Ever hopped on a freight forwarder to find it just took you for a ride? Many businesses face a similar dilemma when they start shipping goods between Thailand and Czechia. The process can seem like a maze, filled with factors such as tariff rates, complex customs legislation, and fluctuating transit times.

Fear not, as this guide aims to simplify your journey. By walking you through each step - from understanding the varied freight options available like air, sea, road, or rail, to detangling the intricate customs clearance, duties, and taxes - we aim to provide you the advice needed for your business to thrive. If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we specialise in turning these shipping challenges into business success stories.

Which are the different modes of transportation between Thailand and Czechia?

Choosing the right transport mode between Thailand and Czechia can feel like picking the fastest horse in a race. It's all about speed, cost, and logistics - finding the sweet spot. With vast distances and numerous borders to cross, air freight is the fastest, though pricey. Sea freight, while economical, can be slower and hampers landlocked Czechia’s accessibility. Road and rail transport, albeit complex, offer a middle ground. The hidden ace? Your shipping needs. Like a racing jockey, choosing your transport method wisely could make you the front runner in this international trade race.

How can Siam Shipping help?

Looking to ship goods from Thailand to Czechia? Let DocShipper streamline your logistics needs! Our expert consultants are at your disposal, ready to guide you through customs clearance, paperwork, and shipping procedures. Contact us today for a free estimate delivered to your inbox in less than 24 hours. Need advice? Reach out to our team - we're just a phone call away.

![]()

Siam Shipping Tip: Consider ocean freight if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- You're not racing against the clock. Ocean freight takes its sweet time, especially when stacked up against other transport methods.

- Your supply chain is linked up with big-name ports. Think of it as the VIP lane on the maritime superhighway.

Sea freight between Thailand and Czechia

Thailand and Czechia share a dynamic trade relationship, with goods regularly ferried between Bangkok's sea cargo port and the Czech Republic's bustling industrial center. The map of this trade is traced by ocean shipping, an economical choice when dealing with bulky, high-volume consignments. Despite being time-consuming, it's a route well-experienced shippers are familiar with.

But here's the catch, even seasoned shippers often stumble over the hurdles that come with this transit. Mistakes occur, whether it's a missed deadline or unexpected break bulk cargo; resulting in lost time, effort, and sometimes, lost business. It's akin to trying to assemble a massive jigsaw puzzle without having seen the picture on the box.

But don't fret! This guide will be your step-by-step manual to ease that process. It’s chock-full of best practices and required specifications, to assist you in navigating these waters with confidence and efficiency. Textbook knowledge, real-life examples, and practical insights come together, preparing you to master the art of shipping between Thailand and Czechia. Let's understand your challenges, anticipate mistakes, and navigate this path together. Remember, forewarned is forearmed, and this guide seeks to do just that.

Main shipping ports in Thailand

Laem Chabang

Location and Volume: Strategically located at the Gulf of Thailand, the Laem Chabang port is a crucial player in Southeast Asia's trade. It boasts an annual shipping volume of over 18 million TEUs in 2022.

Key Trading Partners and Strategic Importance: The port is a hub for trade between Thailand and major global economies, notably China, the United States, Japan, and Singapore. It's significant for container shipping, making it strategically essential.

Context for Businesses: Suppose you're looking to scale up your operations across Asia and beyond. In that case, the Laem Chabang port could be a vital part of your shipping strategy due to its large capacity, modern infrastructure, and strategic location.

Bangkok Port

Location and Volume: Nestled on the Chao Phraya River, the Bangkok port, also known as the Klong Toey port, handles a shipping volume of around 8,7 million TEUs in 2022.

Key Trading Partners and Strategic Importance: Bangkok port primarily facilitates trade between Thailand and other Southeast Asian countries, along with China and India. Its importance is due to it being Thailand's largest port by shipping volume second only to Laem Chabang.

Context for Businesses: This port may be an excellent fit if your trade mainly focuses on south and southeast Asia. Given its connectivity with Bangkok city, land transportation from the port could reduce your overall logistics costs.

Map Ta Phut

Location and Volume: Positioned at the Gulf of Thailand in Rayong province, Map Ta Phut is the biggest industrial port in the country, dealing with about 8.4 million TEUs annually.

Key Trading Partners and Strategic Importance: It plays a crucial role in trade with China, Japan, and Southeast Asia, particularly in the movement of natural gas.

Context for Businesses: If your business revolves around energy or petrochemicals, Map Ta Phut's state-of-the-art facilities could play a pivotal role in your supply chain.

Songkhla Port

Location and Volume: Situated on the eastern side of the Malaysian Peninsula, the Songkhla port handles around 7 million tons of cargo per year in oil, gas, and consumer goods.

Key Trading Partners and Strategic Importance: It is significantly involved in trade with countries in the Indian Ocean, including India and Sri Lanka.

Context for Businesses: If your business trades with Indian Ocean countries, Songkhla's position on the Pearl River Delta, combined with its ability to handle diverse cargo types, makes it a strategic choice.

Sattahip Port

Location and Volume: Located in the Sattahip district, the port handles around 500,000 TEUs annually and serves as a gateway to the South China Sea and Pacific Ocean.

Key Trading Partners and Strategic Importance: The port is a primary trading link with Vietnam, Indonesia, and China. It also supports Thailand's military, making it strategically vital.

Context for Businesses: If you're trading with South China Sea countries, Sattahip's location could optimize your delivery times and reduce logistics fees thanks to its smaller scale and prompt service.

Ranong Port

Location and Volume: Located on the west coast of Southern Thailand and facing the Andaman Sea, Ranong Port deals with around 300,000 TEUs per annum.

Key Trading Partners and Strategic Importance: The port enables trade primarily with Myanmar and India. Its geographic location opens it up to the Bay of Bengal and the Indian Ocean.

Context for Businesses: Ideal for trade with Myanmar and other Andaman Sea countries, the Ranong Port's strategic location may assist businesses targeting these markets to streamline their logistics processes.

Main shipping ports in Czechia

Port of Prague

Location and Volume: Situated on the Vltava River, serving as the primary gateway for goods heading in and out of Czechia, the Port of Prague handles a significant volume of cargo.

Key Trading Partners and Strategic Importance: The port serves a vast regional area, with Germany being one of the most substantial trading partners. The port's strategic location and rail links make it a significant hub for inland shipping in Central Europe.

Context for Businesses: If you’re planning on exporting goods to or from Central, Eastern, and Northern Europe, the Port of Prague could play a vital role in your logistics due to its well-established transport networks and central location.

Port of Decin

Location and Volume: Located on the Elbe River at the country's northern border, Decin is the most significant river port in Czechia in terms of shipping volume.

Key Trading Partners and Strategic Importance: The port exports a good deal of heavy industry products and imports raw materials, mainly for the local industry, with Germany standing out as a chief trading ally.

Context for Businesses: Importers and exporters in heavy industries might find Decin Port especially relevant due to its focus on raw materials and heavy-duty products. Excellent rail connections also provide easy access to the expansive European rail network.

Port of Mělník

Location and Volume: Located on the junction of the Vltava and the Elbe Rivers, Mělník Port is fundamental in Czechia's internal and international logistics, with an impressive volume of shipping traffic.

