Ever tried to figure out how a coconut from Thailand ends up in a store in Mexico? If so, you've stumbled upon the complex world of international freight forwarding, and it's no piece of cake! Businesses often grapple with understanding rates, transit times, and navigating through an abyss of customs regulations.

Fear not, this guide is here to simplify the process, providing crucial insights on various freight options from air to sea, seamlessly deconstructing the customs clearance process, comprehending duties, taxes, and practical advice tailored for your business needs. If the process still feels overwhelming, let Siam Shipping handle it for you!

As your one-stop international freight forwarder, we turn any shipping challenges into a successful journey by curating every step of your goods transportation.

Which are the different modes of transportation between Thailand and Mexico?

Trekking from Thailand to Mexico is like sprinting the length of a marathon - it's quite a distance! To deliver your goods in one piece, you need the right transport method. With vast oceans and countless borders between them, air and sea freight prevail as the most practical options.

Like choosing between a speedboat or a jumbo jet, your choice should hinge on the nature of your cargo, speed requirements, and budget. Let's dive into the pros and cons of these methods to see how they align with your shipping needs. Steer your shipping success with the right choice!

How can Siam Shipping help?

Looking to ship goods between Thailand and Mexico? Let Siam Shipping streamline the process for you! From customs regulations to transportation logistics, we've got you covered. Don't get lost in paperwork; let our experienced team do the hard work for you. We're just a call away and ready to offer you a free estimate within 24 hours. Reach out and let us handle your shipping needs.

![]()

Siam Shipping Tip: Consider ocean freight if:

- You are shipping large volumes or bulky items, as sea freight offers the most space at a cost-effective rate.

- You're not racing against the clock. Ocean freight takes its sweet time, especially when stacked up against other transport methods.

- Your supply chain is linked up with big-name ports. Think of it as the VIP lane on the maritime superhighway.

Sea freight between Thailand and Mexico

Shipping goods across the globe between Thailand and Mexico may seem like an arduous task, but it's actually a vibrant trade channel brimming with possibilities. Bangkok and Monterrey, key industrial hubs, are connected through crucial cargo ports such as Laem Chabang in Thailand and Manzanillo in Mexico.

Opting for ocean shipping is a cost-effective move for those dealing in high-volume goods, despite it being a somewhat slow process. It's much like taking a scenic, budget-friendly road trip instead of a more costly flight - you have more room for your belongings but it'll take longer to reach your destination.

But don't be fooled! The voyage isn't always smooth sailing. Missteps and confusion often plague businesses embarking on shipping between these two countries. Deciphering shipping codes, overcoming language barriers, and missing a single customs detail can cost you both time and money.

But don't worry! In our guide, we'll walk you through proven strategies, important specifications, and insider tips that will simplify your seajourney. Think of it like your trusty compass - leading you safely through the swirling waters of international shipping.

Understanding these tactics will ensure your goods arrive timely and in pristine condition. So stay tuned, because we're about to make the complex, effortlessly simple.

Main shipping ports in Thailand

Laem Chabang Port

Located in the Chonburi Province, this port is indispensable to Thailand's trade, with a shipping volume of approximately 872,000 metric tons. Thailand's modern and advanced infrastructure makes it a prime gateway for key industries such as auto production and electronics.

Key Trading Partners and Strategic Importance: Principal trading partners include China, Japan and the USA. Laem Chabang’s strategic importance is undeniable, as it’s the country’s main deep seaport, able to accommodate even the largest vessels.

Context for Businesses: If you're moving goods that require robust infrastructure such as heavy machinery or vehicles, Laem Chabang Port will be a primary consideration, given its well-equipped handling capabilities.

Bangkok Port

Nestled on the Chao Phraya River in the heart of Thailand’s capital city, Bangkok Port handles close to 21 million tons. The port's advantage lies in its accessibility to the large consumer market in Bangkok.

Key Trading Partners and Strategic Importance: Crucial trading partners include China, Japan, and the European Union. The port's strategic location increases its import and export efficiencies, especially for time-sensitive goods.

Context for Businesses: If you’re targeting the thriving consumer market in Bangkok, implementing Bangkok Port as part of your logistics might be highly advantageous.

Map Ta Phut Industrial Port

Situated in Rayong Province, Map Ta Phut ranks as the globe's 8th largest industrial port with an annual traffic of 3.5 million tons. It specializes in the petrochemical industry and bulk cargoes.

Key Trading Partners and Strategic Importance: Partners cover various countries, with exports primarily reaching Asian markets. As the focal hub for Thailand's massive petrochemical industry, the port carries immense strategic importance.

Context for Businesses: If you're involved in the petrochemical industry or rely on bulk shipping, Map Ta Phut Industrial Port can significantly streamline your shipping processes.

Sattahip Commercial Port

Located in the Chonburi Province close to Pattaya City, Sattahip is a smaller port capable of handling up to 15 million tons of cargo.

Key Trading Partners and Strategic Importance: It mainly facilitates intra-ASEAN trade. Its strategic importance lies in its military and naval facilities, which could provide security benefits during sensitive political times.

Context for Businesses: If you're primarily dealing with ASEAN-member countries, Sattahip Commercial Port could be an efficient part of your shipping strategy.

Songkhla Port

Based on Thailand's southern peninsular coast near the border with Malaysia, Songkhla Port is a maritime gateway to the southern provinces. It handles around 3 million tons a year.

Key Trading Partners and Strategic Importance: The port's key trading partners are Malaysia and other ASEAN countries. Its strategic value lies in its connections to Thailand's southern provinces and its access to a bustling fishing industry.

Context for Businesses: If you're exploring opportunities in the thriving seafood market or aiming at southern provinces of Thailand, Songkhla Port might help tap into these regions effectively.

Sriracha Harbor Deep Seaport

Positioned in the Chonburi province, Sriracha Harbor handles an estimated volume of 3 million tons. It plays a central role in Thailand's grain export sector.

Key Trading Partners and Strategic Importance: The port plays a key role in the nation's grain export, majorly to China and other East Asian markets, imparting it significant strategic importance.

Context for Businesses: Should you be a part of the grain industry or trading along East Asia, Sriracha Harbor Deep Seaport may be an essential consideration for your logistics.

Main shipping ports in Mexico

Port of Veracruz

Location and Volume: Located on the Gulf of Mexico, the Port of Veracruzhttp://www.puertodeveracruz.com.mx/english/ is not just the oldest port in Mexico, but also one of the most significant in terms of overall shipping volume, handling over 2.5 million metric tons a year.

Key Trading Partners and Strategic Importance: The port is a significant hub for trade with the United States, Central and South America, and Europe. It plays a critical role in Mexico's petroleum industry, with specialized terminals for these products.

Context for Businesses: If you're looking to ship goods such as automobiles, agricultural commodities, or petroleum products, the Port of Veracruz, with its modern infrastructure and wide range of specialized terminals, could be an integral part of your shipping strategy.

Port of Manzanillo

Location and Volume: Based on the Pacific Ocean coastline, the Port of Manzanillo is Mexico's busiest port. It handles over 11 million metric tons of cargo, making it one of the largest container ports in the country.

Key Trading Partners and Strategic Importance: The port is a critical link in trade with Asia, especially China, Japan, and South Korea. The port's strategic positioning makes it a gateway for goods moving between Asia and the Americas.

Context for Businesses: For businesses aiming to move goods to or from Asia, or focusing on commodities such as minerals, grains, or cargo containers, the Port of Manzanillo, with its extensive capacity and strategic location, could be a valuable asset to your logistics plan.

