The Asian economic community expects to strengthen Thailand’s positioning as the key transportation hub for the Greater Mekong subregion (GMS), according to a study by Solidiance. Here we'll give you more details on crossing borders in Thailand.

Table of Contents

Cross border transportation for CLMV region.

Growth of the GMS trade

Indeed, Mickaël Feige, responsible for the country of Solidiance, believes that the AEC would increase the trade of the Kingdom with the surrounding countries: Myanmar, Malaysia, Laos and Cambodia but also countries like China and Vietnam.

Thailand has gradually benefited from reducing import duties on products shipped to LTVC countries in comparison to non-alcoholic beverages, motorcycles, tires, soap and cleaning products. Thailand’s cross-border trade with Myanmar, Laos and Cambodia, which represents 20, 14 and 9% of the total in 2012, is expected to grow tremendously in the coming years with a growth rate of about 30%.

In order to optimize our services, Siam Shipping and Siam Relocation are now part of the Docshipper group. Our customers can now benefit from total supply chain coverage. Therefore, Siam Shipping team became Docshipper team

Docshipper note : This opportunity should benefit logistics operators in order to extend their activity to neighboring countries.

This liberalization of the AEC logistics sector will benefit both Thai investors and several other Asian countries. To survive this competition for the ACS, small logistics companies with fewer than 50 trucks in circulation should either become outsourced business units of global enterprises or strengthen to form a wider network.

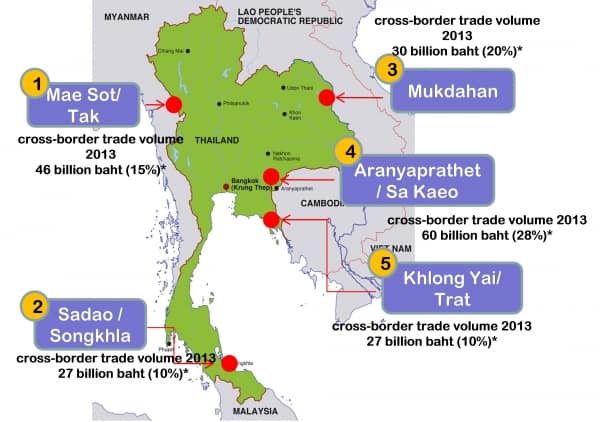

Ranking of the most used roads for Import/Export:

According to the study, R9 is the axes most used by logistics companies among the 4 major routes connecting Thailand and other GMS countries, as shown by these percentages:

- R9: 41.18% (GMS)

- R3A: 21.57% (Chiang Rai-Laos-Kunming)

- R1: 15.69% (Sa Kaew-Cambodia-Vuong Tao, Vietnam)

- R3B: 7.84% ((Chiang Rai-Myanmar-Jinghong, China)

Docshipper Info : The R9 road is very used as it allows to connect Mukdahan to Vietnam (Danang) passing through Laos in two days (510 km) by road while it takes 15 days by ship.

The main products that Thailand exported to its neighboring countries via cross-border trade in 2012, a quarter represented natural rubber, computers and parts accounted for 5%, diesel 4% and automobiles and parts 4% as well.

Natural gas was ranked first among Thailand’s cross-border imports with almost one third of the total:

– Natural gas: 30%

– Electrical machinery and parts: 9%

– Computers and parts: 9%

– Copper products: 5%

– Data, audio and video recorders: 4%

Thailand is one of the major logistic player in ASEAN

ASEAN is a potential market which represents about 600 million consumers. It is composed of: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.

Docshipper Remark : Thailand uses the policy of “three economic rings and five commercial bridges”.

This strategy aims to derive great benefits from the country’s geographical position in Southeast part of Asia.

The five commercial bridges are composed of several roads that can accommodate important transport flows to neighboring countries.

They include:

- The North Gate, Thailand, Myanmar, Laos and southern China

- The northeast footbridge, connecting Thailand to Laos, Vietnam, southern China and East Asia

- The eastern gateway connecting Thailand to Cambodia, Laos and Vietnam

- The West Gateway linking Thailand to several BIMSTEC countries, particularly Bangladesh, India and Myanmar

- The southern gate, connecting Thailand to Malaysia, Singapore and Indonesia.