Key Trading Partners and Strategic Importance: This port has significant trade engagements primarily with Germany on account of its geographical location and well-set transport connections.

Context for Businesses: For businesses aiming to capitalize on trade with German markets, the Port of Mělník can serve as the cornerstone supply chain player due to its direct maritime routes to Germany and a solid network of inland transportation.

Port of Ústí nad Labem

Location and Volume: Based in the northwestern part of the country on the Elbe River, Ústí nad Labem is a key port with respectable cargo handling capacity.

Key Trading Partners and Strategic Importance: It primarily serves Germany, taking advantage of its strategic position and well-connected transportation routes.

Context for Businesses: If you're shipping raw materials or machinery, particularly to or from Germany, the Port of Ústí nad Labem’s capabilities and strategic location can serve your business well. The port’s robust intermodal facilities enable seamless cargo transfers, enhancing your supply chain efficiency.

Port of Lovosice

Location and Volume: Found on the left bank of the Elbe River, Lovosice port is a crucial logistics hub with a substantial cargo volume, particularly in container shipping.

Key Trading Partners and Strategic Importance: It serves a broad spectrum of trading partners, with Germany remaining the dominant partner owing to its exceptional location and connection with strategic routes.

Context for Businesses: If your business focuses more on containerized goods, Lovosice port could be a valuable addition to your supply chain due to its enormous container handling capacity and comprehensive intermodal services.

These port descriptions should give you a clearer picture of Czechia’s main ports and help fit them into your own business's shipping strategy. Remember, picking the right port for your shipping needs can make a significant difference in your logistics efficiency and overall trade success.

Should I choose FCL or LCL when shipping between Thailand and Czechia?

Choosing between Full Container Load (FCL) and Less than Container Load (LCL), commonly known as consolidation, is a strategic decision. This choice directly influences your shipping costs, delivery timing and overall success when shipping from Thailand to Czechia. Let's dive into understanding these two sea freight options, their benefits, and drawbacks. By the end, you'll be equipped to make the best decision for your unique shipping needs. Shall we lay the course for smooth sailing?

LCL: Less than Container Load

Definition: LCL, or Less than Container Load shipment, is a mode of shipping where multiple shippers share space in a single container. This method is commonly referred to as 'consolidation'.

When to Use: LCL freight is an optimal choice when you don't have enough cargo to fill a container (typically under 13-15 CBM). Its flexibility and cost-efficiency make it an excellent option for businesses with smaller shipments.

Example: Imagine you're an artisan furniture manufacturer in Thailand shipping 10 CBM of goods to a boutique store in Czechia. Instead of paying for a full container, you'll only pay for the space your goods occupy, sharing the rest of the container with other businesses.

Cost Implications: As an lcl shipment only charges you for your cargo’s space, it can significantly reduce your shipping costs, especially for lower-volume shipments. However, individual handling charges applied for each LCL load can add up, so careful budgeting is advised. Also, bear in mind that although the LCL shipping quote might be lower initially compared to a full container, the overall cost could outweigh the benefits if your cargo volume increases.

FCL: Full Container Load

Definition: FCL (Full Container Load) shipping is a method in which an entire container is exclusively allocated for a single consignment. It's aptly specified in 'FCL container'—the 20'ft container and 40'ft container being the standard sizes in international shipping.

When to Use: If you're shipping a high volume of goods—from Thailand to Czechia, for instance—above 13 to 15 CBM (Cubic Meters), FCL offers a cost-effective solution. Plus, as the container is sealed from origin to destination, it reduces potential damage, ensuring the safety of the goods.

Example: Suppose you're in the furniture business and need to transport 25 CBM of teak dining tables from Thailand to Czechia. Choosing the FCL shipping option will ensure safe delivery while being more economical due to the high volume of goods.

Cost Implications: With an FCL shipping quote, the costs are fixed regardless of how full your container is. That's why it will be cheaper per CBM if your goods fill up most of the container. Nonetheless, neutrality on weight or the number of goods in the container lets FCL be a predictable, cost-efficient option.

Unlock hassle-free shipping

Choosing between consolidation and full container shipments between Thailand and Czechia? Let DocShipper take the guesswork out. Our expert team analyzes factors like volume of goods, delivery deadlines, and budget. Based on this, they’ll recommend the most suitable and cost-effective Ocean Freight option for your enterprise. Unravel the complexities of cargo shipping with DocShipper. Reach out for a no-obligation, free cost estimation today!

How long does sea freight take between Thailand and Czechia?

Importing goods via sea freight between Thailand and Czechia typically averages around 24 days. These transit times, however, are subjected to variables such as the specific ports of loading/discharge, the weight, and the nature of the goods shipped. For a more precise quotation tailored to your specific shipment needs, it may be best to get in touch with a forwarder like DocShipper. Contact us at DocShipper to provide you with exact sea freight rates for your exact destination to plan for a smoother transaction.

How much does it cost to ship a container between Thailand and Czechia?

The cost of shipping a container from Thailand to Czechia can range widely per CBM, largely due to variations in the Point of Loading, Point of Destination, specific carrier used, nature of the goods, and even the time of year. Because ocean freight rates and shipping costs are subject to monthly market fluctuations and other factors, pinpointing an exact cost isn't feasible.

However, there's no need to sail these financial waters alone! Our dedicated shipping specialists stand ready to help you navigate these variables. They'll work diligently on a case-by-case basis, ensuring you secure the best rates for your specific needs. With commitment to your success, we’re here to anchor your shipping journey on secure financial ground.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (OOG) container, as the name suggests, refers to cargo that exceeds standard shipping container dimensions (length, width, or height). It necessitates special containers with open tops or flat racks to accommodate the oversized goods.

Suitable for: This type of sea freight is perfect for shipping oversized equipment, heavy machinery, large vehicles, or any cargo that doesn't fit in traditional shipping containers due to its dimensions.

Examples: Construction equipment, wind turbine blades, industrial boilers, large-scale artwork, or heavy machinery.

Why it might be the best choice for you: If your business deals with manufacturing, construction, or industrial goods that often exceed standard container dimensions, the OOG container option offers a safe and efficient solution for your shipping needs.

Break Bulk

Definition: Break bulk shipping involves cargo that is too large or heavy to fit into containers and must be separately loaded onto the vessel, as loose cargo load. This method is often used for large, heavy, or awkwardly shaped commodities.

Suitable for: It's ideal for handling cargo like timber, machinery, construction equipment, or any oversized items that are not suitable for containerized shipping.

Examples: Forestry products, metal sheets, construction cranes, or railway tracks.

Why it might be the best choice for you: If your goods are non-standard dimensions that make container shipping unfeasible, or if your cargo needs extra care that cannot be achieved inside a container, break bulk can provide the flexibility you need.

Dry Bulk

Definition: Dry bulk shipping is specifically for cargoes like grain, coal, or minerals that are shipped in large quantities in a loose form and stowed directly into the vessel’s hold.

Suitable for: Businesses shipping commodities in bulk, typically raw materials which need to be sent in large volume like agricultural produce or mining output.

Examples: Wheat, coal, iron ore, or fertilizer.

Why it might be the best choice for you: If your business deals in raw materials in large quantities, like mining or agriculture, dry bulk shipping can offer a cost-effective and efficient option.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-ro shipping is a method where vehicles are driven directly onto the ro-ro vessel and secured within the deck, then driven off once the ship reaches the destination.

