Whoever said Elephants are the only way to move goods from Thailand to the UK obviously had no experience with international freight. Understanding rates, transit times, and customs regulations can seem daunting, especially when trading between countries with different systems and legislations.

This comprehensive guide will light your path in these areas, breaking down various types of transport modes, the customs clearance procedure, and the specifics of duties and taxes. It also includes detailed advice tailored for businesses seeking to streamline their shipping process between Thailand and the UK, ensuring a smooth and efficient international trade.

If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we take care of every step in your shipping journey, transforming complex challenges into successful deliveries.

Table of Contents

Which are the different modes of transportation between Thailand and United Kingdom?

Shipping goods between Thailand and the UK? It's like planning a globetrotter trip! Whether you're sending an express document or a jumbo jet's worth of goods, the 9,500 km journey is like gaming: each choice matters.

Picking air freight is like choosing the fastest race car, zippy but costly. Alternatively, you can select sea freight, the reliable road trip taking weeks but saving your pennies. Your choice is crucial here, just like choosing the right vehicle gives you an edge in the game.

Remember, every journey, like every game, has its rules and challenges. Winning means finding your best style of play.

How can Siam Shipping help?

Looking to ship goods from Thailand to the United Kingdom? Turn to DocShipper! Our tailor-made solutions, expert advice, and robust shipping network simplify the process, from handling customs clearances to selecting the right transportation. Unsure? Speak with our consultants. Get your free estimate within 24 hours. Start your shipping journey with us today!

Siam Shipping Tip: Consider ocean freight if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- You're not racing against the clock. Ocean freight takes its sweet time, especially when stacked up against other transport methods.

- Your supply chain is linked up with big-name ports. Think of it as the VIP lane on the maritime superhighway.

Sea freight between Thailand and United Kingdom

Sea shipping is the heart that keeps the trade pulse between Thailand and the United Kingdom strong. Imagine it as a bridge, extending from Laem Chabang Port nestling in Thailand’s industrial centre, all the way to the bustling London Gateway in the UK. Opt for ocean transport, and you’ve chosen a cost-effective route, ideal for shipping hefty volumes of goods. But it's like a marathon race, remember, it is not necessarily the quickest way to deliver.

Keep this in mind, the journey from Thailand to the UK isn't a walk in the park. Many shippers stumble over the hurdles of customs regulations and paperwork or trip on common mistakes whilst navigating this route. But don't worry, just like a well-trained athlete, knowing the track will make the race easier!

In this guide, we'll be your coach, pointing out the pit stops and hurdles, and showing you ways to ship smart, just like seasoned pros! So, lace up and get ready for a deep dive into the world of sea shipping from Thailand to the UK.

Main shipping ports in Thailand

Port of Laem Chabang

Location and Volume: Laem Chabang port, situated in the city of Laem Chabang in Chon Buri province, is the largest port in Thailand. It handled over 8.6 million TEU in 2023.

Key Trading Partners and Strategic Importance: This port primarily serves trading partners in Asia such as China, Japan, India, and beyond Thailand's borders, extending to North America and Europe. Its strategic importance lies in its location, which is close to Bangkok, the capital city, and its facilities, which are best suited for large container ships.

Context for Businesses: If you’re seeking to ship large quantities of goods, particularly to Asian markets, the Port of Laem Chabang’s vast capacity and modern infrastructure can serve as a key node in your logistics network.

Port of Bangkok

Location and Volume: Located in the capital city of Thailand, the Port of Bangkok is the second largest in the country, with a shipping volume close to 1.4 million TEUs per year.

Key Trading Partners and Strategic Importance: As this port is in the country's economic hub, it often trades with diversified partners, including China, Singapore, Malaysia, and the USA. Its strategic importance lies in its location and its ability to efficiently manage different types of cargo.

Context for Businesses: If you’re looking to manage diverse types of cargos, including break bulk, bulk, and special cargos, along with containers, the Port of Bangkok’s comprehensive set of facilities and city location just may fit your business model.

Port of Map Ta Phut

Location and Volume: Located in Rayong province, Eastern Thailand, the Port of Map Ta Phut is a major industrial port handling 143 million tons annually.

Key Trading Partners and Strategic Importance: Specializing in industrial goods, this port's major trading partners include China, Japan, Indonesia, and Malaysia. Exclusive facilities like liquid bulk terminals and gas terminals mark its strategic importance.

Context for Businesses: Should your business involve trade in petrochemicals, minerals, coal, or other industrial goods, the Port of Map Ta Phut, with its specialized terminals, could certainly meet your shipping needs.

Port of Sattahip

Location and Volume: The Port of Sattahip is located in the province of Chonburi and operates under the Thai navy. Though not known for high container traffic, it is crucial for handling bulk and general cargo.

Key Trading Partners and Strategic Importance: This port caters mostly to regional markets, especially within Southeast Asia. Its strategic importance lies in handling specialized cargo and military vessels.

Context for Businesses: If you deal with bulk or general cargos and aim for efficient distribution within the Southeast Asian market, the Port of Sattahip might serve well for your logistics.

Port of Songkhla

Location and Volume: Situated in the city of Songkhla, southern Thailand, the Port of Songkhla is a smaller port with a sizable volume of local oil and gas transportation.

Key Trading Partners and Strategic Importance: The port facilitates the southern region's trade, primarily with regional partners. Notably, it's a key point for off-shore oil and gas transportation.

Context for Businesses: If your business is connected to the energy sector, specifically oil and gas, the Port of Songkhla’s infrastructure geared towards energy commodities might be crucial for your supply chain.

Port of Si Racha

Location and Volume: Located in the town of Si Racha, Chonburi province, the Port of Si Racha primarily serves petrochemical transportation with its significant oil terminals.

Key Trading Partners and Strategic Importance: It predominantly serves the energy sector, with key trading partners across the region. Its importance stems from being a prime location for petrochemical discharge and shipment.

Context for Businesses: If your business operates in petrochemicals, and access to oil terminals is essential, the Port of Si Racha might be an invaluable addition to your shipping strategy.

Main shipping ports in United Kingdom

Port of Felixstowe

Location and Volume: Situated in Suffolk, the Port of Felixstowe is crucial for UK's imports and exports, boasting a shipping volume of 4 million TEUs per year.