ASEAN Rules and Regulations for Cross-Border Security Obligations

At the end of 2015, the arrival of the ASEAN Economic Community, the capital market actions of Lex Mundi members operating in the ASEAN, came together so that they share with shareholders and customers at the regulatory level Security measures applicable to cross-border supply within all the ASEAN member state one-by-one.

Indeed, this guide provides an understanding of very important elements such as exemption requirements, registration and the regulatory body, rules for the marketing of securities, promoter or agent commitment requirements, but also relevant considerations and disclosure requirements.

In addition, voluntary issuers and providers seeking to increase their income (debt or equity) in the border and emerging markets of ASEAN will be pleased to take advantage of this guide. Institutional investors, private equity funds and fund managers or any other stakeholders involved in the bidding process may also be interested in the guide to identify the requirements to be met before entering the capital ASEAN.

DocShipper Advice : You can get further information by reading our dedicated article : ASEAN Community

Thailand regulation

Applicable regulations and market information

• Exchange and Securities Commission (“SEC”)

• The Thailand Stock Exchange (“SET”) where all the securities are ranked and listed on the land.

• 639 companies listed on 31st of January 2015.

• Market capitalization of 12,898.70 billion THB / USD 359.49 billion at 31/01/15.

Offer of securities and / or conditions of registration and exemption

Most of the time, selling securities in Thailand is not allowed. The only way to circumvent this rule is to obtain an SEC authorization and is mandatory for new security titles only). In addition, enrollment statements and preliminary prospectuses were conducted with the SEC and entered into force. Once the sale is complete, you will have to submit a sales result report.

DocShipper Advice : More information about taxes on our dedicated articles: Thai customs

Foreign equities

Actually, the SEC receives many requests for public offerings of foreign shares, but it only accepts them for the following examples:

A) For the main list on the SET

B) For double entry on both currency and SET

C) No listing on the SET (only authorized for shares of ASEAN companies wishing to be listed or already listed on the ASEAN stock exchange).

Exemptions

In the exemple of an offer to sell foreign shares, the SEC’s approval requirements are exempted, such as the examples below:

A) Private place of shares which belongs to foreigners that are defined in one of the following ways:

1) Made within 12 months to more than 50 investors;

2) An offer to sell shares with a total value which does not exceed THB 20 million during the twelve months only if the total calculation of the real aggregate value of the Offered Shares is based on the price that the Shares can offer;

3) an offer to sell shares to professional institutional investors; or

4) An offer to sell shares while the seller and the buyer are actually shareholders in the company that issue shares and if the offer of shares is not for sale in general.

(B) An offer to sell foreign shares to employees or directors of the foreign stock option plan or its affiliation in Thailand.

Obligations Abroad (Government Bonds or Corporate Bonds)

Most of the time the offer to sell foreign bonds is allowed. Prior approval coming from the Ministry of Finance is required for sales of foreign bonds issued in Bath, and is granted to ASEAN, China, South Korea and Japan only.

Docshipper Info : If the offer of foreign bonds is from a member state which is a signatory to Annex A of IOSCO, it will be approved if issued in foreign currency.

The SEC makes specific conditions and regulations, such as the terms and conditions, transfer restrictions and their registration, the debenture representative or the valuation, for different bidding circumstances such as Private placement.

Exemptions

That being said, the submission of the draft terms and conditions to the SEC is always necessary, although the approval of the SEC is granted in all cases.

The filing of prospectuses and registration statements are exempted under certain conditions, for example in the following situations:

- Recent private placement of government or corporate bonds to more than 10 investors for 4 months (with transfer restriction registration).

- An offer for the sale of bonds which belongs to the government or corporate bonds that are issued by international financial institutions under the obligation prescribed and accepted by the Ministry of Finance.

- An offer for the sale of new corporate bonds in Thailand with more than 10 commercial banks taking into account the law on financial institutions for 4 months.