Suitable for: Ro-ro is primarily used for transporting cars, trucks, trailers, tractors, buses, or any other rolling cargo.

Examples: Cars, construction trucks, tractors, buses, or trailers.

Why it might be the best choice for you: If your business involves automotive trading, vehicle manufacturing, or you need to ship large units that can roll on and off a boat, Ro-Ro shipping ensures safety and efficiency.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used to transport temperature-sensitive cargo that needs to be kept at a constant temperature during shipping.

Suitable for: Businesses shipping perishable goods like fresh produce, fish, meat, dairy products, or any high-value goods that require temperature control.

Examples: Fruits, seafood, meat, pharmaceuticals, or flowers.

Why it might be the best choice for you: If your business deals with food, pharmaceuticals, or any temperature-sensitive goods, reefers ensure that your product remains in the optimal condition all the way to the Czech Republic.

Remember, choosing the right type of shipping for your goods is crucial for efficient and cost-effective logistics. Whether you're shipping OOG, break bulk, dry bulk, Ro-Ro, or reefer containers, DocShipper has got you covered. We encourage you to get in touch with our team at any time for a free shipping quote, delivered to you in less than 24 hours.

![]()

Siam Shipping Tip: Consider Air freight if:

- Time's ticking and you can't wait. Air freight is like the express train of shipping; it's the quickest way to get your stuff from A to B.

- You're not shipping a warehouse. If your cargo is under 2 CBM, air freight is a snug fit for your smaller haul.

- Your supply chain ends somewhere off the beaten path. Airports are everywhere, so you can get your goods to those hard-to-reach spots.

Air freight between Thailand and Czechia

Air freight from Thailand to Czechia - an express route for your valuable goods! When speed and reliability are top priorities, say for small, high-value items like electronics or pharmaceuticals, air freight shines. It's like hiring a champion athlete to carry your parcel - it might cost a bit more, but the pace and precision are unmatched!

But here's where shippers often trip up - the estimation stage. Imagine you're baking a fancy cake; you wouldn't guess the amount of sugar you need, right? The same goes for estimating your shipment's weight - a wrong number can turn your budget upside-down. In our next segment, we'll dive deeper into these common pitfalls and arm you with best practices to avoid unwelcome surprises.

Air Cargo vs Express Air Freight: How should I ship?

Weighing up your shipping options from Thailand to Czechia and feeling a bit adrift? Let's cut through the jargon. Basically, air cargo is like hitching a ride on a commercial airline, while express air freight enjoys its own dedicated plane, ready to rocket your shipment straight to its destination. Join us as we dive into the pros and cons of each to help steer your business in the right direction.

Should I choose Air Cargo between Thailand and Czechia?

Air cargo between Thailand and Czechia offers reliable, cost-effective freight forwarding. Major airlines like Thai Airways and Czech Airlines have dependable, preset schedules, suitable if you have flexibility in delivery dates. While air freight transit times might be longer than sea or land options due to fixed schedules, this mode becomes more attractive for cargo exceeding 100/150 kg (220/330 lbs). Considering your budget and shipment size, air freight might be the choice for you.

Should I choose Express Air Freight between Thailand and Czechia?

Opting for Express Air Freight, a service utilizing exclusive cargo planes for swift transportation, may hit the sweet spot if your shipments between Thailand and Czechia are under 1 CBM or 100/150 kg (220/330 lbs). Global leaders, such as FedEx, UPS, and DHL, offer these services with benefits such as fast delivery times and enhanced security. This option could streamline your shipping strategy, particularly if time sensitivity is a priority.

Main international airports in Thailand

Suvarnabhumi Airport

Cargo Volume: Suvarnabhumi Airport, also known as Bangkok International Airport, handles over 97,774 tonnes of cargo each year.

Key Trading Partners: The airport exchanges goods with major economies such as China, Japan, USA and several European countries.

Strategic Importance: As one of Asia's major cargo hubs, Suvarnabhumi Airport has a vast network of flight routes, offering businesses high connectivity to both regional and international markets.

Notable Features: The airport boasts a Free Trade Zone offering tax incentives, and a Cargo Village for efficient cargo handling.

For Your Business: If you are eyeing widespread access to markets in Asia and beyond, Suvarnabhumi is an optimal choice with convenient cargo services and tax benefits.

Don Mueang International Airport

Cargo Volume: Handling around 35,000 tonnes of cargo annually, Don Mueang is an important freight handler in the region.

Key Trading Partners: The airport often works with the ASEAN countries, China, and India.

Strategic Importance: Once the main airport of Bangkok, it still retains significant logistical access to the capital city and the industrial estates surrounding it.

Notable Features: Don Mueang has multiple cargo terminals designed to handle both regular and express cargo.

For Your Business: Don Mueang could be an efficient shipping point if your cargo is oriented towards the ASEAN economies and other nearby nations.

Chiang Mai International Airport

Cargo Volume: As Northern Thailand's primary airport, Chiang Mai handles approximately 18,000 tonnes of freight per year.

Key Trading Partners: The majority of exchanges are with major Asian economies like China, Asian sub-regions such as ASEAN, as well as Australia.

Strategic Importance: Serving as the main gateway to Northern Thailand, it provides easy access to its booming industries including manufacturing and agriculture.

Notable Features: It is the hub for several regional airlines and has specialized facilities for cold storage.

For Your Business: If your business requires direct logistics access to northern Thailand, Chiang Mai Airport, with its array of regional airline connections, could be your ideal choice.

Phuket International Airport

Cargo Volume: Handling over 12,000 tonnes of cargo annually, Phuket Airport plays a vital role in connecting Thailand's southern region with the world.

Key Trading Partners: Key trade partners include China, India, and several countries in Europe.

Strategic Importance: Provides crucial connectivity for businesses to the Southern provinces of Thailand, which are popular for seafood, rubber, and tropical fruits.

Notable Features: Facilitates the export of time-sensitive and perishable goods thanks to regular international flights.

For Your Business: Phuket can serve your business effectively if the Southern Thailand economy is your preferred market.

U-Tapao Rayong-Pattaya International Airport

Cargo Volume: It handles a substantial amount of cargo, although smaller in volume compared to other major airports with an annual cargo volume of about 30,000 tonnes.

Key Trading Partners: The main cargo trading partners are the ASEAN countries, China, and South Korea.

Strategic Importance: Located in the Eastern Economic Corridor (EEC), it stands as a gateway for businesses looking to tap into this dynamic economic region.

Notable Features: Has an integrated Cargo Village.

For Your Business: U-Tapao airport could be your strategic choice for its immediate access to the thriving economic regions of Rayong and Pattaya.

Main international airports in Czechia

Václav Havel Airport Prague

Cargo Volume: Over 90,210 tons of cargo in 2022.

Key Trading Partners: Germany, Poland, Austria, Slovakia, and France.

Strategic Importance: As the main airport in Czechia, it links the country with major business hubs across Europe, Asia, and North America.

Notable Features: The airport boasts state-of-the-art cargo facilities, including temperature-controlled rooms for sensitive shipment.

For Your Business: If you're constantly shipping goods to or from Central Europe, this airport with its robust network will streamline your logistics and potentially cut down on delivery times.