Port of Lazaro Cardenas

Location and Volume: The Port of Lazaro Cardenas is also on the Pacific coastline and handles 25 million tons of cargo.

Key Trading Partners and Strategic Importance: Its most significant trading partners are China, the United States, and Japan. The port is especially crucial for the steel industry due to the nearby ArcelorMittal steel plant.

Context for Businesses: If your business model involves the movement of goods such as steel, auto parts, or bulk agricultural goods, the Port of Lazaro Cardenas could offer logistical advantages due to its specialization in these areas.

Port of Altamira

Location and Volume: Settled in the northeastern part of Mexico on the Gulf Coast, the Port of Altamira handles a volume close to 1.65 million metric tons a year.

Key Trading Partners and Strategic Importance: The port's main trading partners include the United States, Germany, and Italy. It stands out for its specialization in handling large pieces of machinery and equipment, making it a strategic location for heavy industry.

Context for Businesses: If your shipping requirements include oversized or heavy cargo, consider the Port of Altamira could be a beneficial addition to your logistical operations due to its specialized handling capacities.

Port of Ensenada

Location and Volume: The Port of Ensenada, located on the Baja California Peninsula, is the second closest port to Los Angeles and manages around 250,000 metric tons.

Key Trading Partners and Strategic Importance: This port is pivotal for trade with China and the United States. It is also particularly important for Mexico's growing cruise industry.

Context for Businesses: If you're looking to capitalize on the booming tourism sector or planning shipments to or from California, the Port of Ensenada, due to its geographical proximity and facilities, could be a valuable part of your logistics.

Port of Progreso

Location and Volume: The Port of Progreso, located in the state of Yucatan on the Gulf of Mexico, is growing rapidly. It handles just under 3 million metric tons of cargo annually.

Key Trading Partners and Strategic Importance: The port has direct maritime routes with the United States, Europe, and the Caribbean islands. It's strategically important for the region's fishing and food-related industries.

Context for Businesses: If you are in the food industry looking to export to markets across the Atlantic or import goods from the Caribbean, the Port of Progreso, with its strategic location and growing status, could make a significant contribution to your supply chain orchestra.

Should I choose FCL or LCL when shipping between Thailand and Mexico?

Choosing whether to ship by full container load (FCL) or less than container load (LCL) from Thailand to Mexico is a pivotal business decision. It's a balancing act that weighs cost, time and the smooth delivery of your goods.

This section scans both options—FCL's all-or-nothing approach versus the shared space of LCL—to help you decipher which fits best with your specific shipping requirements. We'll dive into the details, so you're up-to-speed and equipped to make a well-informed choice. Your successful shipping experience starts here.

LCL: Less than Container Load

Definition: LCL (Less than Container Load) is a shipping term that refers to when your cargo doesn't completely fill up an entire container, and needs to be consolidated with goods from other shippers.

When to Use: Consider LCL shipping when your cargo measures less than 13-15 cubic meters. This option is more cost-effective as you only pay for the space you use. Its flexibility comes in handy for businesses with lower-volume shipping needs or when shipping frequency is inconsistent.

Example: Let's say a Bangkok-based producer of organic rice needs to send a shipment of 10 cubic meters to a client in Mexico City, but doesn't have enough to fill a full container. An LCL shipment would be the optimal approach as it neither wastes space nor costs extra.

Cost Implications: While LCL freight might seem more affordable due to space utilization, be aware of additional costs. These might include destination charges, deconsolidation fees, and possibly higher LCL rates when belongings are small and light. Therefore, careful budget management becomes paramount when opting for LCL shipping between Thailand and Mexico.

FCL: Full Container Load

Definition: Full Container Load (FCL) shipping refers to when an exporter rents a whole container solely for their cargo, usually either a 20'ft or 40'ft container.

When to Use: FCL shipping is best suited for high-volume shipments, particularly those exceeding 13/14/15 cubic meters (CBM). The significant feature of FCL is that the container remains sealed from origin to destination, adding an extra layer of security, which makes it a preferred option for valuable goods.

Example: Consider a furniture exporter looking at FCL shipping between Thailand and Mexico. Let's say she has a consignment of 16 CBM. The FCL shipping quote she gets is affordable, and the sealed container ensures her delicate teakwood furniture remains secure during the journey.

Cost Implications: Companies see cost benefits when shipping large volumes. High-volume translates into better utilization of space, lowering the unit cost. However, it's essential to factor in costs associated with storing and transporting full containers. While the FCL container may seem pricey initially, it cost-effectively caters to high-volume transportation and enhanced safety.

Unlock hassle-free shipping

Experience effortless cargo shipping with Siam Shipping, your dedicated freight forwarder. Our ocean freight experts simplify the complex choice between consolidation and full container shipping. Decisions are based on variables like your shipping volume, budget, and urgency of delivery. Let's make shipping between Thailand and Mexico a breeze. Reach out to us now for a free estimation, and get your goods moving smoothly across the seas.

How long does sea freight take between Thailand and Mexico?

The average sea freight shipping time between Thailand and Mexico can stretch up to several weeks. However, it's worth noting that a variety of factors influence this time frame. The specific oceans ports utilized, the weight of the shipment, and the nature of the goods can all affect the transit timeline.

As costs and shipping durations can vary, it is always beneficial to reach out to a freight forwarder, such as Siam Shipping, for a customized quote based on your specific requirements.

| Thailand ports | Mexico ports | Average transit time (days) |

| Laem Chabang | Manzanillo | 45 |

| Bangkok | Lazaro Cardenas | 39 |

| Map Ta Phut | Veracruz | 45 |

| Sattahip | Altamira | 50 |

*Please note that the transit times are estimations and the specific shipping time may vary based on a number of factors.

How much does it cost to ship a container between Thailand and Mexico?

Understanding ocean freight rates between Thailand and Mexico can seem complex due to several varying factors. These include your Points of Loading and Destination, the selected carrier, the specific nature of your goods, and even the whims of monthly market fluctuations, all of which makes quoting an exact shipping cost challenging.

While we can provide a wide range, say $X - $Y per CBM, we know every shipment is unique. Rest assured, our dedicated shipping specialists are here to work closely with you, providing tailor-made quotes that consider your specific needs and circumstances on a case-by-case basis. With us, you’ll get the best possible rates for your container shipping.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is designed for goods that exceed standard shipping dimensions. These containers allow for easy loading and unloading of out of gauge cargo.

Suitable for: Large items like machinery or construction equipment.

Examples: Should you be dealing with transporting items such as industrial boilers or construction vehicles, you might want to consider OOG containers.

Why it might be the best choice for you: If you have cargo that can't fit into traditional shipping containers, the OOG container's flexibility in size accommodates different types of heavy and oversized goods.

Break Bulk

Definition: Break bulk refers to shipping method whereby goods are loaded individually, not in containers. This helps with handling stillage and separate cargo.

Suitable for: Irregularly shaped and oversized goods, like large machinery, logs, or construction materials.

Examples: If you're in the industry that often ships large turbines or propellers, break bulk could be just the solution you need.

Why it might be the best choice for you: Break bulk provides a flexible shipping solution for cargo that may be too big or too impractical to be shipped using container methods.

Dry Bulk

Definition: Dry bulk refers to a shipping category specifically for loose goods, such as grains, coal, iron ore, which are loaded directly onto a ship in mass.

Suitable for: Commodities that are un-packaged and shipped in large quantities.

Examples: Think about companies transporting grains, minerals or coal. Dry bulk will be the go-to shipping option for such needs.

