goods benefiting from the U.S.–Thailand Free Trade Agreement? It could mean a world of difference!

Third, import restrictions vary wildly from country to country. It's no secret that some items hailing from Thailand face stricter scrutiny; it's best to be prepared. Don't forget about compliance - it's our fourth point. Knowing the origin country keeps you in line with regulations and avoids potential hiccups. Lastly, it can influence shipment timelines - an aspect you can't afford to overlook.

As you dive into this process, remember two golden rules. Firstly, double-check whether your product falls under the General System of Preference (GSP), which could result in duty-free entry. Secondly, mind that products like textiles may face quotas. But above all, the key lies in those five reasons - they are the foundation stones of your import venture. Happy shipping!

Step 2 - Find the HS Code of your product

The Harmonized System Code, commonly referred to as the HS Code, is a standardized numerical method for categorizing products and commodities in international trade. This internationally accepted system allows countries to perform customs operations and measure international trade accurately.

Your product's HS Code is essentially its identity in the context of international shipping and frequently determines the tariffs, inspection regulations, and documentation requirements. Hence, acquiring the correct HS Code becomes an indispensable part of your international shipping process.

More often than not, your supplier is a reliable source for this information. They are usually well-versed with the products they are exporting and the associated regulations, including the product's HS code.

However, if acquiring the HS Code from the supplier isn't a viable option, you can use various tools to find it on your own. One such resource is the Harmonized Tariff Schedule. This online tool allows you to search for your product's HS Code effectively.

Please be aware: Accuracy is paramount when identifying your product's HS code. Using an incorrect code can lead to shipment delays, customs complications, and potential fines, interrupting your supply chain. This could inadvertently increase your costs and cause unforeseen business disruptions.

Here's an infographic showing you how to read an HS Code. It's a good reference material to ensure that you've identified the correct code.

Step 3 - Calculate the Customs Value

You might be wondering, what exactly is a customs value? To put it simply, it's the total monetary worth of your imported goods as evaluated by the U.S. customs authority, but it's not the same as your products' market price. It's typically calculated based on the CIF value - which includes the cost of your goods, the cost of international shipping, and the insurance cost.

Imagine you're shipping a batch of statuettes from Thailand to the USA. If the price for the items is $1000, shipping costs you $200, and insurance is $50, your CIF, or customs value would be $1250. Thus, while your goods alone cost you $1000, the customs authorities will calculate duties based on the $1250 CIF value. By understanding this, you can plan your budget more effectively and avoid unexpected costs at customs.

Step 4 - Figure out the applicable Import Tariff

An 'import tariff' is essentially a tax imposed on goods transported across international borders. In the United States, the tariff system predominantly used is the 'Harmonised System' (HS).

To identify the applicable import tariff, a key step is to look up your specific HS code in the US International Trade Commission's Harmonized Tariff Schedule, accessible online.

The tool is simple to use:

1. Enter the name of your product in the search bar.

2. Look for the Heading/Subheading column in the results.

3. Here, you will find the HS code for your product.

Here's a walkthrough example to further clarify this:

Assume that you're importing leather bags from Thailand,classified under HS code 420221.You navigate to the USITC's HTC search engine.Enter 420221 in the search box,and the tool will display the corresponding tariff-let's assume a general duty of 20%.

Furthermore, for the sake of example, say your goods' cost, insurance, and freight (CIF) value amounts to $10,000. As such, your estimated import duties would be calculated as 20% of $10,000, equating to $2000.

It's always recommended to verify these rates with a Customs broker or professional to avoid any discrepancies in your calculations. Remember, understanding your expenses is a crucial aspect in avoiding any surprises during the import process!

Step 5 - Consider other Import Duties and Taxes

When importing goods into the USA from Thailand, beyond the standard tariff rate, you might face additional import duties and taxes. These could include excise duty, anti-dumping taxes, and most crucially, the Value Added Tax (VAT).

Excise duty applies primarily to specific goods, like tobacco. Anti-dumping taxes are levied when imports are priced less than 'fair market value', protecting American industries from unfair competition. For instance, if you import steel at a price lower than the local market, you could face an anti-dumping duty.