Key Trading Partners and Strategic Importance: This port has significant trade relations with various European and Asian countries, including China, Germany, and the Netherlands. It is also a key logistical hub due to its proximity to key UK markets.

Context for Businesses: If your business plans on expanding into the British market, the Port of Felixstowe, with its excellent rail and road links, can be a vital element of your strategy.

Port of Southampton

Location and Volume: Located on the south coast of England, the Port of Southampton handles around 2 million TEUs per year.

Key Trading Partners and Strategic Importance: The port serves major economies like China, USA and other EU countries. Its strategic significance stems from its capacity to handle large container vessels.

Context for Businesses: The Port of Southampton might be a critical ingredient of your logistics plan if you manage high-volume trade, thanks to its ability to accommodate large container ships.

Port of London

Location and Volume: As the nation's capital port, the Port of London is placed on the River Thames and handled about 2 million TEUs in 2022.

Key Trading Partners and Strategic Importance: It facilitates trade with European neighbors, particularly Germany and Netherlands, while also maintaining broader global connections.

Context for Businesses: If your company trades with European nations extensively, the Port of London, and its extensive network, may be your ideal logistics partner.

Port of Liverpool

Location and Volume: The Port of Liverpool, located on the northwest coast, processes nearly 700,000 TEUs yearly.

Key Trading Partners and Strategic Importance: It serves the Americas and the Caribbean extensively and is known as the key transatlantic trading hub.

Context for Businesses: If your company has a significant focus on the Americas, the Port of Liverpool's strong links could make it a crucial role in your logistics plan.

Port of Grimsby

Location and Volume: The Port of Grimsby, located in Lincolnshire, is ranked as the UK's highest auto-handling port.

Key Trading Partners and Strategic Importance: It has a unique partnership with various nations shipping cars, chiefly Japan, Germany, and South Korea.

Context for Businesses: If automobile shipping is a significant part of your operations, the Port of Grimsby's auto-handling capabilities might be essential to your logistics plan.

Port of Bristol

Location and Volume: Positioned in Bristol, England, this port handles close to 13 million tonnes of cargo per year.

Key Trading Partners and Strategic Importance: The Port of Bristol assists in trade with major EU countries, focusing on automotive, and ro-ro traffic.

Context for Businesses: The Port of Bristol may be particularly beneficial if your business primarily involves vehicle and ro-ro shipping.

Should I choose FCL or LCL when shipping between Thailand and United Kingdom?

Sea freight between Thailand and the UK, but how to choose: by full container load or consolidation? This key decision swings the pendulum of cost, delivery speed, and overall shipment success. Our dive into these two primary ocean shipping options will help shine a light on what might, at first, seem like murky waters. You'll gain insights into each type's strategic advantages and how to align them with your unique shipping needs. Ready to unravel this knot? Let's dive in.

LCL: Less than Container Load

Definition: Less than Container Load (LCL) shipping, commonly referred to as 'consolidation', is a freight shipping method where multiple shippers' goods share space in a single container.

When to Use: This option is suitable when your cargo is less than 13/14/15 cubic meters (CBM). LCL consolidation stands out for its affordability, making it an ideal option for businesses with smaller shipments who prioritize cost-effectiveness and shipping flexibility.

Example: Suppose you're an SME that imports specialty Thai silk for your London-based shop. Your supply is predictable and usually doesn't exceed 10 CBM. An LCL shipment can be your best choice here, allowing you to regularly maintain your shop stock without over-spending on a full container.

Cost Implications: In LCL freight forwarding, you only pay for the space your cargo occupies, not for the whole container. This makes it a highly cost-efficient option for smaller shipments. However, remember to factor in additional costs like deconsolidation charges once the cargo reaches the UK. It's also worth bearing in mind that per CBM, LCL might be more expensive compared to Full Container Load (FCL). Despite this, the overall savings for smaller shipments make LCL a sound choice.

FCL: Full Container Load

Definition: FCL, or Full Container Load, in the context of shipping between Thailand and the UK, refers to using the entire 'fcl container' yourself, whether that's a 20'ft or 40'ft container, without sharing the space with other shipments.

When to use: FCL is typically the better option if your cargo exceeds 13 to 15 CBM (Cubic Meters). This route offers advantages in terms of cost-effectiveness for larger volumes, and enhanced security since the container is sealed at origin and only opened once it reaches its destination.

Example: For instance, imagine you’re a business importing ceramic pottery from Thailand. The fragility and volume of your products make FCL shipping a desirable choice. The items will be secured in your own 'fcl container', reducing the risk of damage from movement or mix with other goods.

Cost Implications: When requesting your 'FCL shipping quote', bear in mind that while FCL can be pricier than LCL (Less Container Load), the cost per unit decreases substantially as the volume grows. Thus, for larger shipments, FCL often turns out to be the more economical solution.

Unlock hassle-free shipping

Struggling to decide between consolidation or a full container for shipping from Thailand to UK? DocShipper, your committed freight forwarder, is here to smooth out the process! Our proficient ocean freight team considers factors like cargo dimensions, volume, and shipping timeline to suggest the most cost-effective and efficient option for your business. Take the ambiguity out of shipping – reach out now for a free, no-obligation freight estimation.

How long does sea freight take between Thailand and United Kingdom?

Shipping goods by sea freight between Thailand and the United Kingdom can take, on average, around 30 to 45 days. This time-frame, however, can vary significantly and is influenced by a variety of factors. For example, the specific ports involved in the shipment, the weight, and the nature of the goods can all influence the transit time. To get a more accurate and customized quote, reaching out to a freight forwarder like DocShipper is advisable.

| Thai Ports | UK Ports | Average Transit Time (Days) |

| Port of Laem Chabang | Port of Felixstowe | 37 |

| Port of Bangkok | Port of London | 35 |

| Port of Si Racha | Port of Southhampton | 33 |

| Port of Map Ta Phut | Port of Liverpool | 45 |

*Remember, these times are estimates only: several factors could lead to changes.

How much does it cost to ship a container between Thailand and United Kingdom?

Stumped about ocean freight rates between Thailand and the UK? It's a complex topic, with costs per CBM widely ranging. Pinning down an exact shipping cost can be tricky due to essential factors such as Point of Loading and Destination, the chosen carrier, nature of your goods, and market fluctuations.