Why it might be the best choice for you: If your business involves large-volume, loose cargo load like agricultural or mineral commodities, the cost-effectiveness and ease of loading/unloading make dry bulk an attractive option.

Roll-on/Roll-off (Ro-Ro)

Definition: This method involves cargo that is driven on and off the ro-ro vessel on their own wheels or using a platform vehicle.

Suitable for: Motorized vehicles and heavy equipment.

Examples: Ro-Ro is the ideal choice for businesses in the automobile industry or the heavy equipment sector where trucks, buses, tractors, and other wheeled machinery are part-and-parcel of the everyday operation.

Why it might be the best choice for you: Ro-Ro allows for efficient and secure transportation of wheeled cargo, minimizing handling and potential damage during loading and unloading.

Reefer Containers

Definition: Refrigerated containers, or 'reefers', are used for goods that require temperature-controlled conditions during transport.

Suitable for: Perishable items, such as fruits, vegetables, meat, and dairy products.

Examples: If your business deals with frozen foods, pharmaceuticals, or any other temperature-sensitive goods, reefer containers are your best bet.

Why it might be the best choice for you: Reefer containers maintain a constant temperature from warehouse to destination, preserving the quality of your perishable goods.

At DocShipper, we know that choosing the best shipping option can be overwhelming. We’re here to help you navigate these choices to find the best solution for your specific needs. Contact us today for a free shipping quote in less than 24 hours.

![]()

Siam Shipping Tip: Consider Air freight if:

- Time's ticking and you can't wait. Air freight is like the express train of shipping; it's the quickest way to get your stuff from A to B.

- You're not shipping a warehouse. If your cargo is under 2 CBM, air freight is a snug fit for your smaller haul.

- Your supply chain ends somewhere off the beaten path. Airports are everywhere, so you can get your goods to those hard-to-reach spots.

Air freight between Thailand and Mexico

Jetting your goods between Thailand and Mexico might sound like a task as daunting as climbing Mt. Everest, but it doesn't have to be. Consider it more like a morning jog - brisk, efficient, and swift. Through air freight, you can zip your petite yet precious cargo like jewelry, electronics or documents, at laser-fast speed.

You'd be surprised, but weight doesn't crack your bank as much as you'd think with smaller shipments. It's the go-to route for shippers gunning for reliability and speed.

That being said, some bumps in the air freight road often catch shippers off-guard. Picture yourself at an all-you-can-eat buffet but not realizing the extra charges for drinks! Many overlook key factors like the pricing intricacies, forgetting to use the dimensional weight formula, rather than the actual weight.

These hidden blind spots can secretly skyrocket your shipping cost faster than a space shuttle. But fret not; by the end of this guide, you'll be skilled in decoding these potential pitfalls and make air freighting as smooth as a pilot's landing.

Air Cargo vs Express Air Freight: How should I ship?

Jetting your goods to Mexico from Thailand and wondering if air cargo or express air freight is your best bet? Imagine air cargo as scoring an economy seat for your merchandise on a commercial airline, while express freight is like booking a dedicated private plane.

In this guide, we'll navigate you through this aerial quandary tailored to your business's specific shipping needs. Stay tuned for a runway-ready, hassle-free export experience.

Should I choose Air Cargo between Thailand and Mexico?

Opting for air cargo between Thailand and Mexico might be a strategic move for your business. Both nations boast robust air cargo services with carriers such as Thai Airways and Aeroméxico at the forefront. These carriers offer verified reliability and enhanced security, although they might come with longer transit times due to rigid schedules.

Air cargo becomes notably cost-effective, particularly for freight weighing 100/150 kg (220/330 lbs) and up. Air freight can be a sensible solution, meeting your budgetary constraints and shipping needs.

Should I choose Express Air Freight between Thailand and Mexico?

Express air freight is a specialized service using cargo-only aircraft, perfect for small package delivery. Ideal for shipments under 1 CBM or 100/150 kg, it offers benefits like speedy delivery and extensive tracking.

Renowned courier firms such as FedEx, UPS, or DHL cater to this service. Each offers individual advantages and price points to consider. If you're dealing with smaller, high-value shipments needing quick, secure delivery from Thailand to Mexico, this could be a fitting solution.

Be sure to compare their offerings according to your specific needs.

Main international airports in Thailand

Cargo Volume: More than 1 million metric tons of cargo in 2019.

Key Trading Partners: China, Japan, USA, Hong Kong, and Germany.

Strategic Importance: As Thailand's main gateway, the airport acts as a critical hub for both passenger and cargo traffic throughout the Asia-Pacific region.

Notable Features: With modern and expansive cargo facilities, it is well-equipped to handle all types of goods, including perishable items, fragile goods, and dangerous goods.

For Your Business: Convenient access to major markets in the Asia-Pacific region and robust customs procedures make this airport a crucial hub for businesses wishing to transport cargo to and from Thailand.

Don Mueang International Airport

Cargo Volume: Approximately 1.5 million metric tons of cargo annually.

Key Trading Partners: China, Singapore, Malaysia, India, and Vietnam.

Strategic Importance: Carriers like FedEx and UPS use Don Mueang as a regional cargo hub, moving goods to and from the ASEAN region.

Notable Features: The airport is a major budget airline hub, offering cost-effective options for businesses willing to use passenger aircraft for freight.

For Your Business: If budget is a key concern, this could be a fitting option. Its strategic location can facilitate swift delivery times within the region.

Cargo Volume: Handled 12,000 metric tons of cargo a year.

Key Trading Partners: Australia, China, Russia, Malaysia, and Singapore.

Strategic Importance: Serving as a hub for southern Thailand, it connects tourists and businesses to the region's rich marine and agricultural resources.

Notable Features: The airport recently underwent expansion, allowing it to better manage larger cargo volumes.

For Your Business: Great to consider if your business deals in perishable goods like seafood or tropical fruits because the airport handles and processes such goods daily.

Chiang Mai International Airport

Cargo Volume: Shifted about 20,000 metric tons of cargo annually.

Key Trading Partners: China, Singapore, and Laos.

Strategic Importance: It serves as an essential gateway to Northern Thailand, providing critical logistical support for the region's booming textile and agricultural industries.

Notable Features: It specializes in handling and shipping textiles and perishable goods.

For Your Business: This airport is ideal if your company ships textiles or temperature-sensitive products. Its proximity to the northern provinces allows for fresher and quicker transportation.

U-Tapao Rayong-Pattaya International Airport

Cargo Volume: Though exact figures are quite low, around , its recent upgrade plans significantly increase its cargo-handling capacity.

Key Trading Partners: China, Vietnam, and Cambodia.

Strategic Importance: It's becoming a key player in the Eastern Economic Corridor (EEC) initiative, creating a land, sea, and air logistics hub.

Notable Features: There are plans to establish a Free Trade Zone, which will facilitate more streamlined customs and logistics processes.

For Your Business: Its development and future potential make it a compelling choice if your business looks to leverage tax and customs perks of a forthcoming Free Trade Zone.

Main international airports in Mexico

AICM - Mexico City International Airport

Cargo Volume: Averages over 450,000 tons annually, making it Mexico's busiest cargo airport.

Key Trading Partners: United States, China, Brazil and Canada

Strategic Importance: As the hub of Mexico's busiest city, AICM serves as a gateway to Latin America and is well-connected globally.

Notable Features: Equipped with modern infrastructures and two general cargo terminals.

For Your Business: If your markets are primarily in North and Latin America with spill overs to Asia and Europe, this well-connected hub could be instrumental for your freight forwarding strategy.