Brno-Tuřany Airport

Cargo Volume: Over 11,222 tons of cargo annually.

Key Trading Partners: UK, Germany, and Italy primarily.

Strategic Importance: It's the second most important airport in the country, catering to businesses situated in the economically vibrant South Moravian Region.

Notable Features: Known for its user-friendly cargo handling services and efficient security procedures.

For Your Business: An excellent choice if your business involves lesser volumes of goods targeting destinations within Europe, especially Western Europe.

Leoš Janáček Airport Ostrava

Cargo Volume: The airport handles over 2,000 tons of cargo annually.

Key Trading Partners: Strong connections with China, Russia, USA, and across Europe.

Strategic Importance: Positioned in an industrial city, the airport serves many manufacturing companies, providing essential connections to global markets.

Notable Features: Offers a free customs zone and has capacity for large aircraft, accommodating a variety of cargo sizes.

For Your Business: If you're in the heavy machinery or manufacturing industry, this airport provides the necessary features to handle your shipping needs, especially to and from Asia and the USA.

Pardubice Airport

Cargo Volume: Handles approximately 8,000 tons of cargo annually.

Key Trading Partners: Mainly Russia, China, USA, and the Middle East.

Strategic Importance: It is a vital component in East Bohemia's economic infrastructure.

Notable Features: The airport specializes in ad-hoc chartered cargo flights and is particularly suited for large-sized cargo.

For Your Business: If your cargo is regularly large or outsized, or you require flexibility in shipping schedules, Pardubice is a good choice, especially for destinations in Eastern Europe, Asia, or the Middle East.

Karviná Airport

Cargo Volume: Modest cargo operations.

Key Trading Partners: Mostly Msosravskoslezský region and Poland.

Strategic Importance: It plays a smaller role, servicing mainly regional businesses.

Notable Features: Offers basic handling facilities that can accommodate small to medium-sized cargo shipments.

For Your Business: An excellent choice if your business requires frequent, small scale shipments within the region or to Poland, offering quick and efficient shipping solutions.

How long does air freight take between Thailand and Czechia?

Shipping from Thailand to Czechia by air freight typically takes between 2 to 5 days. However, it's important to keep in mind that the transit time can vary considerably depending on the specifics such as the departure and arrival airports, the weight and nature of the goods being shipped. To get exact timings that align with your specific needs, it's recommended to consult with an experienced freight forwarder like DocShipper.

How much does it cost to ship a parcel between Thailand and Czechia with air freight?

Air freight costs between Thailand and Czechia widely range from around $3 to $8 per kilogram. This disparity exists due to factors like specific airport locations, parcel dimensions, weight, and nature of goods. Hence, it's unfeasible to offer an exact quote without these details. However, rest assured our experienced team works diligently to secure the best rates for each unique shipment, providing personalized quotes. Contact us today and receive a tailored and free quote within 24 hours for your specific shipping needs.

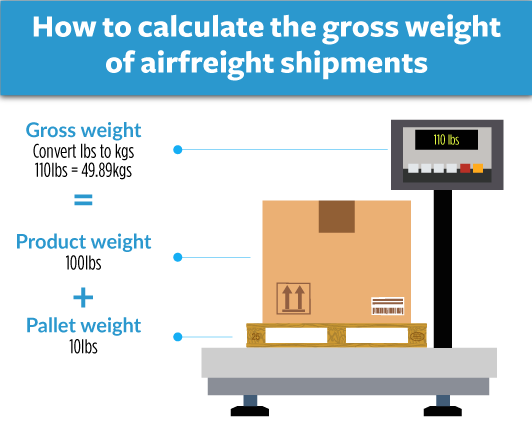

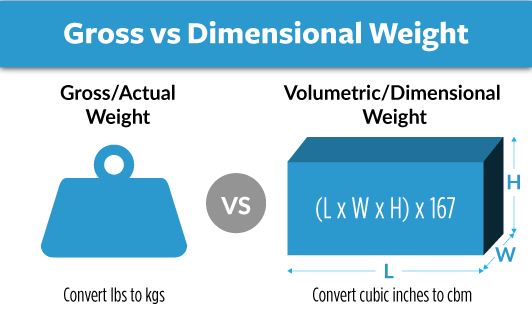

What is the difference between volumetric and gross weight?

Let's unpack these two key terms in the world of air freight shipping, starting with gross weight. Essentially, gross weight is the total weight of your shipment, including the goods, packaging, pallets, or any other materials used. Now, on to volumetric weight. This is a calculation that factors in the space your shipment will take up on an aircraft.

Calculating the gross weight is straightforward. Just weigh your complete shipment, let's say for example it's 90kg (roughly 198 lbs).

On the other hand, volumetric weight is a bit more nuanced. In the air cargo industry, it's calculated by multiplying the length, width, and height (in cm) of your cargo and then dividing the result by 6000. Say your shipment has dimensions of 120cm x 100cm x 110cm. The volumetric weight will be (120x100x110) / 6000, which gives you 220kg (roughly 485 lbs).

For Express Air Freight services, it's a similar calculation, but divided by 5000 instead. Therefore, in this scenario, the volumetric weight comes out to be 264kg (around 582 lbs).

So, why does all this matter? Freight charges aren't just based on the actual weight of your shipment but take into account the amount of space it'll occupy on the aircraft. In essence, you'll be charged based on whichever is higher out of your shipment's gross and volumetric weight. Understanding this can help you better predict your shipping costs and manage your freight budget more effectively.

![]()

Siam Shipping Tip: Consider Door to Door if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You appreciate having a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want less transitions for your cargo, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Thailand and Czechia

Door to Door shipping is your turnkey solution for transporting goods all the way from bustling Thailand to enchanting Czechia. This international shipping method strips away the usual logistic hurdles, offering you unparalleled convenience, cost-effectiveness, and a hassle-free experience. Let's dive in to uncover how this can transform your shipping journey!

Overview – Door to Door

If shipping goods between Thailand and Czechia seems daunting, consider our most popular solution: Door to Door shipping. It eases the process by handling transportation, customs, and paperwork from pickup to delivery. However, it could incur higher costs compared to self-managed alternatives.

But don't fret: the convenience, safety, and stress-free nature, makes it a go-to for our clients. Knowledge of customs regulations and handling paperwork can be tricky, but Door to Door shipping can be your hassle-free way forward. Learn how you can benefit from this service in our detailed guide! With our expertise, your cargo will get to the destination smoothly and affordably!

Why should I use a Door to Door service between Thailand and Czechia?

Hopping between Thailand and Czechia with hefty packages? Never fear, Door to Door service is here! This service is your magic carpet ride when it comes to freight forwarding. Here's why:

1. Simplicity and Alleviated Stress: Door to Door service is your go-to solution for a hassle-free experience. You've got enough on your plate - like making sure your business thrives. Leave logistics to the experts who will pick your goods right from your doorstep in Thailand and deliver them to the final destination in Czechia. Goodbye logistics stress!

2. Timely Delivery: Urgency is our second name. With flights even at odd hours, we ensure your goods reach without any minute to waste. Especially beneficial for fast-moving consumer goods (FMCG), perishables, and any other high-need consignments.