Foreign Collective Investment Scheme (CIS)

Shares which are in a foreign investment company controlled by CLC may be offered for being sold in Thailand and are exempt from approval only in the following cases:

1 ASEAN CIS (ASEAN) – Providing ASEAN shares to accredited investors (institutional or high net worth in Thailand) must comply with several conditions such as:

- Managed by a qualified SIC Operator

- Units must also be offered for being sold in the country of origin

- Units must be offered for sale and sold in Thailand or through a Thai licensing brokerage

- Own a Thaï representative in Thailand

Offering SIC units to retail the investors (general investors) in Thailand can be subject to additional conditions (in addition to those applied to accredited investors) such as:

- The regulator of origin agrees with the SEC the Memorandum of Understanding on the simplified framework for the cross-border public offerings of the ASEAN CIS

- The details of the SIC scheme shall be in accordance with the ASEAN IEC Part I and II Operators Manual

- Provide a distribution channel to settle any dispute without recourse to the court unless the regime does not fit with the Dispute Resolution and Enforcement Mechanism rules (“DREM”), etc.

SICs in the form of a random foreign exchange traded funds (ETFs) – can offer foreign ETFs to the investors in Thailand but it’s subject to a lot of various conditions but not restricted to:

- The Principal Exchange must be a member of WFR

- The original regulator must be a member of the IOSCO

- Have goals to create returns for those who own shares with direct fluctuations such as gold price, commodity index, crude oil index, etc.

- The ETF operator must contact a person in Thailand to coordinate and facilitate the prescribed questions in Thailand, etc.

Securities marketing where issuer / sponsor Offshore and investor in land

The requirements as set out in the left-hand column are for the sale of cross-border foreign securities for investors in Thailand, namely SEC approval and the final result report of the sale.

Docshipper advice : The expression “offer for sale to public” is widely identified and interpreted by the SEC. It’s meant to include any sort of solicitation, marketing activities or attempts to approach Thai investors by foreign issuer and to indicate that it is ready to start trading or accepting orders to market foreign securities.

Simply put, one can speak of a practical exemption that is accepted by the SEC (no express legal exemption) that a foreign supplier responding to a request which wasn’t solicited made by a Thai investor but which should not be considered As an offer on his part.

Need to Hire Land Sponsor, Licensing or Other Distribution Agent:

Offering and selling foreign securities through a company issuing residence permits would not prevent the general market prohibition, with the exception of ASEAN CIS (see previous section “Offer of securities and / or conditions of Registration and exemption “.

Legend or other disclosure requirements for supply materials

No legend required. However, if the situation can be considered as a private placement (if any), any statement that is similar to the following can be recommended when distributing the offering documents:

This documentation has to be given in a confidential way to the person who is supposed to be addressed. The document can not be reproduced or transmitted to anybody except the person to whom the document is addressed.

Myanmar regulation

- Market Information and Applicable Regulatory Authority

- Yangon Stock Exchange Joint Venture Company Limited

- Securities and Exchange Commission of Myanmar (“SEC”)

- Yangon Stock Exchange opened on 12/09/15.

- No companies listed for the moment. The initial six companies can be listed at the beginning of 2016.

Offer of securities and / or conditions of registration and exemption

A public company that makes a public offering of real estate securities is required to provide the necessary process documents to the SEC under the Securities Act, 2013 and the SEC must approve the offer. These process documents are comprised of the memorandum, prospectus and articles of association, audited financial statements for the previous 2 fiscal years and other information requested by the SEC.

Docshipper Advice : The public society must also make public the prospectus which explains all the important information about the company as well as its statutes and its memorandum.

*There are no exemptions from the above requirements under the 2015 Real Estate Securities Act.

Marketing of Securities Where Issuer / Offshore and Investor Onshore Sponsor

Concerning the securitie’s marketing where the issuer / sponsor is offshore and the onshore investor, there is no specification in the Securities Exchange Law of 2013.

Need to Hire Land Sponsor, Licensing or Other Distribution Agent

The Issuer is not obligated to engage an onshore developer, licensee or other distribution agent under the Securities Exchange Law of 2013 or 2015.

Legend or other disclosure requirements for supply materials

The 2013 Securities Act or the 2015 Securities Exchange Rules clarifies that there is no mandatory health that warn disclosure or legend. However, this is linked to any disclosure that can be given by the SEC on some occasions.