But don’t fret - our seasoned shipping specialists are at your service! Ensuring they provide you with the best, personalised rates, we quote on a case-by-case basis. The mystery around costs shouldn’t deter you - we are here to guide and provide a smooth sailing journey for your container.

Special transportation services

Out of Gauge (OOG) Container

Definition: This shipping method uses an OOG container, specifically designed to handle Out of gauge cargo that cannot fit in standard containers due to oversized dimensions.

Suitable for: Ideal for massive freight pieces like construction equipment, heavy machinery, and other oversized items.

Examples: Think of items like excavators, cranes, or turbines – these may require an OOG container.

Why it might be the best choice for you: If your cargo doesn't fit within the dimensional confines of standard container types, an OOG container allows you to ship large items without disassembly, saving time and potentially reducing costs.

Break Bulk

Definition: This method involves break bulk shipping, where individual goods are loaded onto the vessel without a container, much like a loose cargo load.

Suitable for: Appropriate for large, non-containerisable cargo that can be lifted individually.

Examples: If your shipment includes items like heavy machinery or construction equipment that aren't suitable for standard containers, break bulk shipping is a good choice.

Why it might be the best choice for you: This option often enables easier handling and could provide greater flexibility, particularly for unique, heavy, or awkwardly-sized items.

Dry Bulk

Definition: In dry bulk shipping, loose, unpackaged goods are shipped in large quantities directly loaded into the vessel's hold.

Suitable for: Perfect for shipping large quantities of homogeneous cargo such as gravel, sand or commodities like coal and grains.

Examples: If your business focuses on commodities like wheat, barley, or coal, you'll likely prefer dry bulk shipping.

Why it might be the best choice for you: The key advantage of dry bulk is the ability to move large volumes of uniform cargo in one go, often making it the most economical choice for certain commodities.

Roll-on/Roll-off (Ro-Ro)

Definition: A ro-ro vessel accommodates cargos which roll on and off the ship on their wheels, hence the name Roll-on/Roll-off.

Suitable for: Ideal for items that can be driven or towed onto the vessel, such as cars, trucks, trailers, and even railway wagons.

Examples: If you're in the automotive industry and need to ship cars or lorries between UK and Thailand, Ro-Ro could be your best bet.

Why it might be the best choice for you: Ro-Ro shipping can provide quick loading and unloading times, and it also reduces the risk of cargo damage since items aren't lifted but driven on and off the vessel.

Reefer Containers

Definition: Reefer containers are refrigerated containers used in sea freight to transport temperature-controlled cargo.

Suitable for: Perfect for transporting goods that need temperature control during the journey, especially food items or pharmaceuticals.

Examples: If you're importing items like Thai fruits, or any other perishables or pharmaceuticals, a reefer container is a must.

Why it might be the best choice for you: This allows precious cargo to retain its quality during transit, ensuring your goods arrive in the same condition they left in.

At DocShipper, our goal is to make your shipping process between Thailand and United Kingdom as smooth as possible. Our team of experts can help assess your specific requirements and suggest the best shipping options for you. Ready to schedule your cargo's voyage from Thailand to the United Kingdom? Allow us to assist – we offer a free shipping quote within 24 hours!

Siam Shipping Tip: Consider Air freight if:

- Time's ticking and you can't wait. Air freight is like the express train of shipping; it's the quickest way to get your stuff from A to B.

- You're not shipping a warehouse. If your cargo is under 2 CBM, air freight is a snug fit for your smaller haul.

- Your supply chain ends somewhere off the beaten path. Airports are everywhere, so you can get your goods to those hard-to-reach spots.

Air freight between Thailand and United Kingdom

When time is of the essence, shipping goods from Thailand to the United Kingdom via air freight is a standout choice. Famed for its speed and dependability, air freight economically delivers small batches of high-value goods - think fancy Thai silk or precious gems - in no time.

Many shippers, however, get tripped up as they overlook key factors. It's like estimating the cost of a pizza based just on size, ignoring the toppings. Shipping costs aren't only about weight and volume - there are formulas to determine the right price. And believe it or not, a little know-how can help save you a ton! We'll dive more into these points and best practices later in this guide. Stay tuned!

Air Cargo vs Express Air Freight: How should I ship?

With a maze of options for shipping between Thailand and the United Kingdom, you might be puzzled about whether to choose air cargo or express air freight.

Simply put, air cargo gets your goods on a passenger airline, often cost-effective but not the quickest, while express air freight books them on dedicated planes, ensuring sizzling speed but at a higher expense. Let's delve into the nuances of each to find the best fit for your business needs.

Should I choose Air Cargo between Thailand and United Kingdom?

If your cargo to the United Kingdom weighs around 100-150 kg (220-330 lbs), Air Freight could be a cost-effective choice. Major airlines like British Airways and Thai Airways offer reliable cargo services, ensuring your items reach their destination safely. However, be ready for potentially longer transit times based on their fixed schedules. If budget is a concern, this option offers an attractive balance of speed and price.

Should I choose Express Air Freight between Thailand and United Kingdom?

Considering small, time-sensitive shipments from Thailand to the UK? Express air freight offers quick transit times and near seamless door-to-door delivery. This specialized service, provided by firms such as FedEx, UPS, and DHL, uses dedicated cargo planes for accelerated, global delivery.

Particularly suited for sub-1 CBM or 100/150 kg shipments, it's a powerful ally for just-in-time supply chains where time is of the essence. From key commercial documents to critical automotive parts, if speed is paramount to your business, express air freight could be your optimal choice.

Main international airports in Thailand

Suvarnabhumi Airport

Cargo Volume:

Suvarnabhumi Airport processes over 1.94 million tons of cargo annually, making it one of the busiest airports in Southeast Asia.

Key Trading Partners:

The airport handles cargo mainly from China, Japan, the United States, and several European countries, including Germany and France.

Strategic Importance:

Suvarnabhumi Airport serves as a significant hub for many shipment routes within the ASEAN region and onwards. Its strategic location and advanced facilities make it a popular choice for many businesses around the world.

Notable Features:

The airport features state-of-the-art equipment, a dedicated Free Zone for cargo handling, and modern storage facilities, all of which are designed to hasten cargo turnover time and ensure the smooth flow of goods.