3. Specialized Care for Complex Cargo: Fragile? Valuable? Oversized? Each type of cargo gets personalized attention and care. We clad your special cargo in cushy safety, whether it's an intricate decoration piece or sensitive scientific equipment.

4. Efficient Trucking and Delivery: No more endless phone calls with trucking companies. We handle it all – from pickup trucks to delivery vehicles. Just sit back and watch as your goods fluidly roam from Thailand's bustling streets to the quaint lanes of Czechia.

5. Convenience is King: Instead of juggling between different freight companies and customs clearance processes, Door to Door service makes your life easier. We are your one-stop-shop for all international shipments.

Choose Door to Door service: because you've got enough grey hairs as it is.

DocShipper – Door to Door specialist between Thailand and Czechia

Unsure where to begin with shipping your goods from Thailand to Czechia? Entrust your items with DocShipper. We manage every step: packing, transportation, customs clearance, across all transport modes, to ensure a seamless journey. You can sit back and track your shipment, as a dedicated Account Executive takes charge. Quick, efficient, and stress-free, we offer free estimates within 24 hours or immediate assistance via a call. Step into hassle-free international shipping with DocShipper.

Customs clearance in Czechia for goods imported from Thailand

Customs clearance is a complex, often confusing part of importing goods; in this case from Thailand into Czechia. It’s an essential process involving calculating duties, taxes, quotas, and licenses based on the goods’ value and their Harmonized System (HS) codes. Missteps such as incorrect calculations can lead to unexpected fees, delays, and even goods being held up in customs.

Thankfully, the nuances of Czechia's customs process are unpacked in the following sections to help you confidently navigate this task. Remember, DocShipper can manage the entire process for any type of goods, anywhere in the world. Just provide us with the origin, the value, and the HS Code of your goods. These details are crucial for us to give you an accurate costing and airtight process. For expert assistance, don't hesitate to reach out to our team!

How to calculate duties & taxes when importing from Thailand to Czechia?

Understanding how to estimate duties and taxes while importing from Thailand to Czechia is essential for your successful shipping venture. In order to calculate customs duties precisely, several elements come into play. Firstly, you need to identify the country of origin, which is where your goods are manufactured or produced. This is a crucial piece of the puzzle, as both the exporting country, in this case Thailand, and the importing country, Czechia, will use this to determine which trade agreements or conditions apply.

Next, you must identify the HS Code of your product, essential for categorising goods according to a standardized nomenclature. The Customs Value then comes into play - this is the complete cost of your products, including the purchase price, transportation, and insurance costs up to the port of entry.

Following these, the Applicable Tariff Rate is to be determined - this rate is applied to the Customs Value to calculate the actual duty. There may be additional taxes, and fees that you need to account for depending on the product type and import regulations of Czechia.

Remember, initiating this process means determining specifically where the goods you're transporting were produced. This should be your first step in calculating customs duties for your imported goods.

Step 1 - Identify the Country of Origin

Knowing the Country of Origin is key in international trade. Here's why:

1. Trade Agreements: Thailand and Czechia, being part of the European Free Trade Association and ASEAN respectively, enjoy certain duty relaxations. Knowing specific deals can help you save on costs.

2. Customs Duties: Determining the origin country decides the duty amounts under the Harmonized System codes.

3. Product Regulations: Different countries have specific product safety and standards regulations. Making sure your goods comply saves you from legal troubles later.

4. Import Restrictions: Certain goods have stringent restrictions or might be completely banned. Steering clear of these goods provides a smoother transport experience.

5. Documentation: Smooth customs clearance comes from precise documentation reflecting the correct country of origin

Take advantage of the bilateral trade agreements, like the recently negotiated EU-ASEAN agreement that has further slashed duties on numerous goods. Be aware of specific import restrictions, like the ones Czechia imposes on certain agriculture and animal products from Thailand. Bid adieu to import hassles by identifying your goods' Country of Origin accurately from the start.

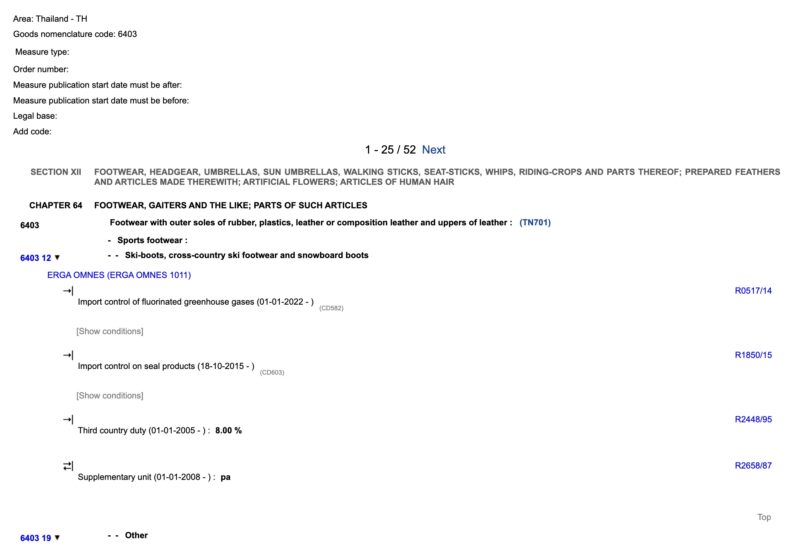

Step 2 - Find the HS Code of your product

The Harmonized System (HS) code plays a pivotal role in global trade, as it provides a standardized method of classifying products. These six to ten digit numbers are universally recognized, allowing each product to be identified easily during the import-export process, whether it's by customs officials or by your own freight forwarder.

You can often obtain the HS code of your product directly from your supplier since they are accustomed to export processes and likely already have this information at their disposal.

When sourcing HS codes isn't feasible from your supplier, you can always conduct your own search by utilizing an HS lookup tool. An excellent choice for this is the 'Harmonized Tariff Schedule' tool.

To find the HS code using this tool, break down your search into these three steps:

1. Access the 'Harmonized Tariff Schedule' lookup tool using this link.

2. Type the name of your product into the search bar.

3. Review the Heading/Subheading column for your HS code.

Please note that accuracy is crucial when choosing your HS code. An incorrect code may result in unexpected delays, additional costs, and potential fines.

Here's an infographic showing you how to read an HS code.

Step 3 - Calculate the Customs Value

Understanding the 'Customs Value' can seem tricky, but let's demystify it together. Imagine you've bought a batch of wooden furniture from Thailand for, say, $1000. That's not your customs value. It sounds confusing, right? Let's unscramble it. The customs value includes the cost of your goods, international shipping, and insurance. This whole sum is commonly known as the CIF value (Cost, Insurance, and Freight).

Say, for instance, your shipping cost is $200 and insurance is $50, your customs value sums up to $1250, not just the $1000 you paid for the goods. It's crucial to get this right because the Czech customs authorities will use this CIF value to calculate any import duty. By understanding your Customs Value, you can accurately anticipate your overall shipment expenses. Keep your invoice breakdown handy and you'll breeze through the calculations.