Guadalajara International Airport

Cargo Volume: Manages over 150,000 tons of freight annually, following closely behind AICM.

Key Trading Partners: United States, Hong Kong, and Columbia

Strategic Importance: Being in proximity to the Pacific Ocean, it's strategically placed for sea-air cargo shipment.

Notable Features: Serves the modern technology and electronics sectors; two cargo terminals.

For Your Business: A significant option if your business trades electronic goods or requires sea-air cargo shipment, known for its effectiveness and time savings.

Monterrey International Airport

Cargo Volume: Processes over 300,000 tons yearly, ranking third in Mexico.

Key Trading Partners: United States, China, Germany and Japan

Strategic Importance: Located in the industrial city of Monterrey, this airport is central to businesses in automotive and heavy industries

Notable Features: One dedicated cargo terminal; home to leading global freight companies, ensuring excellent service levels

For Your Business: If your freight needs cater to the automotive or heavy industries, Monterrey International can offer dedicated service and can interlink with heavy industries in the region.

Tijuana International Airport

Cargo Volume: Handles an estimated 16,000 tons annually.

Key Trading Partners: United States, Japan, and China

Strategic Importance: Sits at the border of the US, making it an ideal spot for cross-border shipments.

Notable Features: Modern cargo facilities and houses the world's first dedicated cargo airport terminal, Cross Border Xpress.

For Your Business: If your business frequently ships to or from the United States, utilizing Tijuana's airport can provide cost-effective cross-border options.

Querétaro Intercontinental Airport

Cargo Volume: Handles over 5,000 tons of cargo per year and growing.

Key Trading Partners: Germany, United States, and Canada

Strategic Importance: Located in one of Mexico's fastest-growing industrial and economic regions, attracting numerous multinational corporations.

Notable Features: Specialized in automobile and aerospace industry shipments; modern cargo facilities.

For Your Business: If you're dealing with auto parts or aerospace industry cargo, Querétaro may offer targeted services that align with your shipping needs.

How long does air freight take between Thailand and Mexico?

The typical shipping time between Thailand and Mexico by air freight averages around 3-5 days. However, it's important to understand that these timelines can fluctify depending on a few crucial factors. The specific departure and arrival airports, weight of your shipment, and the type of goods you're shipping can all greatly influence the transit time.

For the most accurate information, it's recommended to discuss your specific needs with a freight forwarder like Siam Shipping.

How much does it cost to ship a parcel between Thailand and Mexico with air freight?

Estimating an average air freight shipping rate between Thailand and Mexico, expect costs to fall in the ballpark of $4-$8 per kilogram. However, predicting an exact price is challenging due to multiple variables.

Factors such as the distance between departure and arrival airports, parcel dimensions and weight, as well as the nature of the goods contribute to final costs. Rest assured, our team is dedicated to offering you the best possible rates, quoting each case individually to meet your specific needs. Connect with us and secure a free quote tailored to your circumstance within 24 hours.

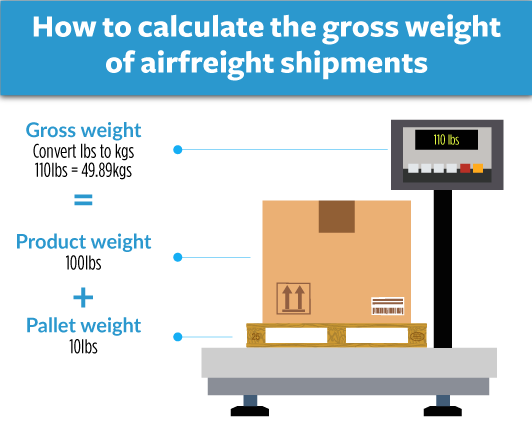

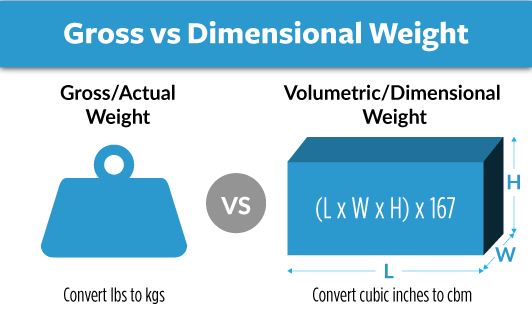

What is the difference between volumetric and gross weight?

Gross weight pertains to the actual weight of your shipment including packaging, while volumetric weight is based on the amount of space your shipment occupies in the air cargo or express air freight service.

Calculating gross weight is quite straightforward—it's the total weight of the items including packing, measured in kilograms (kg). If your shipment weighed 50kg — that's roughly 110 lbs.

Volumetric weight, on the other hand, is calculated by multiplying the height, length, and width (in cm) of your shipment, then dividing by a standard factor. In air cargo, the standard volumetric divisor is 6000. For express air freight services, it's often 5000.

So, if you're shipping a box with dimensions 50cm x 40cm x 30cm, for air cargo, it's (50 x 40 x 30) / 6000 which gives us 10kg. In express air freight, it's (50 x 40 x 30) / 5000, totalling 12kg. In lbs, these would equate approximately to 22 lbs and 26.4 lbs respectively.

These calculations matter because your freight charges are based on the heavier between the two weights. Therefore, a lightweight but large shipment could end up costly. Understanding this is crucial to making cost-effective shipping decisions.

![]()

Siam Shipping Tip: Consider Door to Door if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You appreciate having a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want less transitions for your cargo, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Thailand and Mexico

International door-to-door shipping is your hassle-free, all-inclusive solution for transporting goods from Thailand directly to Mexico. Say goodbye to the headache of managing different transportation phases; this method brings convenience, cost-saving, and efficiency to your logistics. Eager to simplify your shipping processes? Let's dive in!

Overview – Door to Door

Tackling the intricacies of freight forwarding from Thailand to Mexico? Door to door shipping is your stress-free solution. This comprehensive service, often a Siam Shipping favorite, manages everything from transportation to customs, eliminating guesswork and potential setbacks.

While slightly higher costs might apply, the peace of mind and efficiency offered are unmatched. With door to door shipping, you're freed from the complexities of shipping, letting you direct focus to other paramount business aspects. Leave the journey to us and prepare for a smooth arrival!

Why should I use a Door to Door service between Thailand and Mexico?

Think about your most stress-packed day, and then picture this - an international shipment from Thailand to Mexico waiting to rile you up even more. But, here's where a Door to Door service swoops in to save your day, and here's why:

1. Say Goodbye to Stress: Dealing with international logistics can choke you up. Door to Door service swipes away this burden, managing pickup from the origin to the trucking process till the final point in Mexico. It's like a cup of coffee minus the extra caffeine!

2. Hurry, but with composure: Shipments can be urgent, we get that. This service ensures prompt delivery, sticking to schedules like a strict school teacher while ensuring your goods reach their destination in time. Tick-tock? More like tick-tock-drop!

3. Specialized Care: Your complex cargo isn't just another item for Door to Door service. It receives customized care, much like a VIP pass in a posh event. You can rest assured your tricky cargo will be handled with a thorough understanding of its needs.

4. Convenience at its best: Organizing transport to handling customs clearance, all rolled into one service. It's like making a fancy dinner, but instead of you shuffling around to manage multiple tasks, the Door to Door service pulls off the entire gig smoothly for you.

5. Trucking Until the Final Destination: The service will truck your shipment all the way to the end, very much like a faithful dog following you around. You can put your feet up, knowing your goods are en route hassle-free, right until they reach their intended destination.