Other relevant considerations

At the end of 2015, the Yangon Stock Exchange is supposed to start its activities. In addition, the SEC will have the power to set additional conditions for the issuance of marketable securities, according to the Securities Exchange Law of 2013.

DocShipper Advice : More information about duties & taxes in Myanmar on the government website

Cambodia

Applicable regulatory authorities and market information

- Cambodia Securities Exchange (“CSX”) where securities must be registered in the territory.

- Securities and Exchange Commission of Cambodia (“SECC”)

- Three listed companies (2015).

- Market capitalization of approximately $ 176 million.

Offer of securities and / or conditions for registration and exemption:

Before being placed on the Cambodian market, security must be validated by the SECC. In this country, anything that affects or is close to the public market must be offered in correlation with the Cambodian securities rules. The specification of the proposed bid must be registered with SECC.

The above requirements do not apply to cases that are:

1) offers proposed by the Cambodian Government,

2) bids whose price is fixed during the negotiation

3) any other offer selected by SECC.

Securities or Issuers / Promoters and Investor Marketing:

When a national bid is issued, the securities must be validated with the SECC and registered with CSX. In addition, such securities may only be registered in the territory of Cambodia.

Docshipper Note : Cambodian law does not prevent the acquisition of securities offered by Cambodia to foreign investors.

The rules do not prevent local investors from owning securities issued by foreign countries. On the other hand, the foreign issuer can not sell its offer to the Cambodian public: there is no legal obligation under Cambodian law that would oblige the foreign issuer to inform the SECC of the end of the sale of its securities. It is necessary to hire a sponsor or other distribution agent on site to obtain a license for a product. On an offer, all intermediaries involved in the bid must be registered and accredited by the SECC.

Legend and other disclosure requirements for procurement:

The disclosure document must satisfy all requirements as required by applicable laws and regulations. However, the SECC does not require any restrictions on sales restrictions.

The elements that must appear in the document are the responsible parties that relate to the disclosure document and the prospectus prospectus.

DocShipper Advice : More information about duties & taxes in Cambodia on the government website

Laos

Applicable regulatory organism and market information

- Lao Security Exchange (“LSX”), titles must be detailed in the territory.

- The Lao Security Commission (LSC)

- Five listed companies (2015).

- Market capitalization of 10.969 billion KIP / USD 1.35 billion in 2015.

Offer of securities and conditions for registration or exemption

Under current legislation, all securities intended to be sold or offered in the jurisdiction must be registered with the LSC. No exemption is possible for this rule.

Securities marketing where the issuer / promoter and the offshore investor in the country.

When an offer of securities is issued for Laos, the securities must be registered with the LSC and been on the list made by the LSX.

Docshipper Advice : It is necessary to contact the authorized distributor or distributor.

Vietnam

Settlement and Market Information

- Vietnam State Securities Commission (“SSC”)

- The Ho Chi Minh Stock Exchange (“HOSE”) and the Hanoi Stock Exchange (“HNX”) are regulators

- 373 listed companies in the Hanoi Stock Exchange (HNX):

- Market capitalization that represents more or less VND 150 983 billion or USD 6.7 billion in 2015.

- 314 companies listed on the Ho Chi Minh Stock Exchange (HOSE) in 2015.

- A market capitalization that represents VND 985.258 billion or USD 43.7 billion in 2015.

Offer of securities and / or conditions of registration and exemption

In Vietnam, an offer of securities to the public issued by a joint-stock company can be different from the list of shares of that company on the stock exchange. Indeed, there are two scholarships: PIPES (in Ho Chi Minh City) and HNX (in Hanoi). The main requirements for the offering and issuance of securities of a issuer considered as a foreigner in Vietnam are as follows:

For the offering of shares intended for the public, a issuer considered as a foreigner has to follow those obligations:

- Shares must be issued in Dong (“VND”)

- The production and trade activities of the year prior to the public offering must be in line with international accounting laws;

- There is an official Vietnam investment project, a plan for the delivery and use of the product

- The amount of the increase in the offer of sale may not represent more than 30% of the investment capital amount of the project; You must undertake to subscribe the issue considered as an RM commitment to a securities company

- There is also a bank that monitors the use of the product

- The foreign issuer should not finance the product in another country; The Foreign Exchange Control Act regulating the issuance of securities in Vietnam (the opening and maintenance of a bank account in a Vietnam-approved bank, the proceeds and payments relating to the issue must be complied with Via this bank account)

- The meeting of shareholders in the context of a public offer or convertible bonds (a company of the board of directors or a CA is mandatory for public offers). Securities listed on the stock exchange in less than one year started from the date of the end of the sale.