But the essential one to consider is VAT, which is applied to the customs value of the goods plus duties. Though the USA doesn't have a standard VAT rate, assume it to be 10% for illustrative purposes. If your goods have a customs value of $10,000 and duties of $500, you'd pay VAT on $10,500, resulting in $1,050 (10% of $10,500) in VAT.

Remember that these rates and taxes are illustrative and actual rates may vary. Be sure to check latest regulations and consult with a customs professional to understand your exact costs and responsibilities. Knowledge is power in international shipping, and being fully prepared can prevent unexpected charges and delays.

Step 6 - Calculate the Customs Duties

Calculating customs duties is a critical step in the customs clearance process when shipping goods from Thailand to the USA. Begin by identifying your goods' customs value, which includes the product's price, shipping cost, and insurance.

For example, if your product costs $100, your shipping and insurance costs are $20; the customs value will be $120. If the customs duty rate for your product is 5%, your customs duties will be $6 ($120 x 5%).

In scenarios where Value Added Tax (VAT) applies, the percentage is applied to the combined customs value and duties. Let's say VAT is 7%. Add the $6 duties to the $120 customs value to get $126. Then, multiply $126 by 7% to get a $8.82 VAT amount. Final total: $134.82.

When both VAT and anti-dumping taxes are applicable, along with the customs duty, each tax is sequentially calculated and added to the overall cost. If we consider anti-dumping tax to be 4% and an additional Excise Duty of 3%, you begin by applying the 4% to the $134.82 to get $5.39, making the total $140.21. Then applying 3% Excise Duty gives $4.21, totaling $144.42.

Remember, customs duties are subject to change, and additional costs can significantly impact your overall shipping expenses. At DocShipper, our customs clearance services are designed to efficiently guide you through every step, ensuring you pay only what's required. Contact us for a free quote in less than 24 hours and let us make your shipping journey hassle-free.

Does DocShipper charge customs fees?

DocShipper, serving as your custom broker in Thailand and USA, doesn't levy customs duties. The fees we charge pertain strictly to customs clearance, which varies from the duties and taxes that go directly to the government. We strive to maintain transparency in our transactions, so rest assured we'll provide all relevant documentation from the customs office. This helps verify that you're only paying what's legally required, avoiding any hidden or unexpected charges. This distinction between broker fees and governmental taxes is crucial to understanding the true costs of international shipping.

Contact Details for Customs Authorities

Thailand Customs

Official name: Customs Department of Thailand

Official website: http://www.customs.go.th/

USA Customs

Official name: U.S. Customs and Border Protection (CBP)

Official website: https://www.cbp.gov/

Required documents for customs clearance

Ever been stumped by customs jargon? Here's your go-to guide decoding essential paperwork like the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). By mastering these, you're one step closer to faster, smoother international shipments.

Bill of Lading

Navigating Customs clearance between Thailand and the USA? One document you can't overlook is the Bill of Lading. It's like a birth certificate for your shipment, marking the transfer of cargo ownership. With the rise of digitalization, an electronic or telex release is gaining popularity. Faster and more efficient, it eliminates the scramble of tracking physical documents. For air shipment, you'll work with an Air Waybill (AWB) instead. Adopting these practices expedites processes, especially crucial for time-sensitive deliveries. A pro tip? Always double-check information on your Bill of Lading or AWB. A tiny discrepancy can lead to costly delays, derailing your Thai-US business operations.

Packing List

Navigating the shipping journey between Thailand and the USA can feel complex, but let's break down one crucial component—the Packing List. As a shipper, it's your responsibility to prepare this document with absolute accuracy. Think of it as a detailed inventory of your shipment, revealing weights, dimensions, and item counts. For instance, if you're exporting automotive parts, your Packing List should itemize each type of part, their quantities, weight, and other necessary details. Why so meticulous? Customs officials, whether at a bustling Thai seaport or a hectic American airport, rely on your Packing List for inspecting and clearing your goods. Its accuracy determines whether your shipment smoothly sails across the Pacific or faces unexpected delays. So, remember, whether you choose the azure sea or the open skies for shipping, your Packing List is a key flag-bearer of information and accuracy.