Step 4 - Figure out the applicable Import Tariff

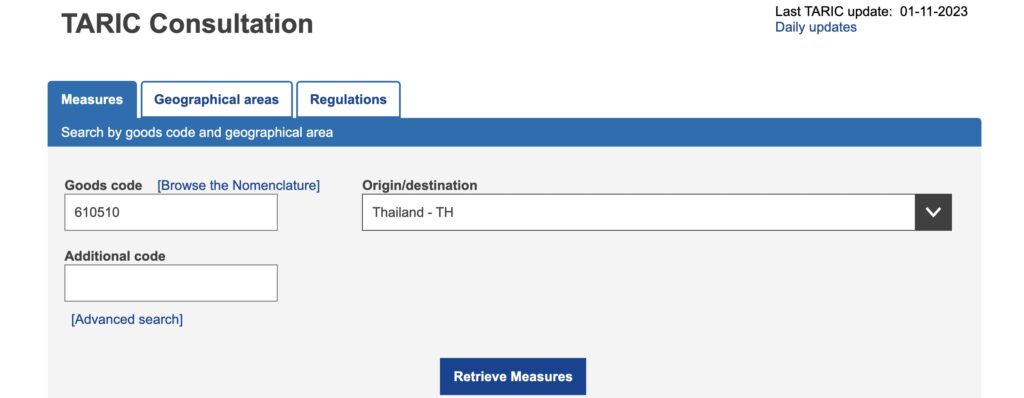

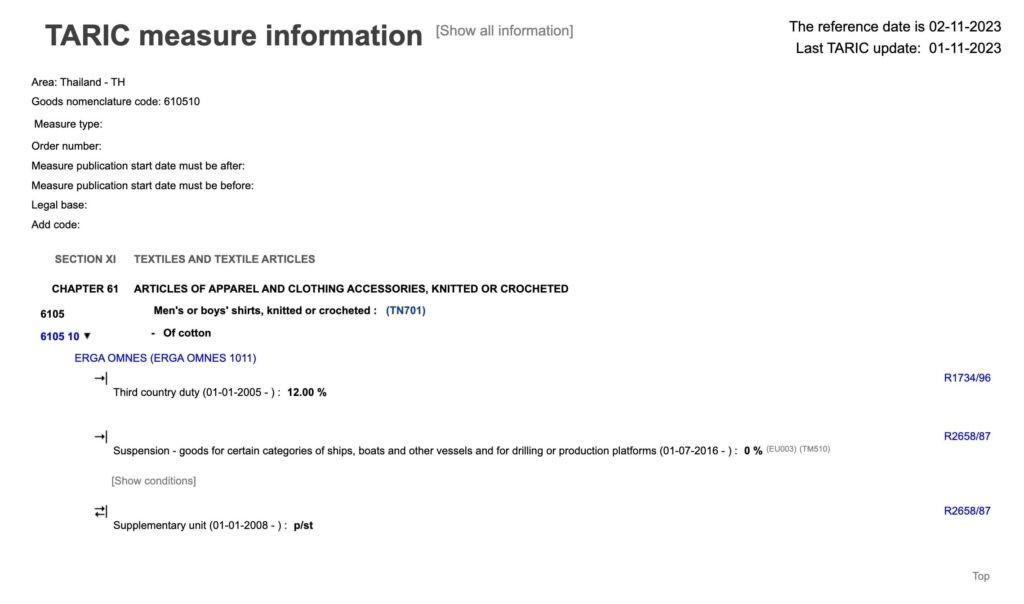

Import tariffs are essentially the tax levied on goods crossing international borders. For goods imported from Thailand to Czechia, which is part of the European Union, the applicable tariff can be determined using the TARIC System - European Customs.

Here's how you determine your import tariff:

1. Go to the TARIC Consultation Tool and enter the Harmonised System (HS) code derived in the previous steps along with Thailand as the country of origin.

2. The tool will display the duties appropriate to your product.

Let's apply this: Assume your product's HS code is 610510 (men’s or boys’ shirts of cotton, knitted). The tool shows a tariff rate of 8% for this product category. For illustration purposes, let's say your Cost, Insurance, and Freight (CIF) costs total to USD 5000.

So, the import duties would be 8% of USD 5000, which equals USD 400. This way, you can determine the cost of importing your goods into Czechia from Thailand and plan your budget accordingly.

Here's a screenshot to guide you:

You should insert the HS Code in the "Goods code" section, along with the country of destination. Once this is done, click on "Retrieve Measures" and you will be able to see the duties and taxes, here's what it should look like:

Step 5 - Consider other Import Duties and Taxes

When shipping goods from Thailand to Czechia, standard tariff rates apply, but watch out for additional import duties. Depending on the product and country of origin, you might encounter these extras!

Excise duty is often slapped on specific products, such as tobacco, alcohol, or energy products. Another potential is anti-dumping taxes, usually applied when a foreign producer sells goods in pretty much 'dumping' prices, potentially disrupting the local market.

But the heaviest additional charge usually comes from VAT, critical to factor into your costings. In Czechia, the standard VAT rate is 21%, with reduced rates of 15% or 10% for specific types of goods. To calculate what you'll owe, add the customs value to the duty paid, and then apply the VAT rate.

For example - if the customs value of your shipment is $10,000, and the duty is $500, your VAT would be $2,210 (21% of $10,500). Bear in mind these are hypothetical numbers, and rates may vary.

Remember, forewarned is forearmed. By anticipating these charges, you can build a cost-effective and efficient shipping strategy.

Step 6 - Calculate the Customs Duties

Calculating customs duties for goods imported from Thailand to Czechia can be a complex process - but you've got this! Start off by defining the customs value of your goods, which includes the purchase price plus insurance and freight to Czechia.

For our first example, say your customs value is $10,000 and the customs duty rate is 5%. Here, your customs duty would be $500 ($10,000 5/100), with no VAT involved.

In the second scenario, with both customs duties and VAT, say the customs value is $20,000 with the same 5% duty rate and a VAT of 21%. Your customs will come to $1,000 ($20,000 5/100), and your VAT will be $4,410 (($20,000+$1,000)21/100), totaling $5,410.

Our last scenario includes customs duties, VAT, anti-dumping taxes, and Excise Duty. If you have a customs value of $30,000, a duty rate of 10%, a VAT of 21%, an anti-dumping duty of 10%, and a $2 per unit Excise Duty for 1000 units, it gets a bit more complex. Your customs duty will be $3,000 ($30,000 10/100). The anti-dumping duty will be $3,300 ($30,000+$3,000)10/100. Then, your VAT would be $7,860 (($30,000+$3,000+$3,300)21/100). Finally, your Excise Duty is $2,000 ($21000). This means your total taxes come to $16,160.

Sound overwhelming? At DocShipper, we specialize in customs clearance worldwide and can streamline the process to ensure you don't overpay. Contact us for a free quote in less than 24 hours, and let us take this load off your shoulders.

Does DocShipper charge customs fees?

Understand that while DocShipper, as a customs broker in both Thailand and Czechia, does facilitate your customs clearance, we do not impose your customs duties. These are government charges, distinct from our clearance fees. Picture it as shopping at a grocery store: you pay for groceries plus sales tax. Here, your goods are the groceries, the sales tax represents customs duty, and our charges are like a service fee for carrying your groceries to your car! We provide authentic customs documentation to assure you that what you're paying is solely the government's claim on your shipment.