Choosing a Door to Door service between Thailand and Mexico is like the all-in-one shampoo-conditioner combo you never knew you needed. It's tailored to trim down your stress, give your cargo the pampering it needs, and bring about a whirl of convenience into your logistics process. Now, wouldn't that be a breath of fresh air?

Siam Shipping – Door to Door specialist between Thailand and Mexico

Experience seamless, door-to-door shipping from Thailand to Mexico with Siam Shipping. Our skilled team manages the entire process, from packing to customs, across all modes of transport. Your dedicated Account Executive ensures a hassle-free experience.

Get in touch for your free estimate within 24 hours or speak directly with our consultant, absolutely free of charge. With Siam Shipping, enjoy stress-free international shipping, curated just for you.

Customs clearance in Mexico for goods imported from Thailand

Customs clearance is the bureaucratic hurdle where your goods get official permission to enter a country, in this case, Mexico. The process can be a mind-field of complexities - think of unexpected costs, complex tariffs, quotas, licenses, and mercantile surprises. Goods can even be impounded. Don't panic. We'll unpack these in the following sections.

A good understanding of these elements mitigates risks, saves time, and helps you plan better. But remember, Siam Shipping can guide you every step of the way, regardless of the goods or their origin. Simply provide us with the origin, the goods' value, and the HS code. These are essential for us to proceed with your project estimates. Get in touch today to ensure a smooth customs experience.

How to calculate duties & taxes when importing from Thailand to Mexico?

Crunching the numbers on customs duties can feel like a daunting task, but if you break it down piece by piece, it becomes significantly less complex. Keep in mind that it all pivots around the country of origin, the Harmonized System Code (or HS Code), the customs value of the goods, the tariff rate applied in the destination country, and any additional taxes or fees attached to your transported goods.

First things first: identification of the country of manufacture or production is not only crucial, but also the very first step towards accurate calculation of your import duties and taxes. This critical information ties directly into pinpointing the correct HS Code and the respective applicable tariff rate, ultimately setting you on the path for an accurate duties and taxes estimation.

Step 1 - Identify the Country of Origin

Knowing your product's country of origin – in this case, Thailand – is more essential than you might think for several reasons.

Firstly, it affects the duty rate. Attention, different rates apply to different countries. Secondly, thanks to Thailand and Mexico's Free Trade Promotion Agreement (FTA), you might enjoy duty-free privileges, reducing economic strain.

Thirdly, products from certain nations might face anti-dumping duties, aimed at leveling the playing field.

Fourthly, origin affects quota restrictions. Some products have limitations on the number imported each year. Finally, knowing the country of origin helps determine eligibility for preferential tariff programs.

Understand this – import restrictions also hinge on your product's origin. In rare cases, Thailand could be subject to specific restrictions due to, for example, environmental concerns.

If you want to be on the safe side, consult the SICE Foreign Trade Information System or your freight forwarder. They can pinpoint specifics about duties, quotas, or other aspects.

Remember this, knowing the country of origin is not just a useful way to get an HS code. It's crucial for steering your goods smoothly through customs. So, take your time to figure it out correctly.

Step 2 - Find the HS Code of your product

Understanding the Harmonized System Code (HS Code) of your product is crucial while shipping it across borders. The HS Code is an internationally recognized code assigned to all products, which is used by customs authorities worldwide to identify the nature of your goods and determine the amount of customs duty that needs to be paid.

When you have this information readily available, it simplifies the shipping and customs process considerably. However, if you're unsure about how to find this crucial piece of information, don't worry. There are various ways you can go about it.

Firstly, you might want to ask your supplier, particularly if you're importing. They would undeniably be familiar with the HS Code of the product in question and the associated customs duties.

If for any reason, that avenue is not entirely helpful, we've got you covered with an easy step-by-step process to find the HS Code of your product. This method involves the use of an HS lookup tool – such as the Harmonized Tariff Schedule.

With this tool, simply key in the name of your product in the search bar and hit enter. Then peruse through the Heading/Subheading column to find the relevant HS code.

A word of caution though! Accuracy is vital when selecting the HS Code for your product. A mistake could lead not only to shipment delays but also solicit potential fines from customs authorities. Thus, it's in your best interest to be as precise as you possibly can.

And on that note, we leave you with an informative infographic that further elucidates how to read an HS Code. Remember, understanding these codes can save you a lot of time and avoid unnecessary customs issues down the line!

Step 3 - Calculate the Customs Value

Understanding the term 'Customs Value' is crucial in your import journey from Thailand to Mexico. Contrary to what you might think, it's not just the price tag on your goods. Instead, it's the CIF value, combining three major components: the original cost of your merchandise, the insurance paid to protect your goods during transit, and the cost of international freight to move your goods from Thailand to Mexico.

As an illustration, if you purchased goods worth $10,000, paid $1,000 for shipping, and $500 for insurance, your customs value amounts to $11,500.

Remember, your customs duties and taxes in Mexico are calculated based on this value, so it's important to get it right. This clear understanding of 'Customs Value' will keep your shipment from unexpected hiccups and cost surprises.