Commercial Invoice

A commercial invoice is an essential document when shipping goods from Thailand to the USA. It plays a crucial role in determining customs duties and clearing your goods swiftly through the US customs. It should include details such as: the seller and buyer's name, detailed description of goods, total value, country of origin, HS Code (Harmonized System Code), and terms of delivery (based on Incoterms 2020, e.g., DDP or EXW). A well-prepared invoice helps synchronize information with other shipping documents like the Bill of Lading or Airway Bill, preventing discrepancies that could delay your shipment. For instance, if you're shipping 100 handmade leather bags worth $3,000 from Bangkok to New York, ensure this exact information reflects in all your documentation. A constant check and alignment of your papers will save you the stress of custom bottlenecks.

Certificate of Origin

If you're shipping goods from Thailand to the USA, you can't overlook the importance of a Certificate of Origin. This document is crucial, as it mentions the country where your products were manufactured. Here's one scenario to vividly picture its impact - imagine shipping auto parts from Bangkok to Los Angeles. Having a Certificate of Origin showing Thailand as the manufacturing country could land you preferential customs duty rates! That's savings right in your pocket, expanding your profit margin. Remember, in international freight, every detail counts and a small piece of paper can make a lot of difference. So, don't treat Certificates of Origin lightly - they're your gateway to cost-effective shipment. Why pay more when you can capitalize on benefits the paper trail provides?

Get Started with Siam Shipping

Facing customs confusion? Take the stress out of shipping between Thailand and the USA with DocShipper. With a team of specialists adept in navigating intricate customs procedures, we'll take care of every clearance step for your peace of mind. Time to focus on what you do best - running your business. Get your hassle-free shipping journey started with a free quote from us, delivered in just 24 hours. Act now!

Prohibited and Restricted items when importing into USA

When shipping goods to the USA, knowing what's off-limits is crucial to avoid legal headaches. But fear not, this guide will clarify what's restricted and what's completely prohibited for a smooth importing experience. Let's start unraveling the complexities together.

Restricted Products

- Alcohol: To transport spirits, you have to apply for a Basic Permit from the Alcohol and Tobacco Tax and Trade Bureau.

- Firearms and Ammunition: You need a Federal Firearms License from the Bureau of Alcohol, Tobacco, Firearms, and Explosives.

- Tobacco: There's a whole list of permits you might need from the Alcohol and Tobacco Tax and Trade Bureau.

- Plants and Plants Products: To import these, you need to apply for a Permit to Import Plants or Plant Products from USDA APHIS.

- Animal products or live animals: If you're planning on shipping anything like this, make sure you check with the USDA Animal and Plant Health Inspection Service.

- Drugs: Prescriptions, over the counter, and even some personal use drugs need prior authorization from the Food and Drug Administration.

- Radioactive materials: To ship anything with radioactivity, apply for a license via the Nuclear Regulatory Commission or specific State-level departments.

- Hazardous materials: Transportation could be tricky; ensure you get a Hazardous Material Shipping Training Certification, outlined by the Department of Transportation.

Remember, each of these licensing requirements vary by state and product, and can be subject to regular changes, so be sure to double-check before you ship.

Prohibited products

- Absinthe (Alcohol)

- Certain fruits and vegetables

- Wildlife and animals, including pets from certain countries

- Drug paraphernalia

- Any items from sanctioned or embargoed countries

- Rough diamonds

- Firearms, explosives, and ammunition (with exceptions)

- Defense Articles or Items with Military or Proliferation Applications

- Unauthorized medical drugs

- Counterfeit money and goods

- Ivory

- Products made from dog or cat fur

- Cuban-made products

- Goods, technology, or services from North Korea

Please be aware that this list is not exhaustive, and restrictions may change. Always consult with a customs broker or legal expert for precise information.