For Your Business:

If your business regularly ships to or from the ASEAN region, the Suvarnabhumi Airport, with its significant network and advanced facilities, could be a key part of your logistics strategy. The airport's Free Zone makes it an attractive option for businesses looking to manage costs and streamline their logistics operations.

Don Mueang International Airport

Cargo Volume:

Don Mueang International Airport handles approximately 90,000 tons of cargo per year.

Key Trading Partners:

The airport primarily manages cargo from neighboring Asian countries such as China, Japan, and Malaysia.

Strategic Importance:

With its location in the capital city of Bangkok, Don Mueang International Airport is well-connected, offering logistical advantage to businesses shipping to and from Thailand.

Notable Features:

DMK, once one of Asia's busiest airports, is now primarily used for domestic and regional flights but still offers cargo services. Its cargo terminal provides warehousing facilities and direct access to road transport networks for quick domestic distribution.

For Your Business:

If your business often sends smaller quantities of goods or engages in e-commerce within Thailand and the immediate region, then Don Mueang International Airport could be a strategic node to consider in your logistics and supply chain networks.

Main international airports in United Kingdom

Heathrow Airport

Cargo Volume: Handled over 1.4 million tonnes of cargo in 2022.

Key Trading Partners: Primary partnerships are with North America, Asia, and Europe.

Strategic Importance: Heathrow is strategically positioned providing access to a wide variety of international markets.

Notable Features: Possesses advanced material handling systems to ensure swift and secure movement of cargo.

For Your Business: As the busiest cargo airport in the UK, tapping into Heathrow's wide connectivity could enhance your supply chain's efficiency and reliability.

Gatwick Airport

Cargo Volume: Transports over 100,000 metric tonnes of goods yearly.

Key Trading Partners: Major trade relations are with Europe, North America, and the Caribbean.

Strategic Importance: Proximity to London makes it a popular choice for businesses aiming for a wide distribution network.

Notable Features: Operates 24/7, allowing round-the-clock shipments.

For Your Business: Gatwick's perpetual operation can ensure timely delivery of your goods, a feature particularly valuable when dealing with time-sensitive cargo.

Manchester Airport

Cargo Volume: More than 120,000 metric tonnes of cargo are handled annually.

Key Trading Partners: Its key trading areas include North America, Asia, and the Middle East.

Strategic Importance: Its central UK location and excellent links to road and rail networks makes it attractive for distribution.

Notable Features: Offers quicker turnaround times for businesses due to less congestion.

For Your Business: With quicker turnaround times, your business may see reduced downtimes and increased overall efficiency of your logistics operations.

Stansted Airport

Cargo Volume: Every year, it handles over 250,000 metric tonnes of cargo.

Key Trading Partners: European countries form most of its trading partners, with considerable share from the Middle East and Asia.

Strategic Importance: Its advanced cargo infrastructure has made it a hub for leading global freight carriers.

Notable Features: Dedicated long-haul cargo flights to key commerical markets.

For Your Business: Given Stansted's robust cargo handling capabilities, your business may tap into its extensive network for a wider, global reach.

East Midlands Airport

Cargo Volume: Moves over 360,000 metric tonnes of cargo per year.

Key Trading Partners: Most partnerships are within Europe, specifically to and from the Netherlands, Germany, and France.

Strategic Importance: Known as the premier cargo airport for the UK's express freight network.

Notable Features: Fast cargo expedite times and it's the UK's busiest airport for dedicated cargo aircraft.

For Your Business: If speed is integral to your business' logistics strategy, East Midlands' expedite times and express freight focus could add value to your shipping operations.

How long does air freight take between Thailand and United Kingdom?

The average air freight transit time between Thailand and the United Kingdom spans approximately 6-8 days. It's important to note, however, that these times are subject to change based on a number of factors.

Depending on the specific airports of origin and destination, the weight of the goods, and their nature, the transit time may either shorten or lengthen. For example, hazardous materials may require special handling and clearance procedures, potentially extending the transit time.

For the most accurate and current transit times, it's recommended to consult with a freight forwarder like DocShipper.

How much does it cost to ship a parcel between Thailand and United Kingdom with air freight?

Shipping an air freight parcel from Thailand to the UK generally costs between $1.50 to $4.50 per kilogram. However, providing an exact rate is challenging due to factors such as distance from departure and arrival airports, parcel dimensions, weight, and the nature of the goods.

Rest assured, our team at Your Company Name meticulously works to determine the most cost-effective solutions for your unique needs, quoting on a case-by-case basis. For a personalized rate, contact us to receive a free quote in less than 24 hours!

What is the difference between volumetric and gross weight?

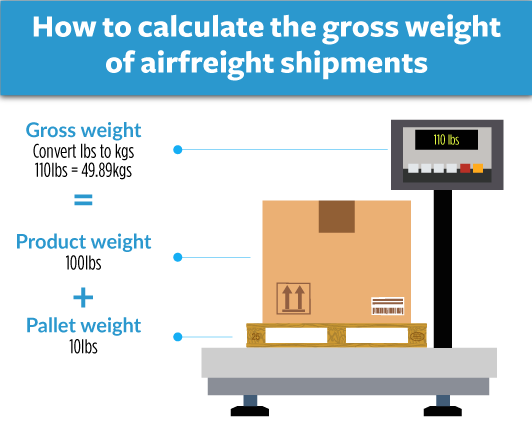

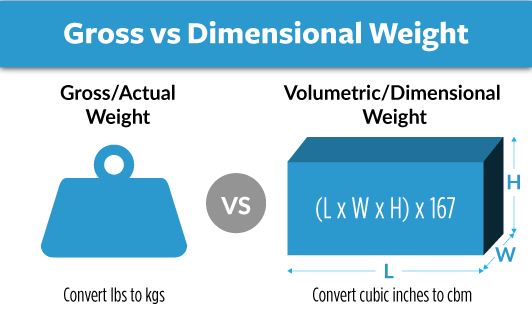

Gross weight is the real weight of your package, simply the weight of your goods including packaging. On the other hand, volumetric weight refers to the amount of physical space your package takes up in the air freight carrier.

To calculate the gross weight for air transportation, you solely focus on the actual weight of your shipment, taken straight-forwardly by a scale, it’s then simply recorded in kilograms. For example, if your package weighs 20kg, the gross weight is 20kg (44.09 lbs).