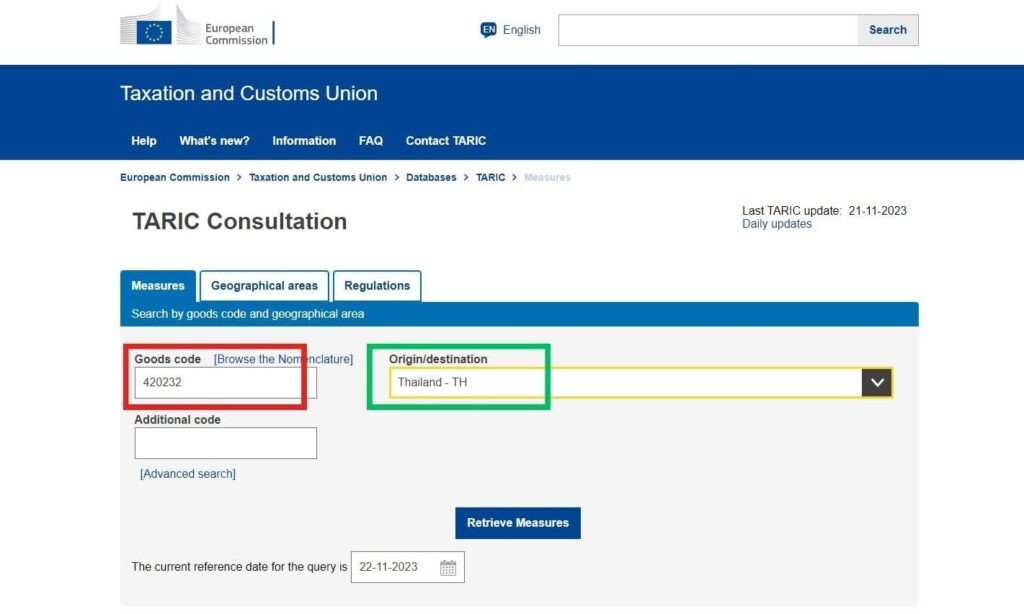

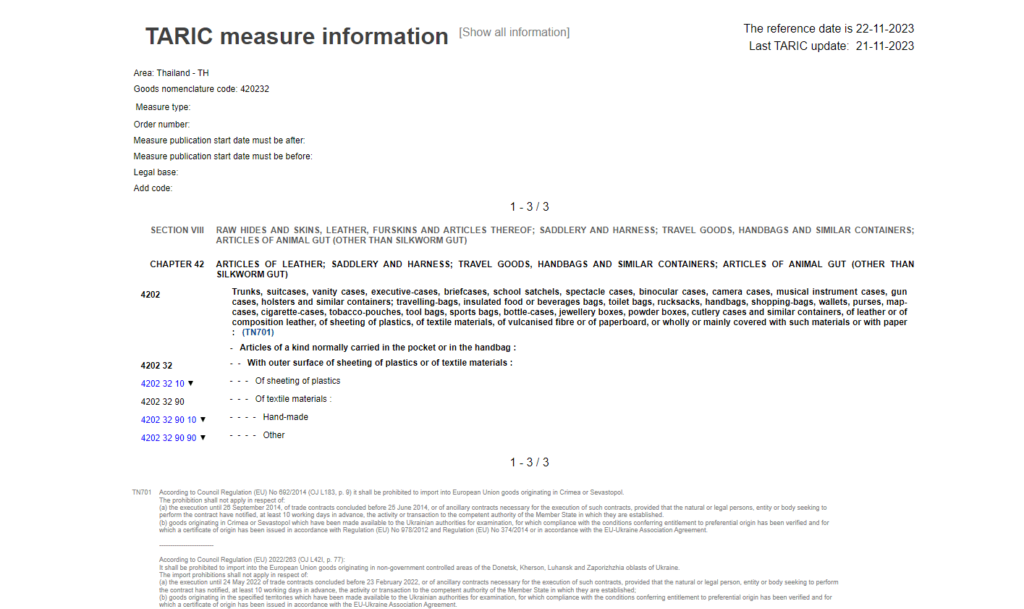

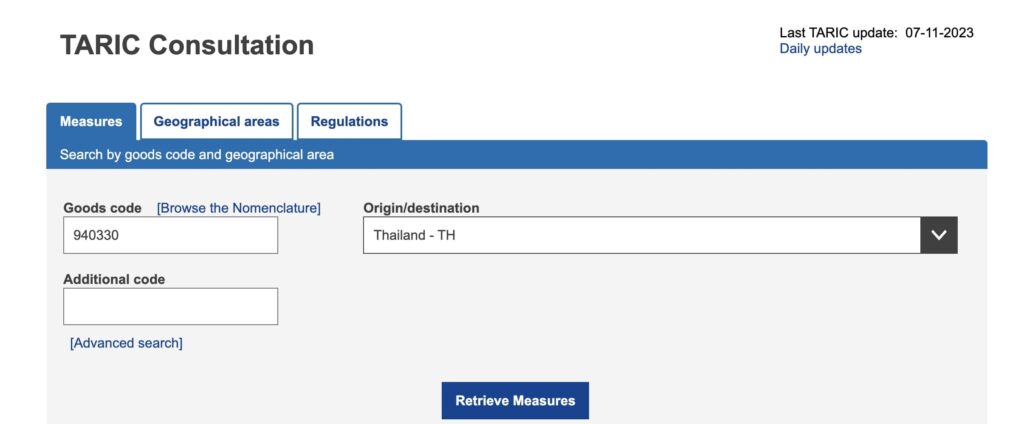

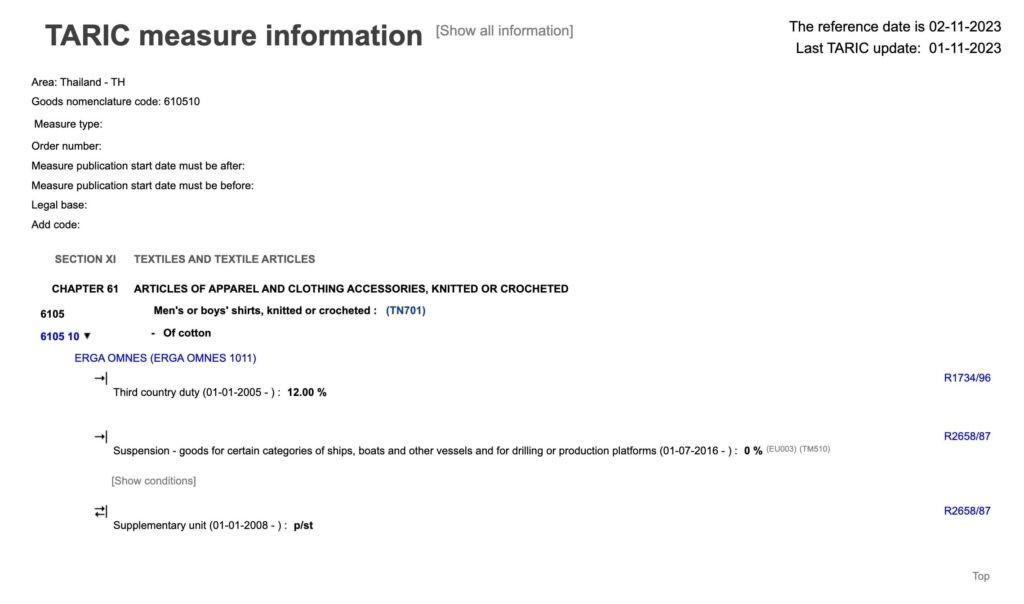

Step 4 - Figure out the applicable Import Tariff

An import tariff is a tax imposed by nations on imported goods, which is typically based on the value of the goods (ad valorem tariff) or a set fee regardless of the value (specific tariff). In the context of Mexico, the ad valorem tariff type is commonly used.

Now, to figure out the specific import tariff for your products, HERE'S a step-by-step guide:

1. Find a directory or an online tool that provides information on tariffs applied by Mexico to imported goods.

2. Enter the Harmonized System (HS) code that you've already identified for your product.

3. Include Thailand as the country of origin.

For instance, let's say you're importing wooden furniture (HS code 9403.60) from Thailand. You enter these details into the tariff tool and it displays a tariff rate of 20%. To calculate your import duties, consider your Cost, Insurance, Freight (CIF) value is $10000. Then, your import tariff to be paid would be 20% of $10000, which amounts to $2000.

The actual rates may differ and are subject to change, so always check the latest rates before making any decisions. The process may seem complicated but understanding it helps in budgeting and can ultimately save your business money.

Step 5 - Consider other Import Duties and Taxes

In addition to the typical tariff, you may encounter a variety of additional import duties and taxes when shipping goods from Thailand to Mexico. These can depend on both the origin country and the nature of your goods. Let's delve into a few of them.

Excise duty is levied on certain products like alcohol and tobacco. For instance, an excise duty of 30% (just a non-actual example) might apply if you're importing expensive whiskies.

Anti-dumping taxes are usually imposed if goods are priced way below market averages in the home country. If your shipment bumps into the anti-dumping norm, Mexico could charge you an additional 25% (non-actual rate).

And we cannot overlook the Value Added Tax (VAT), a pivotal component of your costing. In Mexico, the standard VAT rate is 16%. This is calculated not just on the value of the goods, but also includes the cost of shipping and insurance.

Remember, these examples are hypothetical and actual rates may differ. Always consult with a trusted customs adviser to avoid unexpected expenses and ensure smooth, timely delivery of your goods to Mexico.

Step 6 - Calculate the Customs Duties

When shipping goods from Thailand to Mexico, accurately calculating customs duties can save your business from unexpected costs. This step involves three key variables: the customs value (the price paid for the goods, including shipping and insurance), VAT if applicable, and anti-dumping taxes or Excise Duty if your goods are subject to these.