To register bonds, a issuer considered as foreigner has to follow those requirements:

- Bonds must be denominated in dong

- Bonds are already approved for public sale in correlation with the Vietnam Securities Act

- Bonds to be seized must be As well as those which have been ceded to the public;

- After being registered with HOSE and HNX; The undertaking undertakes to submit to its obligations and to the local law;

- Companies must have been consulted by a local securities company to register their obligations;

- From what we know, there has not been a successful sale to the public by foreigners to date. Foreign issuer or developer market securities and property investors No specific rules are available. Most of the time, the rules applicable to local issuers apply to foreign issuers.

An issuer is not entitled to:

- commit any act of cheating, misrepresentation or misrepresentation of information that may lead to errors;

- providing or registering government securities; • disclose false information that would encourage other third parties to buy, sell or disclose insufficient or untimely information that would affect the market price;

- Even if the SSC monitors the registration of bids, the bidder must only use the information detailed in the prospectus sent to the SSC to operate the market, provided that the issuer submits the information to the SSC. The date of issue and the sale of securities. The award must be a single proposal. The operation of a market should not be directed by the media. It is essential to contact the Sponsor, Licensee or other distribution agent. Please refer to the previous section titled “Requirements for the Offer and / or Registration and Exemption of Securities”. Legal Requirements or Other Information Requirements for Investment Materials

- SSC is authorized to consider and assign the certificate for the offering of government securities. The certificate of public offer of securities transmitted by the SSC certificates that the public offer of securities has been duly registered in correlation with the laws of Vietnam.

- Within one week of the date of certification for the Government Offering, the issuer must announce the offer in three issues in a row of a newspaper.

- Securities may be distributed only after the issuer make sure that purchasers of securities can access the prospectus. Considerations Public Offer or List of Securities By a issuer considered as a foreigner in Vietnam can be more difficult than expected by laws, as Vietnam’s objective is to attract foreign investment to Vietnam.

More information about duties & taxes in Vietnam on the government website

In order to optimize our services, Siam Shipping and Siam Relocation are now part of the Docshipper group. Our customers can now benefit from total supply chain coverage. Therefore, Siam Shipping team became Docshipper team

FAQ | Cross Border Services in Thailand

What is ocean freight?

Ocean freight is a method of transporting large quantities of goods using transport vessels. Goods are packed in containers and then loaded onto a ship. A typical cargo ship can carry about 18,000 containers, which means that ocean freight is a cost-effective way to transport large quantities over long distances.

How do I calculate the cost of freight?

Remember that you have to tell your supplier or forwarder that you want to insure your cargo. Thus the cost of insurance is fixed according to the value of your cargo, in this case about 0.5 to 0.6% of its value.

Maritime groupage (LCL) or full container load (FCL), which option to choose?

If we consider only the financial factor, a full container load (FCL) becomes profitable from about 15 cubic meters. Note that this volume is less than half the capacity of a 20-foot container (33 cubic meters). The full container also has an advantage in terms of security: the container is sealed from departure to arrival.

When does ocean freight make financial sense?

There is no exact volume or weight at which ocean freight becomes profitable. However, we generally notice that from 2 cubic meters or 200 Kgs, sea freight becomes interesting. For smaller volumes, air freight will be more competitive and much faster.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

DocShipper Advise : We help you with the entire sourcing process so don't hesitate to contact us if you have any questions!

- Having trouble finding the appropriate product? Enjoy our sourcing services, we directly find the right suppliers for you!

- You don't trust your supplier? Ask our experts to do quality control to guarantee the condition of your goods!

- Do you need help with the logistics? Our international freight department supports you with door to door services!

- You don't want to handle distribution? Our 3PL department will handle the storage, order fulfillment, and last-mile delivery!

SIAM Shipping | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!