As for the Volumetric weight, it involves a bit more calculation. You'll multiply the length, width, and height of your package, all in centimeters, then divide that by the air industry's standard volumetric divisor which is 6000. So, if your package measures 40cm x 60cm x 50cm, your volumetric weight calculation will be (40 x 60 x 50) / 6000 equals to 20kg (44.09 lbs).

Express Air Freight services, such as couriers, use a slightly different metric. They will still multiply the length, width, and height as usual, but utilize a different divisor, typically 5000. With the same package size, you'd have 24kg (52.91 lbs) for Express Air Freight.

Knowing the difference matters because your freight charge will be based on the higher value between gross and volumetric weight. Hence, understanding the difference can help your business better anticipate shipping costs, and eventually, streamline your international logistics.

Siam Shipping Tip: Consider Door to Door if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You appreciate having a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want less transitions for your cargo, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Thailand and United Kingdom

Breaking down international borders, Door to Door shipping simplifies the process of transporting goods from Thailand to the UK. A hassle-free solution, it encompasses everything from pickup and transportation, to customs clearance and delivery. Perfect for those who value convenience and efficiency. So, why wait? Let's dive into the world of Door to Door shipping that's just as easy as it sounds!

Overview – Door to Door

Considering a stress-free shipping solution from Thailand to the UK? Door to door shipping is a clear winner for businesses seeking simplicity and efficiency.

Despite the inherent challenges in international logistics like customs procedures, language barriers, and various regulations, this service shines as it compresses these complexities into one manageable package, saving you headaches. It's no surprise that it's the most popular choice among DocShipper's clients due to its reliable, comprehensive nature.

However, the premium service comes with slightly higher costs. Evaluate its advantages - could this be the streamlined solution your business needs?

Why should I use a Door to Door service between Thailand and United Kingdom?

Feeling lost in the maze of global shipping? Breathe easy! Here are five solid reasons why the term 'door to door service' is your logistics lighthouse between Thailand and the UK.

1. Stress-Free Logistics: Stop juggling a mind-boggling number of shipping tasks! From picking your goods, right through packing, storage, and transportation - door to door service shields you from the shipping storm. It's all comprehensive, leaving you with essentially one job – letting us know where to pick up and drop off.

2. Timely Delivery for Urgent Shipments: Hitting urgent targets and maintaining supply chain speeds is more of a game of chess. With door to door service, shipping isn’t just shipping. It’s a strategic quasi-time machine, structured to ensure your urgent shipments reach their UK destinations right on schedule.

3. Special Care for Complex Cargo: Do you have goods that demand extra attention? Perhaps a fragile statue or heavy machinery? Not to worry. Door to door service morphs into a careful guardian, ensuring that your precious wares, regardless of how complex, weave safely through the shipping labyrinth, from Thailand to the UK.

4. Consolidated Customs Clearance: Unearthing the mysteries of customs documentation isn't your circus, it's ours. Shifting the burden to us means one less daunting task for you. We'll navigate the regulatory hoops, ensuring your goods delightfully dance their way through customs.

5. Trucking to The Final Destination: Not a fan of the trucking intricacies? With door to door, your goods don't just disembark at the UK port and bid you farewell. They get chauffeured straight to your final destination, serving up convenience on a silver platter.

In essence, door to door service is more than just a shipping method; it's a logistics superhero, waiting to take over your international shipping battles. So, ready to transform your Thailand to UK shipment into a smooth sail?

DocShipper – Door to Door specialist between Thailand and United Kingdom

Introducing DocShipper's all-inclusive freight service from Thailand to the UK! Sit back and relax as we efficiently manage everything - from packing and transportation to customs clearance, regardless of shipping method.

Unparalleled expertise and dedication are at your service. Plus, enjoy personalized assistance with your dedicated Account Executive. Reach out today for a free, hassle-free estimate within 24 hours or connect with our consultants for expert advice at no cost. Your stress-free shipping partners, DocShipper, are just a call away!

Customs clearance in United Kingdom for goods imported from Thailand

Navigating customs clearance when importing goods from Thailand to the United Kingdom can be a challenging endeavor, laden with complex procedures and potential pitfalls including unexpected customs fees.

Becoming well-versed in aspects like customs duties, taxes, quotas, and licenses is crucial to prevent goods from being held up at customs, dampening your business operations. The intricacies of these areas will be further dissected in the subsequent sections of this guide.

Be reassured, DocShipper can assist you with every step, regardless of the goods or their origin. To kickstart your project and obtain an estimate, you just need to provide us with the origin, value and HS Code of your goods. Our team is always ready to help make your shipping journey smoother.

How to calculate duties & taxes when importing from Thailand to United Kingdom?

Cracking the code on import duties and taxes doesn't have to be a migraine-inducing process. Essentially, when you're importing goods from Thailand to the United Kingdom, the customs duties calculation hinges on factors like the country of origin, the Harmonized System (HS) Code, the Customs Value, the Applicable Tariff Rate, and any other relevant taxes or fees.

Think of it as a jigsaw puzzle, each piece is crucial to see the complete picture! So, where do you start solving this complex puzzle? The key to this enigma is in identifying the country where the products were originally manufactured or produced.

Step 1 - Identify the Country of Origin

Defining your good's Country of Origin is essential, and here's why.

Firstly, it directly affects the customs tariffs. Trade agreements between the UK and Thailand are being discussed and will play a massive role in your import costs.

Secondly, special taxes apply to certain goods from specific countries. Product origin will help decide if such tariffs are relevant to you.

Thirdly, regulatory requirements often hinge on origin. Certain goods from Thailand, like plant-based products, face extra checks.

Fourthly, origin confirms if goods are subject to quotas or embargoes. To illustrate, there may be import limitations on Thai automotive parts at particular times.

Lastly, certain goods benefit from preferential treatments because of trade agreements. Properly identifying the origin can help you take advantage of this.

These reasons emphasize why understanding your goods' origin is pretty critical before deciphering the HS code! In our next section, we'll delve into getting the right HS code, but don't forget - Country of Origin influences almost every stage. So keep it front and centre! Stay tuned for more handy-facts in our destination guide.

Step 2 - Find the HS Code of your product

The Harmonized System (HS) code is a globally recognized coding system that facilitates the international trade of goods. Established by the World Customs Organization, it assigns a specific number to each type of product to provide consistency across countries. This standardization makes it easier to understand and follow international trade regulations.