For an import worth $5,000 with a duty rate of 10%, but no VAT, your customs duties will be $500 ($5,000 10%). However, if there's a 16% VAT on that same consignment, the total cost becomes $1,300 (adding $500 custom duties to $800 VAT). Lastly, if your goods also attract an anti-dumping tax of 10% and Excise Duty of 5%, total cost climbs to $2,100 ($500 for duties, $800 for VAT, $500 for anti-dumping, and $300 for Excise Duty).

But don't let these complexities weigh you down. At Siam Shipping, we handle every step of the customs clearance process worldwide, making sure you never pay more than necessary. Reach out for a free quote in less than 24h, taking the guesswork out of your international shipments.

Does Siam Shipping charge customs fees?

Siam Shipping, as your customs broker in Thailand and Mexico, charges only for its clearance service, not your customs duties. Confusing? Think of it this way: We handle paperwork, ensure your cargo complies with local laws and coordinate with customs officers.

That's our fee. The customs duties or taxes—those go straight to the government. We play fair, supplying you with official customs documents as proof. So with Siam Shipping, you're only paying what's due—nothing more.

Contact Details for Customs Authorities

Thailand Customs

Official name: Thai Customs Department

Official website: https://www.customs.go.th/

Mexico Customs

Official name: Servicio de Administración Tributaria

Official website: https://www.sat.gob.mx/

Required documents for customs clearance

Cracking the code on customs can be nerve-racking! Don't get bogged down in paperwork. Here, we'll shed light on essential documents like the Bill of Lading, Packing List, Certificate of Origin, and conformity docs (hello, CE standard) to simplify your shipping journey. No more customs confusion!

Bill of Lading

When transporting goods from Thailand to Mexico, the Bill of Lading (BOL) is a trusty guide in your freight journey. Think of it as the official ticket that travels with your shipment. It doesn't just confirm ownership transition, but also details what you're shipping, where, and in what quantity.

Additionally, today's tech-forward shipping world allows for a telex (electronic) release of BOLs, slimming down processing times and paperwork. Imagine skipping the long queues! For air cargo special fans, note that an Air Waybill (AWB) is your equivalent of a BOL. Bottom-line?

Having accurate BOLs or AWBs is crucial, acting like a passport for your goods to navigate customs without hitches. So, ensure everything is in order before your shipment says 'sawadee' to Thailand or 'hola' to Mexico!

Packing List

When shipping goods between Thailand and Mexico, your Packing List is your lifeline. This document, detailing every item in your shipment, is crucial for both sea and air freight. Declarations must reflect what's exactly on board, from quantity, weight, to precise descriptions, because ambiguity could mean delays, fines, or worse, seized shipments.

Imagine trying to transport surgical equipment - a missing or incorrectly listed item can ripple into life or death situations! So, for businesses hoping to break into the Thai-Mexican market, never second-guess the Packing List. Accuracy will expedite clearances and keep you clear of any red tape, ensuring your goods arrive securely and swiftly.

Commercial Invoice

Navigating customs between Thailand and Mexico? Your key tool is the commercial invoice. It's not just a formality but a cornerstone of the clearance process. This valuable document outlines your goods' details, values, and HS codes as recognized globally. The trick is ensuring your invoice aligns with other shipping documents.

For instance, if your packing list mentions ten crates of car parts but the invoice only reflects nine, that's a mismatch and expect complications. Consistency enhances your credibility with customs officials and accelerates clearance.

Don't omit or underestimate any item, as doing so can lead to penalties and delays. So, make your commercial invoice your top priority—accuracy, consistency, and detail are your tickets to a smooth customs experience.

Certificate of Origin

While shipping goods between Thailand and Mexico, don't overlook the Certificate of Origin, a critical document. It opens the door to preferential customs duty rates, potentially lowering your expenses. This document pinpoints the birthplace of your merchandise, whether it's plump Thai mangosteens or intricate Mexican handicrafts.

For instance, a consignment of artisanal teapots made in Chiang Mai, Thailand, should come with a Certificate of Origin stating Thailand as the country of manufacture. This can significantly streamline customs clearance and make your shipping experience a breeze, not to mention the possible savings on duties. So, always ensure your shipment includes this vital, cost-saving paperwork.

Get Started with Siam Shipping

Tired of navigating the complex customs clearance process between Thailand and Mexico? Let DocShipper streamline it for you! Our expert team understands every step, making your international shipping stress-free. Ready to simplify your logistics? Contact us today for a free, no-obligation quote - shipped to your inbox within 24 hours.

Prohibited and Restricted items when importing into Mexico

Unsure about what goods are off-limits for import to Mexico? It's crucial to know which items are prohibited or restricted to avoid any customs issues. Our guide will give you clarity, help avoid costly shipping mistakes, and keep your business sailing smoothly.

Restricted Products

1. Pharmaceutical products: You'll need to secure an import permit from the Federal Commission for Protection Against Health Risks (COFEPRIS).

2. Agricultural goods: An entry permit from the National Service of Health, Safety, and Agro-Food Quality (SENASICA) is mandatory.

3. Firearms and ammunition: Authorization from the Secretary of National Defense (SEDENA) is required.

4. Wildlife & Flora: You'll need to procure a wildlife trade permit from the Ministry of Environment and Natural Resources (SEMARNAT).

5. Harmful substances & ozone-depleting substances: A license from the Ministry of Environment and Natural Resources (SEMARNAT) is mandatory.

6. Radiocommunication equipment: An approval from the Federal Telecommunications Institute (IFT) should be secured.

7. Cultural goods: Export or import permit from the National Institute of Anthropology and History (INAH) is necessary.

Remember, these are just guidelines, and the rules may slightly change depending on your specific situation and product. Always refer to the websites linked for the most accurate and up-to-date information.

Prohibited products

- Illegal drugs and substances: This includes marijuana, cocaine, heroin, methamphetamine, and other substances categorized as illegal by the Mexican Government.

- Firearms and ammunition: Unless specifically authorized by the Mexican military agency, SEDENA.

- Obscene materials or pornographic literature: This includes DVDs, magazines, books, and electronic files considered offensive or pornographic.

- Live predator fish: Includes live species such as snakeheads, tigerfish, piranhas, etc.

- Totoaba, turtle, and marine mammal products: To protect threatened species, goods made from these animals are prohibited.

- Certain perishable food items: This could include some fresh fruits, vegetables or meat products, depending on specific Phytosanitary regulations.

- Certain cheese products: Those not conforming to specific Mexican health regulations are not allowed.

- Used clothing and footwear: With the exception of clothes considered part of personal luggage.

- Counterfeit items: Goods that infringe intellectual property such as fake branded clothing, accessories, and electronics.

- Lottery tickets: As the Mexican Government reserves the exclusive right to run lotteries.

- Aerosol products: An exception to this would be those considered as personal luggage.

- Matches made from white phosphorous.

- Products covered by the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES), unless accompanied by appropriate permits.

- Unauthorized religious materials: This depends on the nature, quantity, and intended use of such materials.

- Pesticides and other toxic substances banned in Mexico.

- Certain medical devices and equipment: Only those not approved or certified by the Mexican health authorities.

- Cultural property and artifacts: Unless they have export permits.

- Certain breeds of dogs: Such as Bull Terriers, Rottweiler, etc.

These listed above among other items are prohibited from entering Mexico. If you have any doubts regarding what you're shipping, consult with a customs clearance expert. Furthermore, because customs regulations are subject to changes, you'll want to verify your shipment with the latest rules.

Are there any trade agreements between Thailand and Mexico

Yes, there's a key trade agreement in place - the Mexico-Thailand Strategic Partnership, aiming to enhance economic cooperation. However, no specific Free Trade Agreement (FTA) or Economic Partnership Agreement (EPA) currently exists.