Contact Details for Customs Authorities

Thailand Customs

Official name: The Customs Department of Thailand

Official website: www.customs.go.th/

Czechia Customs

Official name: General Directorate of Customs, Czech Republic

Official website: www.celnisprava.cz

Required documents for customs clearance

Frustrated by the paperwork wrangle of international shipping? We'll help you cut through the red tape. This section untangles the complexities of the Bill of Lading, Packing List, Certificate of Origin, and conformity documents (like CE standard), taking the guesswork out of customs clearance. Get ready to master the must-have documents that get your goods across borders like a pro.

Bill of Lading

Shipping goods between Thailand and Czechia? Then you'll be needing a Bill of Lading. This document is your golden ticket in global logistics, marking the transfer of ownership from supplier to buyer. Its importance cannot be overstated. But did you know there's also a digital counterpart? The Telex release enables secure electronic transfer of this document, speeding up the delivery process, making it a win-win for all parties involved. For air shipments, don't forget the AWB (Air Waybill): it's the air freighting cousin of the Bill of Lading. These essentials will help streamline your customs clearance, ensuring your goods reach their destination swiftly and hassle-free. Stay ahead of the game; understand your documents.

Packing List

The Packing List is like your shipping inventory; it's a testament to your organized approach in transporting goods from Thailand to Czechia. Sea or air, it doesn't matter - without a comprehensive packing list, no container gets a go-ahead. It's the shipper’s responsibility to list down every item in the load, meticulously detailing the description, quantity, and often the value too.

Why so much fuss? A Packing List maintains complete transparency with customs officials, eliminating unnecessary delays. Say you're sending 5000 hand-stitched summer hats from Chiang Mai to Prague, the list helps the customs check if there's anything suspicious hiding among your delicate hats. No surprises, no hassles. A clearly formatted packing list might be your golden ticket to a smooth shipping experience.

Commercial Invoice

Commercial Invoice, the star player in your shipping journey from Thailand to Czechia, holds essential details like seller and buyer data, product description, HS codes, etc. It's the first point of review for Czech customs. Overlooking details? Not a good idea. Keeping it accurate with other shipping documents? Critical. Realize that wrong data on your invoice screams delay in customs language. And time equates to money in international freight.

So, double-check matching details on your Bill of Lading, especially the consignee and shipper's information. Remember, uniformity is key to a smooth customs clearance process. Save your business the hassle, get your Commercial Invoice right and tight!

Certificate of Origin

When navigating the shipping journey from Thailand to Czechia, don't underestimate the power of your Certificate of Origin. This key document can unlock some sweet customs benefits, like preferential duty rates, making your cargo's voyage more cost-effective. Let's say, for example, your shipment is a batch of lovely Thai rice – indicating Thailand as the 'country of manufacture' on this certificate can reduce the amount of customs duty you're charged in Czechia. Because, let's face it, any savings in shipping are a big deal. But remember, accuracy is crucial here - this isn't the place for guesswork. A little effort spent on correctly documenting the origin of your goods can lead to significant savings on your bottom line. Happy shipping!

Certificate of Conformity (CE standard)

When shipping from Thailand to Czechia, a crucial document for customs clearance is your Certificate of Conformity (CE standard). Like a passport for your goods, this attests they meet all the necessary European market safety, health, and environmental protection requirements. Note, it's distinct from your quality assurance as it exclusively tends towards European regulatory standards. If your product was previously catering to US standards, you could find differences, as CE standards often appear stricter.

Remember CE marking is not a quality indicator, but a regulatory mark mainly concerned with the safety of the product. If your goods lack this, they might be blocked at the Czechia border. In this way, CE standard can open European doors for your products. Even in the post-Brexit world, Czechia remains integral to Europe, hence CE standard is non-negotiable. Use it as an opportunity rather than a hurdle. Reframe your perspective, and enjoy smooth shipping between Thailand and Czechia.

Your EORI number (Economic Operator Registration Identification)

Securing your EORI number is key if you’re shipping goods from Thailand to Czechia. It's like your passport at customs, indispensable for clearances within the EU, of which Czechia is part. Here's why: every business or individual involved in importing or exporting goods needs this unique identifier for tracking their movements, similar to how FedEx tracks your package. Registration isn't daunting either – you can do this online via the EU’s website. Forget the red tape nightmares; with your EORI in place, expect smooth sailing for your shipments between these two countries.

Get Started with Siam Shipping

Navigating the intricate maze of customs clearance between Thailand and Czechia can be daunting. But with DocShipper, it doesn't have to be! Our team of experts ensures a smooth, hassle-free clearance process, saving you precious time and unnecessary stress. Ready to take the next step? Contact us now for a free quote delivered to your inbox in less than 24 hours. We’re here to make your shipping journey easier.

Prohibited and Restricted items when importing into Czechia

Slipping up with out-of-bounds items can lead to fines and delays when importing to Czechia. Trust us, you don't want that! Knowledge is key - there's valuable info ahead about items that are off-limits or restricted. Read up, stay efficient, and avoid unnecessary hiccups with Czech customs.

Restricted Products

- Weapons and Ammunition: You have to apply for a Firearms and Ammunition Trade License from the Czech Trade Inspection Authority.

- Medical devices: You'll need the Special Permission from the Ministry of Health of the Czech Republic.

- Radioactive materials: A Radiological License from the State Office for Nuclear Safety is required.

- Drugs and Pharmaceuticals: These require a Public Health Permit. You can apply for it at the Ministry of Health of the Czech Republic.

- Live Animals: Don't forget to get a Veterinary Inspection Certificate from the State Veterinary Administration.

- Dairy, Meat and Fish Products: You have to apply for another Veterinary Inspection Certificate, head to the State Veterinary Administration.

- Plant Products: A Phytosanitary Certificate from the Central Institute for Supervising and Testing in Agriculture is compulsory.

Prohibited products

- All types of narcotic drugs and psychotropic substances.

- Obscene and indecent articles, publications, video tapes and software.

- Counterfeit or pirated goods or materials.

- Illegal wildlife and endangered species, along with their by-products.

- Radioactive substances.

- Explosives and fireworks without appropriate permits.

- Certain products of animal origin from non-EU countries.

- All types of weapons, ammunition and military equipment without special permits.

- Pesticides and other harmful chemicals without special documentation.

- Cultural artifacts and national treasures.

Are there any trade agreements between Thailand and Czechia

Yes, trade between Thailand and Czechia is facilitated by the ASEAN-European Union Free Trade Agreement. This reduces tariffs, simplifies customs procedures, and encourages economic collaboration. While there's no direct partnership, both nations take part in the Ayeyawady-Chao Phraya-Mekong Economic Cooperation Strategy (ACMECS) fostering trade growth. However, remember, specific product classifications can greatly influence your final duty costs. Monitor ongoing discussions, such as the potential rail link connecting Thailand with Europe, offering immense transport opportunities in the future.

Thailand - Czechia trade and economic relationship

Thailand and Czechia have established a lucrative bilateral trade and economic extension since 1926. Being a significant trading partner of Thailand, Czechia's involvement spans several sectors including automobiles, machinery, and electronics. Specifically, Škoda Auto, a leading Czech firm, is remarkable for its collaboration with the Thai auto industry. Similarly, Thai products, including food supplies and rubber, have found a thriving market in Czechia.