Ideally, the simplest way to discover your product's HS code is to ask your supplier. As an active player in imports and exports, they're often well-versed in the pertinent regulations and can easily provide you with the necessary code.

However, if obtaining the code from your supplier isn't feasible, follow this stress-free process to find it yourself:

1. Visit this Harmonized Tariff Schedule or any similar HS code lookup tool.

2. Input the name of your product into the search bar.

3. Review the 'Heading/Subheading' column to locate your product's HS code.

A word of caution - accuracy is pivotal when it comes to choosing your HS code. Incorrect codes may cause unwanted shipping delays and invite potential fines, as these codes are used to determine duties and taxes at customs.

Here's an infographic showing you how to read an HS code. This visual guide simplifies the HS code into understandable parts, allowing you to identify your product's code with even greater accuracy.

Step 3 - Calculate the Customs Value

Identifying the customs value is a crucial part of shipping goods from Thailand to the UK. It's not just about the price you paid for the products.

In fact, under the customs legislation, the customs value is based on the CIF value. This includes the cost of the goods (let's say, $1000 for a batch of handmade Thai silk), the cost of international shipping (like $250 for ocean freight), and the insurance cost (which may be around $50). Adding all of these together, your customs value would stand at $1300.

Understand that this total is what customs officers will use to calculate the duties and taxes due. Putting time into correctly working out these costs will prevent any nasty surprises down the line.

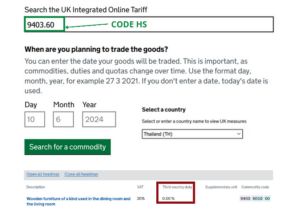

Step 4 - Figure out the applicable Import Tariff

An import tariff, often referred to as customs duty, is a tax imposed on goods when transported across international borders. For those importing goods from Thailand to the United Kingdom, these tariffs are assessed using the UK Global Online Tariff.

Navigating the tariff identification process can be somewhat straightforward:

1. Begin by visiting the UK Global Tariff tool at its government.

2. Enter the previously identified HS (Harmonized System) code for your product and input Thailand as the country of origin.

Let's consider a practical example. Assume your product is Wooden Furniture with HS code 9403.60 originating from Thailand:

1. Enter 9403.60 into the system and select Thailand as the country of origin.

2. The tool might return a tariff rate, such as 2.7% (it is just an example).

Next, calculate the import duty. Assume your cost, insurance, and freight (CIF) for this shipment come to $1000. Therefore:

1. Import Duty = 2.7/100 $1000 = $27.

The import duty you would need to pay, in this example, is $27. Always double-check the most current tariff rates before shipping to ensure a smooth and cost-effective import process.

Step 5 - Consider other Import Duties and Taxes

In the world of imports, your journey doesn't end with standard tariffs. In the UK, as with many other countries, other duties and taxes may be levied, depending largely on the product’s nature and its country of origin. Understanding these can help you avoid unexpected costs and delays in shipping your goods.

Take Excise Duty, for instance. This is an additional cost usually associated with goods like alcohol, tobacco, or fuel. Say, for example, you're importing wine from Thailand. On top of the standard tariff, an Excise Duty has to be paid, whose rates are often subject to change.

Anti-dumping duties, on the other hand, come into play if the goods are being sold way under the fair market price to hurt UK businesses. Though not a common occurrence, you'll want to be mindful to keep your pricing equitable.

However, the real game-changer is likely to be the VAT. In the UK, VAT is typically charged at 20% on the total value of the goods plus duties paid. Using an example, if the goods cost $1,000 and the total duty paid is $100, the VAT would come to $220 (1000+100) 20%.

Please remember, these are illustrative rates and could differ based on your specific scenario. Always check the latest rates and consider seeking advice from a customs expert to ensure compliance.

Step 6 - Calculate the Customs Duties

Understanding customs duties calculation may seem intimidating, but it's all about understanding the components. To calculate, the customs value is the starting point. Let's assume this consists of the price paid for goods, plus any shipping and insurance costs.

For the first scenario, with only customs duties: let's say you ordered ceramics worth $1,000, along with $200 for shipping and insurance. If the duty rate is 5%, the customs duty is $1,200 5%= $60.

In the second scenario, VAT is included. If the VAT rate is 20%, using the values from the first example, the total sum needed for VAT is $1,260 20% = $252. Therefore, the overall tolls here are $60 (customs) + $252 (VAT) = $312.

Finally, if anti-dumping taxes and Excise Duty apply, say 10% and 15% respectively, calculate these on the $1,260 amount as well. The total customs costs are thus $60 (customs) + $252 (VAT) + $126 (anti-dumping) + $189 (Excise Duty) = $627.

Does this calculation seem complex? Don’t fret - here at DocShipper, we handle all customs clearances on your behalf. Our experts ensure you never overpay while guaranteeing compliance with all regulations – anywhere in the world. For a hassle-free clearance and a free quote within 24 hours, reach out to us today.

Does DocShipper charge customs fees?

As your custom broker in Thailand and the UK, we at DocShipper manage the customs clearance process for you, charging only a clearance fee. Your customs duties and taxes, however, are paid directly to the government, not DocShipper.

Imagine buying an item in a store: we act like the cashier processing your purchase, but the sales tax you pay goes straight to the state. To assure transparency, we provide documents issued by customs proving you've only paid government-required charges. We don't pocket a penny of your customs duties!

Contact Details for Customs Authorities

Thailand Customs

Official name: Customs Department - The Kingdom of Thailand

Official website: http://www.customs.go.th/

United Kingdom Customs

Official name: Her Majesty's Revenue and Customs (HMRC)

Official website: https://www.gov.uk/

Required documents for customs clearance

Understand the headaches of sorting through shipping paperwork? Let's simplify it. In this section, we’ll break down the key documents you’ll need for customs clearance: Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Don't let obscure terminology stop your business momentum!

Bill of Lading

In the bustling world of freight forwarding, one document is the backbone of your shipping journey from Thailand to the United Kingdom - the Bill of Lading (BoL). Much like a passport for your goods, the BoL signifies the handover of your cargo from your hands to the shipping line’s care, serving as proof of contract and receipt of goods. It makes the magic of transit possible.