Are there any trade agreements between Thailand and USA

Yes, the U.S. and Thailand enjoy strong trade relations, though there's no formal Free Trade Agreement (FTA) in place. However, they are both members of the World Trade Organization (WTO), which offers certain mutual benefits. Active talks are underway to improve these trade ties further. This evolving landscape of U.S.-Thailand trade affairs may present unique opportunities, particularly for businesses like yours that operate between these nations. Be it commodities or electronics, understanding this dynamic is instrumental in planning your freight shipments. Keep these on your radar when shipping goods between the U.S. and Thailand!

Thailand - USA trade and economic relationship

As the second-largest economy in Southeast Asia, Thailand has fostered a robust trading relationship with the USA. Historically, ties are rooted in the Treaty of Amity and Economic Relations (1833), promising mutual commercial benefits.

Their economic relations peaked post-signed Treaty of Amity and Economic Relations in 1966, enabling U.S. businesses to maintain a majority of shares in most business types. Key sectors include automotive, food products, and electronics, with machinery, mineral fuel and oil, and electrical machinery as dominant commodities.

Statistics reveal a dynamic trade landscape - in 2019, the U.S. goods trade surplus with Thailand was $1.3 billion, with exports valued at $13.3 billion. Conversely, U.S. Foreign Direct Investment in Thailand was $14.9 billion (2017), focusing primarily on manufacturing and wholesale trade sectors. Emphasizing the mutual benefits, this relationship has fortified economies and ensured steady growth trajectories in global trade markets.In 2024, US imports from Thailand totalled $54.96 billion, accounting for 18.3% of Thailand's total exports.

Your Next Step with Siam Shipping

Overwhelmed by the complexities of shipping goods between Thailand and USA? Don't let customs regulations, transportation logistics and paperwork keep you up at night. Let DocShipper experts relieve you from these burdens with our comprehensive freight forwarding services. Embark on your international commerce journey, the hassle-free way. Get in touch today and allow us to simplify your shipping experience!

Additional logistics services

Explore beyond shipping and customs with DocShipper's full-circle supply chain solutions. Uncover how we streamline your journey, tackling storage, warehousing, packaging, and distribution with ease. Grab efficiency by the reins – we've got your logistics covered!

Warehousing and storage

Storing your goods isn't just about space—it's about finding trusted partners who get the nitty-gritty of variables like temperature control. Imagine shipping Thai orchids: a few degrees off can wilt your business. By prioritizing the conditions your goods need, warehousing can move from a headache to a competitive edge. Get the details on our Warehousing service page.

Packaging and repackaging

Ensuring your goods arrive safely from Thailand to the USA is crucial. With our packaging and repackaging services, we carefully wrap your products to withstand global transit's rigors. Whether it's thai silk or electronic devices, our trustworthy team has got you covered. This personalized approach keeps your items secure throughout their journey. Discover more about our commitment to safety on our dedicated page : Freight Packaging.

Cargo insurance

Transporting goods isn't immune to risks, unlike fire insurance. Cargo Insurance covers potential damage during transit, safeguarding you from unexpected costs. Think about a shipment of electronics rendered useless by humidity during a sea voyage; here, the insurance jumps in to cover the losses. It’s prevention and risk management wrapped into a simple service. More info at: Cargo Insurance.

Supplier Management (Sourcing)

Looking to manufacture in Asia or East Europe? Struggling with supplier communication and language barriers? DocShipper simplifies your sourcing journey by identifying reliable suppliers and handling the entire procurement cycle. Think of us as your local partner, smoothing out the process and taking the guesswork out of procurement. Curious? Find out more about how we can make your global sourcing efforts a breeze on our dedicated page: Sourcing services.

Personal effects shipping

Shipping your prized possessions from Thailand to the USA? We handle fragile or bulky items with the utmost care. Say you've got a delicate Thai silk painting or a hefty teak wood table - we manage it all. Gain peace of mind with our flexibility in larger and sensitive item transportation. More info on our dedicated page: Shipping Personal Belongings.

Quality Control

Shipping from Thailand to the USA? Prioritizing quality inspections at the manufacturing or customization stage can save you major headaches later. Imagine avoiding a full shipment of defective toys or incorrectly labelled skincare products. An early inspection, like the services offered by Siam Shipping, ensures your goods meet all required standards before they're loaded onto the transport. Learn every detail about this critical step on our dedicated page: Quality Inspection.