There has been ongoing dialogue about a potential FTA, which could significantly streamline your shipping process once implemented. Be proactive and keep an eye on these developments to stay competitive. It's also relevant to note ongoing infrastructure projects, such as rail lines, that could open new shipping routes and opportunities in the future.

Thailand - Mexico trade and economic relationship

Historically, Thailand and Mexico have enjoyed a robust trade relationship, enhanced by the establishment of diplomatic relations in 1975. Such bonds have fostered various key sectors including automotive, electronics, and agriculture. The cornerstone of reciprocal trade lies in the auto parts industry, while electronics, processed food products, and raw materials also contribute significantly.

In recent years, considerable growth has been witnessed in bilateral trade, reaching over 3 billion dollars of exports from Thailand to Mexico and 700 million dollars of Mexican exports to Thailand.

In summary, Mexico and Thailand, with their symbiotic trade relations, offer ample opportunities for forwarding businesses eager to tap into the potential of these markets.

Your Next Step with Siam Shipping

Understanding the maze of international shipping can be daunting, especially between Thailand and Mexico. Say goodbye to complexities and uncertainties with Siam Shipping. Our expert team effortlessly coordinates every step from customs clearance to final delivery. Ready to simplify your logistics and boost your business? Reach out to us now for a seamless shipping experience!

Additional logistics services

Explore beyond shipping! Uncover how Siam Shipping manages your complete supply chain, offering a bouquet of additional services that streamline your international business operations. Discover more, stress less.

Warehousing and storage

Ensuring your goods are stored under ideal conditions, such as temperature control, is tricky yet crucial. Imagine seafood left in an overheated warehouse – disaster, right? Don't fret; we've got you covered with reliable warehousing solutions that take such challenges head-on. More info on our dedicated page: Warehousing.

Packaging and repackaging

When shipping your goods from Thailand to Mexico, correct packaging and repackaging can be the difference between a successful operation and damaged products. With our expert agents diligently working on it, rest assured your products, whether delicate ceramics or heavy machinery, will reach in pristine condition.

Just imagine the sigh of relief when your products survive the tumultuous journey unscathed! Want more insights? More info on our dedicated page: Freight packaging.

Cargo insurance

Cargo insurance, unlike fire insurance, protects your goods during their journey, not just at stationary points. Say a shipment faces unexpected events - from extreme weather to ships capsizing - this coverage is a lifesaver!

It mitigates potential financial losses and ensures your business runs smoothly. Discover more about this essential safeguard on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Stuck in the infinite loop of sourcing suppliers in Asia or East Europe? Look no further! Siam Shipping ends the guesswork by finding reliable manufacturers and streamlining the procurement labyrinth for you. Imagine avoiding the hassle of language gaps and securing a smooth sourcing process. Like a GPS for your supply chain! More info on our Sourcing services.

Personal effects shipping

Planning a personal move from Thailand to Mexico? Our service for Shipping Personal Belongings adjusts to your unique needs. Whether it's an heirloom cabinet or your favorite motorcycle, trust us to handle your precious items with utmost care and expertise.

For instance, we once secured an antique Thai statue for a safe sea journey, unscathed! More info on our dedicated page: Shipping Personal Belongings.

Quality Control

Ensuring the product quality before it departs Thailand for Mexico can save you headaches and additional costs down the line. Imagine receiving a shipment of artisanal Thai silk, only to find the quality misrepresented. That's where Quality Control inspections come in.

To prevent such mishaps, our team inspects your items during manufacturing or customization, making sure they meet the required standards. Get peace of mind with our meticulous checks. More info on our dedicated page: Quality Inspection.

Product compliance services

Complying with international trade regulations is critical, especially when shipping products that may face stringent rules. Our product compliance services ensure your goods meet these standards, with thorough lab testing and certification procedures.

This way, we remove the hassle, preventing potential regulatory snags from slowing your shipment's progress. More details about this important service can be found at our dedicated page: Product compliance services.

FAQ | For 1st-time importers between Thailand and Mexico

What is the necessary paperwork during shipping between Thailand and Mexico?

When shipping from Thailand to Mexico, DocShipper manages the bill of lading for sea freight or the air waybill if the mode of transport is air freight. As a customer, you need to provide us with the packing list and the commercial invoice. Understand that additional documentation may be required, depending on the nature of your goods. For instance, goods classified as dangerous would require the Material Safety Data Sheet (MSDS) or other applicable certifications. We carry out our duty diligently to ensure smooth customs clearance and delivery of your shipment.

Do I need a customs broker while importing in Mexico?

Indeed, we strongly advise using a customs broker when importing into Mexico due to the intricate process and mandatory details and paperwork involved. The procedures with customs authorities can be quite daunting, and avoiding any missteps is vital. As part of our services here at DocShipper, we act on behalf of your cargo, representing it with customs in most of our shipments. This way, you can focus on your core operations, while we navigate the intricacies of customs procedures. Trusting a customs broker is not just about clearing your goods; it's about having peace of mind.

Can air freight be cheaper than sea freight between Thailand and Mexico?

It's difficult to definitively state whether air freight is cheaper than sea freight from Thailand to Mexico, as this depends on various factors like the route, volume, and weight of your cargo. For instances where your shipment is less than 1.5 cubic meters or 300 kg (660 lbs), air freight might be a more cost-effective solution. We at DocShipper strive to evaluate all these elements to provide you with the most competitive shipping option. Your dedicated account executive will assist you in making a decision based on your specific needs.

Do I need to pay insurance while importing my goods to Mexico?

While insurance is not a prerequisite for shipping goods, we at DocShipper highly recommend it. This applies to both local and international shipments, including imports to Mexico. The reason is that during transit, your goods can be subjected to various incidents leading to potential damage, loss, or theft. Investing in insurance provides a safety net against these unforeseen events and ensures that you aren't left in a financial lurch should anything adverse occur. Our aim is to provide you with the best possible shipping experience, and we believe a well-insured cargo is a critical part of that process.

What is the cheapest way to ship to Mexico from Thailand?

Navigating the oceanic route from Thailand to Mexico is often the cheapest shipping method. Despite the longer transit times, sea freight offers cost-benefit due to large volumes. We, at DocShipper, can help you optimize your cargo to reduce costs even further, through consolidation and careful route planning. It's crucial to note factors like customs duties, local regulations and transport to your final destination, as they can impact the overall cost.

EXW, FOB, or CIF?

Whether you choose EXW, FOB or CIF heavily relies on the relationship with your supplier. Suppliers are not typically logistics experts, hence the importance of letting an agent such as we, at DocShipper, manage the process. Especially the international freight and destination procedures are quite complex. Traditionally, suppliers sell under EXW (directly from their factory door) or FOB (which includes all local charges until the origin terminal). We offer a flexible choice though and regardless of the initial terms, we're able to provide comprehensive door to door services for smooth and efficient shipment of your goods.

Goods have arrived at my port in Mexico, how do I get them delivered to the final destination?

When your goods arrive at a Mexican port and we're handling them under CIF/CFR incoterms, you'll need a custom broker or freight forwarder to help with terminal clearance, pay import charges, and finalize delivery. If you prefer a seamless process, we can handle everything under DAP incoterms. Please discuss with your account executive to clarify and choose the best option for your needs.

Does your quotation include all cost?

Indeed, our quotation does cover all costs involved, barring duties and taxes at the destination. Be assured that DocShipper values transparency and we aim to avoid any undisclosed fees. To estimate duties and taxes, you're welcome to connect with your respective account executive. Our aim: no unpleasant surprises!