But, what if you could speed up the process? Enter 'telex' release, the electronic equivalent, working wonders by saving you time and paperwork. A similar must-have for air cargo is the Air Waybill (AWB). The AWB, just as vital in the aviation space, carries the weight of the BoL, keeping your goods moving smoothly. In essence, consider these documents your unmissable checkpoints in your shipping journey, helping keep hitches at bay and ensuring seamless customs clearance.

Packing List

Cargo journeys from Thailand to the UK require a thorough Packing List. Picture this: you're shipping a palette of artisanal Thai silks to a boutique in London. Your Packing List specifies each bolt's material, colour, and quantity. Accurate information is crucial; it's the key to smooth customs clearance at both ends, whether you're shipping by molten skies or churning seas.

Shortcuts here can lead to costly detours—like a misdeclared item causing unexpected delays. So, for timely delivery, carefully itemize each product on your Packing List, and reap the benefits of unhindered transit. Your UK clients will thank you for your meticulous preparation.

Commercial Invoice

A Commercial Invoice is your ticket to a smooth customs clearance when shipping from Thailand to the UK. It's more than a price tag - it tells customs what's in your shipment, its value, the buyer and seller details, and the country of origin. Missteps here can lead to delays or even fines.

So, for your ceramics shipment - make sure all descriptions are clear, specific, and match with the Harmonized System (HS) code. Also, double-check the consistency of information across your Bill of Lading and other documents to ensure a smoother clearance process. Don't let an incomplete invoice stand between your beautiful Thai ceramics and UK buyers. This piece of paper could be the difference between an easy pass or a laborious detour through customs.

Certificate of Origin

Navigating customs can be tricky, especially when shipping goods from Thailand to the U.K. One vital document you'll need is the Certificate of Origin. This isn't just a piece of paper, it's a passport for your goods, verifying their birthplace. Let's say you're exporting Thai silk.

The Certificate of Origin proves your silk is genuinely made in Thailand, which might net you preferential customs duty rates, making your shipment more cost-effective. Always ensure you mention the silk’s country of manufacture clearly. This not only eases your goods' journey but also fortifies trust with your customers, who are assured they're getting the real deal, Thai silk straight from its homeland. As in business, in shipping too, credibility counts!

Get Started with Siam Shipping

Navigating customs clearance between Thailand and the UK can be overwhelming. At DocShipper, we thrive in turning complexities into simplicity. Handling every step, we ensure a smooth, hassle-free process for your peace of mind. Still striving with customs? Take advantage of our services and get a free, no-obligation quote within 24 hours. Say goodbye to customs stress today!

Prohibited and Restricted items when importing into United Kingdom

Facing customs red tape can be confusing. Mistakenly importing restricted or prohibited items into the UK could mean costly penalties or shipping delays. Let's demystify those puzzling rules for you.

Restricted Products

- Firearms and ammunition: You have to apply for a Firearms Certificate from the Firearms Licensing Unit.

- Animals and plants: A license obtained through DEFRA's Animal and Plant Health Agency is essential before these products can be imported to the UK.

- Food products: To import certain food products, remember to first secure the right permit from Food Standards Agency.

- Medicinal products: To bring in medicinal products, you're required to have a license from the Medicines and Healthcare products Regulatory Agency.

- Alcohol, tobacco and certain types of oil: You're required to use the UK Government's HMRC service to pay Excise Duty on these items.

- Pesticides and chemicals: You'll need to obtain a license from Health and Safety Executive.

- Telecommunications equipment: Importing such equipment mandates that you secure an Ofcom licence from the Office of Communications.

Always remember, each time you're dealing with restricted products it's important to abide by the correct legal process to ensure your business runs smoothly.

Prohibited products

- Illegal narcotics/drugs (Such as Cannabis, Cocaine, Heroin, etc.)

- Offensive weapons, including switchblades, butterfly knives, and disguised knives.

- Endangered animal and plant species, or products derived from them (like ivory or certain types of wood)

- Rough diamonds (unless they are accompanied by a certificate of their provenance)

- Indecent and obscene materials such as pornographic books and DVDs.

- Counterfeit, pirated and patent-infringing goods

- Self-defence sprays, such as pepper sprays and CS gas

- Certain radio transmitters not approved by OFCOM

- Unauthorised medicines and drugs

- Goods breaching intellectual property rights

- Goods that bear the emblem of the Red Cross or Red Crescent, unless they are authorized

- Products containing the biocide dimethyl fumarate (DMF) commonly found in domestic items

- Personal imports of meat and dairy products from most non-European Union (EU) countries

Are there any trade agreements between Thailand and United Kingdom

Yes, there are trade alliances between Thailand and the UK, including a continuity agreement that preserves the terms from when the UK was part of the EU. This ensures duty-free access for 52% of Thai exports to the UK. Plus, ongoing discussions might pave the way towards an Economic Partnership Agreement, opening more opportunities for your business in the future.

So, whether you're shipping electronics or vehicles, such alliances could play a crucial role in reducing costs and potentially increasing profits. Further infrastructure developments, like the high-speed rail project, could also streamline future cross-country shipments.

Thailand - United Kingdom trade and economic relationship

Trade between Thailand and the United Kingdom has a rich history and has grown steadily in recent years. Key sectors like automotive, pharmaceuticals, and seafood underline a vibrant economic relationship.

In 2022, the total trade value reached approximately $6.5 billion. British investment in Thailand surpassed $25 billion, making the UK one of the largest investors in the country. Tech sectors are of growing interest, with digital and innovation leading the way. On the commodities front, Thai shrimp, canned pineapple, and canned sweet corn proudly take top spots in UK import markets. As these two nations continue to deepen trade ties, expanding opportunities exist for businesses in diverse sectors.

Your Next Step with Siam Shipping

Confused with customs clearance? Overwhelmed by ocean freight or air cargo choices? Trust DocShipper with your UK-Thailand shipments. We handle all the tricky parts, from transport organization to administrative procedures. Say goodbye to shipping stress, let our experts guide you. Ready for a smoother shipping experience? Contact us today!

Additional logistics services

Explore beyond shipping and customs with our comprehensive logistics solutions. From storage to distribution, we've got you covered. Let DocShipper handle your entire supply chain, simplifying the process and saving you time.