Product compliance services

Confused about meeting destination-specific regulations? We got you covered. Our reliable Product Compliance Services are tailored to ensure your goods meet all criteria for smooth sailing. From obtaining necessary certification via laboratory testing to ensuring optimal compliance standards, we alleviate the stress out of the import-export game. With our support, you're less of a stranger in a strange land. Dive deeper into our services here on our dedicated page: Product compliance services.

FAQ | For 1st-time importers between Thailand and USA

What is the necessary paperwork during shipping between Thailand and USA?

We will coordinate the necessary paperwork for your shipment from Thailand to the USA. For sea freight, a bill of lading is needed, while for air freight, an air waybill is used. These will be taken care of by us at DocShipper. In return, we'll need you to supply a packing list and commercial invoice. These key documents detail the nature, quantity, and price of your goods. Depending on the specific nature of your shipment, more documents may be required, such as a Material Safety Data Sheet (MSDS) or certain certifications. Be assured, we'll guide you step by step, ensuring a smooth shipping process.

Do I need a customs broker while importing in USA?

In the world of imports, navigating customs can be complex and demanding; that's where the expertise of a customs broker comes into play. It's widely encouraged to engage a customs broker due to the intricate procedures and numerous mandatory documents that need to be processed. As your logistics partner, at DocShipper, we offer our expert services to represent your cargo at customs for an overwhelming majority of shipments. This saves you a considerable amount of time and allows you to focus on your core business, knowing that your goods are being handled efficiently and securely.

Can air freight be cheaper than sea freight between Thailand and USA?

At DocShipper, we understand the complexity of determining whether air freight is cheaper than sea freight between Thailand and USA. It involves numerous factors like route, weight, and volume. Generally, if your cargo is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), air freight becomes a cost-efficient choice. As your trusted freight forwarder, we're committed to offering the most competitive options tailored to your specific needs. Your dedicated account executive is always ready to help make these decisions easier and more advantageous for you.

Do I need to pay insurance while importing my goods to USA?

At DocShipper, we want you to know that insurance isn't mandatory for shipping goods either locally or internationally, including when you're importing to the USA. That said, we highly recommend opting for insurance. There can be many unforeseen incidents that might occur during transportation, potentially leading to damage, loss, or theft of your goods. Having insurance coverage safeguards you from such eventualities, ensuring peace of mind during the transit process. It's always a smart choice to protect your valuable investments.

What is the cheapest way to ship to USA from Thailand?

Considering the geographic distance, ocean freight is typically the most cost-effective way to ship from Thailand to the USA. We, at DocShipper, can efficiently organize your shipment, though keep in mind, this method does take more time due to the extended shipping route. Air freight is faster but comes with a higher price tag. The ultimate choice depends on your budget and time constraints.

EXW, FOB, or CIF?

Understanding whether to opt for EXW, FOB or CIF is largely contingent on your relationship with your supplier. Suppliers often prefer selling under EXW or FOB terms, where their responsibilities end either at their factory door (EXW) or include all local charges until the freight reaches at the origin terminal (FOB). Keep in mind, your supplier may not be a logistics expert, that's where we come in. At DocShipper, we are well-equipped to navigate the intricate arenas of international freight and destination procedures. Regardless of the delivery terms chosen, we offer a door-to-door service, ensuring your shipment is handled professionally and arrives seamlessly to its desired destination.

Goods have arrived at my port in USA, how do I get them delivered to the final destination?

When your goods reach a U.S. port under CIF/CFR incoterms, you'll need a customs broker or freight forwarder to clear the goods, pay import charges, and arrange delivery. If you'd prefer a more hands-off approach, our DocShipper team can handle the process under DAP incoterms. Your dedicated account executive can clarify these details for you to ensure a smooth delivery.

Does your quotation include all cost?

Absolutely, at DocShipper, we believe in total transparency. Our quotation covers all costs, excluding the duties and taxes at your goods' destination. Don't worry about surprises – we don't believe in hidden fees. However, you can always request your dedicated account executive to provide an estimate of duties and taxes to better plan your budget.