The investment ebb and flow between these nations have notable contributions; Thai investments in Czechia amount to an approximated $200 million, with Czech investments in Thailand at a value of $100 million. The total trade volume displayed a promising increase, reaching $334 million in 2019. Also, after the visit of the Thai Prime Minister to the Czech, Thailand encouraged the Czech to continue buying Thai products, especially agricultural products. This historical exchange and strategic collaborations demonstrate a robust and mutually beneficial economic ties. These figures paint a picture of an ever-evolving economic relationship, enriching both nations' continual development.

Your Next Step with Siam Shipping

Frustrated with the complexities of shipping goods between Thailand and Czechia? Let DocShipper simplify it for you. From handling customs, administrative strategies to choosing the best transport mode, we've got you covered. Say goodbye to unexpected issues and hello to smooth sailing. Ready to lighten your shipping burden? Get in touch with us today.

Additional logistics services

Dive into DocShipper's arsenal of extra logistics solutions, streamlining your supply chain beyond mere shipping and customs. Uncover how we handle everything from warehousing to distribution, ensuring a smooth journey for your goods.

Warehousing and storage

Finding the right warehousing for your goods, especially when they need specific conditions like temperature control, can be a head-scratcher. But don't fret - our robust solutions offer a worry-free experience. Need to store Thai spices or Czech glassworks? Get the perfect conditions every time. Soak up more nuggets of wisdom on our dedicated Warehousing page.

Packaging and repackaging

Proper packaging becomes crucial when shipping between Thailand and Czechia, ensuring your precious freight remains intact. Whether it's fragile ceramics or sturdy automotive parts, a reliable agent can cater to diverse packaging needs. Take, for instance, bespoke wooden crates for valuable artefacts. More info on our dedicated page: Freight packaging.

Cargo insurance

For every shipping venture, Cargo Insurance acts as your trusted safeguard. Contrary to Fire Insurance—which covers losses from fires—Cargo Insurance takes it a step further. It shields your goods both from unforeseen accidents and transport conditions that could potentially harm them. Picture your product's unfortunate exposure to rain or damaging sea-air - an insurance policy ensures those risks are mitigated. For more gainful insights, explore our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

If you're looking to source or manufacture in Asia, East Europe, and more, DocShipper streamlines the task with efficient supplier management. Our expert team negates language hurdles while guiding you through the entire procurement journey. For instance, if you have your eyes on Czech glass manufacturers, think of us as your reliable touchpoint to great products and services. Delve into the details on our dedicated page: Sourcing services.

Personal effects shipping

Relocating from Thailand to Czechia or vice versa? Your personal belongings - appliances, souvenirs, keepsakes - deserve top-tier care, especially when they're fragile or large. Lean on our high-flexibility solution for moving these special items, just like Mr. Somchai who safely shipped his vintage Buddha statue collection to Prague. More info on our dedicated page: Shipping Personal Belongings.

Quality Control

Ensuring quality is crucial when shipping from Thailand to Czechia. Picture this: you're manufacturing beautiful wooden furniture in Chiang Mai, but upon arrival in Prague, your client finds blemishes and defects. Ouch! With our Quality Control service, these nightmares are averted. Our experts scrutinize every detail of your goods, ensuring they're up to standard, leaving no room for nasty surprises. Keep your clients smiling. More info on our dedicated page: Quality Inspection.

Product compliance services

Meeting product compliance regulations is crucial when importing or exporting. Mistakes can lead to costly fines, or worse, barred entry for your goods. Our Product Compliance Services offer laboratory testing and certification to ensure products align with destination regulations. Avoid complications and keep operations smooth.More info on our dedicated page: Product Compliance Services.

FAQ | Freight Shipping between Thailand and Czechia | Rates - Transit times - Duties and Taxes

What is the necessary paperwork during shipping between Thailand and Czechia?

When shipping from Thailand to Czechia, the necessary paperwork includes a bill of lading for sea freight or an air waybill if air transport is used. These documents are absolutely crucial and rest assured, we'll manage these for you at DocShipper. Furthermore, you'll need to furnish us with a packing list and a commercial invoice. Depending on the type of goods being transported, certain additional documents such as Material Safety Data Sheets (MSDS) or certifications might be required. Please remember that careful documentation is key to a smooth and successful transport process.

Do I need a customs broker while importing in Czechia?

Yes, it's highly advisable to employ a customs broker while importing in Czechia due to the potentially complex and stringent customs process. At DocShipper, we routinely represent your cargo at customs for most shipments. Our specialized personnel understand the intricacies of the customs process and can expertly handle all mandatory document submissions, ensuring a seamless import process. This professional assistance can be crucial in avoiding complications or delays that can result from errors or missing information. Our valuable experience can make your import operation into Czechia smoother and more efficient.

Can air freight be cheaper than sea freight between Thailand and Czechia?

Whether air freight is cheaper than sea freight between Thailand and Czechia depends on various factors, including route, weight, and volume of the goods. As a rule of thumb, if your cargo is less than 1.5 cubic meters or weighs under 300 kg (660 lbs), air freight could potentially be more cost-effective. At DocShipper, we take these factors into account to offer you the most competitive shipping option. Rest assured, your dedicated account executive is always on hand to help you make the best decision for your business.

Do I need to pay insurance while importing my goods to Czechia?

We want to ensure that you understand the intent behind shipping insurance. While it's not a requirement while transporting goods to Czechia or anywhere else in the world, it's a safety net we proudly recommend. The shipping arena can be unpredictable, and instances of damage, loss, or theft could occur. Even though we employ every measure to safeguard your goods during transit, insurance helps you mitigate financial risk involved in unforeseen circumstances. So, while you're not obliged to pay for insurance, it's a smart move to consider.

What is the cheapest way to ship to Czechia from Thailand?

Shipping from Thailand to Czechia, we recommend sea freight as your most cost-efficient option. Due to the sizeable geographical distance, air freight may be faster but will cost considerably more. With sea freight, although transit times can be longer, you'll save a significant amount on shipping costs, making it an ideal choice for non-time-sensitive shipments.

EXW, FOB, or CIF?

The best choice between EXW, FOB, or CIF largely depends on your relationship with your supplier. They might not specialize in logistics, which is where we step in. At DocShipper, we excel at handling all aspects of international freight and destination processes. Suppliers often sell under EXW or FOB terms, covering charges until the factory door or the origin terminal, respectively. This scenario, however, shouldn't limit your options. We have the resources and expertise to provide door-to-door service regardless of what terms your supplier prefers. Remember, ensuring a smooth logistics process is our top priority.

Goods have arrived at my port in Czechia, how do I get them delivered to the final destination?

If your goods are shipped under CIF/CFR terms and have reached the Czechian port, you will need to engage a custom broker or a freight forwarder to clear them and deliver to your final destination. However, our DocShipper team can handle the complete journey for you with the DAP incoterm, ensuring a smooth process. It's best to discuss this with your account executive to confirm the best approach for your shipment.

Does your quotation include all cost?

Absolutely, we ensure transparency in our dealings. Our quotation includes all costs except for duties and taxes at your destination, which are subject to local regulations. However, your dedicated account executive can assist you with an estimate to avoid any unexpected costs. We're committed to making the whole process as clear and surprise-free as possible.