Warehousing and storage

Thinking of warehouse storage for your goods between Thailand and the UK? Selecting a dependable facility can be a daunting task, especially when conditions like temperature matter. Take, for instance, storing pharmaceuticals which demand specific temperature ranges. Stress not - we've got you covered with our specialized solutions.

Packaging and repackaging

Understanding the ins and outs of packaging is vital when shipping from Thailand to the UK. With our strategic guidance, you'll strike a perfect balance in protecting a variety of goods, like Thai silk or antique furniture. Our agents, loyal allies in the complex world of freight forwarding, are equipped to handle distinct packaging standards.

Cargo insurance

When shipping, no one wants surprises. In contrast to fire insurance, cargo insurance secures not just your warehouse but every step of your freight's journey. Prevention, it's key! Think about a case where goods get damaged during transit, quite a nightmare, isn't it? Our cargo insurance sweeps that worry away, protecting from risks and bringing peace of mind.

Supplier Management (Sourcing)

Struggling to source goods from Thailand for your UK operations? DocShipper unzips the complexities of global procurement for you. We scout and secure suppliers across Asia, East Europe, managing everything from language hurdles to complete procurement processes.

For example, let's say you're looking to order specialty Thai silk. We pinpoint trusted suppliers, negotiate terms, and manage orders, letting you focus on your core business. Unleash the potential of global markets with us.

Personal effects shipping

Moving your personal effects from Thailand to the UK doesn't have to be nerve-wracking. Whether it's an heirloom vase or a whole condo's content, our team ensures top-notch care during transport. And bulky or awkwardly shaped item? No issues! They've handled plenty before.

Quality Control

When shipping from Thailand to the UK, quality inspections are vital. They ensure your goods meet both countries' standards, smoothing out the customs clearance process. Imagine your teak furniture shipment stuck at customs due to non-compliance - inspection sidesteps such delays.

Product compliance services

Product compliance is a must for shipments, and your goods can face a sudden halt without it. Think of it like a passport for your goods - lacking it can get them stuck. We help with everything from lab-based testing for certification to ensuring your products pass muster on arrival. Perfect when you don’t want your valuable shipments stuck in limbo for non-compliance.

FAQ | For 1st-time importers between Thailand and United Kingdom

What is the necessary paperwork during shipping between Thailand and United Kingdom?

Transporting goods from Thailand to the United Kingdom requires a few important documents. First, for sea shipments, a Bill of Lading is a must, whereas an Air Waybill is vital for air freight. But don't worry, as your international logistics partner, we at DocShipper will manage these for you. What we'll need from you though, is the packing list and the commercial invoice of your shipment. Be aware that depending on your goods, additional documentation like Material Safety Data Sheets (MSDS) or certain certifications may be necessary. So knowing your cargo well in advance will help with a smooth shipping process.

Do I need a customs broker while importing in United Kingdom?

Yes, utilizing a customs broker when importing in the United Kingdom is considered beneficial due to the complexity of the process and the stringent requirement of specific details and documents. As specialists in navigating these complicated procedures, customs brokers can efficiently interact with customs authorities on your behalf. At DocShipper, part of our service is to represent your cargo at customs for the majority of shipments. This can provide a seamless, hassle-free experience for you, allowing focus on the other aspects of your business. So, while not a strict requirement, a customs broker can prove highly advantageous in such contexts.

Can air freight be cheaper than sea freight between Thailand and United Kingdom?

It's challenging to determine if air freight would be cheaper than sea freight between Thailand and the United Kingdom because costs depend on various factors like route, weight, and volume. Generally, if your cargo is less than 1.5 cubic meters or weighs under 300 kg (660 lbs), you might find air freight a cost-effective option. At DocShipper, we're dedicated to helping you find the most competitive shipping solution that suits your specific needs. Rest assured, your account executive will guide you through your options and help you make an informed decision.

Do I need to pay insurance while importing my goods to United Kingdom?

As DocShipper, we would like to make it clear that insurance is not obligatory when you're importing goods to the United Kingdom or elsewhere. However, it is strongly advisable to protect your goods with insurance due to the potential risks involved in shipping. Numerous incidents such as damage during transit, theft, loss, and other unexpected events can occur. By insuring your shipment, you are safeguarding your financial interests and making sure your goods reach their destination securely. Your peace of mind is our top priority!

What is the cheapest way to ship to United Kingdom from Thailand?

Given the significant distance between Thailand and the United Kingdom, maritime transport is usually the cheapest option. However, ocean freight also comes with the longest transit times. We at DocShipper can assist with arranging less-than-container-load (LCL) or full-container-load (FCL) shipments as per your specific requirements, ensuring a cost-effective and seamless shipping experience for you.

EXW, FOB, or CIF?

The most suitable trade term honestly depends on your relationship with your supplier. However, a key fact to consider is that your supplier might not proficiently navigate through logistics. Therefore, it'll be prudent to involve a veteran freight forwarder like us, DocShipper, to manage the international freight and the process at the destination. Typical suppliers regularly prefer to sell via EXW terms (from their factory door) or FOB (inclusive of all charges until the terminal of origin). But, don't fret; we've got your back. At DocShipper, our specialty is offering an uncomplicated door-to-door service, saving you the stress of the logistics maze.

Goods have arrived at my port in United Kingdom, how do I get them delivered to the final destination?

Once your goods reach the port in the UK, you have several options for final delivery. If we've arranged your goods under CFR or CIF incoterms, you'll need to engage a customs broker or freight forwarder to clear goods onsite and manage import duties. Alternatively, opt for our DAP incoterm services where we handle the entire process for you. Always confer with your assigned account executive to clarify these arrangements.

Does your quotation include all cost?

Absolutely, our quotations are comprehensive, meaning they include all costs except for destination duties and taxes. However, we're always here to assist you in estimating those as well – just reach out to your dedicated account executive. At DocShipper, we maintain transparency and are committed to ensuring no hidden fees spoil your experience.

SIAM Shipping info: Do you like our article today? For your business interest, you may like the following useful articles :

SIAM Shipping Advise : We help you with the entire sourcing process so don't hesitate to contact us if you have any questions!

- Having trouble finding the appropriate product? Enjoy our sourcing services, we directly find the right suppliers for you!

- You don't trust your supplier? Ask our experts to do quality control to guarantee the condition of your goods!

- Do you need help with the logistics? Our international freight department supports you with door to door services!

SIAM Shipping | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!